Upstox Originals

Will gold’s outperformance continue, or is it silver’s turn to shine now?

4 min read | Updated on April 21, 2025, 11:52 IST

SUMMARY

Over the past 12 months gold has returned ~40% returns versus silver’s ~15%. The trend is also mirrored in YTD returns. As global uncertainty spikes, investors are evaluating these safe haven assets to take shelter in the during the storm. Which begs the question – does gold’s outperformance continue or is it finally silver’s turn to shine now?

Technical signals are pointing towards potential silver outperformance

Tariff-related tensions and persistent uncertainties in global trade have recently infused significant volatility across various asset classes. Equities worldwide experienced pronounced selloffs; although markets recovered from their lows, they continue exhibiting heightened volatility.

Concurrently, the U.S. Dollar Index has notably weakened, touching its recent lows during this turbulent phase, underscoring shifting investor perceptions of risk and safe-haven assets.

This combination of equity market instability and currency fluctuations has inevitably driven investors towards alternative investment avenues, prominently precious metals such as gold and silver, as they seek refuge and portfolio diversification. Understanding this backdrop becomes crucial for investors navigating the volatile investment landscape.

Precious metals shine

The intensified volatility has led to a notable outperformance in the precious metals space, as is clearly captured in their recent price trajectories. Over the past 12 months, gold has demonstrated robust strength, recording a significant gain of 39.8%, while silver has posted a comparatively modest rise of 15.0%.

Similarly, YTD returns reflect continued investor appetite, with gold appreciating by 25.1% and Silver by 10.0%. These metrics underline a growing emphasis on gold's role as a primary hedge, though evolving market dynamics suggest a potential upcoming shift favoring silver's relative outperformance.

Gold vs silver: Analysing relative returns

The recent comparative performance between Gold and Silver highlights a noteworthy divergence in returns, emphasising the importance of strategic asset selection within the precious metals segment.

Although both metals have delivered positive returns gold has distinctly outpaced Silver. Investors who strategically favoured gold in their portfolio allocations would have benefited significantly more and captured greater gains. This divergence underscores the importance of carefully assessing relative strength dynamics, as selection decisions can substantially influence portfolio performance even within traditionally correlated asset classes.

Relative strength shifts: Silver poised for potential outperformance

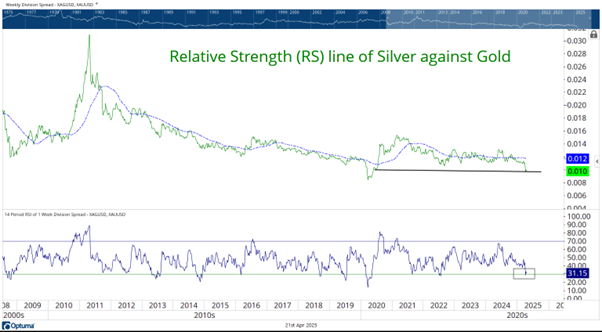

Recent relative strength (RS) analysis between gold and silver signals a potential shift toward silver's outperformance. Over the past two years, the relative performance between these precious metals has been predominantly neutral, with the RS line moving sideways without significant directional bias. However, this equilibrium was disrupted recently when gold surged dramatically, causing silver's RS line to decline sharply.

The RS line for silver against gold has concurrently tested critical five-year lows and long-term support levels. Given these pivotal technical conditions, the possibility of a rebound in silver's relative strength is growing. Consequently, investors should anticipate a scenario where gold may consolidate recent gains, allowing silver to stage a meaningful catch-up rally in relative terms.

Technical divergence signals silver's potential catch-up Over the past 4-5 weeks, the relative performance of silver versus gold has exhibited a distinct negative divergence. gold prices have surged sharply, largely driven by fundamental factors, while silver's price movement has remained comparatively subdued.

