Upstox Originals

Scouting for stability: How Nifty PSE is outshining broader indices

4 min read | Updated on April 11, 2025, 14:44 IST

SUMMARY

Trump tariffs have led to a sharp spike in market volatility, with investors and traders looking for a potential silver lining. Technical indicators reveal the Nifty PSE index displaying notable resilience and signals of possible near-term outperformance. In this article, we analyse the index's technical structure and the performance of its major components.

The Nifty PSE Index is showing signs of potential outperformance

Nifty PSE: A silver lining amid market volatility

In an environment marked by heightened volatility and global risk aversion, the Nifty PSE Index has emerged as an area of relative strength. This segment of the market, representing India's Public Sector Enterprises, has not only respected key technical support levels but also demonstrated a marked improvement in its relative strength against the broader markets.

Scouting for relative strength plays a critical role in effective portfolio construction. Firstly, stocks or sectors exhibiting strong relative strength tend to outperform during upward market phases, enhancing overall portfolio returns. More importantly, during times of market stress or downturns, such investments often display resilience, declining less than the broader indices. This characteristic becomes invaluable in preserving capital during adverse conditions.

The recent behaviour of the Nifty PSE Index highlights this principle. Its ability to hold ground and outperform peers during turbulent times suggests growing investor confidence. It highlights the potential of this segment to offer both stability and growth in a challenging market landscape.

Composition of the Nifty PSE Index

The Nifty PSE Index is a sectoral benchmark that tracks the performance of select public sector enterprises (PSEs) listed on the NSE. Comprising 20 constituents, the index is heavily weighted towards a few large-cap names, reflecting the dominant presence of certain state-owned companies in India's economy.

The top four constituents—NTPC, Power Grid Corporation of India (POWERGRID), Bharat Electronics Limited (BEL), and Oil and Natural Gas Corporation (ONGC)—collectively account for 43.66% of the index's total weight. Expanding further, stocks such as Coal India, Hindustan Aeronautics Limited (HAL), Power Finance Corporation (PFC), Bharat Petroleum Corporation (BPCL), REC Limited, and GAIL (India) Ltd. round out the top ten. Together, these ten stocks represent a substantial 77.15% of the Nifty PSE Index.

This concentration underscores the index's reliance on a handful of large public enterprises. It highlights the importance of tracking these key constituents to better understand the index's overall direction and behaviour.

Rising relative strength: Opportunities within Nifty PSE constituents

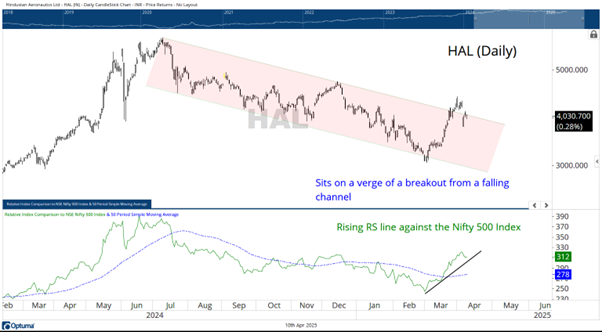

A consistent feature observed across several Nifty PSE constituents is the steady rise in their Relative Strength (RS) lines when compared against the broader Nifty 500 Index. A rising RS line indicates that a stock is outperforming the benchmark index. This can either be due to the stock declining less during broader market weakness or advancing more during upswings—both signs of relative outperformance.

Among the PSE constituents, Bharat Electronics Limited (BEL) has displayed exemplary resilience by posting only a minimal decline, even as the broader markets have remained under pressure. This signals strong underlying demand and investor confidence.

Other key stocks like Power Grid Corporation, NTPC, and Hindustan Aeronautics Limited (HAL) have either broken out of falling channel patterns or are on the verge of doing so—an encouraging sign from a technical perspective. Breakouts from such consolidation patterns often suggest a reversal in trend and potential for renewed upward momentum.

The improving RS profile of these stocks not only makes them candidates for short- to medium-term relative outperformance but also strengthens their case for inclusion in well-diversified portfolios. Allocating or increasing exposure to these counters, particularly during times of broad market uncertainty, can offer a degree of protection through resilience while also capturing potential upside.

Given the current technical and relative strength set-up, these PSE stocks are well-positioned to deliver superior risk-adjusted returns and can play a strategic role in stabilizing and enhancing overall portfolio performance during turbulent phases.

In summary

In an environment where market uncertainty continues to dominate, identifying pockets of strength becomes essential. With its improving technical structure and rising relative strength, the Nifty PSE space stands out as a convincing theme. Backed by strong fundamentals and technical resilience, select stocks within this group offer an attractive combination of stability and potential upside. As investors seek shelter in quality and consistency, the Nifty PSE index presents itself as a strategic allocation worth considering.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story