Pradhan Mantri Awas Yojana (PMAY) List 2023 & How to Check

PM Awas Yojana Urban

-

122.69 Lakhs house sanctioned

-

105.03 Lakhs houses grounded

-

64.05 Lakhs houses completed

-

₹127553 Crores central assistance released

-

₹8.31 Lakh crore total investment

Pradhan Mantri Awas Yojana Gramin

Pradhan Mantri Awas Yojana Gramin: Features

-

The unit cost is shared between the central and state governments in a 60:40 ratio in plain regions.

-

The assistance has been increased from ₹70,000 to ₹1.20 lakh/unit in plain regions.

-

In IAP Districts, difficult areas, and hilly states, assistance is increased from ₹75,000 to ₹1.30 lakh/unit, with a split ratio of 90:10 between the central and state governments.

-

The center pays 100% of the grant for the union territory of Ladakh.

-

Per the Awas Yojana guidelines, the carpet size of a house could be up to 30 square feet. However, the states and union territories can increase the house sizes upon the ministry's approval.

-

Houses financed by PM Awas Yojana include all essential amenities, such as electricity, water supply, kitchen, and toilet.

-

The beneficiaries of this scheme also receive ₹90.95/day worth of unskilled labour from MGNREGA.

-

The respective Gram Sabhas pick beneficiaries based on socio-economic and caste census (SECC) parameters.

-

Attempts would be made to provide piped drinking water, LPG gas connection, electricity connection, etc., using other government programs.

-

Moreover, the beneficiaries are entitled to receive ₹12,000 as assistance to construct toilets under Swach Bharat Mission-Gramin (SBM-G).

Pradhan Mantri Awas Yojana Urban: Features

-

PMAY(U) has a demand-driven approach wherein the states and UTs assess the housing shortage. The chief stakeholders that play crucial roles in the implementation of this scheme are central nodal agencies, state-level nodal agencies, implementing agencies, and primary lending institutions (banks and housing finance companies).

-

The PM Awas Yojana Urban encompasses the entire urban area. Hence, it consists of development authorities, industrial development authorities, special area development authorities, notified planning areas, and statutory towns. This scheme also covers any other authority under state legislation that may deal with urban planning and regulations.

-

The scheme is available to applicants who do not currently own a house anywhere in India.

-

The PM Awas Yojana would aid the building of houses up to 30 square meters in carpet area, with all basic amenities. Affordable housing partnership projects and slum redevelopment projects should have all essential amenities like electricity, road, water, sanitation, and sewerage. Akin to that urban local bodies (ULBs) would ensure that beneficiaries under the credit-linked subsidy and beneficiary-led construction may also avail the essential civic services.

-

The assistance from the center would be released directly to the approved beneficiaries' bank accounts per the recommendations of their respective states/UTs.

-

The final installment of ₹30,000 of central assistance would be released only after the house completion/possession.

-

The construction progress of the houses would be tracked through geo-tagging.

-

To avoid possible benefit duplication to a household, their Aadhaars, bank account numbers, house owner certificates, electoral IDs, etc, should be added to the Housing for All Plan of Action (HFAPoA) database.

-

Awas Yojana Urban empowers women and marginalized sections of society. Women are preferred as applicants, especially widows and single women. Also, in the case of married applicants, house ownership is provided in the woman's name. Similarly, disabled people, transgender people, minorities, scheduled castes/tribes, and other backward classes also get preferences.

PMAY Urban: Implementation Verticals

-

Beneficiary-led individual house construction or enhancement (BLC): These subsidies are meant to construct or extend individual houses for the populace belonging to the EWS category. These families can avail of central assistance of ₹1.5 lakh under this scheme. The state should be responsible for preparing apt projects for such subsidy recipients.

-

Affordable Housing in Partnership with the public or private sector (AHP): These construction projects can be in partnerships with private or public entities, including semi-government or government agencies. Criteria for central assistance in these projects are that 35% of these houses should be dedicated to the EWS category populace and there would be a minimum of 250 such houses. Under this scheme, the centre would assist to the tune of ₹1.5 lakh per house (only belonging to the EWS category).

-

In-situ slum redevelopment (ISSR): All eligible slum dwellers contributing land for redevelopment in partnership with private entities would be supported to the tune of ₹1 lakh. There is a provision for additional efforts to make the project viable in the form of extra FSI/TFR/FAR.

-

Credit linked subsidy scheme (CLSS): Under this scheme, eligible beneficiaries belonging to EWS/low-income group (LIG), middle-income group (MIG)-I-II receive subsidies of 6.5%, 4%, and 3% on loan amounts of up to ₹6 lakh, ₹12 lakh, and ₹18 lakh, respectively. The applicants may seek loans from housing finance companies, banks, and other similar institutions.

