Upstox Originals

Cola wars are back in India and this time it’s getting even hotter

8 min read | Updated on April 16, 2025, 12:55 IST

SUMMARY

As temperatures soar, so does the competition in India's beverage market, with brands pulling out all stops to stay ahead. But this year, the competition is fiercer than ever, thanks to Reliance’s bold move of reviving Campa Cola at an aggressive ₹10 price point. Can Campa Cola topple the giants and spin its desi magic? Should Coca-Cola and PepsiCo be worried? Let’s find out!

Cola wars are back in India and this time it’s getting even hotter

No, it’s not what you’re thinking!

It means summer has arrived!

And, as the mercury soars, India's cola war is heating up—in store shelves, advertising war rooms, board rooms, cricket fields and drawing rooms.

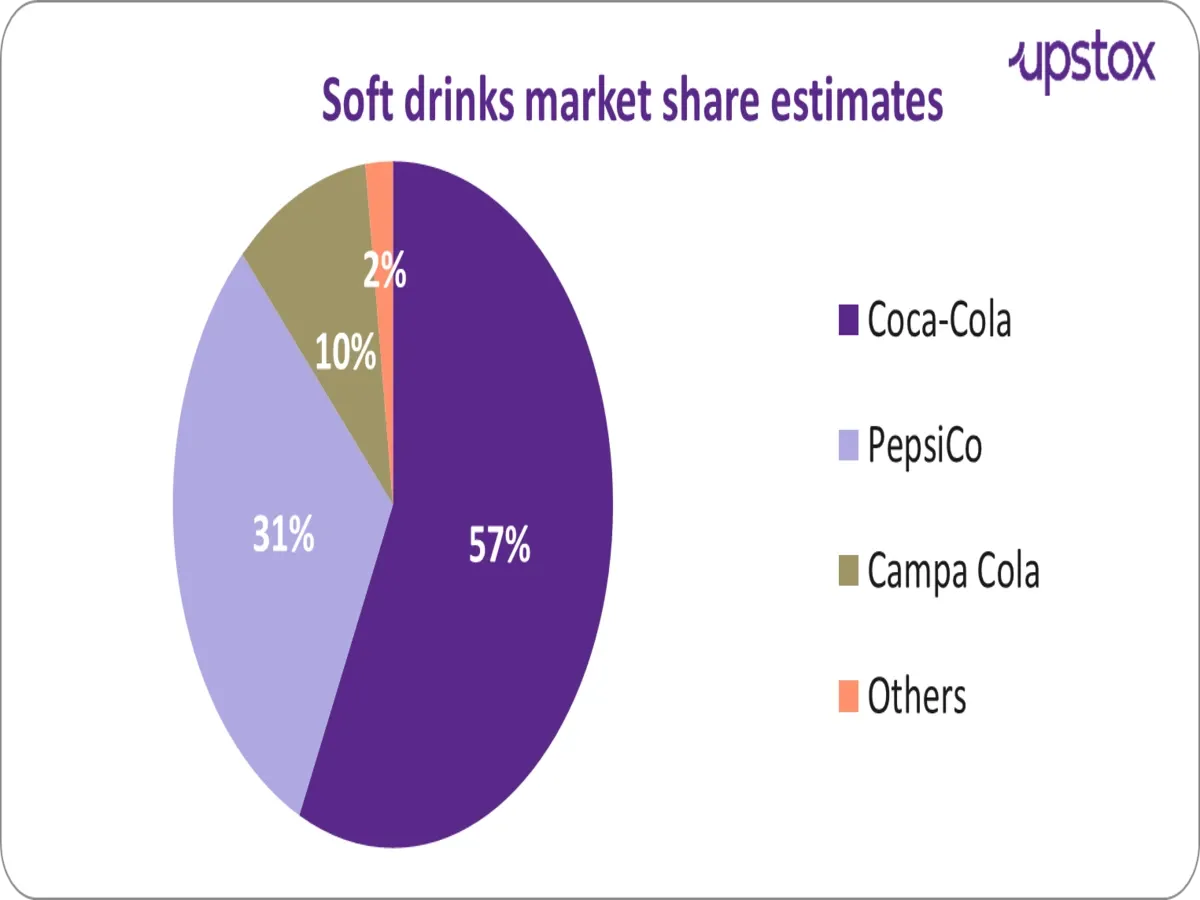

The fight for dominance in India’s soft drinks market

They kicked out popular Indian brands like Parle’s Gold Spot, the Indian government's Double Seven and even Campa Cola in the late 1990s.

