Upstox Originals

India's discretionary spending boom: Lessons from the USA and China

.png)

5 min read | Updated on February 12, 2025, 12:34 IST

SUMMARY

With India’s current GDP per capita, the economy is set for a long-term boom in discretionary spending. As income levels rise, demand for a wider range of consumer goods will grow, offering businesses opportunities to innovate and expand. By analysing past trends in the USA and China, we can draw valuable parallels to forecast India’s economic outlook.

At India's current level of GDP per capita, discretionary consumption can see a boom

The Union Budget 2025 announced a cut in personal income taxes which will lead to an aggregate 1 lakh crore additional savings for consumers. This is aimed at reviving consumption in India. This prompts us to dive deeper and look at how consumption patterns have evolved over the past and what the outlook suggests.

India’s income and consumption at an inflection point

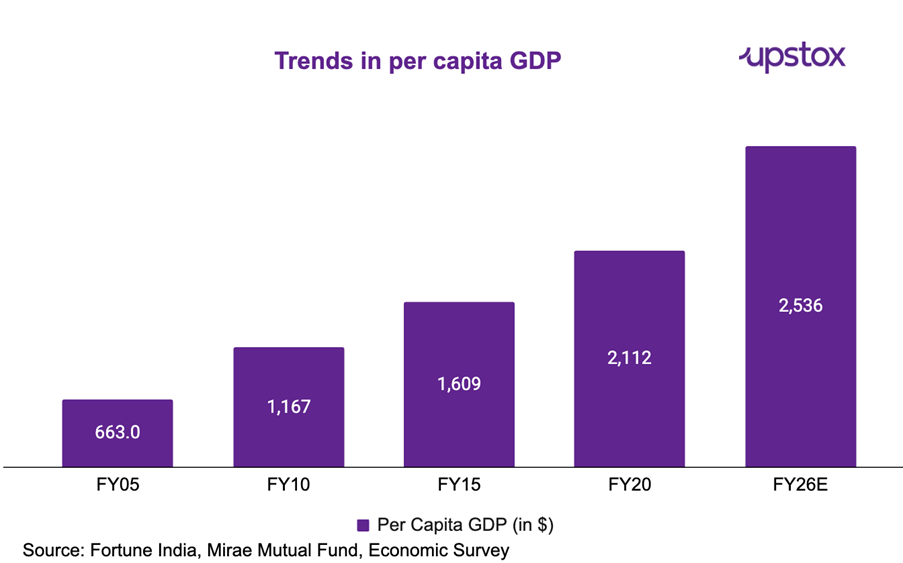

India’s per capita income has decisively surpassed $2,000 and is closing in on the $2,500 threshold — a critical range, beyond which most economists suggest indicates a shift towards increased discretionary spending.

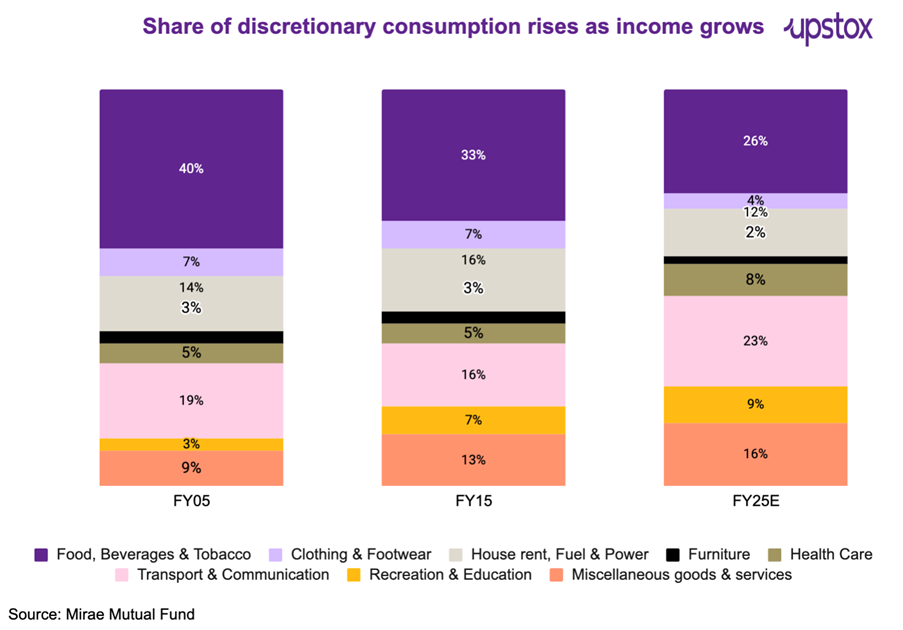

The chart below shows the evolution of India’s changing consumption patterns. From the necessities of food, clothing, and shelter, Indians have already started increasing their spending towards more discretionary items such as recreation, travel, and healthcare.

