Upstox Originals

Is India economic growth now ‘privately funded’?

5 min read | Updated on November 18, 2025, 19:41 IST

SUMMARY

India’s private credit market has quietly become the country’s alternative lending engine by filling the gap left by cautious banks. Global and domestic funds are now writing cheques where traditional lenders can’t, powering growth in capital-heavy sectors like real estate and renewables. But as this $70-billion market (2x in 5 years) races ahead, are rules catching as well?

India’s private credit market has swelled to around $70 billion in FY25, roughly double what it was five years ago

Getting a business loan from a bank is typically a long drawn process with a lot of paperwork and stringent lending criterias. Banks are cautious in nature and prefer the comfort of retail borrowers and top-rated corporates.

Banking credit to the industry sector grew just 8.5% in FY24, far slower than retail, which continues to expand in double digits. The sector’s share in total bank credit has dropped from 27% in FY22 to about 23% in FY24.

This has however, opened up lines of private credit for businesses looking to quickly borrow money and get a move on. These private credit funds have become the go-to lenders for businesses that need capital fast and can be customised. They move faster than banks, price risk liberaly, and take a more practical view of growth.

Banks vs private credit - A quick comparison

| Feature | Private Credit | Bank Loans |

|---|---|---|

| Time to get the loan | Weeks | Months |

| Terms | Customised | Standardised |

| Interest rate | Higher: 10-20% | Lower: 5-12% |

| Requirements | Lenient; evaluated on a case-by-case basis | Stricter regulations |

Source: News articles

Once a niche side hustle of global financiers, India’s private credit market has swelled to around $70 billion in FY25, roughly double what it was five years ago. Big names like KKR, Blackstone and Apollo, along with homegrown players such as Edelweiss, Kotak Alternatives and Piramal, are now competing to lend to sectors such as real estate, infrastructure, renewables, even mid-sized manufacturers.

The rise of private credit isn’t just about new lenders. It’s a sign that India’s growth engine is running faster than its banks can keep up, and borrowers are happy to pay a little extra for speed, structure, and silence.

Why is private credit taking off?

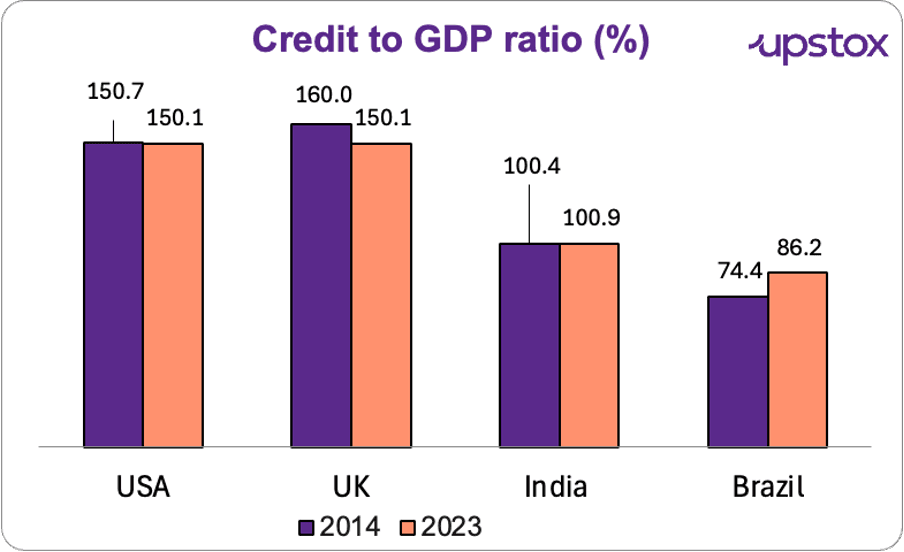

India’s economy has been racing ahead, and credit flow is critical to its sustained growth. One way to measure that is the credit-to-GDP ratio, basically, how much lending supports the economy. Think of it as a quick health check on how easily businesses can borrow.

That number hasn’t moved much in a decade, even as countries like the US have far deeper credit systems; their lending activity is often one-and-a-half to two times the size of their economies.

Source: Care Edge analytics

After the bad-loan crisis and tighter RBI rules, banks now steer clear of lower-rated borrowers and high-risk sectors such as real estate, NBFCs, and infrastructure. They also have certain restrictions from funding land or equity acquisitions, further narrowing corporate lending. The result is a widening financing gap, one that private credit funds are stepping in to fill with faster, more flexible capital.