But now the dynamics of this industry are changing!

How is that, you ask?

Well, with the comeback of the homegrown brand Campa Cola that held cult status in the 1970s and 1980s.

To give you some idea, Reliance Industries Limited (RIL) acquired Campa Cola in 2022 and reintroduced it in India in 2023 to take on American soda-making giants.

But the question is…

Why is Reliance entering the soft drink business dominated by household names—Coca-Cola and PepsiCo?

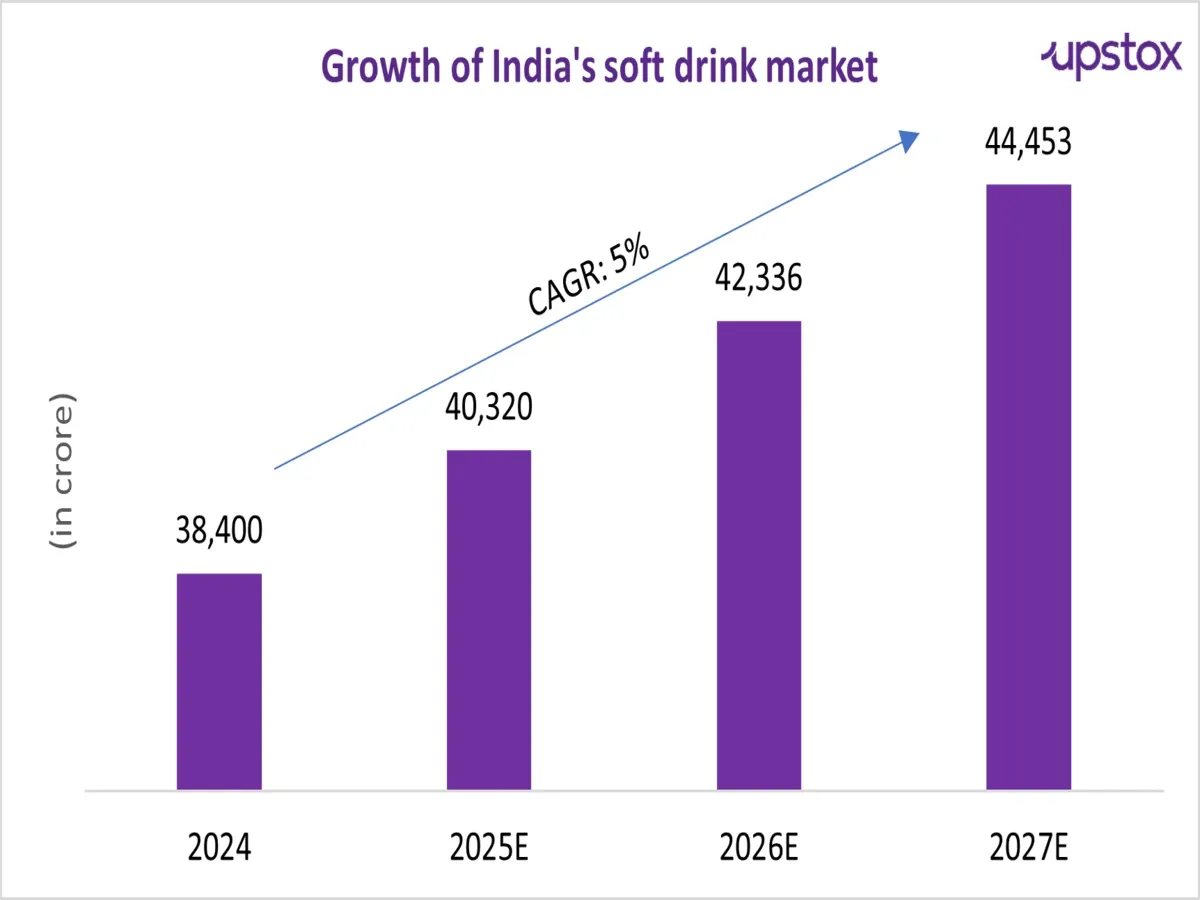

Clearly, there’s lots of fizz in India's cola market!

