Upstox Originals

India's e-commerce opportunity: Capitalising on USA's China tariffs

.png)

8 min read | Updated on April 22, 2025, 12:30 IST

SUMMARY

The USA has recently imposed substantial tariffs on Chinese e-commerce imports, with rates reaching up to 145%. This policy shift, aimed at curbing the influx of low-cost Chinese goods, presents a strategic opening for Indian exporters. India, currently enjoying zero-tariff access to the USA market for e-commerce goods, stands poised to fill the void left by Chinese sellers.

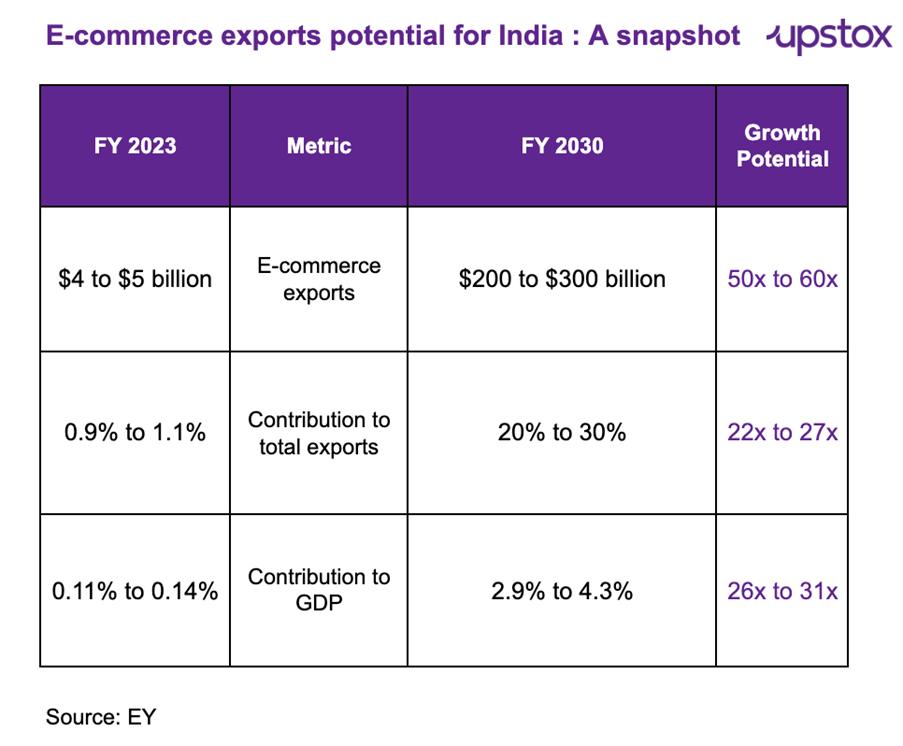

As of FY23, India’s e-commerce exports account for ~0.9% to 1.1% of total merchandise exports.

China has dominated the global e-commerce landscape due to its unparalleled technological capabilities, world-class manufacturing infrastructure, and robust supply chains. A significant factor behind China’s success has been USA’s e-commerce policy, which allows low-value e-commerce packages (worth under $800) to enter foreign markets duty-free.

This policy has been crucial in propelling China’s e-commerce exports, which expanded from $5.3 billion in 2018 to $66 billion in 2023. Notably, the USA accounts for 30% of China’s e-commerce exports, meaning that for every $100 worth of Chinese e-commerce goods, $30 is destined for the USA market.

However, in a move to protect USA industries and curb the influx of inexpensive Chinese products, particularly in categories like fast fashion and electronics, the USA has escalated tariffs on these low-value imports. The new tariffs, which have been raised to a staggering 145% as of 11th April-25, effectively nullify the competitive edge that Chinese sellers previously enjoyed.

As a result, this shift opens up new opportunities for alternative suppliers, including India, to capture market share in sectors that were once dominated by Chinese e-commerce exports.

Opportunities for alternative suppliers: India's strategic position

India presents itself as a highly attractive and viable option, primarily due to its zero-tariff status for e-commerce exports to the USA. This favourable trade environment allows Indian exporters to capitalise on market gaps left by Chinese goods, positioning India as a key player in various sectors such as textiles, electronics, and home goods.

