Upstox Originals

The role of small finance and payment banks in India

.png)

6 min read | Updated on April 30, 2025, 14:31 IST

SUMMARY

Imagine a street vendor getting a loan with just a tap or a farmer making digital payments without a traditional bank account. That’s exactly what Small Finance Banks and Payment Banks are doing - bringing banking to your fingertips. As these banks gain prominence, we evaluate the role of these banks, the risks associated with them, and also some global parallels.

The RBI has introduced two major types of niche banks - payment banks and small finance banks

Have you ever wondered why some banks focus only on digital transactions, while others prioritise small businesses? Well, that's because not all banks are the same! The Indian banking sector has evolved to introduce niche banks - specialised institutions that cater to specific financial needs. Unlike traditional banks, which offer a full suite of financial services, niche banks are designed to serve particular customer segments, ensuring better financial inclusion and innovation.

What are niche banks?

The concept of these banks was introduced in the banking system in India by the Reserve Bank of India (RBI) based on the recommendations of the Nachiket Mor Committee in 2013. This initiative aimed to offer specialized services or unique products designed specifically to suit a particular sector.

The RBI has introduced two major types of niche banks - payment banks and small finance banks (SFBs). Breaking it down: What do these banks actually do?

Payment Banks

Bridging the gap between traditional and digital banking, payment banks offer secure, fast, and accessible financial services. They simplify payments, savings, and remittances without credit-based complexities. Registered under the Companies Act, 2013, they operate under strict RBI regulations. Whether it’s quick transactions, bill payments, or savings, they make banking accessible with just a smartphone.

What makes them different?

- No lending - just secure digital transactions.

- Safe deposits up to ₹2 lakh, fully regulated by RBI.

- Debit cards, UPI, and mobile banking for seamless access.

As of 2025, six Payment Banks are driving financial inclusion across India. Payment Banks aren’t only about loans; they’re about convenience as well.

| Payments banks | Headquarters | Parent company | Started operations |

|---|---|---|---|

| Airtel payment bank | New Delhi | Bharti airtel | January 2017 |

| Fino payment bank | Navi Mumbai | Fino paytech limited | July 2017 |

| Paytm payment bank | Noida | One97 communications Ltd | May 2017 |

| Jio payment bank | Navi Mumbai | 70:30 joint venture between Reliance Industries and State Bank of India | April 2018 |

| India post payment bank | New Delhi | Department of Posts, Government of India | September 2018 |

| NSDL payment bank | Mumbai | National securities depository limited | October 2018 |

Source: Razorpay

Small finance banks

Ever heard of a bank dedicated to small business owners, farmers, or low-income groups? That’s exactly what SFBs do! Their main objective is to offer financial services to the unbanked and underserved segments, ensuring that even small borrowers get access to credit. Think of them as banks designed for small borrowers, farmers, and MSMEs - people who often struggle to get loans from bigger banks.

What sets them apart?

- Can lend money (unlike Payment Banks), making them a vital source of microcredit.

- Must dedicate at least 75% of loans to priority sectors with 50% of their loan portfolio consisting of advances up to Rs 25 lakh (agriculture, MSMEs, etc.).

- Operate under strict RBI regulations to ensure security.