Pradhan Mantri Awas Yojana Gramin: Progress

| State Name | 2014-2015 | 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2016-2023 | 2014-2023 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | 0 | 0 | 2115 | 3815954 | 4472392 | 2128843 | 3399499 | 4239491 | 2214505 | 20272799 | 20272799 |

| ARUNACHAL PRADESH | 0 | 0 | 0 | 0 | 85 | 747 | 2417 | 992 | 3205 | 7446 | 7446 |

| ASSAM | 0 | 0 | 4 | 26059 | 159017 | 84009 | 130879 | 117694 | 148231 | 665893 | 665893 |

| BIHAR | 0 | 0 | 1 | 28135 | 581827 | 376216 | 942615 | 508363 | 748304 | 3185461 | 3185461 |

| CHHATTISGARH | 0 | 0 | 136 | 365868 | 341381 | 34587 | 59684 | 23290 | 1434 | 826380 | 826380 |

| GOA | 0 | 0 | 0 | 0 | 22 | 3 | 87 | 19 | 8 | 139 | 139 |

| GUJARAT | 0 | 0 | 12 | 95280 | 83096 | 35589 | 50742 | 77282 | 53163 | 395164 | 395164 |

| HARYANA | 0 | 0 | 1 | 6676 | 5961 | 6670 | 1215 | 263 | 497 | 21283 | 21283 |

| HIMACHAL PRADESH | 0 | 0 | 1 | 3504 | 3096 | 447 | 605 | 1884 | 1273 | 10810 | 10810 |

| JAMMU AND KASHMIR | 0 | 0 | 0 | 1979 | 14441 | 5610 | 21745 | 42569 | 16918 | 103262 | 103262 |

| JHARKHAND | 0 | 0 | 25 | 188296 | 272678 | 156974 | 235013 | 295041 | 172788 | 1320815 | 1320815 |

| KERALA | 0 | 0 | 48 | 9444 | 6519 | 779 | 686 | 2440 | 2617 | 22533 | 22533 |

| MADHYA PRADESH | 0 | 0 | 152 | 636338 | 679294 | 271273 | 260964 | 605954 | 422310 | 2876285 | 2876285 |

| MAHARASHTRA | 0 | 0 | 219 | 145630 | 201968 | 92276 | 181756 | 179021 | 68424 | 869294 | 869294 |

| MANIPUR | 0 | 0 | 0 | 66 | 7655 | 1151 | 2379 | 3626 | 1804 | 16681 | 16681 |

| MEGHALAYA | 0 | 0 | 0 | 260 | 11329 | 4995 | 5016 | 7009 | 4342 | 32951 | 32951 |

| MIZORAM | 0 | 0 | 0 | 1333 | 900 | 997 | 1123 | 1158 | 574 | 6085 | 6085 |

| NAGALAND | 0 | 0 | 0 | 0 | 17 | 3687 | 535 | 0 | 966 | 5205 | 5205 |

| ODISHA | 0 | 0 | 443 | 431669 | 403127 | 361187 | 395106 | 97143 | 14703 | 1703378 | 1703378 |

| PUNJAB | 0 | 0 | 0 | 608 | 12751 | 410 | 3908 | 5473 | 470 | 23620 | 23620 |

| RAJASTHAN | 0 | 0 | 108 | 317728 | 326594 | 166764 | 315481 | 141346 | 154657 | 1422678 | 1422678 |

| SIKKIM | 0 | 0 | 0 | 372 | 646 | 34 | 13 | 5 | 11 | 1081 | 1081 |

| TAMIL NADU | 0 | 0 | 0 | 78680 | 104388 | 49986 | 51868 | 57322 | 93405 | 435649 | 435649 |

| TRIPURA | 0 | 0 | 0 | 3333 | 20690 | 6155 | 15462 | 1639 | 127202 | 174481 | 174481 |

| UTTAR PRADESH | 0 | 0 | 14 | 817001 | 426571 | 174166 | 37710 | 1094662 | 35578 | 2585702 | 2585702 |

| UTTARAKHAND | 0 | 0 | 4 | 6236 | 5925 | 192 | 19 | 3844 | 10598 | 26818 | 26818 |

| WEST BENGAL | 0 | 0 | 30 | 589790 | 739777 | 286333 | 678583 | 959230 | 127772 | 3381515 | 3381515 |

| ANDAMAN AND NICOBAR | 0 | 0 | 0 | 0 | 0 | 286 | 483 | 335 | 29 | 1133 | 1133 |

| DADRA AND NAGAR HAVELI | 0 | 0 | 0 | 1 | 196 | 221 | 972 | 641 | 575 | 2606 | 2606 |

| DAMAN AND DIU | 0 | 0 | 0 | 6 | 7 | 0 | 0 | 0 | 0 | 13 | 13 |

| LAKSHADWEEP | 0 | 0 | 0 | 0 | 0 | 9 | 28 | 7 | 0 | 44 | 44 |

| PUDUCHERRY | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ANDHRA PRADESH | 0 | 0 | 681 | 27347 | 18674 | 5 | 0 | 0 | 12 | 46719 | 46719 |

| KARNATAKA | 0 | 0 | 236 | 34315 | 43760 | 7085 | 2405 | 11239 | 2635 | 101675 | 101675 |

| TELANGANA | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 2115 | 3815954 | 4472392 | 2128843 | 3399499 | 4239491 | 2214505 | 20272799 | 20272799 |

