Upstox Originals

iProfit: How Buffett earned over $100 billion on Apple

.png)

5 min read | Updated on May 06, 2025, 10:28 IST

SUMMARY

Warren Buffett’s bold bet on Apple is one for the history books. For someone who shied away from tech investing for most of his career, Buffett saw Apple as more than a technology play. He saw this as an opportunity to invest in a brand with a strong product and incredible consumer loyalty. This article unpacks Buffett’s investment journey in one of his most successful investments and why the Oracle of Omaha officially tipped his hat to Apple CEO Tim Cook.

Apple has been one of Berkshire Hathway's most successful investments

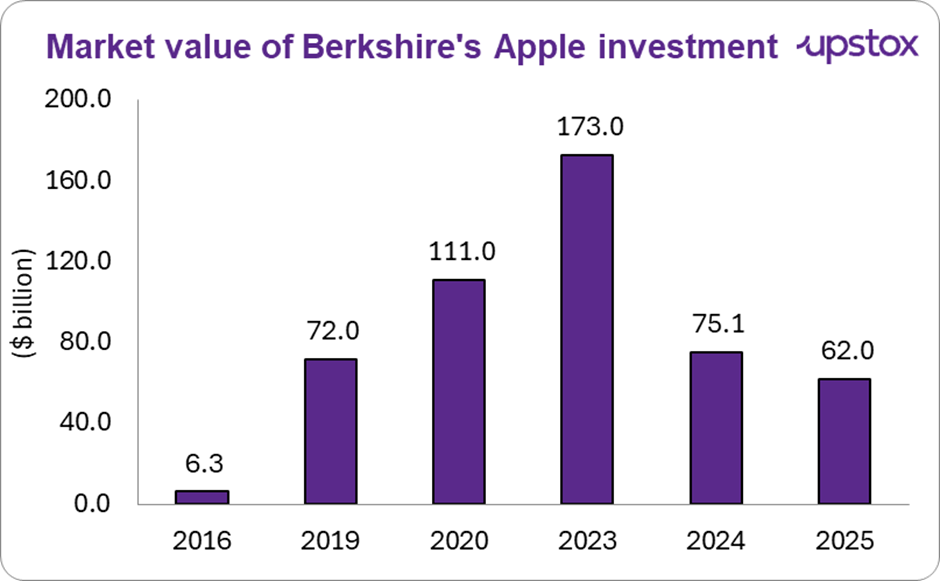

Warren Buffett, long cautious about investing in tech companies, shocked many in 2016 when Berkshire Hathaway began quietly buying shares of Apple. The purchases, initially handled by Buffett’s lieutenants, soon escalated as Buffett recognised Apple’s potential as more than just a gadget maker. Between 2016 and 2018, Berkshire invested roughly ~$35 billion in Apple, accumulating a significant stake in the company.

Source: Berkshire’s shareholder letters, Wall Street Journal, CNBC, Business Insider

Why Buffett chose Apple

Though Buffett traditionally avoided technology stocks, he viewed Apple through a different lens. He didn’t see it as a high-risk Silicon Valley bet, but rather as a consumer brand with unrivaled customer loyalty and an ecosystem that encouraged repeat purchases.

Buffett has repeatedly praised Apple for its product quality, pricing power, and user retention. While still committed to traditional value investing principles, Buffett’s embrace of Apple signals a recognition that today’s best businesses may be tech-driven, provided they have the right financial traits—strong cash flow, loyal customers, and disciplined capital allocation.

What made Apple stand out wasn’t just its innovation—it was its durability. Buffett saw a company with predictable earnings, global reach, and a moat built on customer trust.

What sealed the deal was the company’s shareholder-friendly approach, especially its massive stock buyback program, which effectively increased Berkshire’s ownership without additional investment. Buffett summed it up plainly: “Apple is probably the best business I know in the world.”

How much did Buffett make?

While we were unable to find the exact profit number, back-of-the-envelope calculations suggest that they should be more than $100 billion (including dividends).