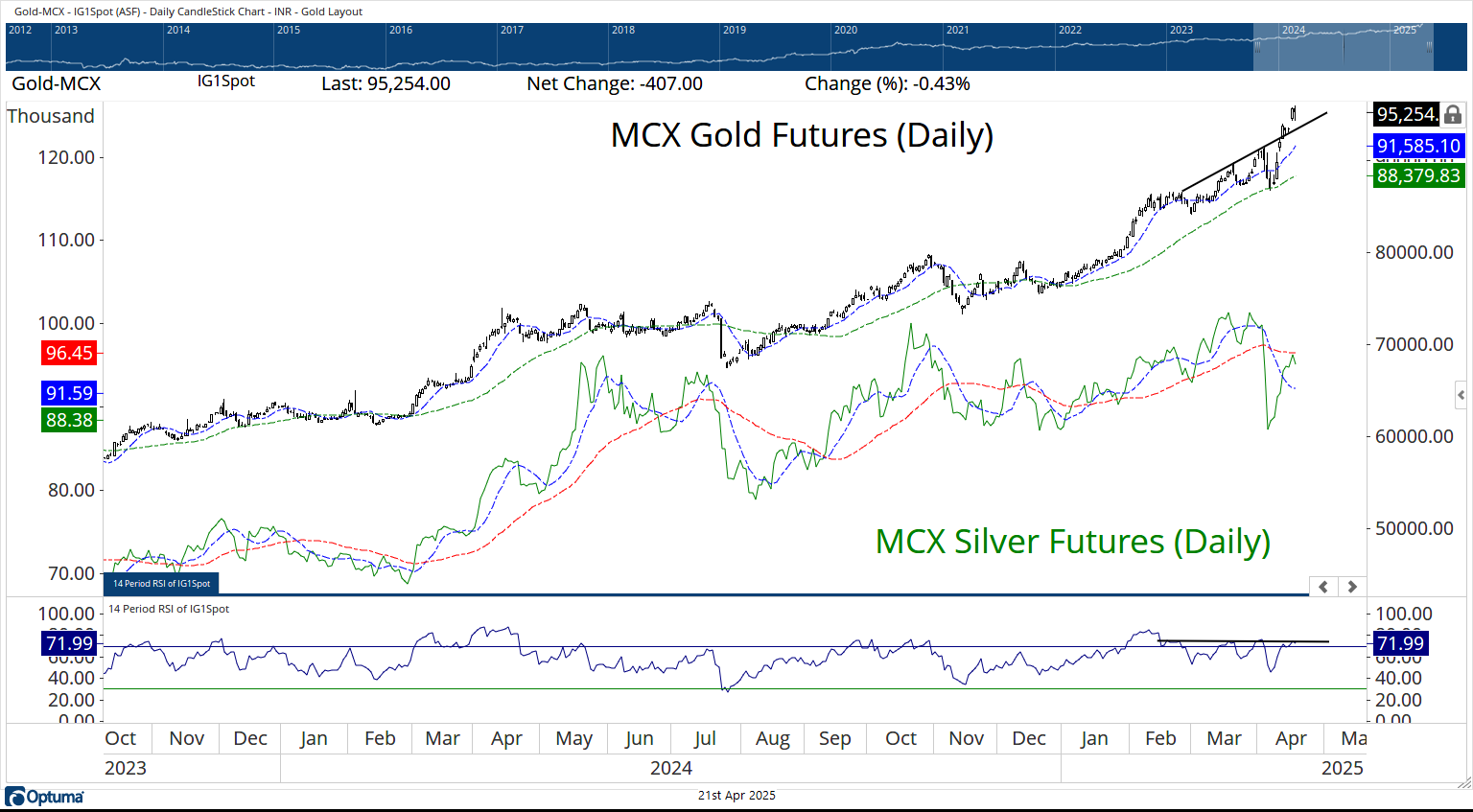

The effectiveness of technical indicators, particularly the 10- and 40-period Daily Moving Averages (DMAs), has been pronounced for both metals. Gold continues to trade firmly above its 10-DMA, consistently finding support at its 40-DMA during recent corrective moves. Conversely, Silver remains below these key DMAs, although its 10-DMA shows initial signs of flattening, indicating stabilisation.

Furthermore, Gold's recent rise has been accompanied by a negative RSI divergence, suggesting diminishing momentum. Coupled with an extended deviation above its 10-DMA relative to historical norms, Gold appears primed for consolidation.

During this anticipated consolidation phase in Gold, Silver is well-positioned technically to stage a meaningful catch-up, potentially testing the domestic ₹97,000–99,000 range.

Relative strength favors silver, not bearish on gold

It is essential to emphasise that the anticipated improvement in Silver's relative strength does not suggest adopting a bearish stance or initiating short positions in gold.

Gold remains fundamentally supported and may continue to advance or consolidate without significant retracement. The core perspective of this analysis is focused purely on relative performance dynamics, highlighting silver's potential to outperform gold over the medium term.

Investors should, therefore, interpret this analysis as an indication to possibly tilt portfolio allocations slightly towards silver, recognizing that both precious metals could appreciate further, with silver potentially offering relatively superior gains going forward.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story