Who’s lending?

The market is now a mix of global and domestic investors, each bringing a different style of money to the table.

Private credit funds are at the centre of this boom. They’ve gone from short-term, high-yield loans to handling multi-billion-dollar transactions, offering flexible capital to companies that can’t easily borrow from banks.

Most operate as Alternative Investment Funds (AIFs) that are SEBI-regulated Category II vehicles which allows them to raise money both in India and overseas. Then there are Special Situation Funds (SSFs) which are a smaller, high-risk set that specialises in financing companies under stress or during restructuring.

NBFCs haven’t disappeared either. They still lend to the structured credit segment, often partnering with these funds to co-lend or syndicate deals.

On the investor side, the money now comes from almost everywhere. Global funds like KKR, Apollo, and Brookfield continue to dominate inflows, drawn by double-digit returns. But domestic investors, from family offices and HNIs to corporate treasuries, now make up nearly half the pool.

Even NIIF, Motilal Oswal, and Vivriti Asset Management are raising large pools for performing credit. Interestingly, Bandhan AMC and Blackstone are launching retail-focused credit funds, signalling how mainstream this asset class is becoming.

Where does the money go?

Private credit isn’t one-size-fits-all. These lenders design custom financing structures that match each borrower’s cash flow and business needs, something traditional banks rarely do. Here’s a breakdown of where most of that money is going right now:

| Use case | Share of facility utilisation (in %) | What it means |

|---|---|---|

| Refinancing & working capital | 39% | Longer-term funding or PIK (payment-in-kind) loans to replace high-cost bank debt. |

| Acquisition financing | 35% | Funding M&A deals, often using shares or hybrid equity-linked structures. |

| Growth capital | 25% | Supporting expansions, cost overruns, or new projects in real estate, infra, and renewables. |

| Other | 1% | Small-ticket or short-term financing, including bridge loans, venture debt, and R&D funding. |

Source: PWC report

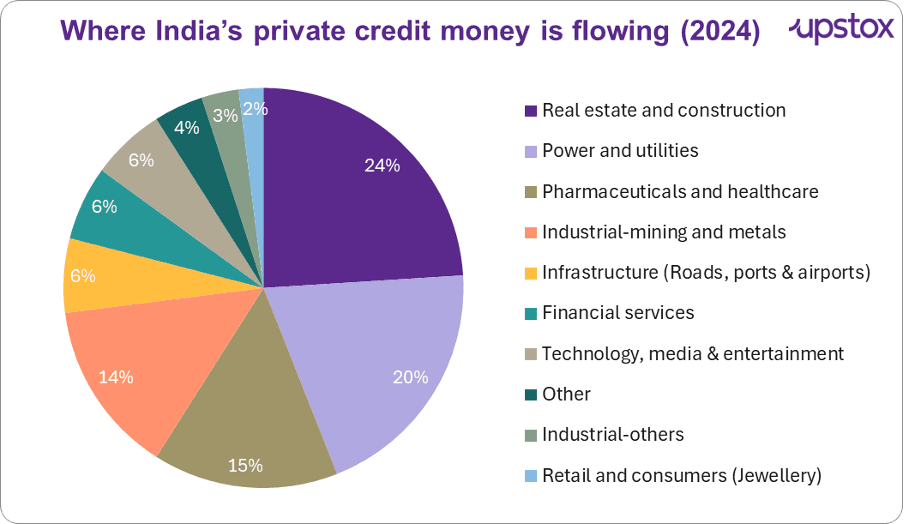

The obvious next question: where is all this private credit actually going?

Source: PWC report

The reason these sectors dominate is simple: they’re all capital-hungry. These projects involve complex cash flows, delayed paybacks, or risks that don’t fit standard bank models.

What happens when money moves faster than the rules

For now, private credit’s rise looks like a win-win, fast capital for businesses, strong returns for investors. But it’s still relatively uncharted territory. Most funds operate under SEBI’s AIF framework, not a dedicated credit regulation, which means reporting standards vary widely.

As the market crosses $70 billion, the challenge will be to balance flexibility with oversight, because in finance, speed helps you take off, but without guardrails, even the best flight path can get bumpy.

Because in finance, speed helps you take off, but without the right guardrails, even the best flight path can get bumpy.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story