Upstox Originals

Is quick commerce a threat to Indian e-commerce giants?

8 min read | Updated on April 09, 2025, 15:18 IST

SUMMARY

In the age where convenience is king, quick commerce is rewriting the rules of retail. Ultra-fast delivery services are challenging traditional retail models. However, this race for speed raises critical questions: How sustainable is this model? Is it a threat to established e-commerce giants? Let’s find out!

Is quick commerce a threat to Indian e-commerce giants?

Run out of sugar? No worries—pick up your smartphone, place an order on your favourite quick-commerce app and you have it delivered to your doorsteps within 10 minutes, even before your coffee is brewed.

From a fresh loaf of bread to the latest iPhone and even fashion accessories and clothing, you can now order almost everything at the click of a button and have it delivered in practically the time it takes to watch half an episode of your favourite show.

This is all thanks to quick-commerce (q-commerce) platforms like Blinkit, Zepto, Swiggy Instamart and more.

What makes these platforms a big hit among consumers? Well, it’s the convenience, ultra-fast delivery, and instant gratification.

No surprise here—India’s q-commerce sector is growing at breakneck speed.

Just look at the numbers…

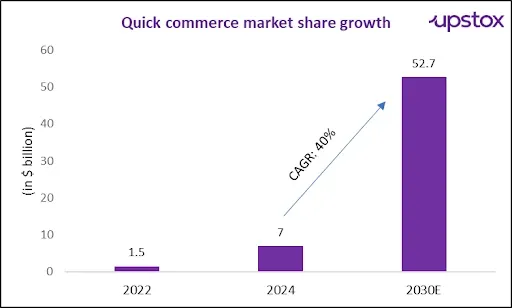

In 2024, more than two-thirds of all e-grocery orders and one-tenth of e-retail spend happened on quick-commerce platforms, whose total market share has surged nearly fivefold, reaching $7 billion in 2024 from 2022 levels. The sector is expected to further grow by over 40% every year until 2030.

Source: Bain & Company

Source: Bain & CompanyThe interesting bit?

Quick commerce is “India's fastest-growing industry segment ever” and it currently serves over 20 million annual online shoppers.

Who leads the quick commerce market in India?

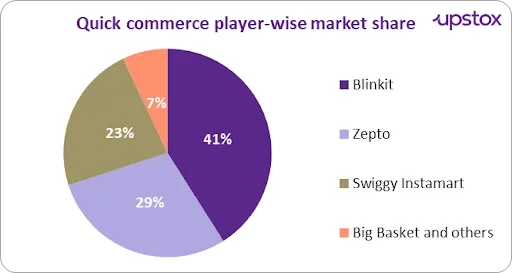

Estimates from Citi’s latest report suggest that Blinkit (owned by Zomato) leads the quick commerce race with a 41% market share, followed by Zepto with 29%, Instamart (owned by Swiggy) with 23%, and other players including Big Basket (owned by Tata) with total 7% share.

Source: Citi report

With competition heating up, players are pulling out all the stops to stay ahead.

They’re doubling down on rapidly expanding dark stores, venturing into new cities, diversifying product offerings, and securing fresh funding to strengthen their cash reserves—leaving no stone unturned in the q-commerce race.

FYI: The q-commerce model relies heavily on dark stores—small warehouses strategically located close to delivery points typically within a 2-4 km radius to ensure that orders can be fulfilled within 10-20 minutes.

| Q-commerce platform | Dark-store count as of Q3FY25 | Estimated stores in 2026* |

|---|---|---|

| Blinkit | 1,007 | 2,000 |

| Zepto | 750 | 1,200 |

| Swiggy Instamart | 705 | 1,046 |

Source: MoneyControl; *As per company announcements

In fact, Swiggy Instamart is taking a step further by introducing Megapods, which are up to three times larger than standard dark stores to increase its stock-keeping units (SKUs) per store from 20,000 to 50,000.

Looking at the growth of q-commerce, a key question emerges:

Is q-commerce eating into the sales of e-commerce giants?

Well, earlier the q-commerce business was restricted to groceries and essentials, but now they have ventured into almost everything, from electronics to clothing, beauty, toys, gifts and even gold and silver coins. In fact, 15%–20% of its gross merchandise value (GMV) now comes from the new categories.

Not to forget, these categories were earlier dominated by e-commerce companies. Naturally, this didn’t sit well with them.

Q-commerce companies stepping into e-commerce territory meant a dent in their sales, market share and profitability.

But e-commerce giants played smart.

Recognising the explosive growth and consumer adoption of q-commerce, e-commerce giants soon entered the q-commerce space to grab a piece of the pie.

Here's some context: Flipkart has entered into the 10-minute delivery space with the launch of Flipkart Minutes. Amazon has started rolling out its 10-minute delivery service, Amazon Now. It is also gearing up to launch Amazon Tez, which is presently in the testing phase. Besides, Myntra has launched M-Now, a 30-minute delivery service for fashion and beauty products. The country's largest retailer, Reliance also began offering quick commerce services via JioMart in select cities.

While the entry of e-commerce giants into quick commerce validates the market’s potential, will it impact the profitability and expansion of existing players?

