Upstox Originals

Tangled threads: Why India’s textile sector has stagnated

.png)

7 min read | Updated on May 19, 2025, 14:20 IST

SUMMARY

India’s textile industry has been limping for almost a decade due to crop infestation issues. Cotton yield has been declining, and India is on the cusp of becoming a net importer! This article examines the factors that are hindering progress. It also explores potential strategies that could help the industry get back on its feet.

Stock list

Textile production in India has stagnated for almost a decade

The Indian textile industry, contributing 2.3% to GDP and employing over 45 million people, is undergoing rapid transformation. Government initiatives like PLI and NTTM, along with rising domestic demand, are driving growth. However, a deeper inspection presents a relatively worrying picture.

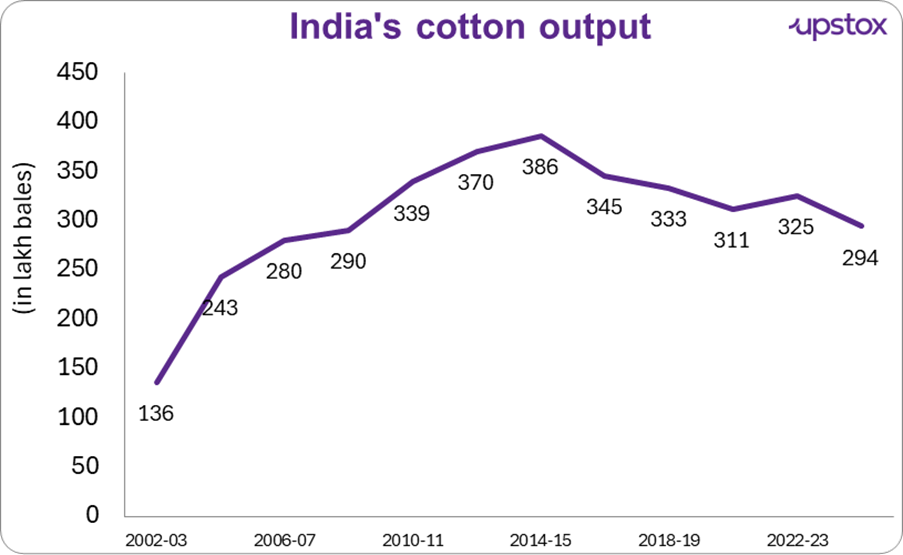

Back in the early 2000s, India’s cotton story was nothing short of a miracle. The introduction of genetically modified (GM) cotton hybrids with Bt genes (Bacillus thuringiensis) transformed farming, boosting yields from 136 lb to 398 lb per acre in just a decade. However, since then, production has continuously been dropping.

Source-Committee on Cotton Production & Consumption

Farmers enjoyed record harvests, and India rose as a global cotton leader. But now, with exports falling and imports rising, the pink bollworm (PBW) has emerged as a key reason behind this shift.

Not only production, but cotton productivity has dropped from 500 kg/ha in 2017-18 to 441 kg/ha in 2023-24 (P). Alongside this, acreage has reduced from 134.77 to 124.69 lakh hectares. Unfavourable weather, pest attacks, and high input costs have made cotton farming increasingly uncertain for growers.

Cotton Acreage and Yield in the last 5 years

| Cotton Year | Cotton Acreage (in lakh hectares) | Cotton Yield (Lint in Kg/ha) |

|---|---|---|

| 2017-18 | 125.8 | 500 |

| 2018-19 | 126.1 | 449 |

| 2019-20 | 134.7 | 460 |

| 2020-21 | 132.8 | 451 |

| 2021-22 | 123.7 | 428 |

| 2022-23(P) | 129.2 | 443 |

| 2023-24(P) | 124.6 | 441 |

Source- Committee on Cotton Production and Consumption (COCPC); Note: P-Provisional

The main culprit: The Pink Bollworm (PBW)

The resurgence of the pink bollworm (PBW) is a major reason for India’s declining cotton yields. This monophagous pest feeds primarily on cotton and has developed resistance to Bt cotton, especially in areas with continuous monoculture. PBW infestations first appeared in central and southern India around 2014 and spread northward by 2018.

It now attacks earlier in the crop cycle, damaging bolls and reducing yield and fibre quality. Long-term use of the same Bt variety, lack of crop rotation, and poor pest control have worsened the crisis. Experts recommend integrated pest management (IPM), a strategy that combines biological, cultural, and chemical methods to reduce pest impact and minimise reliance on insecticides.

Limited GM crop diversification

After a successful Bt cotton rollout, approval for new GM technologies stalled. Per reports, India has not approved any new genetically modified (GM) cotton variants since 2006. No GM crop has been commercialised since 2006 due to opposition and long approval processes.

