Upstox Originals

Powering India’s EVs: The li-ion boom

.png)

6 min read | Updated on April 16, 2025, 17:31 IST

SUMMARY

India’s EV revolution is revving up, and lithium-ion batteries are leading the charge—with a projected 39% growth rate and strong government backing. But as automakers localise and invest big, below all this buzz lies one question: can India truly build a self-reliant battery ecosystem?

Within auto ancillaries, lithium ion batteries are expected to see the fastest growth

India’s auto and auto ancillary industry is experiencing steady growth, expanding at 7-10% annually. However, while traditional segments like engines and transmissions continue to thrive, the biggest disruption is unfolding elsewhere—in lithium-ion batteries.

The rise of EVs is reshaping the industry, creating a multi-billion-dollar opportunity for lithium-ion battery manufacturing. But is India ready to capitalise on this shift? Does the country have the infrastructure and resources to build a self-sufficient battery ecosystem, or will it remain dependent on imports?

This article explores the growth of the Li-ion battery sector, India's production capabilities, and what it will take for the country to achieve self-sufficiency in this critical area. Why are we talking about lithium-ion batteries?

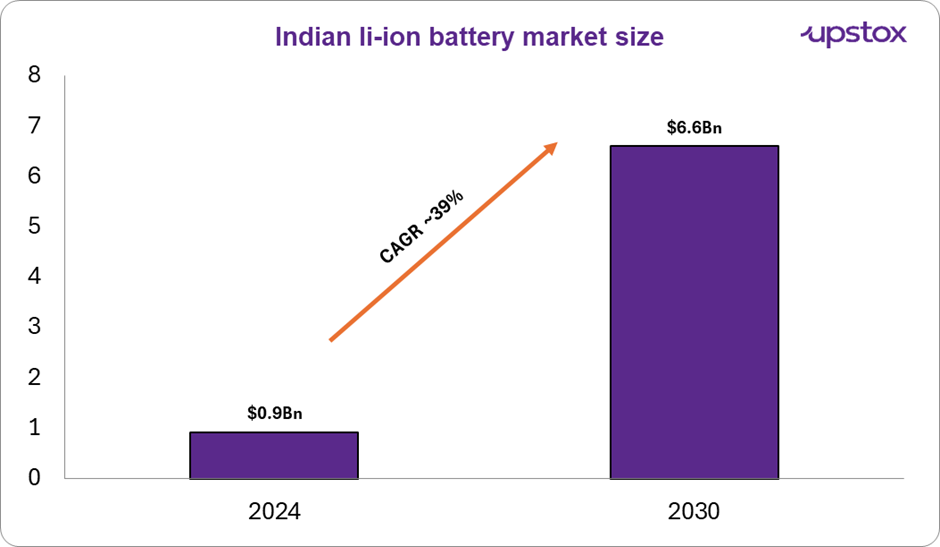

Within the auto ancillary sector, lithium-ion batteries are on a completely different trajectory, poised to grow at an astonishing 39%! This makes li-ion the game-changer that’s accelerating India’s electrification journey and driving unparalleled potential within the broader auto ecosystem.

Source: Grandviewresearch

Encouraging developments in the industry:

