Upstox Originals

What the SC’s Bhushan Power ruling means for JSW Steel

.png)

7 min read | Updated on May 05, 2025, 18:39 IST

SUMMARY

The Supreme Court has struck down JSW Steel’s resolution plan for Bhushan Power & Steel, calling it “illegal.” Due to this, JSW Steel could face a 10–15% production loss, a ₹4,000–5,000 crore EBITDA hit, and lose its ₹19,700 crore investment. The company is evaluating legal options, including a review petition. In this article, we look at the complete story, right from the investment in 2021 to the impact of the recent ruling on the lenders.

Stock list

The Supreme Court's recent order has dealt a blow to JSW's financials as well as future plans

JSW Steel, a leading steel maker in India, acquired over-indebted steel maker Bhushan Power and Steel Limited (BPSL) in 2021 under the Insolvency and Bankruptcy Code, 2016. This act allows new owners to take over high-debt assets so that the original lenders can get repaid.

The acquisition already faced multiple legal hurdles, including ED’s right over certain assets owing to money laundering and fund acquisitions by previous owners.

Here is a timeline of the events

| Year | Event |

|---|---|

| May 2017 | BPSL defaulted on certain loans. BPSL's total debt to lenders: ₹47,000+ crore. |

| July 2017 | BPSL was admitted to insolvency under the IBC Code, 2016. |

| Feb 2019 | JSW Steel wins bid with ₹19,700 crore offer; Committee of Creditors (Banks) approves. |

| Jul 2019 | NCLT approves the resolution plan. |

| Jan 2020 | Legal hurdles surface; ED attaches BPSL assets, citing money laundering by previous promoters. |

| Feb 2020 | NCLAT clears the plan and protects JSW under Section 32a of the IBC. |

| Mar 2021 | JSW pays ₹19,700 crore; BPSL becomes JSW subsidiary. |

| Oct 2021 | JSW increases its stake to 83.3%, renames the entity to JSW Bhushan Power & Steel. |

| Dec 2024 | SC ordered ED to hand over assets of over 4,025 crore of BPSL to JSW Steel |

| May 2025 | SC rules entire resolution process illegal; orders liquidation of BPSL. |

Source: Media articles, court filings, JSW Steel’s exchange filings

What happened recently?

On May 2, 2025, the Supreme Court ruled that the entire resolution plan of JSW Steel to acquire BPSL is illegal. The decision led to a ~6% correction in JSW’s share price as this came as a shock.

The court objected to key issues:

-

JSW Steel had funded the acquisition using a mix of equity and optionally convertible debentures (OCDS or debt). The court ruled that under IBC guidelines, acquisitions must be purely equity-funded to ensure transparency and commitment.

-

The court strongly criticised the delay in completing the resolution process, which had exceeded the prescribed 330-day timeline.

-

The ED had attached BPSL’s assets, suspecting they were proceeds from money laundering. The NCLAT process allowed JSW to take control of these assets. The Court ruled that the NCLAT had no authority to review the ED's actions.

-

Non-compliance with certain regulations of the IBC Code, 2016, and certain directions of courts/banks, including proving its eligibility to become a bidder.

With this judgment, the court ordered the liquidation of BPSL has put an overhang on JSW’s ownership in the company.

Impact on JSW Steel

The decision to reject the resolution plan and order the liquidation of Bhushan Power & Steel has had an immediate and adverse impact on JSW Steel, evident from a correction in the stock price.