Monsoon uncertainties

Only a third of India’s cotton area is under irrigation. As such, monsoon uncertainty continues to impact cotton yield. Per experts, cotton needs a minimum of 5-6 irrigations. As such, any adverse change to rainfall during this period can impact crop yield.

Delayed government support

Government support in the form of MSPs is sometimes delayed, which leads to increased pressure on the cotton farmers. For instance, as of May 2024, a 33% subsidy on Bt seeds announced by certain state governments was yet to be paid out. This subsidy was for the 2023 produce. This, coupled with rising costs, further impacts farmer profitability and eventually hurts produce.

Impact on exports

Challenges in production have also extended to India’s textile exports. Overall textile exports have stagnated for almost the past decade!

Source: IBEF, Note: *FY25: April-June

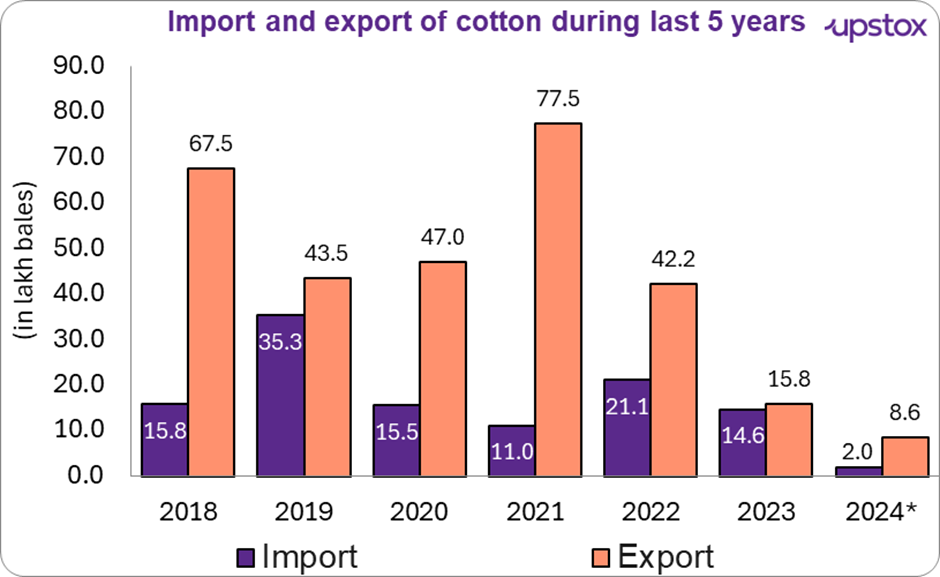

With regards to cotton, if the situation is not remedied, India might soon become a net importer from a strong net exporter just a few years back.

Source-Ministry of Textiles; Note: Upto 31st January 2024

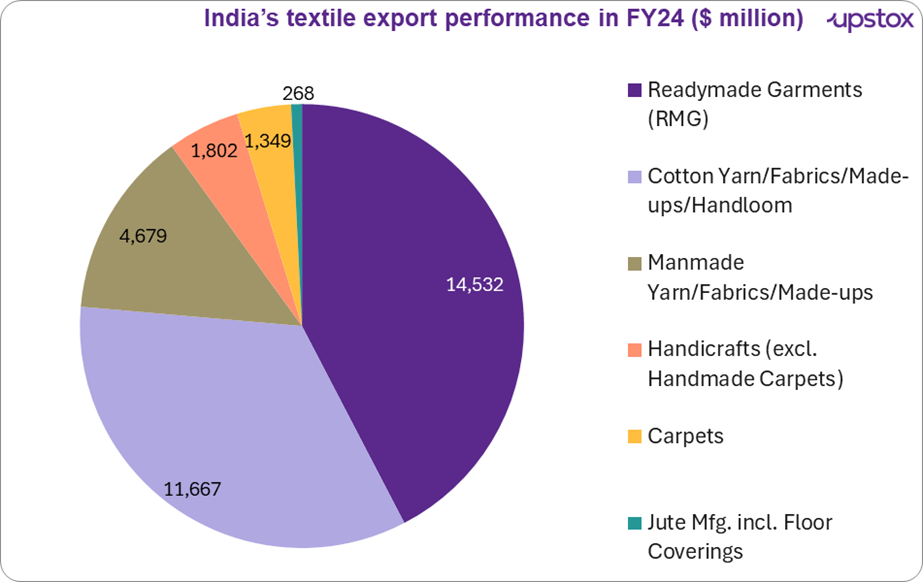

India’s textile export performance in FY24

While India does have a diverse export base, cotton and readymade cotton textiles play a dominant role.