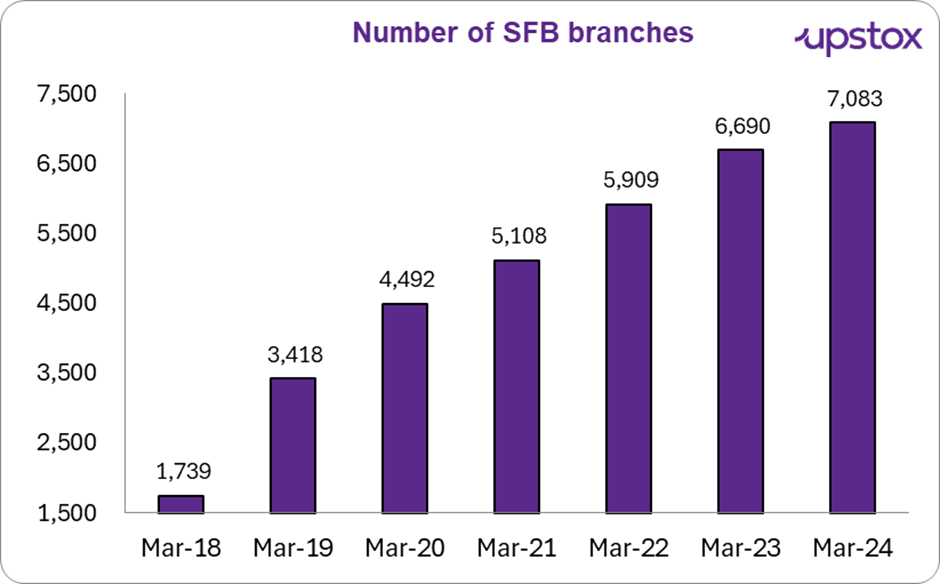

- Rapidly increasing branch networks while leveraging digital banking for wider financial access.

As of 2025, there are 11 SFBs operating in India. They are established as public limited companies under the Companies Act, 2013, and licensed under Section 22 of the Banking Regulation Act, 1949. These banks are governed by the Reserve Bank of India Act, 1934, ensuring strict regulatory compliance.

With an expanding branch network and digital banking solutions, they are reshaping the way small businesses and underserved communities access banking in India.

Source: CareEdge ratings

The surge in SFB branches from 1,739 in 2018 to 7,083 in 2023 proves their game-changing role in financial inclusion. By empowering small businesses, farmers, and the unbanked, these banks are proving that banking isn't just for the big players - it’s for everyone.

But are these banks sustainable?

One key challenge is managing risk. While SFBs provide essential credit to underserved communities, their lending model also comes with financial vulnerabilities. According to ICRA, gross NPAs for small finance banks are expected to rise to 2.8-3% in FY25, up from 2.6% in FY24. This makes strong risk management a top priority for these banks. SFBs must maintain a minimum Capital to Risk-Weighted Assets Ratio (CRAR) of 15%, ensuring they have enough capital to absorb potential loan losses.

Why do we even need these banks?

Despite these risks, SFBs remain indispensable. Be honest—if you already have an account with a major bank, why would you ever deposit money in a telecom company’s bank? Or trust a small finance bank over a national giant? At first glance, it seems risky, unnecessary, and even redundant. But dig deeper, and you’ll see why these banks aren’t just filling a gap - they’re revolutionising financial access. Here’s why:

-

No-frills banking for the underserved – Millions of Indians, from street vendors to gig workers, struggle to access formal banking. Niche banks make it easier.

-

Small loans without big hassles – Need ₹50,000 for your shop? Traditional banks may not entertain small borrowers, but SFBs specialise in this.

-

Seamless digital transactions – Payment Banks are built for the digital age, making mobile banking effortless.

But aren’t these banks risky?

It’s fair to ask: Why should I trust a bank that isn’t a big name?

Here’s the truth: These banks are regulated just like traditional banks. They must follow RBI’s strict guidelines, maintain cash reserves, and operate with financial discipline. Payment Banks can’t lend, so there’s zero risk of bad loans. Small Finance Banks, on the other hand, are required to lend responsibly, with a strong focus on financial inclusion.

So, does that mean they are completely safe? No. There is always risk and as such doing prior and thorough research is definitely essential.

Global parallels

India’s niche banking revolution mirrors global trends:

- Challenger banks (UK) – Monzo, Revolut, Starling offer branchless, mobile-first banking, much like India’s Payment Banks, focusing on seamless transactions and user convenience.

- Neo-banks (US) – Chime, Varo, Aspiration operate digitally with fee-free banking, making financial services more accessible - similar to Payment Banks in India.

- Microfinance models (Bangladesh) - Grameen Bank pioneered small-scale lending, much like India’s Small Finance Banks, empowering underserved communities.

- Latin America’s digital banks – Nubank and others are transforming banking with mobile-first, low-cost services, mirroring India’s push for financial inclusion.

In summary

The rise of niche banks is not about competition - it’s about filling gaps that big banks ignore. Whether it’s digital transactions or microloans, these banks are helping real people, not just big corporations.

Disclaimer: This article is for informational purposes only and must not be considered investment advice. Investors should consult with experts before making any investment decisions.

About The Author

Next Story