And things get even crazier when you look at the larger picture.

The numbers show that there is plenty of room for new players to enter and gain a strong foothold in the market.

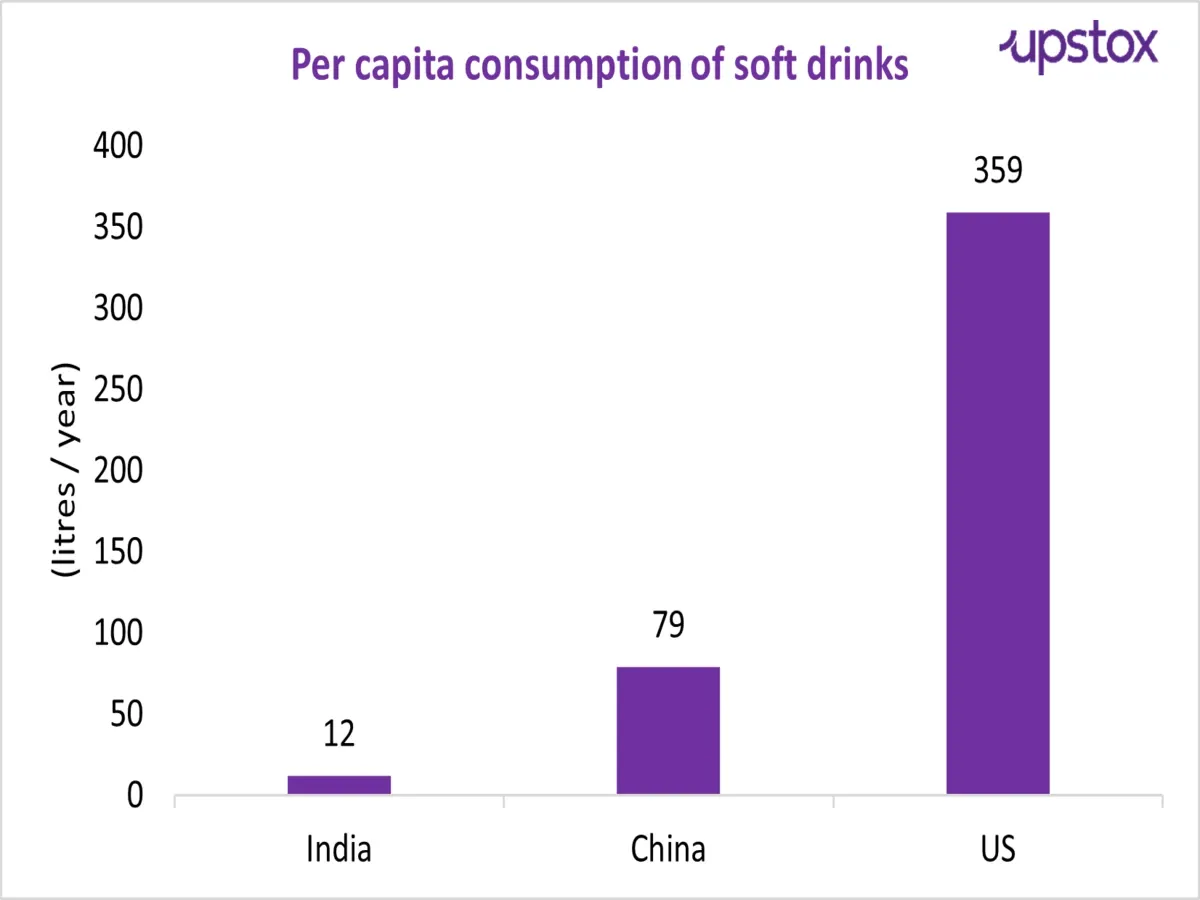

But wait. This is not the only reason Reliance has entered this market. There’s more to the story! Despite being the world’s second-most populous country, India’s per capita consumption of soft drinks is significantly lower than other countries. For context, in India, each person consumes an average of 12 litres of soft drinks per year, compared to 79 litres in China and a whopping 359 litres in the US.