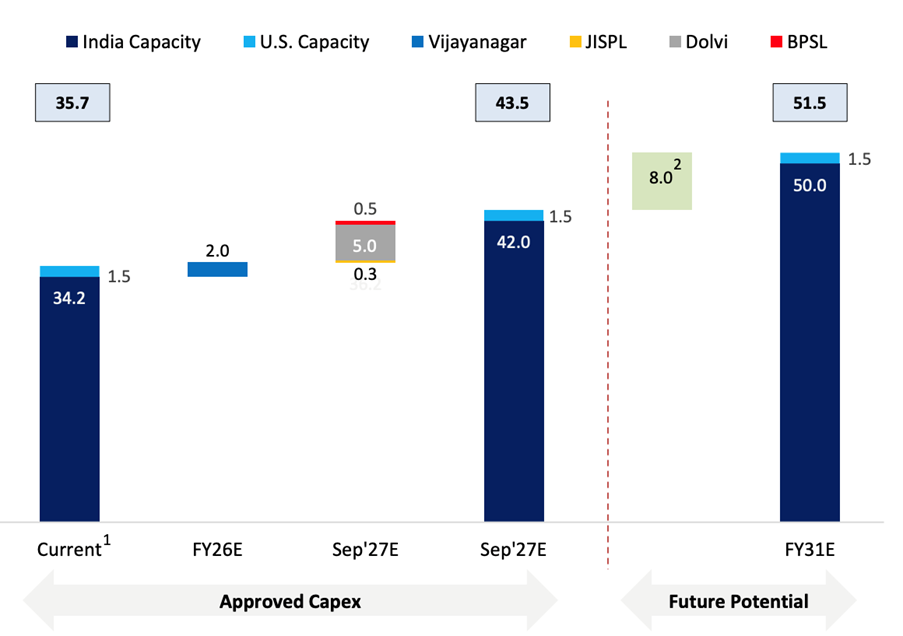

Expansion plans at BPSL formed a crucial part of JSW’s broader capacity growth strategy. JSW’s long-term vision to scale capacity to 51.5 MTPA by 2030 from 35.7 MPTA currently includes BPSL’s capacity expansion, while overall capacity expansion may also take hit due to the potential impact of this ruling on its balance sheet.

Source: JSW Steel Investor Presentation; *All capacities are in mt. 1: 5.0mt capacity at Vijayanagar under commissioning, 2: Subject to board approvals

Acquisition / investment - Impact on balance sheet

JSW Steel paid ₹19,700 crore to acquire BPSL, representing 8.5% of its total assets. With liquidation now ordered, there is no clarity on how much of this can be recovered. The current enterprise valuation of BPSL would be around ₹30,000 crore, considering capacity expansion and improved performance

Capacity and sales volume

BPSL added 2.75 million tonnes per annum (MTPA) of steel capacity. This accounted for 12.5% of JSW Steel’s total capacity.

Capex

JSW had planned to expand this to 5 MTPA via Phase II. The ₹4,488 crore capex earmarked for this is now at risk. Some expansion-related facilities have already been commissioned.

EBITDA - impact on P&L

BPSL contributed approximately 10% to JSW Steel’s consolidated EBITDA. Analysts estimate a ₹4,000–₹5,000 crore impact on annual EBITDA.

JSW Steel is awaiting the SC's written order to decide its future course of action.

Way forward: What can JSW do?

-

File for review: JSW can file a review petition in the Supreme Court. However, review petitions are rarely accepted unless there’s a clear legal error or new evidence. The court was strong in its language, calling the plan a “flagrant violation”, making this path uncertain.

-

Participate in liquidation: As a creditor who has infused capital, JSW could claim dues during liquidation. It may also bid for BPSL assets again, though this time at possibly distressed prices.

-

Revisit growth strategy: JSW will now need to find alternative routes to meet its growth targets. Options include:

- New brownfield expansions at existing facilities.

- Greenfield projects (though costlier and slower).

- Exploring smaller M&A opportunities.

Impact on banks: Lenders brace for fresh uncertainty

The Supreme Court’s order to liquidate BPSL has raised fresh concerns for the consortium of banks that had extended loans to the company. Leading lenders like Punjab National Bank, Allahabad Bank, and others had already marked recoveries from the ₹19,700 crore JSW Steel payout as part of their resolved assets under the IBC process.

With the resolution now overturned, these recoveries are at risk of being legally questioned or reversed during liquidation. If JSW Steel’s investment is deemed invalid, banks could be forced to reclassify the exposure as non-performing again, potentially triggering fresh provisions or write-downs.

This not only affects their financials but also dampens the outlook for recoveries from other large stressed assets under IBC, especially those facing legal challenges. The episode underscores the fragility of resolution gains for banks in cases where legal closure is prolonged or uncertain.

| Bank | Loan amount recovered (in Crores) |

|---|---|

| SBI | 3,930 |

| PNB | 2,440 |

| Canara Bank | 1,490 |

| Union Bank of India | 1,280 |

| Indian Bank | 1,060 |

| Bank of Baroda | 1,050 |

| Indian Overseas Bank | 420 |

| Axis Bank | 350 |

| IDBI Bank | 230 |

| J&K Bank | 170 |

| Karur Vysya Bank | 140 |

| Total | 12,400 |

Source: Bank Exchange Filings, Court Rulings, Media Articles

In summary

The Supreme Court’s ruling on Bhushan Power & Steel is a turning point not only for JSW Steel but also for India’s insolvency resolution ecosystem. It exposes cracks in how large IBC cases are handled, from delays and funding structures to enforcement gaps.

For JSW, the verdict means:

- A likely write-down of nearly ₹25,000 crore (investment + capex already incurred).

- A reset in its capacity expansion roadmap.

- A potential EBITDA decline in the near term.

While the company still has legal options, the immediate future is marked by uncertainty. For investors, this episode highlights a critical lesson—even high-profile deals backed by court approvals can face reversal in India’s legal framework. A cautious approach toward companies engaging in large stressed asset deals under IBC is warranted.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story