Upstox Originals

As Apple rethinks China, India is in the spotlight. But is it ready?

8 min read | Updated on April 26, 2025, 10:40 IST

SUMMARY

Trump’s tariff could hit Apple hard. Amidst rising tariffs on China, Apple has ramped up iPhone production in India by 60%, signalling a shift away from China. With 20% of global iPhone output coming from India, Apple is quite bullish on India. But the key questions are: Is India ready to seize this opportunity? Can India become the next iPhone factory? Can India replace China in global tech manufacturing? This article offers a reality check on India’s manufacturing readiness.

As Apple rethinks China, India is in the spotlight. But is it ready?

Think your latest smartphone is made in China?

Probably not!

Not long ago, India relied heavily on importing electronics and critical mobile components. But now things are changing!

India is boosting its domestic capabilities

India's electronics manufacturing ecosystem is strengthening, and it now manufactures even critical mobile components such as chargers, battery packs, camera modules, display assemblies, microphones and speakers.

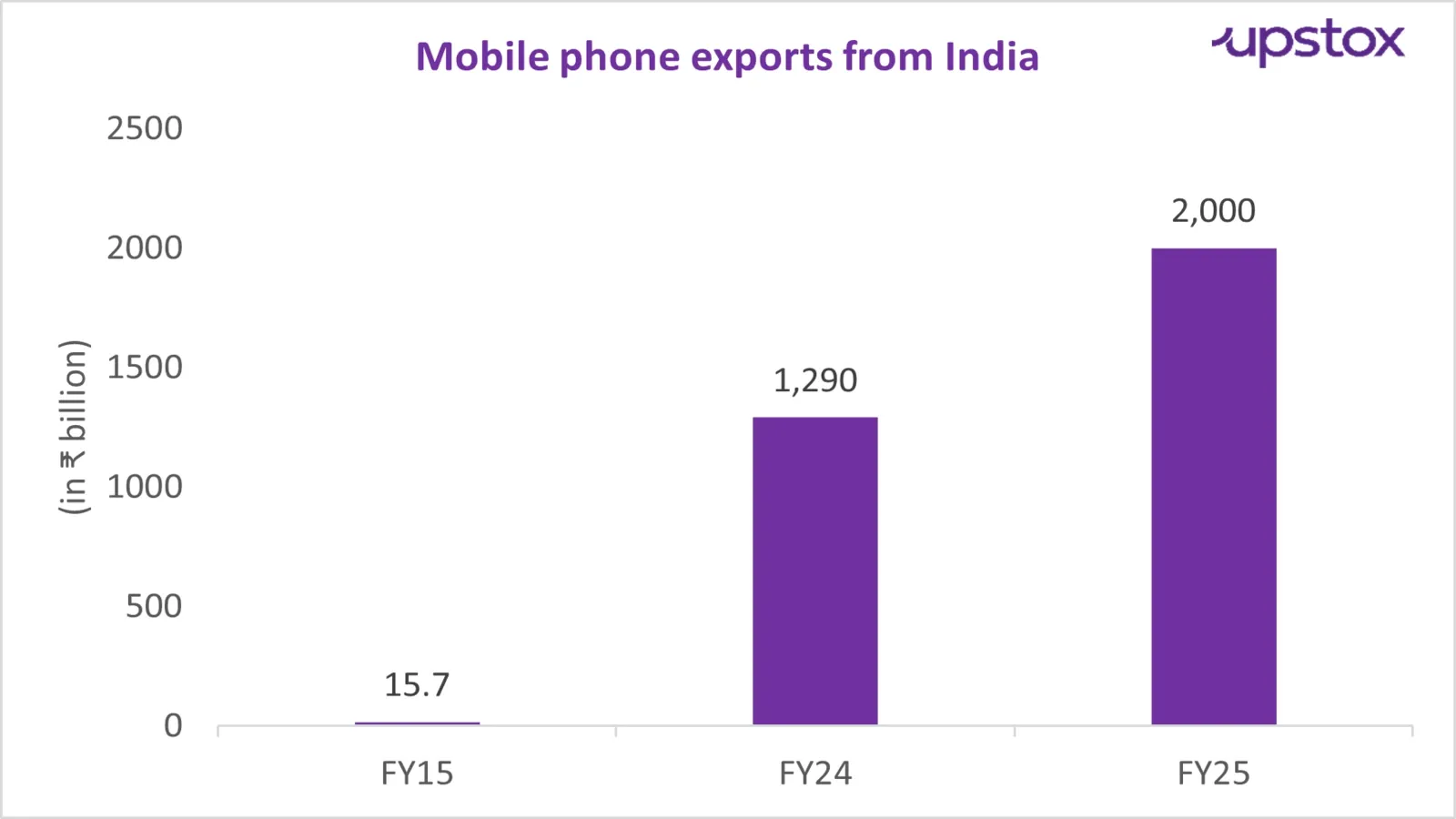

Here’s a stat that shows just how far India has come.

Now here’s the kicker…

Today, smartphones are among the top exported goods from India.

India’s iPhone output has soared

Apple’s increased focus on India also signals a shift away from China. There was a time when China assembled every single iPhone. But now, a small but significant percentage of iPhone production happens in India.

But now, with the trade war between the US and China, Apple is looking for a different plan. And India fits the bill.

We’ll come to how and why of it, but before that, let’s answer those who are wondering:

You see, it’s not that simple! While an iPhone is designed in the US, its components and assembly come from over 43 countries. A single iPhone contains hundreds of individual parts, which come from different suppliers in different countries.

To give you some idea, the camera comes from Japan, the battery comes from China, the display comes from Korea, the accelerometer comes from Germany, semiconductor chips come from Taiwan and so on.

The point is, it’s an assembled gadget that needs to be pieced together. And to do that, Apple needs a network of specialised suppliers, a trained workforce, engineering know-how and most importantly, the scale to pull this off. And, the US lacks all of it!

Just so you know, the Chinese city Zhengzhou is popularly referred to as "iPhone City" because its iPhone factory produces 5 lakh iPhones a day!

This is the scale that the US needs, and that’s a problem!

But that’s not the only challenge!