This means the market is largely underpenetrated, with huge room for growth.

Source: MMR Research, a global consumer market research agency

Now by this point, you might be wondering–

How Reliance is breaking into this competitive industry?

Let's go behind the scenes!

Reliance isn't picking an easy fight, but it has several advantages that can help Campa Cola reclaim its long-lost crown. Reliance’s winning market strategies for Campa Cola are also helping it enter the beverage market with a bang.

Vast retail and distribution network

In contrast, Coca-Cola and PepsiCo both follow traditional distribution models that rely on third-party logistics. Reliance’s direct-to-consumer strategy creates a seamless supply chain advantage for Campa Cola.

Imagine, if Reliance Retail decides to replace the popular brands of Coca-Cola (Thums Up, Sprite, Limca, Fanta, Maaza, etc.) and PepsiCo (7Up, Mountain Dew, Mirinda, Tropicana, etc) from all of its stores, how much will the market share of these giants drop?

Disruptive pricing strategy

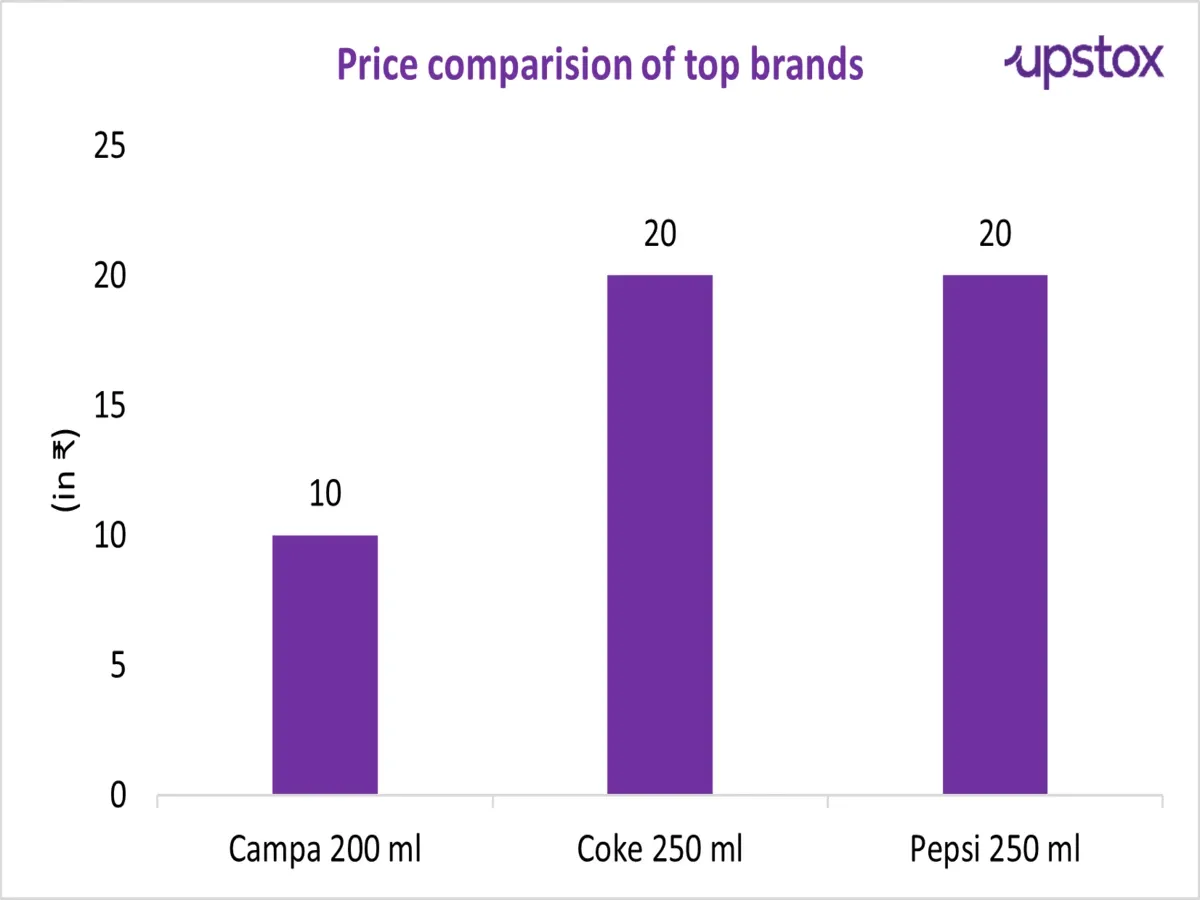

Reliance's disruptive pricing strategy positions Campa Cola as the go-to choice for India’s price-sensitive consumers.

For context, a 200ml bottle of Campa is priced at ₹10, whereas a 250ml bottle of Coke and Pepsi is priced at ₹20. Likewise, a 500ml bottle of Campa is priced at ₹20, whereas a 600ml bottle of Coke and Pepsi is priced at ₹40. You will find a price differential of ₹10-20 across most pack sizes.

If this rings a bell, you’re right! Reliance adopted a similar strategy with Jio, where it penetrated the market with low prices and quickly gained market share.

But that’s not all.

Reliance isn’t just targeting consumers. It is also making sure retailers have a strong reason to push Campa Cola over other brands. How? With higher trade margins.

