Upstox Originals

Watt’s Next? India’s growing rural electrification

.png)

7 min read | Updated on April 04, 2025, 15:06 IST

SUMMARY

India’s power supply has transformed over the past decade, with rural areas now getting nearly 22 hours of electricity daily. This article explores how an expanded transmission and distribution network made this possible and the current challenges still to be overcome.

https://assets.upstox.com/content/assets/images/cms/20241230/indutrialthumb1.webp

Years ago, in many parts of rural India, electricity was a luxury. Families planned their evenings around erratic power cuts, businesses shut down after sunset, and students studied under dim kerosene lamps. Fast forward to today—villages that once had just 12 hours of electricity a day now enjoy nearly 22 hours. This isn’t just about convenience; it’s a transformation that fuels economic growth, empowers small businesses, and improves quality of life.

But how did this happen?

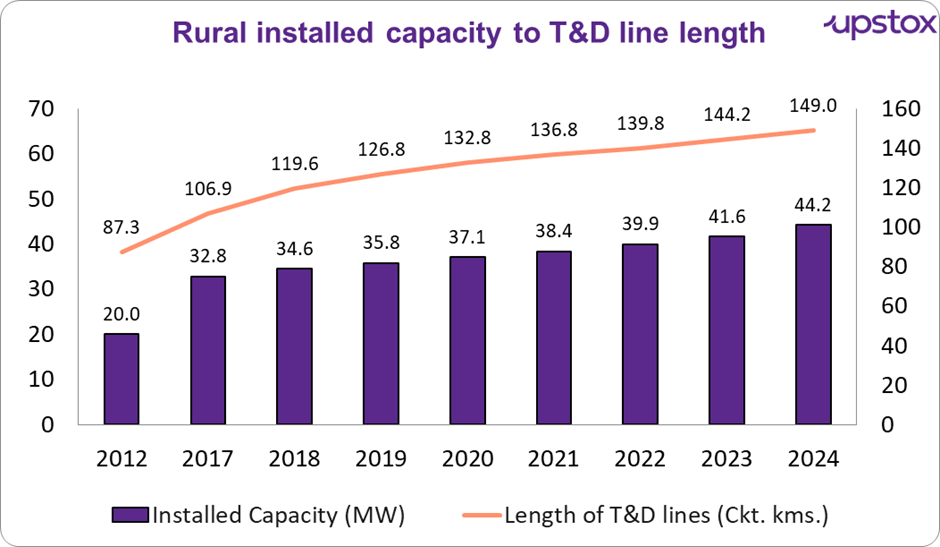

Behind the scenes, India’s transmission and distribution (T&D) network has undergone massive expansion, ensuring that power generation translates into reliable electricity for households and businesses. Over the last decade, India has added 195,181 circuit kilometres of transmission lines, integrating the country into a unified grid. Just give you perspective that is equivalent to almost 28 round trips from Kashmir to Kanyakumari!

The distribution network has also been strengthened, with new substations, transformers, and upgraded lines helping reduce power outages.

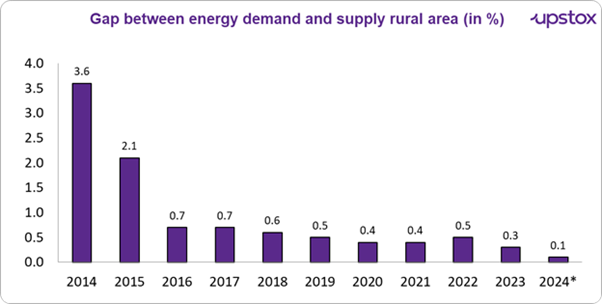

Looking at the chart below, it's clear that the gap between electricity demand and supply in rural areas has changed significantly. Lower the percentage means the demand is being met more effectively. Over the past nine years, we've seen things moving in the right direction—rural areas are getting closer to meeting their electricity needs.

Source: Economic survey 2024-25, Note: * data up to Dec 2024

As a result, as per a government press release power availability in rural areas has jumped from 12.5 hours in 2015 to 21.9 hours in 2024, while urban areas now receive 23.4 hours on average. Electrification vs. Accessibility: Are all villages benefiting?

Demand and supply dynamics of rural electrification

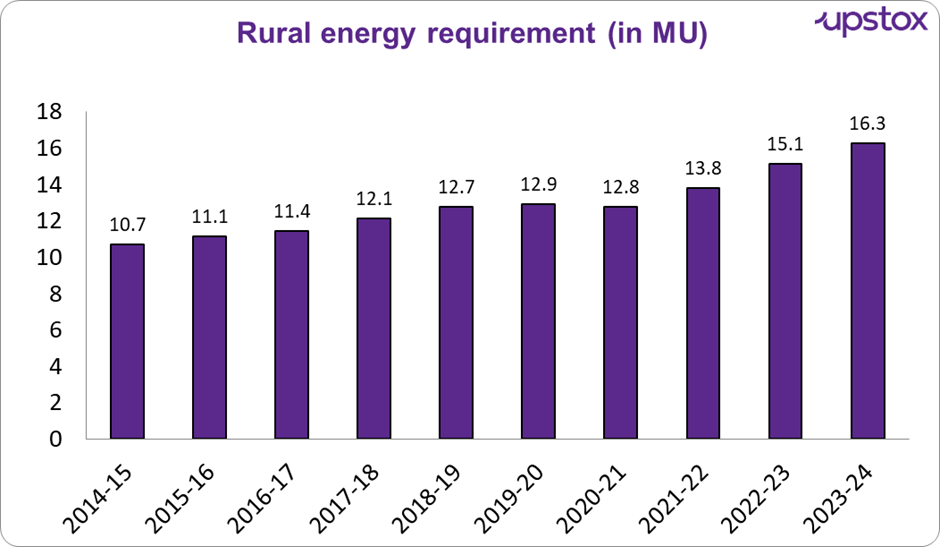

Rural demand for electricity has been steadily increasing with almost 60% increase in the last 10 years.