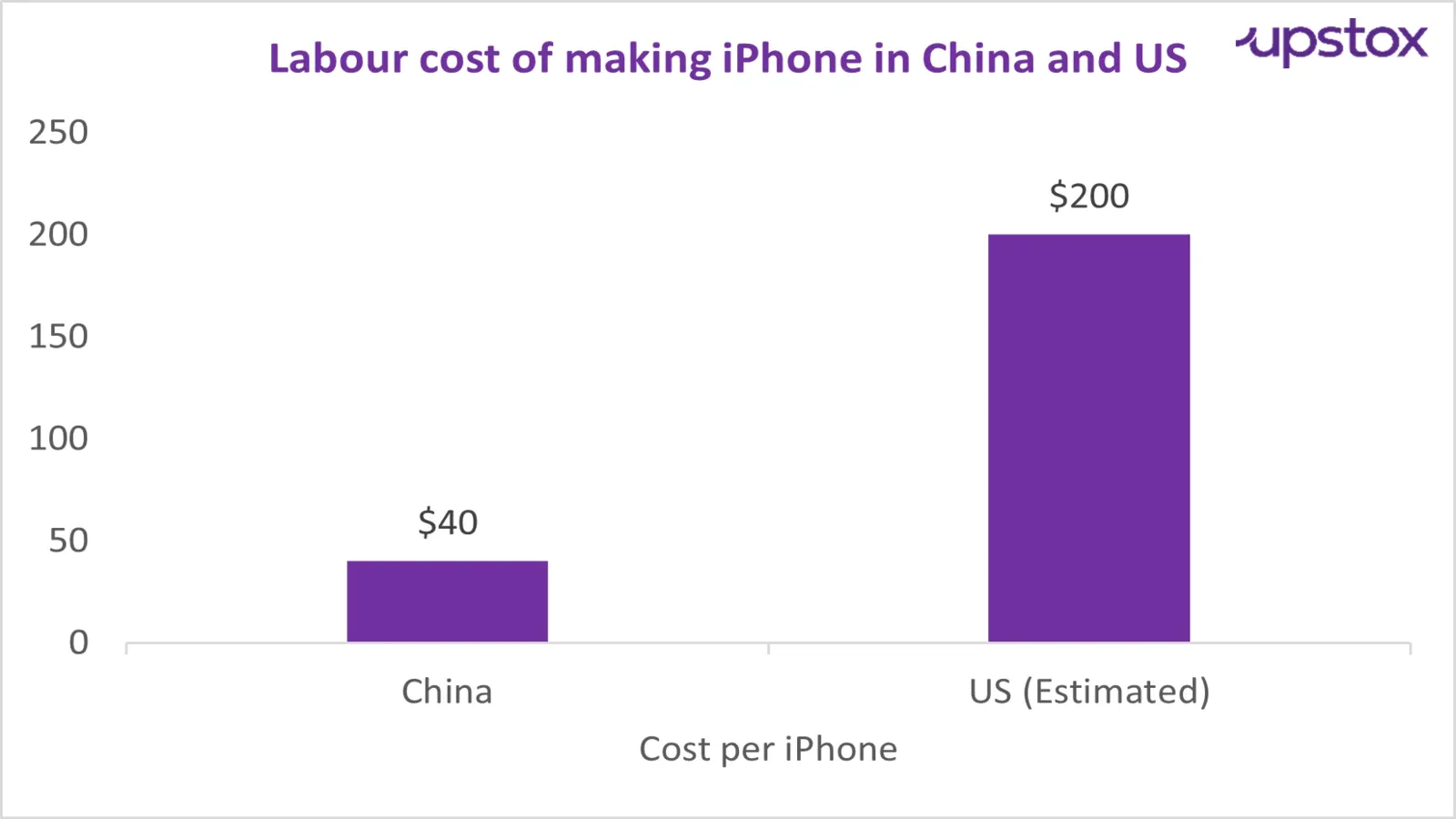

Let’s just look at the labour cost. Assembling and testing the iPhone costs $40 per iPhone in China, but a whopping $200 in the US!

But the question is:

While some things work in India’s favour, there are also broader-level challenges.

Let’s take it from the top!

What works for India?

