Upstox Originals

Are Indians getting dependent on borrowing?

6 min read | Updated on December 05, 2025, 16:41 IST

SUMMARY

Borrowing has never been easier. From UPI-linked credit lines to ₹500 BNPL borrowings, micro-loans are blurring the line between access and addiction. While convenience has gone up, fiscal discipline has come into question. An increase in borrowing is followed by a spike in delinquencies. Read to find out how borrowings are moving from asset creation to simply funding expenses.

Unsecured personal loans under ₹50,000 have grown over 30% YoY as per the RBI

If you look around, you will surely find someone who took a loan to fund their wedding or their vacation! The trend of borrowing money for personal spending has been growing in India.

Not long ago, taking a loan meant paperwork, stress, and maybe parents’ disapproval. There was even a time when Indians shied away from borrowing. The thought - stretch your legs according to your blanket - was the overarching philosophy of most Indian households. However, as consumption rises, with it, fiscal discipline seems to be taking a backseat!

Today, millions of Indians are taking microloans, sometimes even ₹500 or less, not for emergencies, but for convenience. It’s a quiet shift in borrowing behaviour, one that’s turning small credit into big business.

The rise of India’s smallest loan

India’s lending system has long revolved around big loans for homes, cars, or personal needs. But now, a new layer is forming at the bottom: tiny, everyday credit that fits into daily life.

The RBI’s Financial Stability Report (December 2024) shows that unsecured personal loans under ₹50,000 have grown over 30% YoY, the fastest among all retail categories. Much of this growth is coming from digital and fintech-led lenders, who use transaction data to offer instant approvals.

Apps like Paytm, PhonePe, and Slice are piloting the RBI’s Credit Line on UPI, a feature that lets users borrow small amounts directly through UPI. Banks such as HDFC and Axis have joined in too, signalling that micro-credit is now moving into the mainstream. Digital-first lenders like LazyPay and CASHe say their average loan size is around ₹5,000–₹7,000, mostly for groceries, bills, or quick online purchases.

The data tells the story: small-ticket loans make up only a tiny share of total lending by value, but they dominate by volume. Indians are borrowing smaller sums, and doing it far more often.

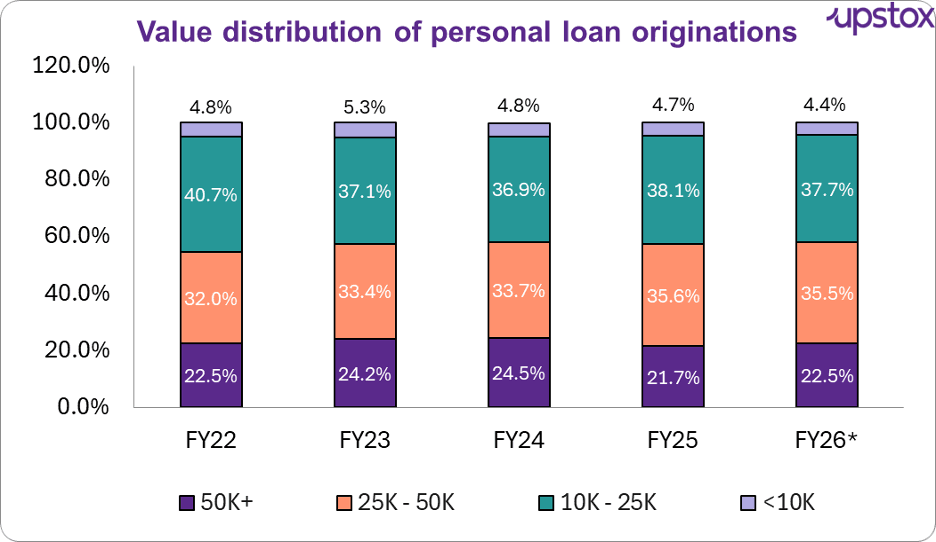

Source: CRIF High Mark, Note: FY26* is the average of Q1 & Q2 FY26 data.

Small-ticket loans (<₹10K) may contribute 5% of total lending value, but they’ve become the busiest corner of the credit market.

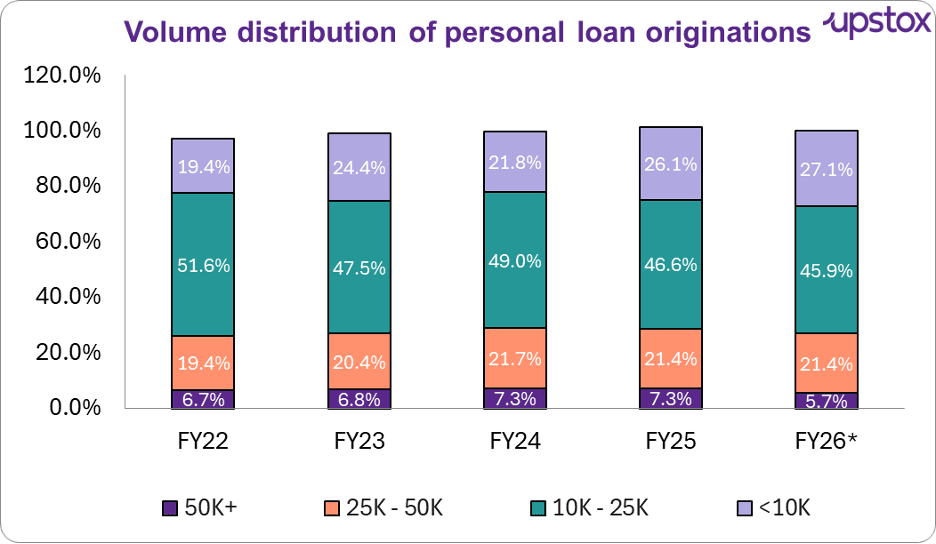

Source: CRIF High Mark, Note: FY26* is the average of Q1 & Q2 FY26 data.