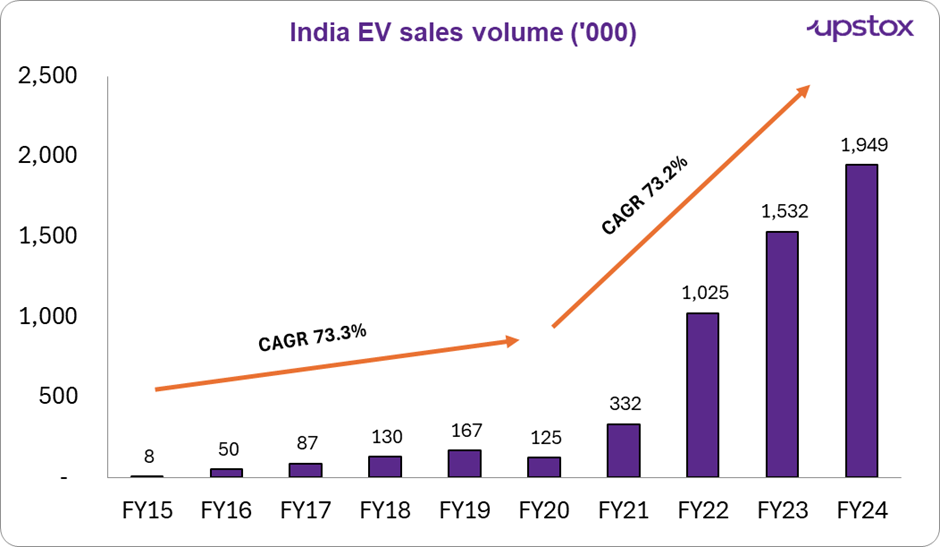

Increasing EV penetration in India

In 2023, total EV sales were ~1.6 million units; Excitingly, in 2024 that figure surged to around 2 million units, marking a growth of 24%. As a base case, EV sales are projected to touch ~27.2 million, a CAGR of 35% from 2023-2032, according to a recent report by Customised Energy Solutions.

Source: Vahan

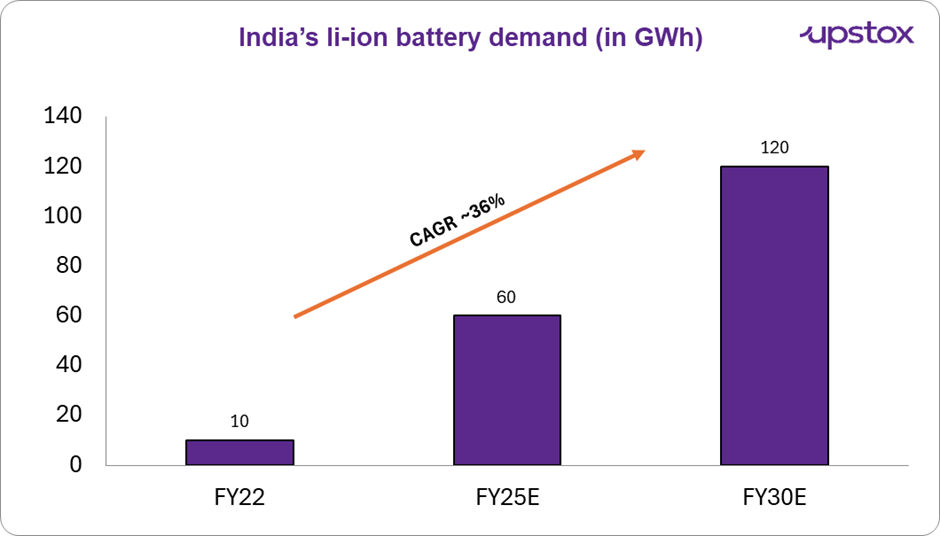

Demand increase

Unlike fuel-powered ICE vehicles, EVs rely entirely on batteries for propulsion. Li-ion batteries dominate due to their high energy density, lightweight build, efficiency, long lifespan, fast charging, and eco-friendliness. The lithium-ion battery market is projected to achieve impressive growth of 39%, alongside a notable rise in demand of around 36% in India is also expected during the same period.

Source: NITI Aayog

Government push

The Finance Minister, in the Union Budget 2025-26, announced a major boost for li-ion batteries, signaling a drop in the cost of essential materials and encouraging domestic manufacturing Batteries or Li-ion cells, when imported into India are subject to customs duty. However, the government has eliminated the Basic Customs Duty (BCD) on essential materials such as cobalt, li-ion battery scrap, lead, zinc, and 12 other critical minerals, most of which serve as key raw materials for li-ion battery production.

