Upstox Originals

Emerging relative strength in the auto sector

4 min read | Updated on May 14, 2025, 12:43 IST

SUMMARY

After a year of relative underperformance, the Nifty Auto Index is displaying technical signs of a potential turnaround. From RSI divergence to a favourable move on the RRG graph, it is fast becoming a key space for investors to track. In this article, we look at the sector’s performance and highlight a few stocks that should be on an investor’s watchlist.

The Nifty Auto Index is showing technical signs of potential bullish performance

Over the past month, the markets have experienced significant volatility, contending with a range of challenges, including escalating geopolitical tensions between India and Pakistan, as well as concerns related to tariffs and trade wars. Despite these headwinds, the Nifty has displayed notable resilience, managing to absorb these developments without any major breakdown.

The index successfully defended a crucial support zone in the 23,900–24,050 range, which is created by the 200-day moving average and the 50-week moving average. The strong recovery witnessed at the beginning of the week has not only underscored the market’s strength but has also effectively pulled the support levels higher.

This behaviour reflects growing stability in the broader market, even amid external uncertainties. The ability of Nifty to sustain itself above these key technical levels signals a constructive undertone in the current market structure.

Relative underperformance of the auto sector

While sectors such as Public Sector Enterprises (PSE), Banks, Financial Services, and Energy have exhibited strength in recent weeks, the Auto space has relatively lagged behind.

Over the past 12 months, the Nifty Auto Index posted a modest gain of 4.2%, significantly trailing the Nifty 50 Index, which advanced 12.8%, and the Nifty 500 Index, which recorded a gain of 9.8%. This divergence persists on a YTD basis as well. These figures highlight the relative underperformance of the Auto sector in the broader market context.

Emerging reversal and technical strength in Nifty Auto Index

The Nifty Auto Index has largely remained in a broad uptrend since mid-2022. However, this momentum was interrupted in August 2024 when the index marked a peak at 26,934 and began showing early signs of weakness. A marginally higher high was recorded in September 2024 at 27,696, but this failed to trigger a sustainable uptrend. Following this, the index entered a prolonged corrective phase that persisted for several months.

RSI divergence

More recently, encouraging technical developments have started to emerge. In the latest leg of the decline, while the index formed lower lows on the price chart, the 14-period RSI did not follow suit. Instead, it formed higher lows, thereby exhibiting a classic bullish divergence. This divergence between the price and RSI suggested waning downside momentum and hinted at a potential reversal.

Since forming a base, the Nifty Auto Index has rebounded and successfully broken out above a falling trendline resistance. This breakout, combined with the bullish divergence on the RSI, points to a potential trend reversal and suggests the possibility of renewed relative strength emerging within the Auto sector.

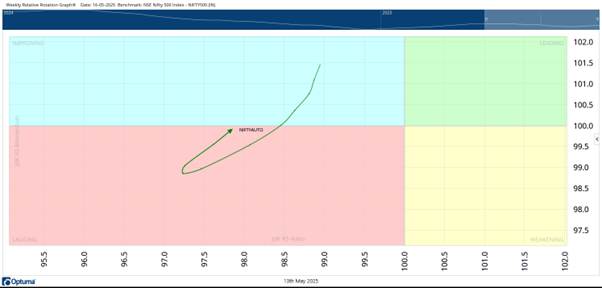

RRG indicates improving relative momentum in Nifty Auto

The Relative Rotation Graph (RRG), benchmarked against the broader Nifty 500 Index, reveals a notable improvement in the relative momentum of the Nifty Auto Index. While the index currently resides within the lagging quadrant, its trajectory has turned sharply upward and is on the verge of entering the improving quadrant.

Rolling into the improving quadrant is technically significant—it often signals the beginning of a phase where the security or index starts to outperform the broader market on a relative basis. This development adds conviction to the view that the Auto space could emerge as a key area of market leadership.

Top technical setups in the auto space

A closer analysis of individual stocks reveals emerging leadership within the Auto sector.

TATAMOTORS has completed a base formation pattern following a strong bullish divergence between the RSI and price. This was followed by a breakout above the pattern resistance, reinforcing the potential for continued strength.

MARUTI remains within a large symmetrical triangle—a continuation pattern—while maintaining its primary uptrend, suggesting the potential for a directional breakout.

ASHOKLEY has crossed above its 200-day moving average, which had been acting as a dynamic resistance, indicating renewed bullish momentum.

BAJAJ_AUTO is showing signs of reversal after forming a base that followed a clear bullish divergence of RSI against the price.

Lastly, BHARATFORG has reversed its multi-month downtrend, breaking out following a well-established bullish RSI divergence.

In summary

These technical developments collectively highlight a shift in relative strength and suggest that select Auto stocks are well-positioned to outperform in the near term.

About The Author

Next Story