Upstox Originals

Trade wars and India's dumping woes

.png)

5 min read | Updated on May 02, 2025, 16:29 IST

SUMMARY

Summary While the world’s largest economies lock horns in trade battles, Indian businesses face an invisible but very real threat: dumping. Sectors from steel, plastics, electronics, tyres, chemicals, and more could be under pressure. India’s trade deficit with China is already rising year after year, dumping could further exacerbate the problem.

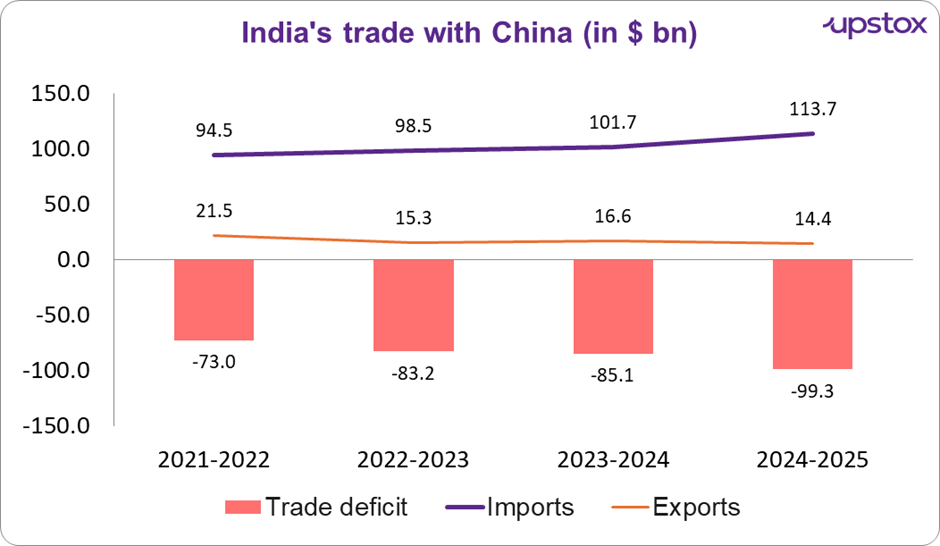

India's trade deficit has been widening ever year

The last month has been a tumultuous one for global trade, thanks to the ‘liberation day‘ tariffs. As the global trading order stands disrupted, China’s refusal to relent has led to a serious escalation of trade tensions between two of the world’s largest economies.

Even as the event plays out, an important question is starting to fester. What happens to Chinese exports to the USA in the meantime? In 2024, China’s goods exports to the USA were ~$439 billion. The worry is - what happens even if a fraction of the goods meant for America are flooded in Indian markets? Just to put that into perspective, India’s total imports from China in FY24 stood at ~$100 billion.

From China’s perspective, they now have a classic overproduction problem , having manufactured more goods than they can sell domestically. As such, as India watches the shifting tides of global tariffs and trade agreements, could dumping (selling goods at lower than cost) turn out to be a bigger threat than the trade war itself?

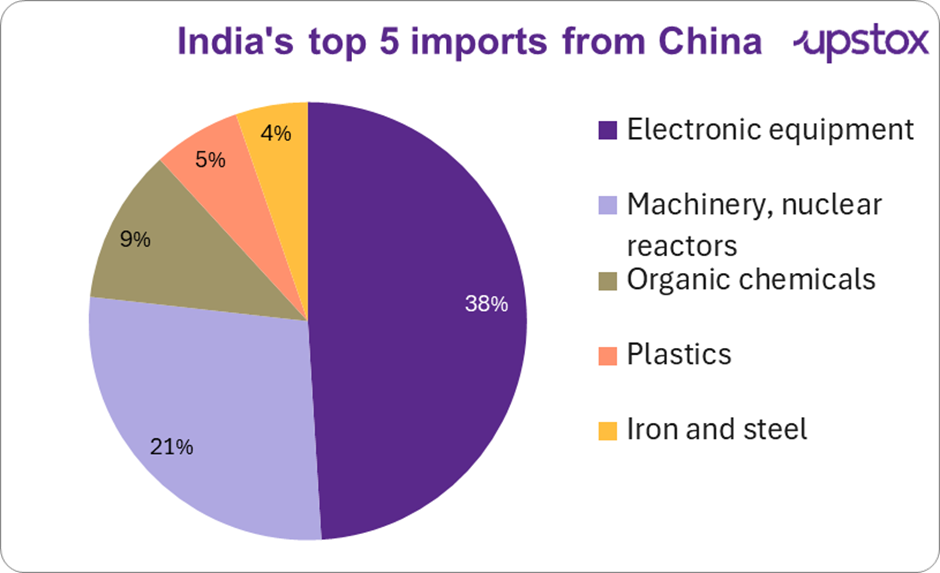

In the chart below, we look at some of India’s top imports from China in FY24.