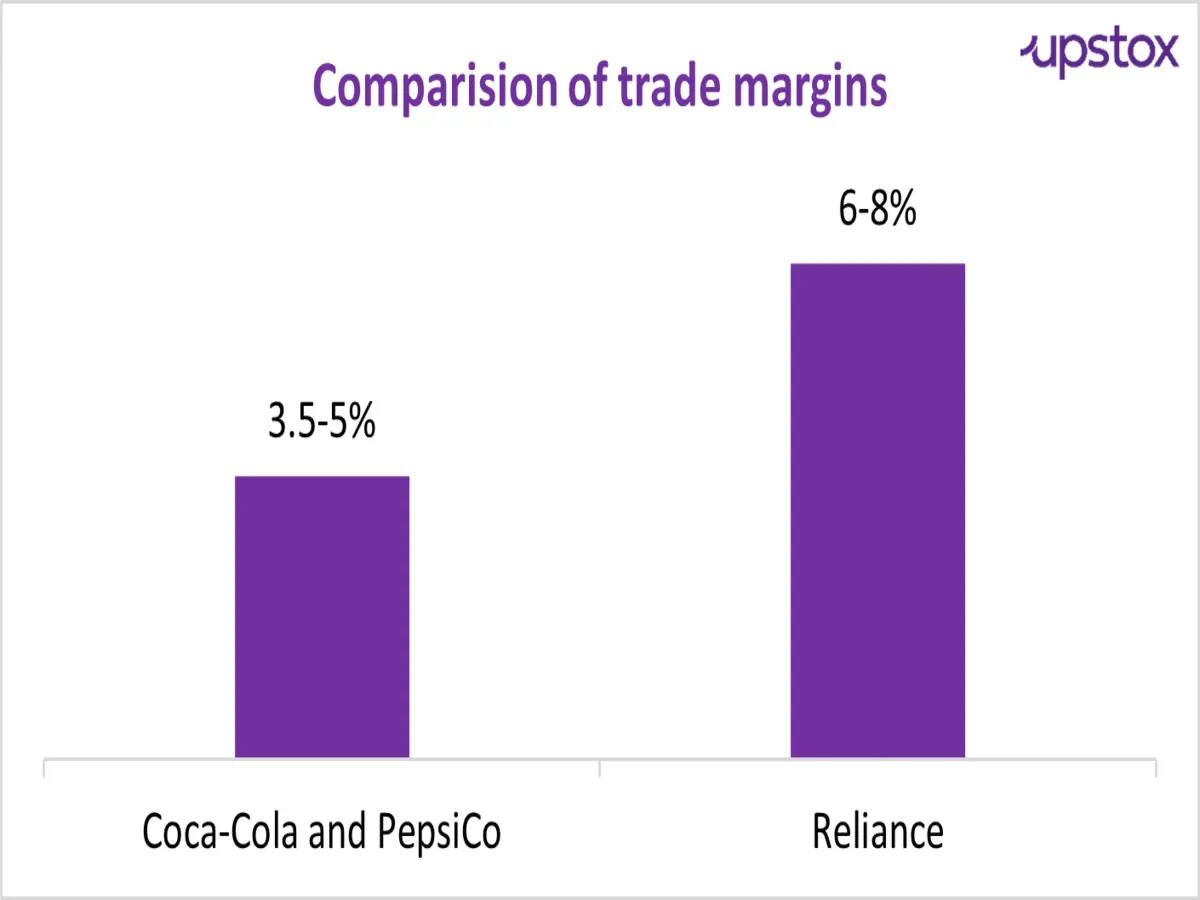

Reliance is luring retailers and distributors by offering them higher profit margins of 6-8%, whereas other brands typically offer 3.5-5% margins. The benefit? Substantial retailer interest in Campa Cola and prime shelf space in the retail market.

This is a genius strategy in two ways! One, they are generating a pull among retailers with sweet price points and margins. And two, they might save crores on marketing compared to over ₹2,500 crore spent by Coca-Cola and PepsiCo combined on marketing last year.

Expansive merchant partner network

Read on, we have more for you!

Strategic partnerships and sponsorships

See, the summer months between March and July account for over half of the annual sales of soft drinks. The IPL, one of the country’s most-watched sporting events held between March and May, gives massive visibility to the brand among 250 million+ viewers.

By securing IPL T20 rights, Reliance has also edged out last year's rights holder Coca-Cola's Thums Up.

Now that’s a winning marketing strategy, isn’t it?

Market expansion and visibility

Besides, Reliance is placing Campa smartly and strategically in events, fuel stations, and cinemas to increase its customer reach in India.

While Campa is capturing hearts and markets again, things are a little fizzy for them. This brings us to an important question:

Can desi brand Campa topple the giants–Pepsi and Coke?

Let’s understand!

But Reliance’s strategic play of hiring Prasoon Joshi, the ad man behind the iconic Coke campaign ‘Thanda Matlab Coca-Cola’ and roping in T Krishnakumar, former Coca-Cola India chairman in their core leadership team can strengthen their game.