Indian market shift

To break free from dependence on imports, Indian automakers are taking matters into their own hands—literally. Here’s a look at who’s partnering with whom in the battery game.

| OEMs | Battery Suppliers (Current) | Battery Suppliers (Going Ahead) |

|---|---|---|

| Ola Electric | LG Energy Solution (South Korea) | In-house |

| Ather Energy | Amara Raja (India) | Amara Raja (India) |

| Bajaj Auto | Exide, Tata Green Batteries | Exide, Tata Green Batteries |

| YC Electric | JV - Jiang Li and Xue Jian Nan (China) | Domestic Suppliers |

| Dilli Electric | Multiple domestic suppliers | Multiple domestic suppliers |

| Euler Motors | In-house | In-house |

| TVS Motors | Tata Green Batteries | Tata Green Batteries |

| Mahindra and Mahindra | BYD (China), Farasis Energy (China), LG Energy Solutions (South Korea) | Domestic suppliers |

| Tata Motors | Octillion Power Systems (USA), EVE Energy (China), Gotion High-Tech (own sub) | In-house |

| MG Motors | JV - SAIC Motors (Parent Co.) CATL (China) | JV - JSW |

| JBM Auto | In-house | In-house |

Source: BDO Research

Planned capex

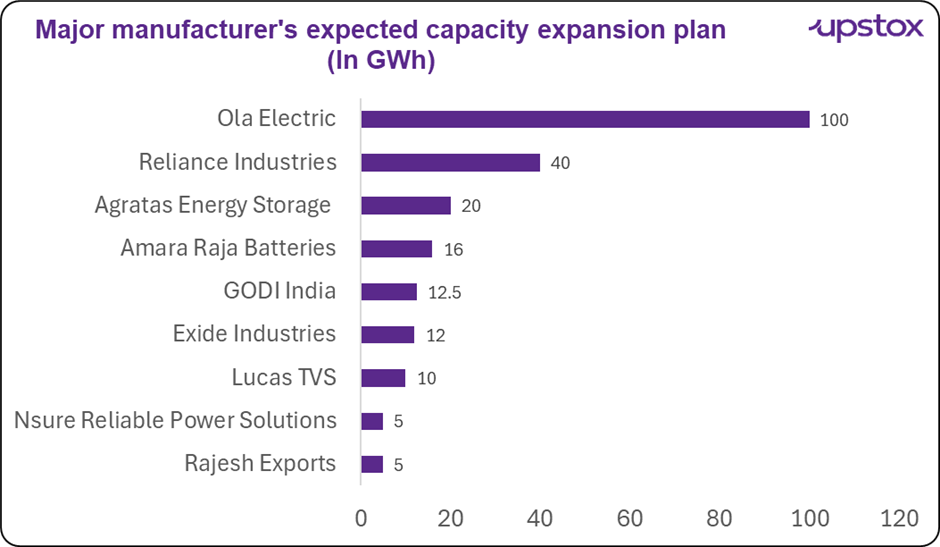

According to a recent BDO report, achieving the below-planned capacity will require ~$22bn in capex over the next few years, placing batteries among the top capex industries in India.

Source: BDO Report

Having delved into the what’s, the why’s and the encouraging developments in the sector, let us have a look at some noteworthy stocks in the space.

A non-exhaustive list of stocks in this sector

| Company Name | Market Cap (In ₹ Crore) | ROE (in%) | EBITDA Margin (%) | 3-yr Stock Price CAGR (%) | 3-yr Stock PAT CAGR (%) |

