Upstox Originals

A cement ceiling: A concrete shift in demand?

SUMMARY

What if we told you that cement demand over the next few decades could actually decline? For years, cement has been synonymous with steady growth, driven by urbanisation, infrastructure projects, and industrial expansion. However, recent forecasts from the World Cement Association (WCA) suggest a significant shift is underway. So, what’s behind this change?

According to the World Cement Association, cement demand could fall in the future

For years, forecasts indicated that cement demand would rise in tandem with urban growth, infrastructure development, and industrial expansion trends. However, as the world embraces sustainability and new technologies, the outlook for cement demand is becoming less predictable.

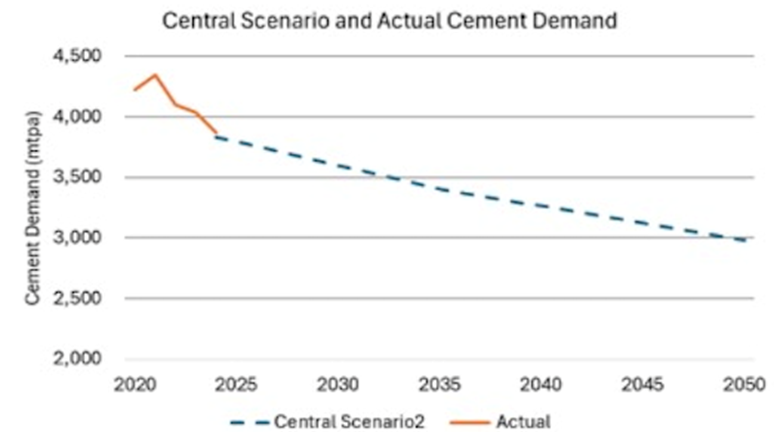

But there’s a new outlook emerging, particularly from the World Cement Association (WCA). According to their forecast, global cement demand could actually decline by up to 22% by 2050. A major driver of this change is the growing emphasis on reducing carbon emissions.

Cement production is one of the largest sources of CO2 emissions globally. As governments, industries, and consumers focus on reducing their environmental impact, there’s a shift toward more eco-friendly alternatives.

Source: WCA, Note: This chart represents one of the many possible scenarios, each based on different assumptions about demand growth, technology adoption, policy changes, and sustainability initiatives.

At the core of this shift is the rise of low-carbon cement and new materials which are more eco-friendly alternatives to traditional cement. As governments and companies push for reductions in carbon footprints, low-carbon cement is gaining ground. But what exactly is it, and how does it impact the cement industry?

What is low-carbon cement?

The Global Cement and Concrete Association (GCCA) defines low-carbon cement as cement produced with a lower carbon footprint than traditional cement. This is achieved through various methods, such as using alternative materials or more energy-efficient production processes.

Low-carbon cement is produced with methods that emit less CO₂ compared to traditional cement production, which is responsible for a significant portion of global emissions. There are several ways to achieve this:

-

Supplementary Cementitious Materials (SCMs): These materials, such as fly ash and slag, can replace part of the traditional cement in concrete, which reduces overall CO₂ emissions.

-

Carbon Capture and Storage (CCS): This technology captures carbon emissions during cement production and stores them underground, preventing them from entering the atmosphere.

-

Alternative Clinker Materials: Research is ongoing to find substitutes for the traditional clinker used in cement, such as geopolymer and limestone calcined clay cement (LC3), which produce fewer emissions.

