Upstox Originals

Top 6 most tradable currency pairs: Where liquidity meets strategy

.png)

7 min read | Updated on May 12, 2025, 20:57 IST

SUMMARY

In the trillion-dollar world of forex, not all currency pairs are created equal. Some move with the rhythm of global markets, drawing in day traders, institutions, and hedge funds like clockwork. These currency pairs dominate for a reason – they’re liquid, easily tradable, and backed by economic powerhouses. But what makes these six pairs the most tradable? Let’s break down the logic, the volatility, and what’s driving all that market momentum.

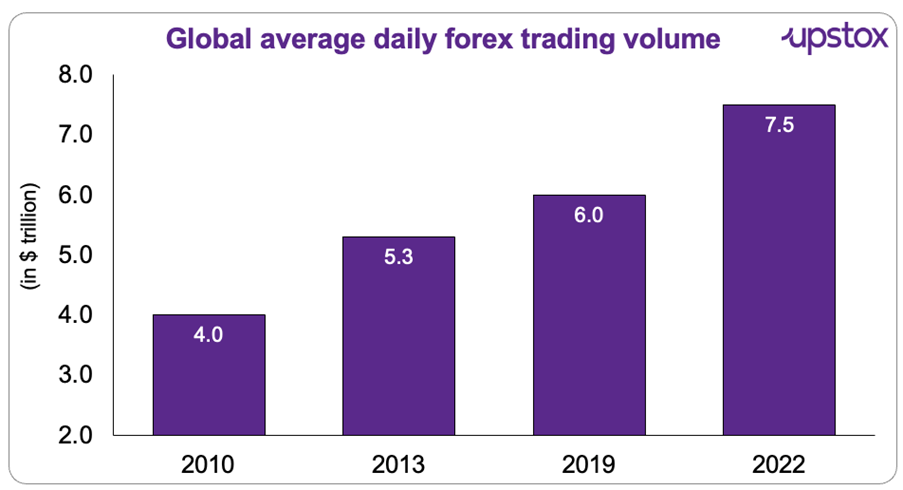

With a daily trading volume of over $7.5 trillion, forex is the largest and most liquid market.

Step into the world of forex, where fortunes are made and lost every second. With a daily trading volume of over $7.5 trillion, forex is the largest and most liquid market. Open 24 hours a day, five days a week, the forex market never rests - it's a global powerhouse where market-moving decisions are made in real-time.

Source: Bank for International Settlements

Now that you know how massive the forex playground is, let's zoom in a little. Every trade in forex isn’t about buying a currency, it's about buying one currency and selling another at the same time. This constant tug-of-war between two currencies is what creates opportunities for traders to profit.

And to understand that, let’s understand currency pairs - the building blocks of every forex move.

Understanding the currency pairs

In the forex world, you’re always trading one currency against another. That’s why trades happen through what’s called a currency pair.

Here’s the easy way to think about it:

- The first currency is the base currency (the one you are buying or selling).

- The second currency is the quote currency (the one you are comparing it to).

When you buy a currency pair, you’re betting that the base currency will go up in value against the quote currency.

When you sell a currency pair, you’re betting the base currency will drop compared to the quote currency.

And here's a quick guide to the types of pairs:

- Majors = Strong currencies paired with the US dollar (Example: EUR/USD)

- Minors = Big currencies, but no US dollar involved (Example: GBP/JPY)

- Exotics = A major currency paired with one from an emerging market (Example: USD/INR)

How currency trading drives price discovery

Curious about how a currency’s value is decided? In the forex market, every trade is driven by economic factors like interest rates, inflation, and geopolitics. Just like all other markets, this constant push and pull of supply and demand leads to price discovery, where the market sets a currency’s true value.

Unlike stocks, which focus on individual companies, currency prices reflect an entire country’s economic health. For instance, if traders believe the US economy will outperform the Eurozone, they'll buy dollars and sell euros, lowering the EUR/USD rate.

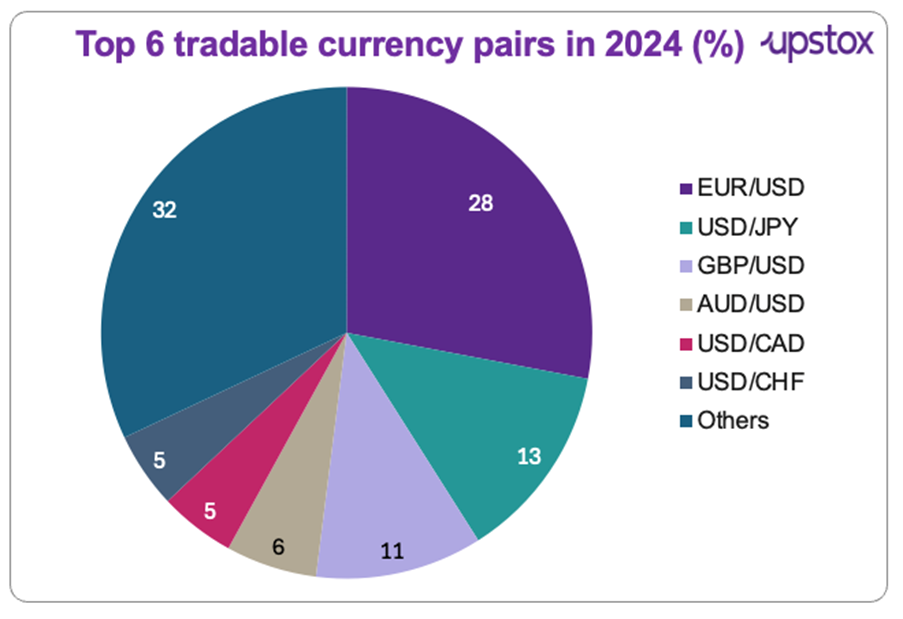

So...what currency pairs are most traded?