|---|---|---|---|---|---|

| Bharat Electronics | 2,08,329 | 26 | 25 | 51 | 24 |

| Exide Industries | 31,390 | 7 | 11 | 33 | 2 |

| TATA Chemicals | 21,202 | 2 | 18 | -5 | 27 |

| Himadri Specialty Chemical | 21,564 | 15 | 15 | 77 | 106 |

| Amara Raja Energy & Mobility | 17,855 | 14 | 14 | 20 | 12 |

| HBL Engineering | 13,886 | 28 | 19 | 97 | 160 |

Source: Screener; Data as of 14-04-25; *Rounded up numbers

Challenges

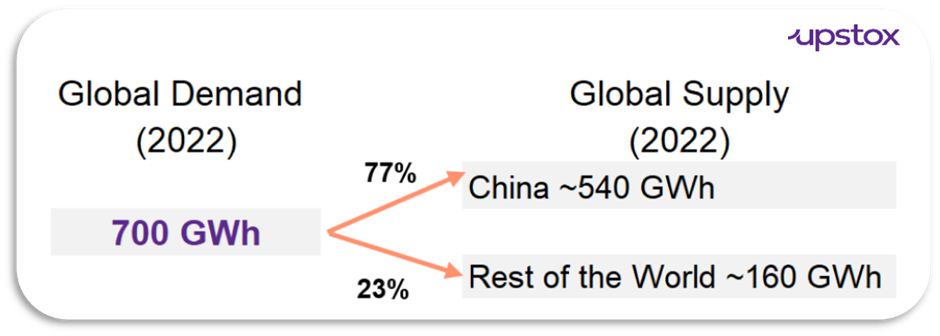

But it’s not all smooth sailing. There’s one major roadblock—China’s grip on the global lithium supply chain. China has been processing largest volumes of lithium chemistry components, solidifying its dominance in this sector. China dominates the global lithium-ion battery supply chain, controlling 60% of lithium refining capacity, leading in critical mineral processing, and accounting for 77% of global battery production in 2022, with projections to maintain around 70% market share by 2030

Source: BDO Report

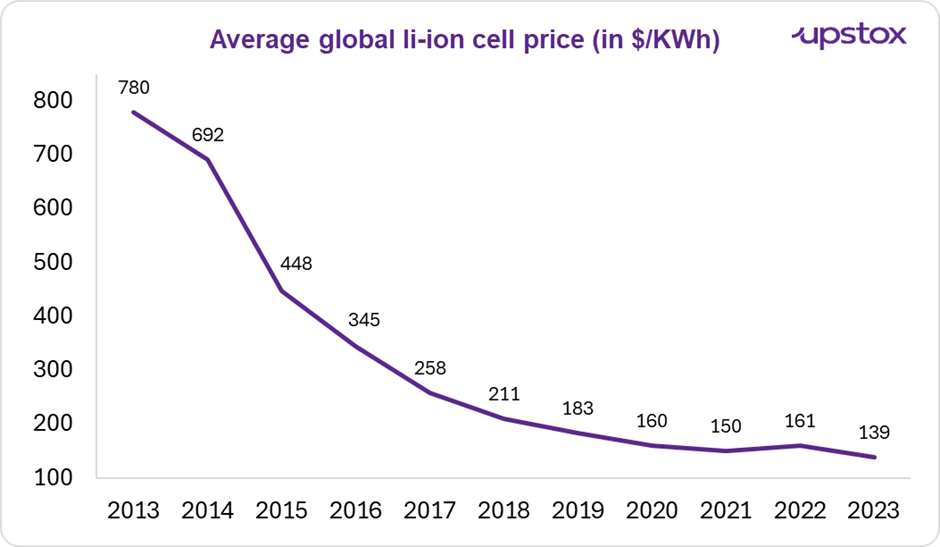

Contemporary Amperex Technology Company (CATL Ltd)., a prominent manufacturer, reduced the price of LFP cells by 50% in 2024, dropping from RMB 900 per kWh ($135/kWh) to RMB 400 per kWh ($56/kWh) within a year. This strategic move aims to strengthen China's position as a preferred import source, deepening India's dependence on Chinese battery imports.

Source: BDO Report

Moreover, with global li-ion cell prices plummeting nearly 90% over the past 10 years as seen from the above, imports from China often appear more cost-effective than domestic production.

Outlook

India’s auto ancillary sector, particularly li-ion batteries, is at the centre of the EV revolution and presents an attractive growth story for investors. As India moves to reduce import reliance and scale up domestic production, early movers stand to benefit.

So we turn over to the question asked at the start: Can India build a self-sufficient Li-ion battery ecosystem?

The answer is: not yet, but it’s moving in that direction. India is making strides toward a self-sufficient Li-ion battery ecosystem, but unless it secures its own lithium supply, ramps up domestic production, and scales battery recycling, full manufacturing independence is still a lofty goal.

About The Author

Next Story