Adoption and replacement of traditional cement

The adoption of low-carbon cement varies globally, with several regions leading the way:

-

United States: Companies like the Roanoke Cement Company in Virginia have replaced a significant portion of their clinker with SCMs, achieving emissions reductions of up to 83% compared to traditional Ordinary Portland Cement (OPC). (wri.org)

-

Europe: In Norway, a facility is being constructed to capture CO₂ emissions from a cement plant, aiming to implement CCS in cement production. (theguardian.com)

-

North America: Fortera has launched North America's first commercial climate-friendly cement plant, capable of producing 15,000 tons of cement annually while avoiding 9,600 tons of CO₂ emissions. (time.com)

While low-carbon cement has not yet fully replaced traditional cement on a global scale, these developments indicate a growing trend toward its adoption in specific regions and projects. The transition is influenced by factors such as technological advancements, regulatory incentives, and the construction industry's commitment to sustainability.

| Feature | Traditional Cement (OPC) | Green/Alternative Cement |

|---|---|---|

| Composition | Limestone, clay, gypsum | Includes industrial byproducts like fly ash, slag, or carbon-capturing materials |

| Carbon emissions | High (-0.9 tons CO₂ per ton) | Lower emissions (up to 50% less CO₂) |

| Durability | Standard lifespan | Improved resistance to cracks, corrosion, and weathering |

| Energy use | High energy consumption | Uses less energy and alternative fuels |

| Cost | Generally lower upfront | May have higher initial cost but better long-term savings |

| Sustainability | High environmental impact | Eco-friendly, reduces carbon footprint |

Source: Press articles

According to the CEEW (Council on Energy, Environment and Water) report, the Indian cement industry will require a Capex of ₹2,500 billion and an annual Opex of ₹2,958 billion to transition to net-zero cement. According to CRISIL Ratings, leading cement manufacturers plan to invest ~₹1,250 billion between fiscal 2025 and 2027, aiming to expand cement grinding capacity by 130 million tonnes per annum (MTPA), which is about 20% of the current capacity.

Adopting decarbonization measures with negative mitigation costs can reduce cement prices by 3% while lowering emissions intensity by 20%. Furthermore, implementing measures with positive mitigation costs can achieve a breakeven at current cement prices while reducing emissions intensity by 32%.

Regional shifts: Where demand will rise and fall

While cement demand is expected to decline globally, the changes will not be the same everywhere. In some regions, demand will continue to grow, while in others, it will slow or even decline.

-

China’s: China has long been the world’s largest cement consumer, but its demand is set to decrease as urban growth slows and the focus shifts from building new infrastructure to upgrading existing urban areas. While cement will still be needed for residential projects and urban renewal, the explosive demand seen in the past might not return.

-

Emerging markets: In countries like India, Nigeria, and other parts of Sub-Saharan Africa, demand for cement will continue to rise. These regions are experiencing rapid urban growth, which requires significant infrastructure development, including roads, housing, and utilities. Although these areas may adopt low-carbon cement more slowly, they will drive overall demand.

Environmental pressures and innovation

The cement industry is facing mounting pressure to reduce its environmental footprint. As one of the largest sources of CO₂ emissions globally, cement production is under scrutiny, and governments are tightening environmental regulations. To stay relevant and compliant, the industry must innovate and embrace greener technologies.

-

Timber as an alternative: Another growing trend in construction is the use of timber. Timber, especially engineered wood products like Cross-Laminated Timber (CLT) and Glue-Laminated Timber (Glulam), are strong, durable alternatives to cement and steel. These materials are more sustainable, as they have a lower carbon footprint and can be used in mid- and high-rise buildings. Timber’s appeal is growing, particularly in regions that prioritise sustainable construction practices.

-

Green technologies: Technologies like CCS, new cement formulas, and supplementary materials are still in early stages but show promise. As these technologies scale, they could significantly reduce the carbon footprint of cement production.

In summary

The era of steady growth driven by infrastructure and urbanization may be coming to a close. As the World Cement Association predicts, global demand for cement is likely to stagnate or decline with the rise of more sustainable building practices. While emerging economies will continue to drive demand, the overall trend is shifting.

To thrive, cement manufacturers must innovate, adopt greener technologies, and adapt their strategies to regional needs. The cement industry of 2050 will be more sustainable, adaptive, and environmentally conscious than today.

Next Story