Source: Government press release; *MU - million units

So, what’s driving this surge in electricity demand? Several factors are at play:

-

Increased appliance ownership: More households are acquiring medium-to-high power appliances like refrigerators, leading to higher electricity consumption.

-

Reliable power supply: Dependable and longer power supply hours encourage households to connect to the grid and use more appliances.

-

Stable income sources: Households with salaried jobs or businesses tend to use more electricity due to predictable income, enabling higher appliance usage.

-

Electrification of rural enterprises: Connecting non-farm enterprises to the grid reduces reliance on costly alternatives like diesel generators and boosts demand.

-

Productive use in enterprises: Appliances for business activities, such as welding or milling, are increasingly being adopted, further driving demand.

-

Policy support: Government initiatives that promote appliance adoption and support electricity usage are contributing to growth.

You might be wondering how these demands are being met?

These growing demands are being addressed through a significant expansion in power generation capacity, along with the extension of transmission and distribution networks to ensure electricity reaches villages across rural areas. According to government press releases, as of 2019, all 5,97,464 villages in India have been electrified.

Source: Central electricity authority

How village electrification was achieved

So, how did India pull off electrifying nearly 6 lakh villages? It wasn’t just about laying down power lines—it took a mix of smart policies, private sector involvement, and better technology.

-

Big government push: The Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Saubhagya Scheme played a massive role.

-

Private players stepping in: The government didn’t do it alone. With reforms like the Electricity (Amendment) Bill, private companies jumped into the game, bringing in fresh investments and efficiency. A great example? CESC Limited taking over Chandigarh Power Distribution Limited (CPDL)—just one of the moves that helped shake up the sector.

-

Smarter, not just bigger: It wasn’t just about adding more power lines; it was about making the whole system smarter. The rollout of smart meters and automated grids meant fewer power losses and better reliability.

-

Renewables to the rescue: Some remote villages were just too far from the grid. The solution? Solar microgrids and wind power stepped in, helping places that would’ve otherwise been left in the dark. Plus, with India aggressively adding solar and wind power, even the main grid got stronger.

-

Less waste, more power: Earlier, a lot of electricity was lost before it even reached homes. But in recent years, AT&C (Aggregate Technical & Commercial) losses have been cut down big time, meaning more of the electricity generated actually reaches the people who need it.

All of this combined to make sure that by 2019, every single village in India had access to electricity—a huge milestone for the country.

Now that we have seen the demand and how it has reached multiple villages we will look at some challenges

While all villages in India are officially electrified, not all benefit equally. Larger villages with better infrastructure see significant economic gains, while smaller and remote villages often struggle with unreliable power supply.

In certain states, official figures claim an average of 19 hours of rural power supply per day, but the reality tells a different story. Frequent power outages, especially during critical irrigation seasons or extreme weather, disrupt daily life. Some villages still report receiving as little as 10 hours of electricity a day.

Even with initiatives like the Gruha Jyothi scheme, which offers free power up to 200 units, uninterrupted electricity remains a challenge for many rural communities. A study by the University of Chicago and the University of Maryland found that villages with fewer than 300 people see little economic benefit from rural electrification, while larger villages experience significant improvements in income and business activity.

This disparity highlights a critical gap—not just in power generation, but in effective transmission and distribution. If the grid doesn’t reach everyone equally, then increased power generation alone won’t solve the problem.

This highlights a crucial point—while rural electrification has improved, ensuring a stable and efficient transmission and distribution network is what will truly sustain this progress across the country

Capital expenditure plans of major players

Investment in T&D infrastructure is expected to remain strong. Some key players and their capex plans include:

-

Power Grid Corporation of India Ltd (PGCIL): ₹35,000 crore investment planned over the next 3-5 years for transmission network expansion.

-

Adani Energy: Aggressive expansion with ₹12,000 crore capex to strengthen its pan-India footprint.

-

Tata Power: Focused on smart grid, smart metering, and distribution automation, with significant investment earmarked.

-

State distribution companies: Supported by Revamped Distribution Sector Scheme [RDSS] to modernise outdated networks and reduce losses.

Let us look at some stocks from this sector: -

| Company | Market cap (₹ Cr) | P/E | ROE | 3Yr stock return % | 3Yr profit growth % |

|---|---|---|---|---|---|

| Power Grid Corporation of India | 2,69,159 | 17 | 19% | 19% | 8% |

| Tata Power Company | 1,19,618 | 31 | 11% | 15% | 44% |

| Adani Energy Solutions | 1,04,439 | 60 | 9% | -29% | -5% |

| Torrent Power | 75,485 | 32 | 15% | 48% | 11% |

| CESC | 20,314 | 14 | 12% | 25% | 1% |

| India Power Corporation | 1,198 | 72 | 2% | -7% | -13% |

Source: Screener; Data is as of 01-04-25

Outlook

Power transmission and distribution (T&D) is the backbone of India’s energy sector. Without a strong and efficient grid, even the most ambitious renewable energy goals will fall short. For investors, this sector offers long-term growth potential, backed by government policies, increasing demand, and rising capital expenditure from key players. Simply put, this sector isn’t just about keeping the lights on—it’s about powering the future.

About The Author

Next Story