You might wonder - where’s everyone actually trading? It's not random! A handful of currency pairs totally dominate the action, and knowing them gives you a serious edge.

Source: FXSSI

Curious about what makes a currency the most traded? It’s all about stability! Currencies from strong economies inspire trust and offer high liquidity, letting traders buy and sell without crazy price swings. Plus, with global demand and active central banks, these currencies are always in motion.

Top currency pairs uncovered

EUR/USD

The king of forex! In 2024, the US exported $370.2 billion worth of goods to the EU, with top exports like mineral fuels ($78.9 billion), pharmaceuticals ($39.4 billion), and aircraft ($35.1 billion). Meanwhile, US imports from the EU totaled a massive $605.8 billion, led by pharmaceuticals ($127 billion), machinery ($89.8 billion), and cars ($60.3 billion). Big economies, deep trade relations, and ultra-high liquidity make EUR/USD the ultimate favorite for traders.

USD/JPY

Big trade, bigger moves! In 2024, Japan exported $148.2 billion in goods to the US - mainly automobiles, vehicle parts, and electronics. The US, in return, exported $80.2 billion worth of goods like aircraft, machinery, and semiconductors to Japan. The yen’s safe-haven status plus strong trade ties keeps USD/JPY buzzing 24/7.

GBP/USD

Known as "Cable," this pair is fueled by solid US-UK trade ties. In 2024, U.S. goods exports to the UK hit $79.9 billion, while imports stood at $68.1 billion, giving the U.S. a $11.9 billion goods trade surplus.

AUD/USD

The AUD/USD pair is a top trader's pick, with Australia’s economy heavily relying on iron ore, coal, and gold exports. In 2024, US-Australia trade reached $51.3 billion, with $34.6 billion in US exports to Australia - up 3.1% from 2023. On the flip side, U.S. imports from Australia hit $16.7 billion, rising 4.7%. This strong trade synergy makes the AUD highly sensitive to global risk sentiment, commodity prices, and economic shifts in China, which often dictate the AUD/USD pair’s movements.

USD/CAD

Ever wondered what makes the USD/CAD move? In 2024, US-Canada total goods trade hit a staggering $762.1 billion. Canada shipped over three-quarters of its goods to the US and sourced almost half its imports from the US Expect USD/CAD to dance closely with oil price movements and US-Canada trade flows.

USD/CHF

In 2024, US exports to Switzerland were $25.0 billion (including gold, pharmaceuticals, and machinery), while imports from Switzerland reached $63.4 billion. The Swiss franc’s reputation for stability makes USD/CHF a go-to pair in times of global uncertainty.

How can traders profit in currency pairs?

Want to turn currency movements into profit? Let’s break it down with a real-life scenario using the EUR/USD pair listed at 1.55.

Option 1: Riding the Euro wave (Long position)

- Imagine you’re feeling confident about the euro. You decide to buy the euro because you believe it’s about to gain strength against the US dollar.

- If the euro picks up steam and the exchange rate rises, you’re in the money! The higher the rate, the bigger your win.

Option 2: Betting on the Dollar (Short position)

- Now, maybe you think the U.S. dollar is on the rise. You decide to sell the Euro, meaning you’re banking on the Euro weakening and the dollar gaining momentum.

- If the dollar climbs and the exchange rate drops, congratulations! Your short position just paid off!

Now, here’s the fun part: Would you bet on the euro (go long), hoping it will rise? Or would you bet on the U.S. dollar (go short), thinking it will climb higher?

How does it help overall trade?

Forex isn’t just a playground for traders; it’s the secret sauce behind global trade. Think of currency pairs like EUR/USD or USD/JPY as the bridge that connects economies. They make international transactions quick and easy, letting businesses trade across borders without a hitch.

But...Is there a risk?

Absolutely. Let’s break down a few you’ll want to keep an eye on:

-

Liquidity risk: Ever tried selling something no one’s buying? That’s liquidity risk. In 2018, the Turkish Lira (USD/TRY) dropped over 35% - and traders scrambled to exit, but there were barely any takers.

-

Geopolitical risk: Politics can move markets fast. After the Brexit vote in 2016, GBP/USD fell more than 10% overnight.

-

Leverage risk: Doubling down sounds exciting - until it backfires. In 2015, the Swiss franc (CHF) jumped 15% in minutes after the Swiss national bank ditched its Euro cap. Many over-leveraged traders suffered major losses.

Smart trading isn’t just about chasing profits, it’s about managing the downside. Know the risks, and you’re already trading with an edge.

Final thoughts

In forex, trading isn’t about taking wild guesses. It’s about understanding what drives the market. The six currency pairs we’ve discussed are at the core of the forex world, and knowing why they move can help you trade smarter.

When you're looking at pairs like EUR/USD or USD/CAD, think about what’s influencing them. Is it economic news? Global trade? Commodity prices? Successful traders aren’t just reacting to price changes; they understand what’s behind those moves and build strategies around it.

About The Author

Next Story