PMAY Urban: Progress

National Level

State-wise Status

| Name of the State/UT | Project Proposal Considered | Physical Progress of Houses (Nos) | Financial Progress (₹ in crores) |

|---|

Grounded*

Completed/ Delivered*

Investment

Sanctioned

Released

1,290

20,75,773

18,80,603

6,15,956

89,056.67

31,641.87

16,591.21

520

3,27,614

3,07,949

96,885

18,518.31

5,187.20

2,544.76

1,796

2,98,664

2,52,683

1,52,918

13,688.31

4,734.13

3,362.70

10

3,265

2,867

2,865

694.50

76.86

67.72

1,707

10,58,902

9,53,081

7,12,518

1,09,965.70

21,765.75

15,708.88

457

1,67,211

88,452

54,570

15,750.39

2,987.05

1,349.18

364

13,266

11,745

8,304

900.90

240.92

172.41

453

2,34,544

2,12,962

1,15,244

11,635.97

3,691.04

2,520.23

2,760

7,07,232

5,91,965

2,77,345

51,909.16

11,630.46

5,871.83

699

1,59,650

1,30,800

1,04,071

8,575.51

2,644.89

1,832.43

1,910

9,68,236

8,62,052

5,43,048

53,865.08

15,950.72

12,356.23

1,536

15,01,263

9,84,911

6,46,767

1,85,176.81

27,742.10

13,916.70

976

2,13,749

1,63,417

1,12,951

9,842.19

3,365.25

2,070.89

871

1,15,791

1,00,525

56,900

8,491.50

2,081.42

1,418.09

673

2,78,436

1,70,038

1,37,644

23,386.52

5,309.39

3,313.22

4,798

6,89,378

6,19,362

4,74,154

48,944.12

11,258.59

8,610.82

303

2,50,199

2,35,413

2,11,559

30,679.90

4,481.04

3,044.09

4,611

17,05,967

15,02,310

11,72,124

84,282.99

26,903.94

20,795.23

261

62,867

39,682

25,157

5,030.99

1,161.68

683.96

656

6,98,006

4,96,258

2,95,671

38,238.23

11,197.31

6,411.22

1,15,30,013

96,07,075

58,16,651

8,08,633.75

1,94,051.60

1,22,641.80

61

9,002

8,397

3,642

511.20

189.90

146.13

441

1,61,472

1,55,785

58,958

4,919.13

2,444.10

1,306.17

45

56,037

46,418

7,943

1,446.25

841.19

435.44

36

4,756

3,710

1,025

185.89

72.16

24.95

52

40,743

37,192

5,500

941.69

623.87

204.60

75

32,335

32,085

9,878

1,050.00

511.02

306.97

11

703

562

179

36.03

11.86

6.41

126

94,169

80,999

61,946

2,971.77

1,511.93

1,091.21

3,99,217

3,65,148

1,49,071

12,061.96

6,206.04

3,521.89

2

378

377

45

95.83

5.87

1.97

- 1,279

1,129

1,129

263.80

29.10

25.56

9

10,532

8,789

6,417

942.86

222.48

164.95

- 30,286

27,288

27,288

5,661.27

698.40

624.76

403

49,086

46,780

15,498

2,690.23

753.15

363.50

8

1,366

1,071

624

67.97

31.07

22.15

45

16,394

15,754

7,205

947.93

257.82

167.64

467

1,09,321

1,01,188

58,206

10,669.89

1,997.90

1,370.53

27,965

120.39 Lakh!

104.75 Lakh*

63.65 Lakh*

8.31 Lakh Cr.

2.02 Lakh Cr.

1.28 Lakh Cr.

Pradhan Mantri Awas Yojana List

How to Check Name in Pradhan Mantri Awas Yojana List

-

The first step is to log on to pmaymis.gov.in.

-

Next, ‘'Select Beneficiary'’ and "Search by Name" by scrolling through the drop-down menu.

-

Then the Aadhaar number should be entered.

-

The beneficiary details can be found if the Aadhaar number is present in the database.

-

Finally, the applicant can explore the available benefits.

Conclusion

FAQs

How is the subsidy released to the beneficiaries?

What are the criteria for EWS, LIG, and MIG categories regarding the PM Awas Yojana?

How much carpet area is allocated under the PMAY scheme?

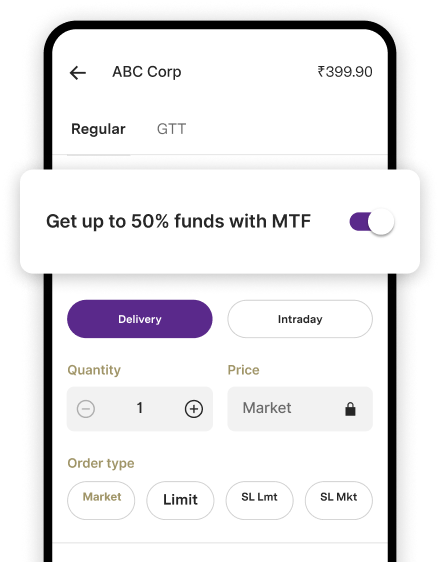

Never miss a trading opportunity with Margin Trading Facility

Enjoy 2X leverage on over 900+ stocks