Let’s find out!

Will large e-commerce platforms be able to counter q-commerce players?

May be, may be not! It’s a mixed bag.

You see, profitability is a challenge for q-commerce platforms. For the uninitiated, Blinkit is the only platform that is EBITDA positive as of FY24. The biggest lever for profitability is volume. And, with large players entering the space backed by strong supply chains and financial muscle, it will be interesting to see how existing q-commerce companies manage to boost their volumes as well as become profitable.

The entry of deep-pocketed competitors could squeeze the profitability of dedicated quick commerce firms. They may also face immediate challenges to grow into markets beyond large cities.

Why you ask? Well, because expanding into smaller towns and rural areas presents unique challenges such as logistical inefficiencies, lower order volumes, and affordability concerns. The cost of warehousing in smaller cities and towns itself is too high compared to the size of the average order. And, only the big players have the wallet to bear that cost.

Having said that, whether e-commerce giants will hold their ground against q-commerce players is still debatable. However, increased competition can potentially have some impact on the q-commerce industry's profit pool.

That’s not all.

Other challenges loom

One of the pressing concerns is high logistics and operational costs.

To live up to the promise of ultra-fast deliveries, companies need to invest heavily in operating thousands of dark stores, maintaining multiple SKUs, scaling their delivery fleet, and adding more delivery vehicles, which drive the costs up.

For instance, opening a single dark store costs a hefty ₹80-90 lakh (including setup, rent deposit, initial inventory, and capex towards racks, freezers, chillers, and IT infra). And, an average 2,000 sq. ft. dark store catering to 1,500 orders daily, requires around 20 people to manage it.

The problem doesn’t end there. Rather, it creates a ripple effect.

The financial strain often weighs down the company’s financial results. For context, in the Q3FY25 earnings report, Zomato reported a sharp decline of 57% YoY in its net profit, Swiggy’s losses surged 39% YoY, and Zepto continued to burn ~₹350-400 crore per month. It is important to note that some of these companies are not profitable at the group level either, q-commerce, with its high burn and operational intensity, further adds to the burden.

Another concern is long-term sustainability and growth.

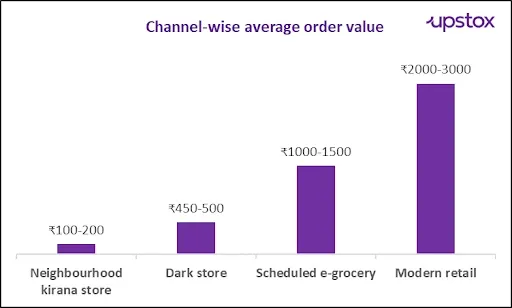

Currently, the average order value (AOV) of dark stores (₹450 to ₹500) is way too low compared to modern retail stores like Reliance Fresh (₹2,000 to ₹3,000), and e-grocery companies like Big Basket (₹1,000 to ₹1,500).

Source: JM Financials

This puts pressure on profitability, questioning the long-term viability of the model.

It is a major reason why q-commerce players in several countries have failed. Take for example, Fridge No More (a US-based startup that had to shut down in March 2022), Buyk (a US-based company had to file for bankruptcy in March 2022), Jokr (despite being a unicorn in 8 months, had to cease operations in the US and Europe in June 2022), and Getir (exited UK, US and Europe in April 2024).

But hold on.

It's not all doom and gloom!

While there are challenges, multiple factors favour this sector in India.

The number one is: labour economics.

While other countries are struggling with q-commerce, India’s lower labour cost makes it profitable. The per-delivery cost in India is up to 20x cheaper than in the US and 13x cheaper than in Europe.

Besides, India’s demographic advantage and internet penetration make it one of the most attractive markets for quick commerce. In addition, rising urban and middle-income groups and a young, tech-savvy population also give quick commerce players ample room to grow.

Another reason why q-commerce caught on so fast in India is changing consumer behaviour from traditional price-focused shopping to value-based purchasing. Today Gen Z and Millennials are willing to pay a premium for speed and convenience.

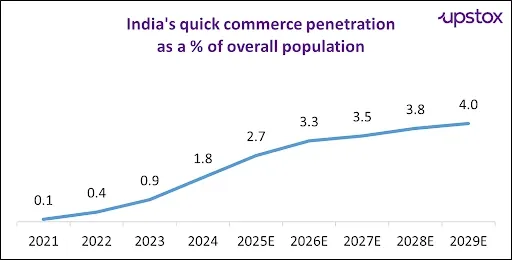

Considering the positives, q-commerce penetration in India is expected to grow at a rapid pace—from the current 1.8% to 4% by 2029

Source: Statista

As India’s q-commerce market races towards growth, its long-term sustainability hinges on the ability of companies to find the right balance between speed, scale, and profitability.

However, to hit the estimated 40% annual growth figure, there should be a significant rise in AOV and order frequency per user. While we are on track right now, with reports indicating 40% rise in AOV between FY23 and FY25 and 6x rise in order frequency per month between FY21 and FY24. How far we can go is something to be seen.

So, let’s keep our fingers crossed, as we don’t want to miss our late-night ice cream cravings!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story