As of FY2023 (latest available data), India’s e-commerce exports are ~$4-$5 billion, accounting for ~0.9% to 1.1% of total merchandise exports. In contrast, China’s e-commerce exports constitute 6.4% of its total merchandise exports.

With rising global demand for Indian products, projections indicate that India’s e-commerce export sector could surge to ~$200-300 billion by 2030, an ambition further reinforced by recent statements from India’s commerce secretary.

This shift presents an unprecedented opportunity for Indian businesses to capture a larger global market share, leveraging the country’s competitive advantages such as cost-effectiveness, skilled labour, and a growing digital infrastructure.

Factors driving India’s e-commerce export growth

India’s e-commerce export sector is poised for significant expansion, fueled by several key factors that are reshaping the landscape of global trade. We look at some of the primary factors driving India’s e-commerce export growth

Increase in digital buyers worldwide

As of 2024, global digital buyers have grown to 2.71 billion, up 14.3% since 2020 (as per EY). This surge expands the global market for Indian e-commerce exports, especially in apparel, home, and health products.

Government initiatives

-

The National E-Commerce Policy aims to regulate India’s digital commerce landscape, ensuring fair competition, consumer protection, and robust data governance.

-

Government schemes like the Software Technology Parks scheme (STP), India BPO Promotion Scheme (IBPS) and Service Exports from India Scheme (SEIS), custom clearance through Indian Customs Electronic Gateway; and Market Access Initiatives along with plan to set up E-commerce Export hubs heavily incentivise companies to export their digital offerings to global markets.

-

The consignment-wise cap on E-Commerce exports through courier has been raised from ₹5 - ₹10 lakh in the FTP 2023. This means that e-commerce exporters can ship goods worth up to ₹10 lakh per consignment through a courier, which is faster and more convenient than the traditional cargo mode.

Rising adoption of customer-centric models

In today's world, customer choices drive business success, and e-commerce platforms play a crucial role in helping businesses gather organised, data-driven feedback, enabling Indian firms to better understand consumer preferences and tailor their offerings accordingly.

Growing Indian diaspora

The global Indian diaspora, which is estimated to number around 60 million people worldwide, is increasingly serving as a bridge to sell Indian-origin products globally, especially in markets like the USA, the UK, and the Middle East.

Increased focus on international expansion by MSMES

-

A report by the Payoneer Survey found that 91% of Indian businesses plan to expand internationally, with many of them focusing on online platforms due to increasing digital adoption.

-

The ability of MSMES to participate in cross-border trade via e-commerce platforms has resulted in over 1 million sellers from India reaching international consumers. This has resulted in India’s e-commerce exports growing from $2bn in 2019 to $5 bn in 2023.

-

A key factor driving the growth of India’s e-commerce exports is the digital adoption among MSMES. As of 2024, 6 million out of 60 million+ MSMES are actively engaging in online sales, with 64% reporting higher sales through digital channels.

UPI going global

India’s flagship payment system, UPI, has been going global, with 7 countries (France, UAE, Singapore, Sri Lanka, etc.) accepting it as a valid payment system, helping Indian e-commerce exports to provide them a smooth payment platform.

Continuous cycle of global festivities

Global festive seasons such as Christmas, Diwali, Eid, and Black Friday contribute to a continuous cycle of shopping demand, especially for handicrafts, jewellery, and clothing traditions; home decor stands to benefit from global festive buying patterns.

Why China outpaces India in E-commerce exports

India lags behind China in several key aspects of e-commerce exports. Unlike China, India lacks dedicated Customs Supervision Codes for e-commerce exports, causing delays and inefficiencies in customs procedures. Chinese companies have warehouses all over the world, helping them deliver faster, evident from the fact that 60% of E-commerce exports are being serviced through foreign warehouses by Chinese e-commerce players.

