Upstox Originals

India’s sporting calendar has no off-season anymore

6 min read | Updated on November 27, 2025, 16:07 IST

SUMMARY

From ₹1,000 crore in 2008 to nearly ₹8,000 crore in 2024, India’s sports advertising has grown at a 13% CAGR—outpacing every other screen business. With IPL drawing 1.19 billion viewers and Pro Kabaddi reaching 351 million, the country has shifted to a year-round multi-sport marketplace. Behind this rise is also the story of how sponsorships, franchise investments, and endorsements have quietly built the business backbone of sport.

Pro Kabaddi continues to anchor India’s non-cricket calendar, reaching 351 million viewers

There was a time when sport in India had an off-season. Cricket ruled the summer, football flickered through the weekends, and by monsoons, screens mostly went silent. Then came the IPL, and suddenly, sport stopped taking breaks.

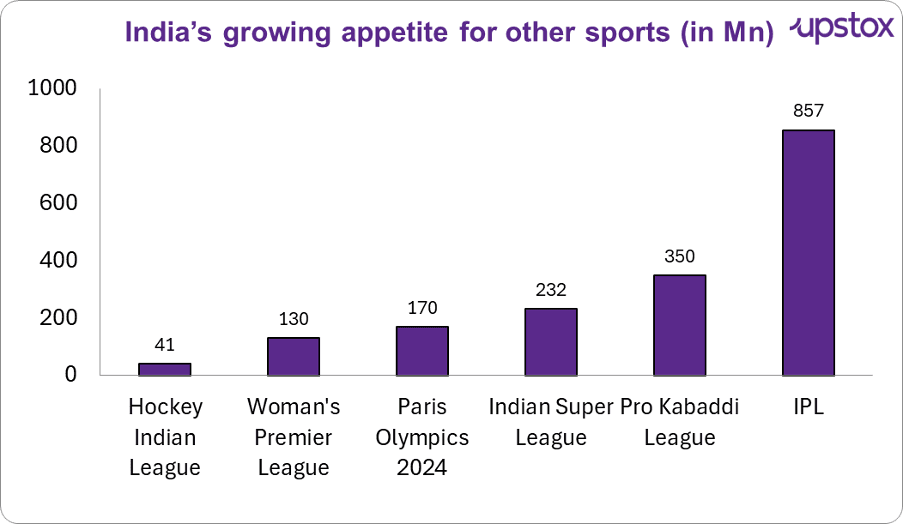

What began as a two-month burst of cricket has grown into a year-round rhythm of competition and content. Pro Kabaddi now fills the monsoon months, the Women’s Premier League leads the spring schedule, and even hockey and football have carved out loyal audiences of their own. Add the growing buzz around India’s Olympic performance, and it’s clear that the country’s sporting calendar has quietly gone full-time.

The IPL didn’t invent India’s love for sport, it industrialised it. The league showed that fans would tune in for skill, storytelling, and spectacle, and that template has since spilled into every corner of Indian sport. Today, whether it’s kabaddi in Patna, women’s cricket in Mumbai, or Olympic qualifiers in Paris, the audience has learned one thing: there’s always something to watch.

What’s striking isn’t the scale, but the stamina. The IPL has turned watching sport into muscle memory, habitual, automatic, built into India’s daily scroll, and every other league is learning from that reflex.

But the story doesn’t end with cricket, it only begins there. Across kabaddi courts, football grounds, and women’s cricket arenas, India’s sporting landscape is expanding faster than ever.

The next wave of Indian sport

Source: GroupM report, Havas play report, News articles

While cricket remains India’s biggest draw, the real story lies in the sports quietly climbing the charts. The Women’s Premier League has been the breakout performer, doubling its audience in 2024 and surging another 150–200% in 2025, fuelled by fresh sponsors and younger fans.

Pro Kabaddi continues to anchor India’s non-cricket calendar, reaching 351 million viewers with steady 17–20% YoY growth, proving regional leagues can now sustain national scale. The Paris Olympics 2024 delivered India’s highest-ever viewership for a single multi-sport event at 170 million, while the Indian Super League maintained a solid 200+ million following, driven by southern and northeastern clubs.