Source: Trading Economics

In the last 4 years, Indian imports from China increased by 20%. This trend has raised concerns that dumping may already be underway, especially since exports to China have declined during the same period.

Source: Commerce.gov.in, News articles

A key worry with dumping is not just that it would lead to an increase in trade deficits, it's also that it could also adversely impact local producers. Cheap imports from China, while beneficial to consumers, will hurt the competitiveness of domestic producers.

Let’s turn to the steel industry, where the government has already announced anti-dumping duties to protect against the cheap Chinese imports

Steel sector

For context, the global steel capacity is ~1.8 billion tonnes, of which China controls ~1.1 billion. India comes in at a distant number two at 200 million tonnes. India is estimated to have imported ~3 million tonnes of steel from China in FY24. With the USA’s tariffs, ~500-600k tonnes of annual Chinese exports to the USA are now looking for a new home! In the absolute worst case, that could mean an additional 17% import from China!

Over the past four years, India’s steel imports have surged by over 50%, while exports have fallen sharply by more than 80%. This has caused the trade deficit to balloon a whopping 19x to $1.9 billion in FY24 from a slight surplus in FY21.

Source: Commerce.gov.in, Note: *Data from Apr-Jan 2025

The pricing gap is clear, Chinese steel prices have consistently undercut Indian prices by 5–18% in recent months

Source: The Hindu; Steel price in ₹ tonne. Chinese imported steel price includes port & handling charges

As mentioned above, India has imposed a 12% tariff on certain steel products, effective from 21 April 2025, for a 200-day period.

Other sectors at risk and how India is responding

Building on our earlier conversation about steel, there's a likelihood of other sectors, such as chemical products, consumer goods, textiles, tyres, electronic products and solar panels, experiencing similar instances of dumping into India, as observed in past trades with China.

-

Tyre industry- The earliest to feel the impact was in tyre imports back in 2008, as per data from the Automotive Tyre Manufacturers Association (ATMA) showed a staggering 1,300% increase in tyre imports, particularly in truck and bus radials. This flood of low-cost imports meant Chinese tyres were selling at around 30% lower than Indian-made ones. To make matters worse, these tyres came with no warranty, raising concerns over quality and reliability.

-

Solar panels- In the year 2018, dumping of cheap Chinese solar panels is estimated to have cost India around 200,000 jobs and decimated its solar exports, which were robust between 2006-2011 before Chinese dumping intensified.

-

Chemical products- In the last two fiscal years, the specialty chemical space saw a 15-20% decline in its revenue from both domestic and international transactions due to an increase in Chinese imports.

-

Electronic products- Crisil rating recently flagged a growing risk of China dumping electronics in India. Chinese electronics components manufacturers are offering to drop prices by up to 5%. This concession becomes even more vital given that these segments typically operate at low margins of 4-7%.

In response to these past dumping episodes, the government implemented sector-specific duties and safeguards. But what’s being done today? India has adopted several measures to prevent dumping from other countries:

-

Import surge monitoring: An inter-ministerial group that tracks weekly and monthly trends to detect unusual import surges and takes preventive action.

-

Tariff bypass monitoring: A dedicated unit that tracks cheaper imports and prevents goods from being rerouted through India to avoid tariffs.

-

Anti-dumping duties: The government can impose duties to protect domestic industries if any of the above is observed.

Outlook

Trade tensions often come with unexpected side effects. Dumping could chip away at the margins of Indian firms, trigger import duties, and ripple through market sentiment. That said, India is much better placed to compete now, and increasing localisation in many sectors definitely helps. That said, at this point, we could be looking at firefighting on dual fronts - arriving at a trade deal with the USA and staving off the impact of any potential Chinese dumping.

About The Author

Next Story