In the first three quarters of 2024, Berkshire sold off ~67% of its Apple stake. The company currently owns ~300 million shares in Apple, valued at ~$62 billion. Apple still comprises around 23% of Berkshire’s stock portfolio; in total, Berkshire’s stake represents about 2% of Apple’s outstanding shares.

Apple currently pays a $1.00 annual dividend per share, meaning Berkshire earns $300 million per year—roughly $75 million per quarter. This income is expected to grow. Apple has raised its dividend every year since 2012, most recently by 4.2% in May 2024. While its dividend yield remains modest at 0.45%, Apple makes up for it with aggressive stock buybacks—returning over $110 billion to shareholders in 2024 alone.

Tim Cook’s role in Apple’s success

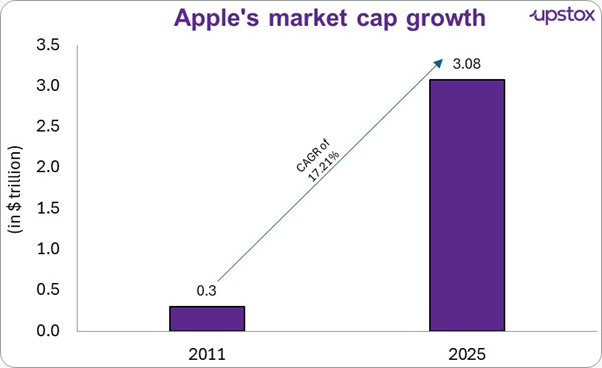

When Tim Cook took over Apple after Steve Jobs’ death in 2011, skeptics questioned whether he could maintain the company’s innovative edge. Over a decade later, Cook has not only maintained Apple’s dominance but expanded it.

He oversaw the launch of new product categories like the Apple Watch and AirPods and shifted Apple’s business model to place a stronger emphasis on services, such as Apple Music, Apple Pay, iCloud, and Apple TV+. Under Cook, Apple became not just a hardware company but a diversified tech ecosystem. He was adept at supply chain management, ensuring not only operational efficiency but also widening reach.

Financially, the results have been remarkable. Revenue and profit margins remained strong, and the company continued returning capital to shareholders via dividends and stock repurchases, which is reflected in the sharp rise in its market capitalisation

Source: Oberlo; *Market cap as on May 02, 2025

Buffett’s legacy

As Buffett now prepares to retire, he leaves behind a staggering stat: from 1964 to 2024, Berkshire has gained 5,502,284%—versus the S&P 500’s 39,054%. The table below gives some of Berkshire’s major successes under his stewardship.

Berkshire Hathaway’s major investment successes

| Company | Initial investment year | Initial investment ($ billion) | Estimated current value ($ billion) | Notes |

|---|---|---|---|---|

| Apple | 2016 | $1.0 | $62 | Largest ever bet; significant stake trimmed in 2024 |

| Coca-Cola | 1988 | $1.0 | $25 | Annual dividends alone exceed $775 million |

| American Express | Early 1960s (major stake in 1990s) | $1.3 | $28+ | Buffett holds ~20% of the company; consistent dividend income |

| Bank of America | 2011 (warrants exercised in 2017) | $5 | $32 | Strategic post-crisis investment; warrants proved highly valuable |

| Moody’s Corporation | 2000 | $0.25 | $9.5+ | Small stake turned multi-billion; still held |

Sources: The Wall Street Journal, Yahoo Finance, WallStreet Waves; * The figures above are based on available data.

Final thoughts

Berkshire Hathaway’s Apple investment will likely go down as one of the greatest stock picks in corporate history. The investment embodies the very essence of Buffett’s long-term strategy: buy great businesses, hold them, and let compounding do its work.

Apple, under Tim Cook, proved it could not only survive Steve Jobs’ absence but thrive. Its evolution from a hardware maker into a services powerhouse has been central to its sustained growth. In many ways, Apple became the perfect Buffett stock. And in return, Buffett’s conviction gave Apple the ultimate stamp of approval from the world’s most famous investor.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story