- Great local demand

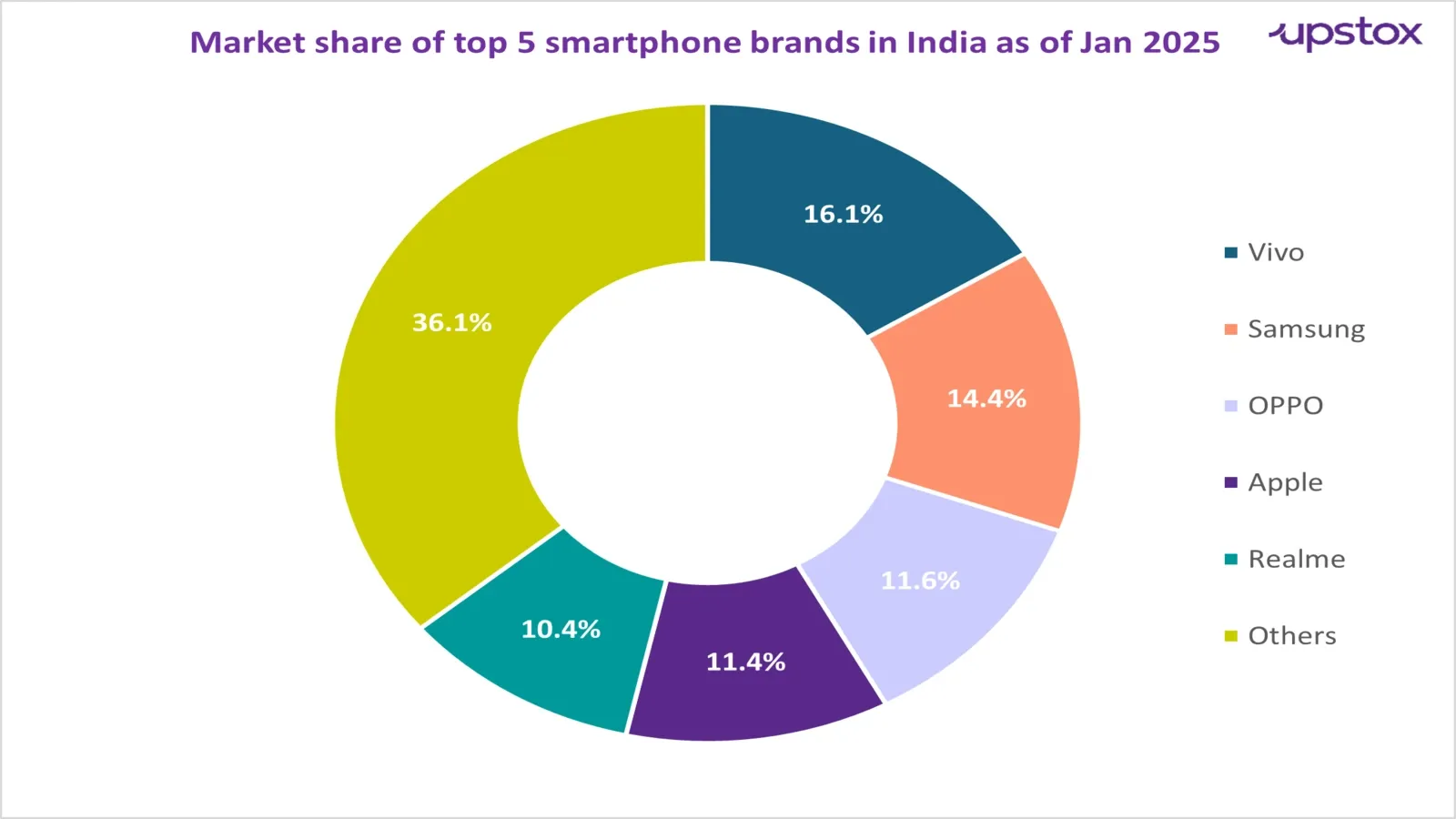

You see, China is the biggest smartphone market in the world and the second biggest for iPhones. However, Apple is not even one of China’s top five smartphone brands.

India, on the other hand, has a growing local market for iPhones. Apple featured among the top five smartphone brands in India for five consecutive months, with an 11.4% market share in January 2025.

Source: IDC India monthly smartphone tracker, March 2025

Just look at the numbers.

Very soon, India may become Apple’s 3rd largest market globally.

- Large workforce

India also has a vast labour pool, especially in the tech and electronics sectors. It can easily fulfil Apple’s manufacturing and production needs. Plus, India’s low-cost labour can reduce Apple’s overall cost.

- Growing iPhone exports

- Government support

Besides that, India will soon sign a bilateral trade agreement with the US, which will help us boost exports, attract more investment, deepen supply chain integration, address tariffs and increase market access.

Apple is bullish on India

However, all is not rosy. As mentioned earlier, there are challenges in this journey.

What is holding India back?

Apple currently has R&D facilities in the US, China, Germany and Israel. In 2024, Apple set up a subsidiary in India named Apple Operations India, focusing on R&D. Thus, if Apple decides to move beyond assembling in India, then it will face problems.

That’s not all!

Long story short

India certainly stands to gain from the reconfiguration of global value chains. In recent years, it has shown remarkable progress in its smartphone manufacturing capabilities. Apple and other tech giants have also shown confidence in India by shifting their supply chains.

But let’s accept it. Right now, India may not be able to compete with China's huge manufacturing ecosystem. However, as it strengthens its manufacturing capabilities and works on the existing issues in the coming few years, there is a good chance it will close that gap and emerge as the next big tech giant.

For now, it’ll be interesting to see how this growth shapes up!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story