Upstox Originals

Gold: Decoding macro and demand trends

.png)

6 min read | Updated on May 13, 2025, 14:46 IST

SUMMARY

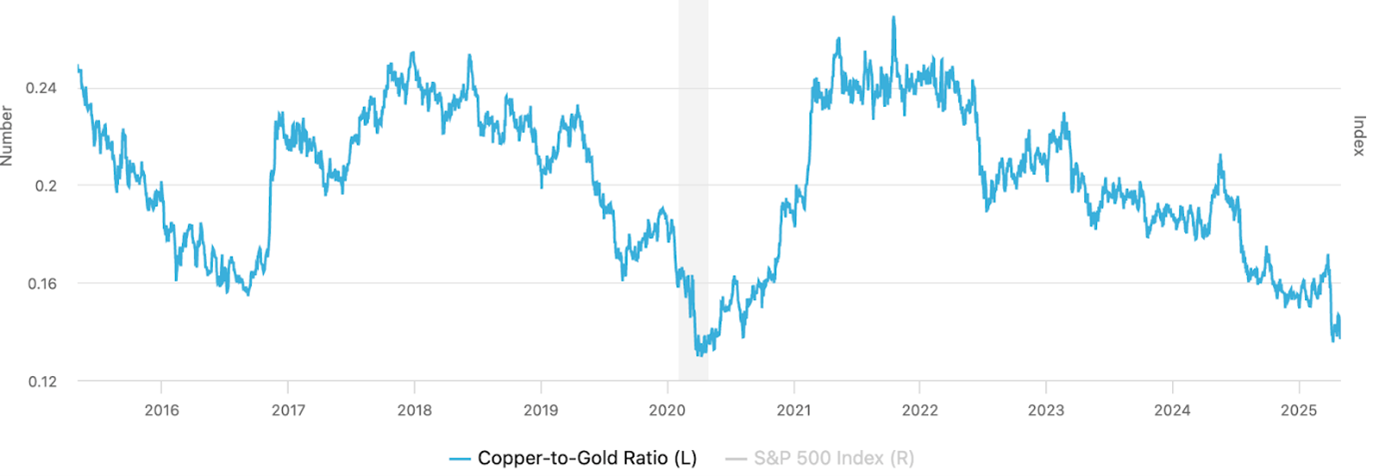

Gold continues to shine as a safe-haven asset amid economic uncertainty, with strong demand driven by inflation and geopolitical risks. In 2024, global gold demand reached its highest in 15 years, with a notable rise in investment, especially in India and China. The copper-to-gold ratio, which shows economic health, has dropped, signalling caution in the market, as gold outperforms copper in times of economic uncertainty.

Gold has returned over 40% in FY25 versus ~5% from equities

Gold has long been considered a safe-haven asset, prized for its ability to maintain value in times of uncertainty. In this article, we explore the macro trends influencing gold’s performance, the market drivers, and how investment behaviour has shifted in response to economic changes.

Additionally, we will dive into India’s growing importance in the global gold market and its influence on demand patterns.

Performance versus other asset classes

Gold emerged as the best-performing asset class in 2024 amid global uncertainty and geopolitical tensions

| Asset class | 1Y (%) | 3Y CAGR (%) | 5Y CAGR (%) | 10Y CAGR (%) |

|---|---|---|---|---|

| Gold ($) | 41.1 | 17.2 | 14.2 | 10.2 |

| Nifty 50 TRI | 5.3 | 10.7 | 24.3 | 11.8 |

| Nifty 500 TRI | 3.8 | 12.8 | 26.7 | 12.8 |

Source: NSE, World Gold Council. Data as on 31st March-25

Why does gold glitter?