Source-IBEF

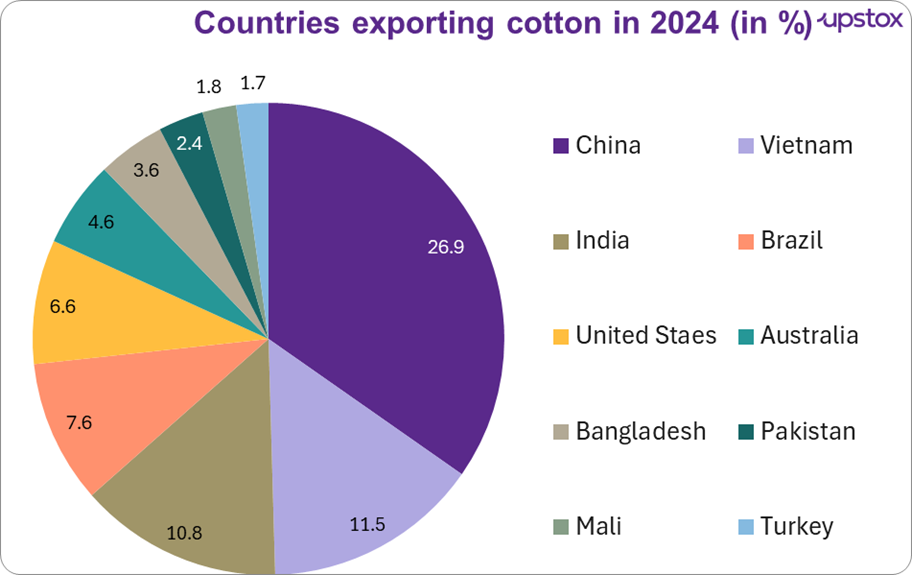

Leading cotton exporters by country in 2024

China continues to lead the global cotton export market, with Vietnam and India following closely behind. Countries like Brazil, the United States, Australia, and Bangladesh also hold significant positions in the export landscape. Let’s find out what percentage of the global share each country holds through the chart below.

Source- Tendata

Trade agreements offering future hope

-

India-UAE Comprehensive Economic Partnership Agreement (CEPA): This agreement provides duty-free access for Indian textiles to the UAE market, enhancing export potential.

-

India-Australia Economic Cooperation and Trade Agreement (ECTA): Signed in April 2022, the ECTA aims to enhance bilateral trade by eliminating or reducing tariffs on various goods and services, including textiles.

-

India-European Union Free Trade Agreement (EU FTA): Currently under negotiation, this agreement aims to enhance market access for Indian textiles in European markets.

How India can increase cotton production and revive textile exports

-

Fast-track GM approvals: India has not approved any new GM cotton varieties since Bt cotton in 2006. Speeding up regulatory clearance for improved pest-resistant hybrids is critical.

-

Promote crop rotation and IPM: Overuse of Bt cotton has allowed pink bollworms to develop resistance. Crop rotation and integrated pest management (IPM) practices can help mitigate pest resurgence.

-

Expand irrigation coverage: Only about 33% of India’s cotton acreage is irrigated. Enhancing micro-irrigation infrastructure would reduce dependence on erratic monsoons.

-

Ensure timely subsidies and MSP payouts: Delays in seed subsidy payments and MSP support reduce farmer morale and shift cropping patterns away from cotton.

-

Strengthen public-private R&D: Increased investment in cotton biotech R&D through public-private partnerships is needed to address long-term productivity issues.

-

Upgrade logistics and storage: Improving warehousing and streamlining freight can reduce post-harvest losses and enhance global competitiveness.

Top Indian textile companies powering the sector

India’s textile export story is strongly supported by several key companies that have built a significant presence both domestically and globally. These companies play a vital role in driving innovation, production capacity, and international trade.

| Company Name | Market Cap (₹ Cr) | P/E Ratio | ROE (%) | Stock Price CAGR (5 Years) | PAT CAGR (5 Years) |

|---|---|---|---|---|---|

| Grasim Industries | 1,88,997 | 46.4 | 6.9% | 39% | 18% |

| Vardhman Textiles | 15,083 | 17.0 | 9.3% | 32% | 9% |

| Welspun Living | 14,499 | 22.7 | 15.6% | 41% | 13% |

| Arvind | 10,303 | 29.2 | 9.7% | 77% | 23% |

| Raymond | 4,288 | 82.5 | 1.3% | 66% | -21% |

| Bombay Dyeing | 3,039 | 77.2 | 1.9% | 26% | -35% |

| Average | ₹39,368 | 45.8 | 7.5 | 46% | 12% |

Source- Screener & TopStockResearch as of May 16th, 2025

Final thoughts

In 2025, it is difficult to digest that a disease (PBW) has held back India’s textile sector for almost a decade. Dedicated research not only towards the curing of this PBW infection, along with the introduction of new GM crops, is vital to revive the sector. India’s textile industry has a long and storied history, besides being a major employer in the country (45 million directly employed).

As such, robust and sustained revival of this sector is crucial not just to recapture our global export markets as well as improve the overall economy and employment.

About The Author

Next Story