The Hockey India League, returning after a long hiatus, surprised many with a 48% recovery from 2017 levels, reaching 40.8 million viewers in its 2024–25 season. Together, these numbers show how India’s viewing habits are maturing, from a single-sport nation to a multi-sport marketplace. Each league may occupy its own lane, but the crowd, increasingly, is the same: always on, always watching.

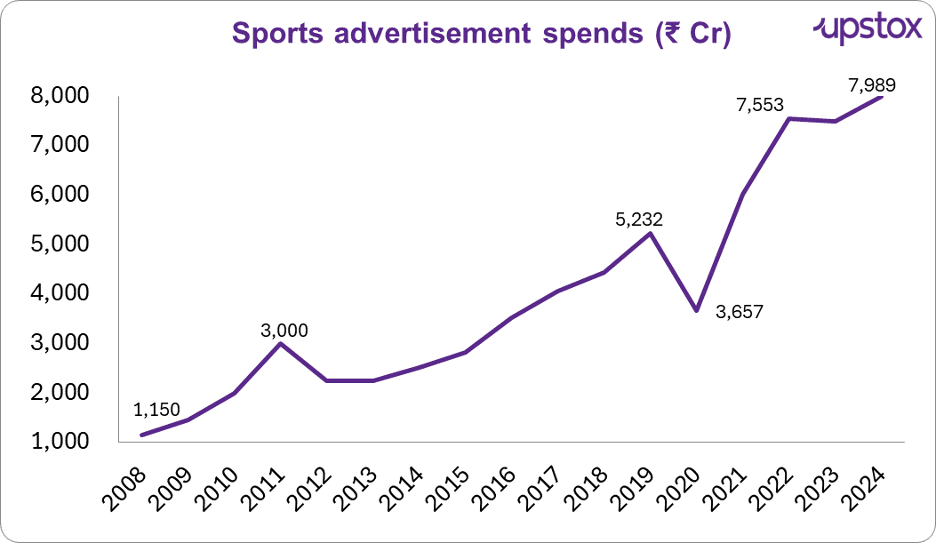

Following the money in Indian sport

Over the last seventeen years, India’s sports advertising market has grown from just over ₹1,000 crore in 2008 to nearly ₹8,000 crore in 2024, a compound annual growth rate of about 13%, according to GroupM. That’s well above the broader media and entertainment industry’s 8.2% CAGR over the same period, underscoring how sport has outpaced every other screen business in both ad money and momentum.

Source:GroupM report

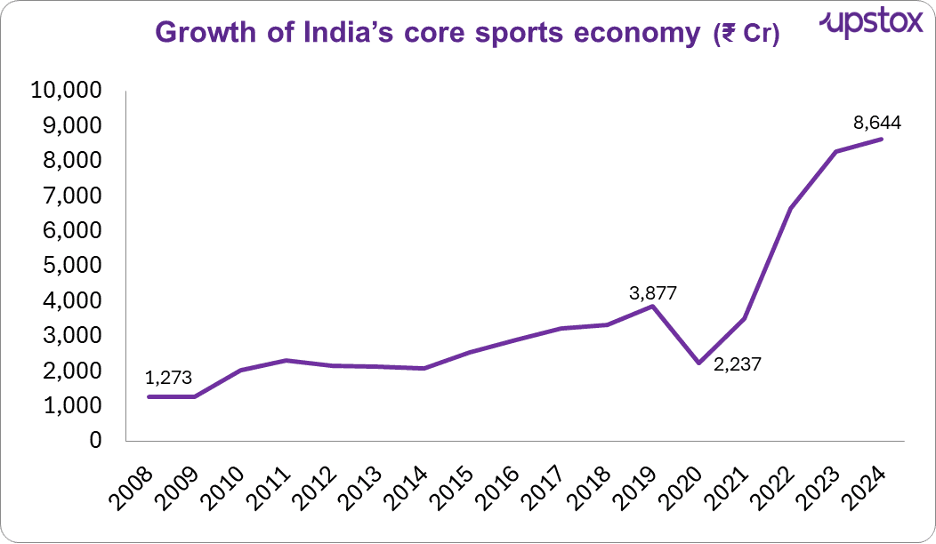

But advertising is only one slice of India’s sports economy, the real story lies in how sponsorships, franchise investments, and endorsements have quietly built the business backbone of sport.