Gold’s performance in recent years reflects its role as a store of value in times of economic volatility. Over the past decade, gold has provided steady returns, especially during periods of global financial uncertainty. Key factors influencing gold’s performance include:

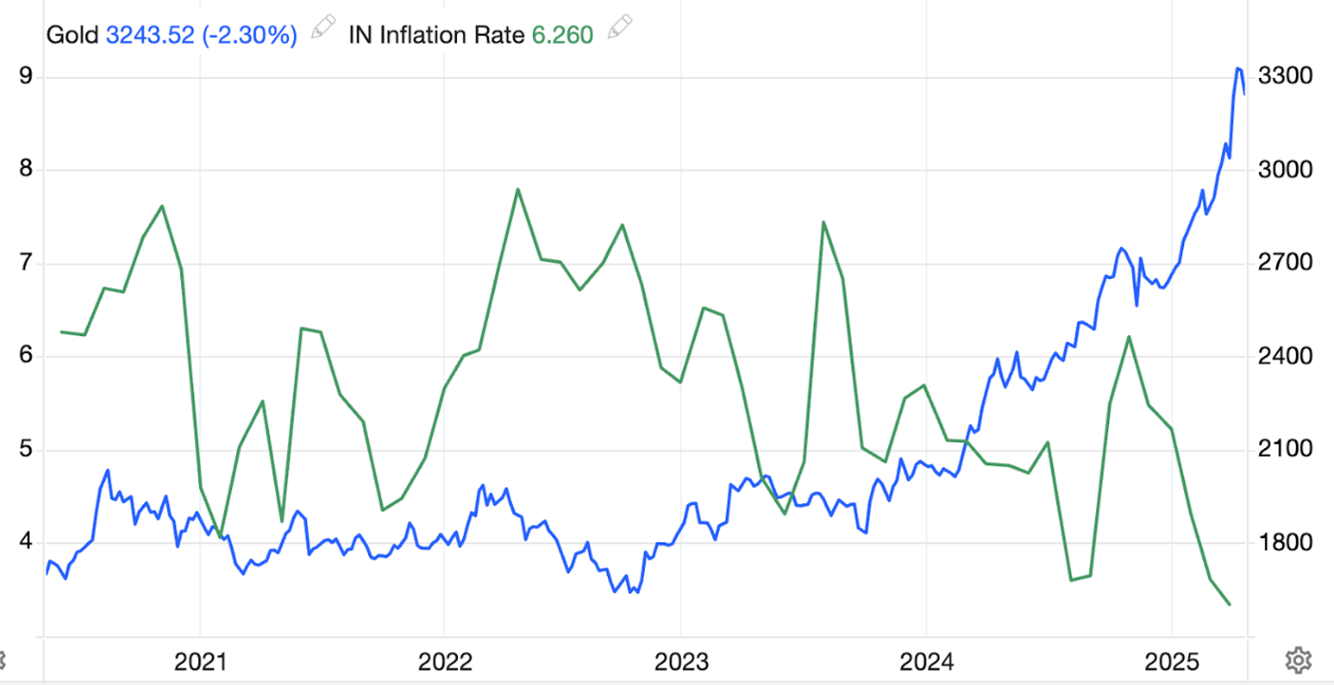

- Inflation Hedge: Gold has become a key asset for investors looking to preserve purchasing power. In times of rising inflation, gold typically rises as a hedge.