In terms of volume, though, the story flips completely. By FY26, loans under ₹10K made up nearly 27% of all new loans, up from 19% in FY22, showing that borrowing in India is becoming more frequent, more digital, and more personal.

Small-value credit may be light in rupees, but it’s now the heartbeat of India’s lending system.

The new credit culture: Convenience over caution

If borrowing once meant stress, today it’s just another swipe. Small-ticket credit has grown because it’s easy, digital, and habit-forming, not because people are struggling.

UPI made it effortless.

The RBI’s Credit Line on UPI, rolled out in 2023, turned short-term credit into a three-tap process. Borrowing ₹500 to pay for groceries no longer feels like a loan, it feels like a payment.

Younger borrowers normalised it.

The total number of active borrowers in the NBFC industry stood at 15.5 Cr as of June 2025, according to CRIF High Mark. Almost 50% of them are under 30, and they see credit as flexibility, not liability. For many, a ₹1,000 UPI loan is their first step into formal finance, long before a credit card.

Data replaced documents.

Fintechs like Slice, LazyPay, and CASHe use transaction and repayment history instead of paperwork, helping millions of first-time borrowers access credit instantly.

And habit did the rest.

Once people experience instant credit, they repeat it. Redseer estimates over 60% of small-ticket users take a second loan within three months.

Together, these shifts have created a new kind of credit behaviour, borrowing not out of need, but out of convenience.

Who’s leading the charge

Fintechs built the habit — but NBFCs are running the engine.

Platforms like LazyPay, Kissht, CASHe, and Paytm made small-ticket credit aspirational and instant. Behind them sit their NBFC partners, licensed lenders that actually disburse the money and carry the risk. Fintechs handle the front-end experience; NBFCs handle the back-end capital.

And as the data shows, NBFCs now dominate both in value and volume.

Though small-ticket loans form just a tiny corner of India’s overall lending market, NBFCs dominate it almost entirely. Their share has climbed from about 68% in FY22 to over 82% in FY26 by value, and nearly 87% by volume, as banks step back from riskier unsecured credit.

Fintech-led NBFCs are driving most of this growth, while banks have pulled back as regulatory scrutiny on unsecured lending tightened.

The shift is clear. In FY22, private banks held roughly a third of the small-loan market. By FY26, that’s down to barely 15%.

NBFCs, meanwhile, have grown into the sector’s workhorse, taking on risk, expanding reach, and powering the fintech-led credit engine.

What began as a digital experiment is now an NBFC-driven ecosystem, one where traditional banks are happy to play the safer, back-end role through partnerships.

It’s a new pecking order, fintech’s drive demand, NBFCs drive disbursals, and banks supply the regulatory comfort.

But behind this surge in small loans lies a quieter risk, not of default, but of dependence.

The thin line between access and addiction

Easy credit always comes with a quiet cost.

The same tech that’s made borrowing seamless has also made it habitual. Redseer estimates nearly 60% of small-ticket users take another loan within three months.

What starts as convenience can quickly become a cycle.

Further research from CRIF High Mark shows why the RBI’s recent caution isn’t misplaced.

Delinquency levels in small-ticket loans, especially at the bottom and top ends of the ticket-size range, are beginning to edge higher. In the sub-₹10,000 bracket, short-term delinquencies (31–90 days overdue) rose from 1.9% in September 2024 to about 2.15% by March 2025. For loans above ₹50,000, that figure climbed from 1.09% to 1.35% over the same period.

Smaller loans are more prone to impulsive borrowing and repayment fatigue, as one analyst put it, “The risk isn’t default, it’s fatigue.”

Larger loans, meanwhile, are starting to feel the pinch of rising EMIs and tighter liquidity.

It’s not a debt crisis, it’s a behaviour shift. Defaults overall remain manageable, roughly 4–5% for unsecured retail credit, according to CRIF, but the pattern is clear: as small-ticket lending scales, the line between access and addiction grows thinner.

The challenge for lenders now is to keep credit inclusive without letting convenience turn into compulsion.

From survival to lifestyle finance

India’s credit story is quietly evolving, from borrowing out of need to borrowing out of habit. Micro-loans aren’t just filling gaps anymore; they’re shaping how people manage their daily lives.

A ₹500 loan once meant a shortfall. Now, it’s a signal of convenience, proof that digital credit has become as routine as a UPI payment. But as borrowing turns into behaviour, the question is no longer how fast credit grows, but how responsibly it’s used.

The ₹500 loan began as a convenience, and became a mirror of how India now borrows, spends, and believes.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story