Source: GroupM report

Between 2008 and 2024, India’s sports business, excluding sports advertising spends, surged from ₹189 cr to ₹1,170 cr, reflecting a CAGR of around 13%. The steady rise comes from three pillars: team sponsorships, which grew at an average of 11% annually, franchise fees, up 43%,and endorsements, climbing 17% each year. Together, they’ve transformed sport from a two-month cricket economy into a robust, year-round business sector.

The screens of sport: Where India is watching now

India’s sports audience in 2025 no longer lives in the silos of “TV” or “digital.” Viewers now move freely between live television, smartphones, and smart TVs, picking screens that fit the moment.

For the first time, OTT has overtaken TV in reach. The IPL 2025 season drew 652 million viewers online, against 537 million on television, with a combined 1.19 billion people watching across platforms.

The real surge is on Connected TV (CTV; TV connected to the internet), up 85% year-on-year, from 69.7 million to 129.2 million viewers. CTV is now India’s second-biggest streaming screen after mobile, turning living rooms into digital stadiums.

Regional viewing is fuelling this boom: over 30% of IPL and WPL watch time now comes from vernacular feeds, especially in southern and eastern states. The WPL’s digital audience jumped 70%, and TV ratings rose 150%, showing how women’s sport is finding both new viewers and advertisers.

Platforms have turned this momentum into experience. JioCinema, FanCode, and Star now serve fans through multi-angle streams, regional commentary, and tiered models, from free streaming to low-cost or premium bundles. Ad buying has evolved too: brands now seek interactive moments, live polls, highlight clips, and overlays, with CTV ad rates up 30% year-on-year.

The new playbook for advertisers

If the old game was about buying airtime, the new one is about owning attention, and increasingly, association.

The real-money gaming ban in 2023 left a temporary gap in sports advertising. Fantasy platforms like Dream11 and MPL had accounted for nearly 20% of total sports ad volumes, especially during IPL and kabaddi seasons. But by 2024, fintech, e-commerce, and consumer brands had filled that space, not just as advertisers, but as long-term sponsors.

Sponsorships, once centred almost entirely on cricket, are now far more distributed. Cricket still commands the bulk of sports sponsorship, but other leagues are catching up fast. Pro Kabaddi and the Women’s Premier League now attract over ₹1,200 crore in brand partnerships annually, while football, hockey, and niche sports are drawing diverse backers.

The most telling shift is who’s sponsoring what, and why.

-

Odisha’s government has turned its historic connection with hockey into a branding success, sponsoring national teams and global tournaments while promoting state tourism.

-

Hero MotoCorp, title sponsor of the Indian Super League, tailored regional digital campaigns in Malayalam and Assamese, driving a 300% rise in engagement across Kerala and the Northeast.

-

Patanjali, backing the Pro Kabaddi League, positioned itself as a homegrown brand supporting traditional Indian sports, resulting in a 35% jump in rural brand affinity.

-

Even Karnataka Tourism and TT Group are backing ocean sports like surfing and stand-up paddling, betting on India’s coastline as the next sporting frontier.

For sponsors, this isn’t just CSR, it’s smart marketing. Aligning with sport gives brands cultural legitimacy and regional depth that few ad campaigns can match. From hockey to kabaddi to ocean racing, sponsorship today is less about logo visibility and more about storytelling: being part of the journey, not just the broadcast.

Parthing thought

India’s sporting calendar no longer has an off-season, it’s always on. What began with cricket has evolved into a full-time economy of screens, sponsors, and stories. The country isn’t just watching sport anymore; it’s living it.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story