Breaking into the soft drinks market is challenging due to many entry barriers, especially, building a massive distribution network. While Reliance has an extensive network, managing an efficient supply chain can be challenging. Coca-Cola and PepsiCo have established networks, especially in remote areas, where Reliance might need to set up cold storage and transportation.

Reliance's aggressive pricing of Campa Cola at ₹10 per 200ml bottle, half the price of competitors, has already started a price war, compelling competitors to consider promotional offers and potential price adjustments. However, such low prices question long-term sustainability and profitability.

But but but…

While Campa has played its cards well, its competitors are also not sitting quietly.

To counter Campa's threat, here’s what rivals are doing.

- Coca-Cola is leveraging its partnering with Jubilant FoodWorks to offer Coca-Cola's extensive range of sparkling beverages at Domino's and other outlets operated by them.

- PepsiCo's bottling partner, Varun Beverages, recently raised ₹7,500 crore through a qualified institutional placement (QIP) to expand into new markets, increase product portfolios and make strategic acquisitions.

- Coca-Cola and PepsiCo have rolled out no-sugar drinks with diet and light variants at ₹10 to meet the growing demand for healthier beverage options.

In the end, as brands pop open new strategies to fight the battle of bubbles and shelf space, who will win is something only time (and consumer preferences) will tell!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story