Source: Trading Economics

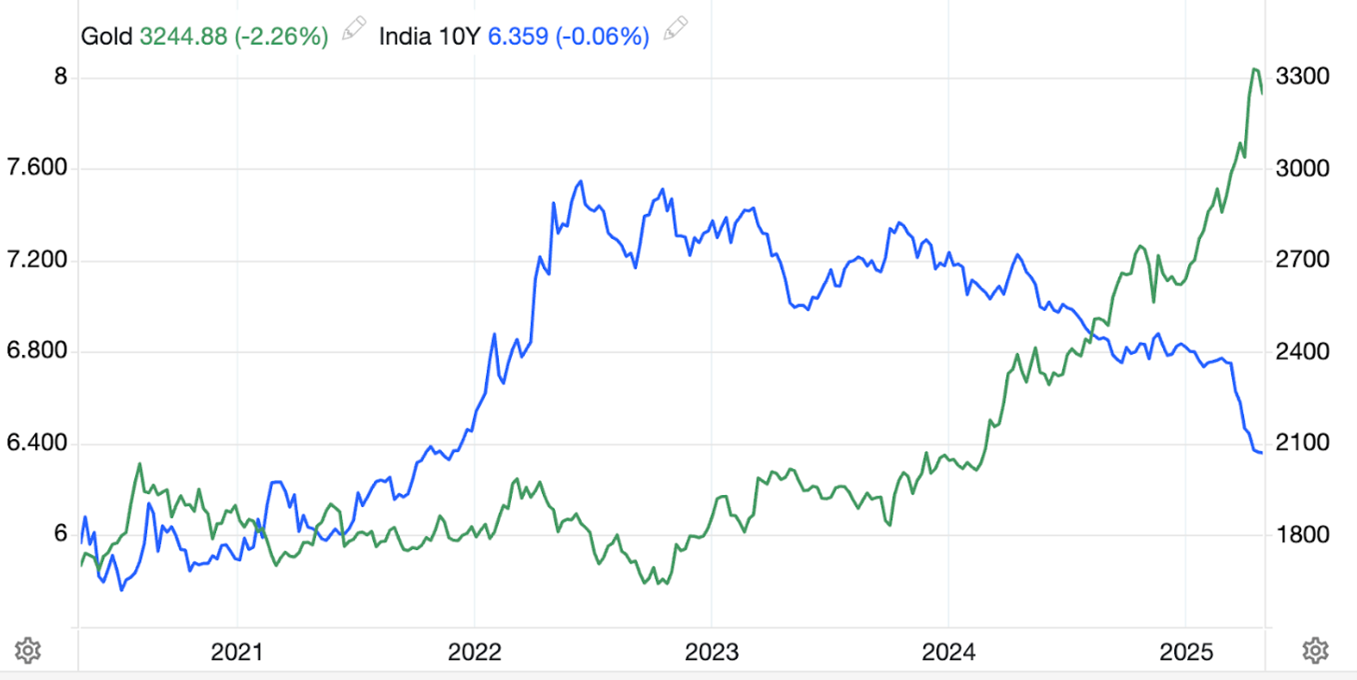

- Interest rates: The relationship between interest rates and gold is inversely correlated. When interest rates rise, the opportunity cost of holding gold increases, making it less attractive compared to interest-bearing assets. Conversely, when interest rates are low, gold tends to shine as an alternative investment, yielding positive returns.

Source: Trading Economics

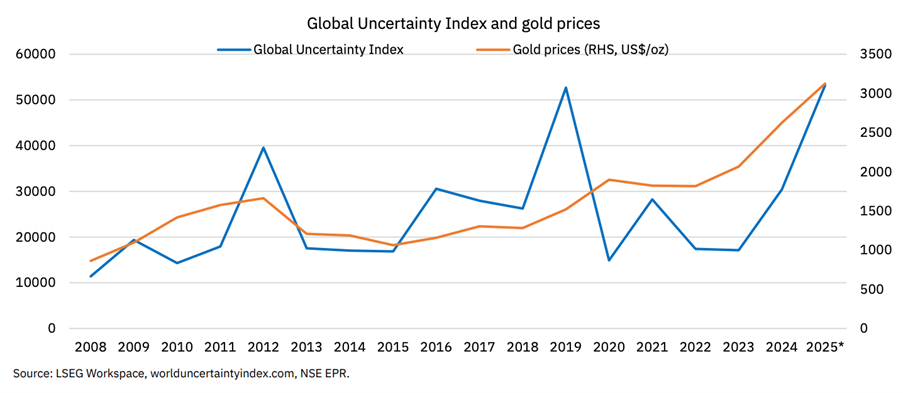

- Geopolitical risks and market uncertainty: Events like political instability, financial crises, and major geopolitical shifts often drive investors to seek safe assets. Gold’s status as a hedge during times of market instability has remained steadfast. This is particularly evident during periods of heightened uncertainty, where gold often experiences price appreciation.

Decoding global gold demand trends

Global gold demand has been steadily rising. In 2024, it hit 4,974 tonnes, the highest since 2009.

A snapshot of gold demand

| Category | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Jewellery fabrication | -6.0% | -38.5% | 68.5% | -1.6% | -0.2% | -8.6% |

| Investment | 40.8% | -44.8% | 24.7% | 12.2% | -15.0% | 24.7% |

| Technology | -2.6% | -7.1% | 9.1% | -6.6% | -3.1% | 6.9% |

| Central banks & other institutions | -7.7% | -57.9% | 76.6% | 139.9% | -2.7% | -0.6% |

| OTC and other | 58.3% | 102.5% | -34.4% | -92.3% | 753.6% | -7.2% |

| Gold demand | 2.3% | -3.0% | -0.8% | 1.1% | 4.0% | 0.6% |

Source: NSE, World Gold Council.