This trend is expected to persist and only amplify as discretionary spending (other than food & grocery) is expected to grow faster than non-discretionary spending (food & grocery).

| Category | CAGR FY 2019 - FY 2024 | CAGR FY 2024 - FY 2027 (E)* |

|---|---|---|

| Total retail spend | 9.3% | 10.1% |

| Non-Discretionary spends | ||

| Food and Grocery | 8.6% | 8.0% |

| Pharmacy & Wellness | 9.7% | 12.3% |

| Discretionary spends | ||

| Home & Living | 9.0% | 13.0% |

| Apparel & Apparel Accessories | 11.4% | 16.0% |

| Non-Apparel Accessories | 10.0% | 14.9% |

| Jewellery | 10.4% | 14.0% |

| Consumer Electronics | 11.7% | 14.1% |

| Footwear | 8.3% | 16.9% |

| Watches | 11.4% | 13.4% |

| Others | 9.8% | 9.0% |

Source: Technopak Analysis. Data as of November 2024; *E = Expectation

If one takes a step back and thinks about this - it's only logical. As disposable income grows, there is a natural move away from just spending on necessities and moving towards luxuries. A recent analysis by White Oak Capital Mutual Fund (based on data from Bain and the IMF), further outlines why the $2,000 mark is an inflection point and outlines the anticipated shift in Indian spending.

| GDP per capita | Spend |

|---|---|

| Up to $2,500 | Consumption is necessity-driven—retail, credit, and real estate see early growth |

| $3,000 | Affordability improves, boosting real estate, retail, and financial inclusion. |

| $5,000 | Urban aspirations rise, driving demand for cars, premium retail, and luxury housing. |

| $6,500 | Lifestyle spending surges—durables, luxury goods, and recreation take off. |

| $8,000 | Consumption dominates—travel, entertainment, and high-end retail flourish |

Source: Whiteoak Capital

Still not convinced? Let’s look at what happened in the USA and China

What does history tell about the US consumption boom?

The US witnessed a ~10X increase in consumption spending between 1980 and 2023, driven by a sharp rise in per capita income.

-

Per capita income grew from $3,200 (1960) → $80,300 (2023)

-

Consumption spending jumped from $332B → $18.8T

-

Consumption's share of GDP rose to 69%, driving sustained growth

| Year | 1960 | 1980 | 2023 |

|---|---|---|---|

| Per capita income ($) | 3,200 | 13,390 | 80,300 |

| Growth | - | 4.2x | 6.0x |

| Consumption spend ($ bn) | 332 | 1,751 | 18,823 |

| Growth | - | 4.3x | 9.8x |

Source: Edelweiss AMC, Trading Economics, Macro Trends, Economic Survey

What is important to note is that consumption always grows faster than per capita income growth and this is largely due to the multiplier effect, discussed in more detail in the next section.

Moving to China

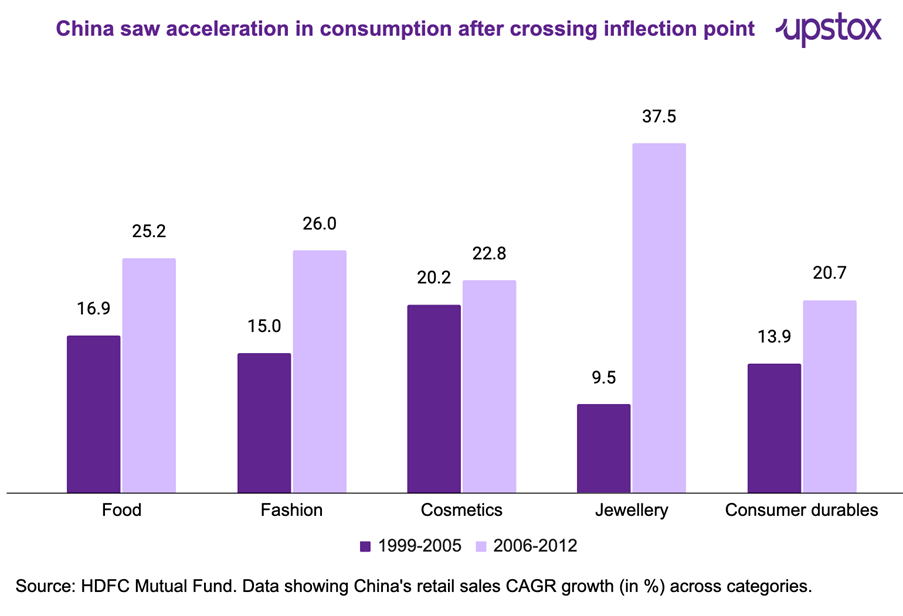

Similar to America, China has also seen a boom in consumption driven by rising incomes. China is not only closer to home, but in contrast to America shares a few more similar traits with India. It has a vast population and both nations (India and China) have moved from tough economic periods to more prosperous times. From 2006-12 when their per capita income almost doubled (from $2,688 in 2007 to $5,596 in 2011), the country witnessed a boom in discretionary categories.

Insight for investors

As per the IMF, the consumption multiplier is ~5x. Meaning, for every one ₹1 spent, it would lead to additional follow-on spending of ₹5 in the economy. Economic theory suggests that people save 20% and spend the balance 80%. As such, the recently announced tax cuts of ₹1 lakh crore could result in a spending of ~₹4 lakh crore contributing to ~2% of the GDP growth.

Increased demand boosts production, employment, and incomes, further reinforcing the cycle of economic expansion. In essence, higher spending power drives businesses to grow, which in turn accelerates overall GDP growth.

Are there any pitfalls?

About The Author

Next Story