| Aspect | China | India |

|---|---|---|

| Customs clearance | Within 24 hours electronic mode | Within 1–2 days for air cargo and 4–6 days for sea cargo through electronic mode |

| Export value limit (courier) | Up to $50,000 per consignment | Up to $12,000 per consignment |

| Returns | E-commerce returns are exempt from import duty | E-commerce returns are exempted from import duty but physical verification of goods re-imported is required |

| E-commerce export hubs | Specialised zones with simplified export procedures | No dedicated export hubs, initiatives introduced under FTP 2023 |

| Payment realisation | No time limit or variance limit on realised export payments | RBI mandates payment realisation within 9 months with a 25% variance limit |

| Bilateral agreements for e-commerce exports | Memoranda with 15 countries | No dedicated agreements for e-commerce exports |

| Customs supervision | Separate customs codes expedite clearances and help in data collection and policy formulation | No separate customs codes, leading to delays in customs verification and hindering data collection for future policy interventions |

| Defining responsibilities | Seller only needs to obtain company/product-specific licenses, with the e-commerce operator handling export and payment reconciliation | No segregation in responsibilities, necessitating seller participation in every step, leading to increased focus on compliance and affecting ease of doing business |

Source: EY, Commerce Ministry, Foreign Trade Policy 2023, Media Articles

These are the bottlenecks apart from manufacturing infrastructure and supply chain inefficiencies. But that’s not a bigger problem since US consumers have higher per capita income than China and India; hence, they can afford to pay more for the same product.

Or even if the prices are kept similar to Chinese, the margins for Indian firms would be lower compared to the Chinese. As per the Consumer Product Safety Commission (CPSC) of the US, around 70% of notices were issued (for sub-standard quality) to Chinese firms.

A significant progress definitely needs to be made by India in various aspects of regulation and operation to overcome certain bottlenecks.

Which sectors have the highest potential for India to grow in e-commerce exports?

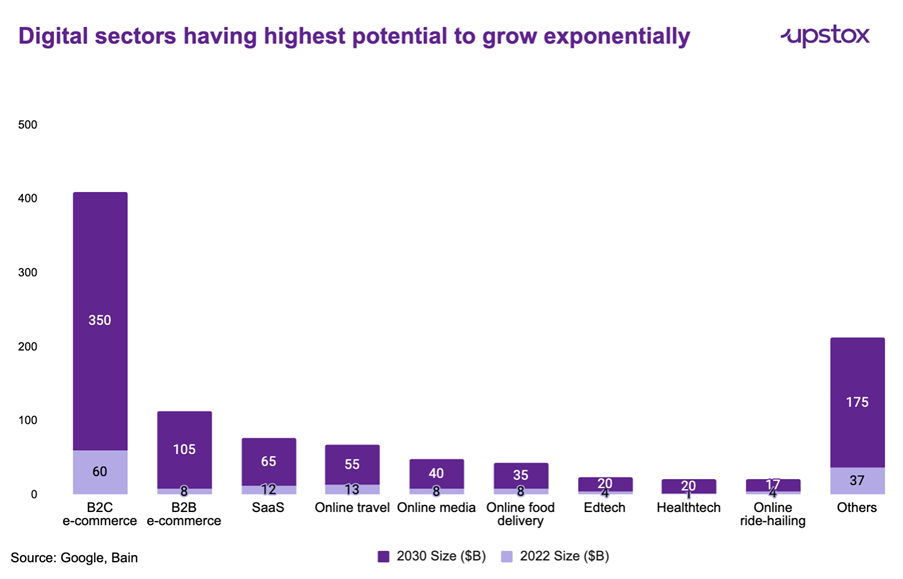

India is poised to lead in exports of apparel, electronics, footwear, and plastic goods—segments identified by Google and Bain for digital economy growth.

What gives India an edge? E-commerce exports to the US enjoy tariff exemptions for goods within certain value limits, unlike traditional exports that face reciprocal tariffs.

This opens a massive opportunity for Indian sellers to scale globally with fewer trade barriers.

In summary

India’s e-commerce export sector is set for a substantial rise, driven by a convergence of digital adoption, governmental support for MSMES, growing international demand for unique heritage products, and strategic global expansion initiatives.

With an increasingly interconnected world and growing consumer bases, India's e-commerce exports are positioned to take full advantage of global opportunities. However, to sustain this growth, continued improvements in logistics, compliance, and infrastructure will be essential to match the potential of this burgeoning export market.

Indian manufacturers can out-compete China and SEA’s exports by international product certifications/quality standards, while providing best-in-class value via scaled manufacturing.

About The Author

Next Story