-

Investment is key: Investment demand grew 25% in CY24 vs 0.6% growth in overall gold demand, making up almost 24% of total demand. People bought gold bars and coins for safety. Asia, especially China and India, where demand grew by 20% and 29% YoY in CY24 led by gold ETF flows.

-

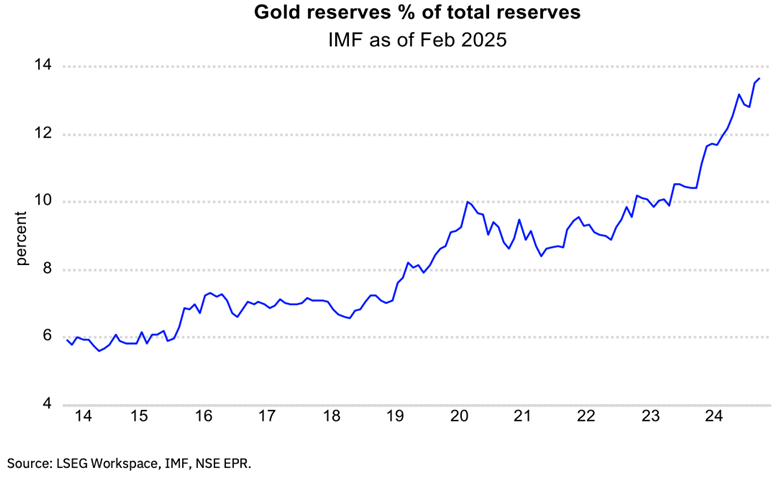

Central banks buying big: Central banks bought over 1,000 tonnes of gold for the third year straight in 2024. They are diversifying their reserves away from the US dollar and seeking safety, evident from the fact that Gold accounts for 6% of total central bank reserves in 2003 to now 13% as per the IMF. In India, the RBI also increased gold reserves by 56% in the last 3 years and now gold accounts for 11% of the total RBI reserves. Going forward, 66% of global institutions have said they will increase the proportion of gold in total reserves in the next 5 years.

- Global jewellery demand declined in 2024 due to reduced consumer demand, as gold prices reached record highs. Jewellery now represents only ~38% of total gold demand, down from 50% during 2010–2019.

How did Gold demand fare in the recent quarter (Jan-25 to Mar-25)?

In Q1 2025, gold demand rose to 1,206 tonnes, marking a 1% YoY increase despite the high price environment. The surge was fueled by a revival in gold ETFS, contributing to a 170% YoY increase in investment demand, which amounted to 552 tonnes.

-

Gold ETFS saw 226 tonnes of inflows globally, primarily driven by price momentum and tariff policy uncertainty, as gold served as a safe-haven asset during global economic turmoil.

-

Bar and coin demand: Increased by 3% YoY, with 325 tonnes of demand, led by retail investment in China. However, demand in the US fell by 22% YoY, while Europe saw a modest recovery.

-

Central bank purchases: Central banks continued to be net buyers of gold for the 16th consecutive year, adding 244 tonnes to reserves, though this was 21% lower YoY.

-

Gold supply: Remained flat YoY, with 1,206 tonnes of supply. Mining production hit a record high in Q1, while recycling was slightly lower.

Where does India stand in gold usage?

-

RBI a top buyer: The Reserve Bank of India (RBI) was the third-largest central bank buyer of gold in 2024, adding 73 tonnes. It has consistently been among the top buyers recently. Gold now makes up nearly 11% of India's foreign reserves, up from 5.4% in 2015. This is part of a strategy to diversify and strengthen reserves.

-

Top jewellery market: As China's demand fell, India became the world's largest gold jewellery consumer again in 2024, accounting for 30% of global demand.

-

More financial gold investment: Strong growth in Gold ETFS and SGBS shows Indians are increasingly using financial products to invest in gold.

Insight for investors

For a broader economic perspective, investors often watch the copper-to-gold ratio. Copper, vital for industrial activity, signals economic expansion when its price rises relative to gold. Conversely, a falling ratio (gold outperforming copper) often indicates economic caution and a flight to safety.

During the 2008 Financial Crisis, copper plunged while gold soared. In the early 2020 pandemic, gold initially spiked before copper rebounded as industrial activity resumed. Monitoring this ratio provides valuable context alongside gold's specific drivers.

Source: Macro Micro

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story