Upstox Originals

Fasten your seatbelts: India's domestic air travel soars

.png)

7 min read | Updated on April 15, 2025, 14:15 IST

SUMMARY

India’s domestic air travel has grown 60% in the last decade. With flight fares on key routes comparable to first-class train tickets, flying has become the new normal, even for budget-conscious travellers. This article unpacks the surprising surge in domestic air travel and why it could be the country’s next breakout growth story.

Stock list

India’s domestic air travel has grown 60% in the last decade.

When most people think of flying, it’s usually about that long-awaited foreign trip, a vacation in Europe, or visiting relatives in the US. International travel grabs all the glamour, all the headlines.

But while the spotlight remains on international journeys, something else is taking off—India’s domestic air travel market. And while it may not come with duty-free shopping or passport stamps, it’s becoming one of the most promising growth stories in the country.

Despite the buzz around international flights, the real action might be unfolding right here at home. So what’s driving this rise in domestic air travel, and how can investors strap in for the ride? Let’s find out.

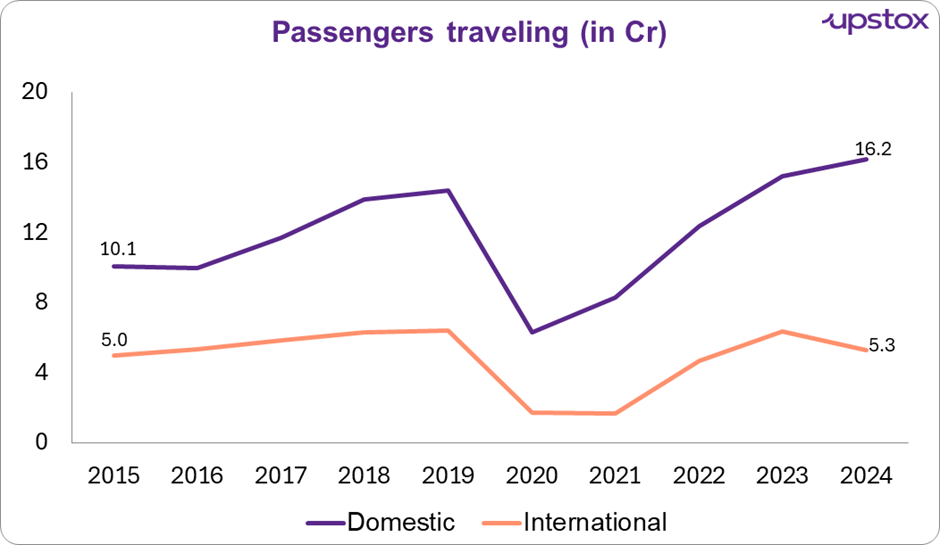

While general perception makes it seem that international flyers are soaring, domestic travel, when viewed through a decadal lens, has grown much faster. In the last 10 years, international travelers have only marginally increased as compared to an almost 60% rise in domestic travelers.

Source: DGCA

Domestic air travel takes off

If you've been flying across India lately, you've probably noticed the surge in domestic air travel. Airports are bustling, flights are packed, and budget airlines are offering fares that sometimes make train tickets look expensive. So, what’s fuelling this domestic aviation boom? Let’s break it down.

- Budget Airlines: Once upon a time, flying was a luxury reserved for the well-heeled. Not anymore! Thanks to low-cost carriers, air travel is now affordable for the masses. If you've ever found a last-minute flight that costs the same (or even less) than a first-class train ticket, you've got these budget airlines to thank.

| Routes | Flight | 2AC Train | 1AC Train |

|---|---|---|---|

| Mumbai-Delhi | 4,800-5,500 | 3,700-4,300 | 3,900-5,200 |

| Delhi-Bengaluru | 5,000-6,000 | 3,400-5,800 | 5,500-7,300 |

| Mumbai-Bengaluru | 3,500-4,000 | 1,900-2,100 | 3,400-3,500 |

Source: Makemytrip.com, Note: 1) These prices are for 01/05/25, 2) The price range for each of the above is taken as a rounded figure from the lowest to highest price point, 3) BOM-BLR: Premium trains like Rajdhani and Duronto are not serviceable on the route.

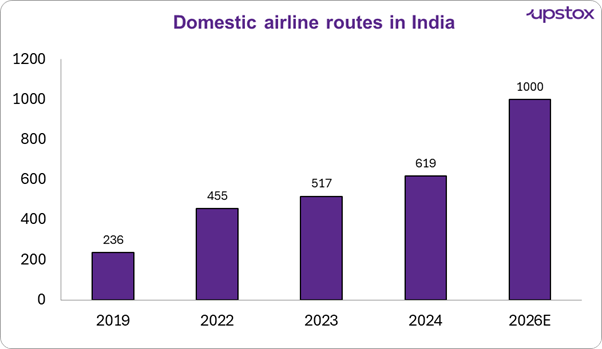

- UDAN scheme: Ever heard of the UDAN scheme? It stands for Ude Desh Ka Aam Nagrik (which roughly translates to "Let the common man fly"), and it’s doing exactly that. The Indian government has been pumping money into regional connectivity, making air travel possible for people in smaller towns and cities.

Source: Press release

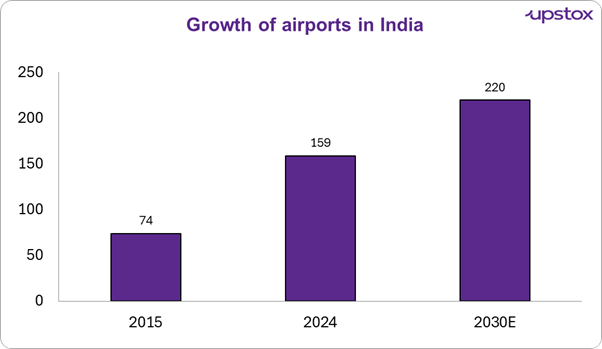

- Newer, bigger and better airports: India is rapidly expanding its aviation infrastructure to keep up with growing air travel demand. New airports are being built across the country, while major hubs are undergoing massive upgrades to handle rising passenger traffic.The Airports Authority of India (AAI) and private stakeholders are driving this transformation, ensuring less congestion, improved facilities, and a smoother travel experience for all.

Source: Ministry of civil aviation

- Business travel: After a pandemic-induced lull, suits and briefcases are back in airport lounges. Companies are back to sending employees across the country for meetings, conferences, and client visits.

Indians are ready to fly

India isn’t just flying more—it’s spending more. By 2030, the country is projected to become the fourth-largest travel spender globally, with the rising middle class—set to make up 47% of the population—leading the charge. Travel spending is expected to skyrocket to $410 billion, a steep climb from $150 billion in 2019.

Today’s Indian traveller is evolving. It’s no longer just about getting from A to B—it’s about the experience – 37% of travellers are now eyeing business or first-class, while 44% are ready to splurge on lounge access. As per statistics shared by Aloke Bajpai, CEO of Ixigo. The numbers do tell a compelling story

- ₹27,000 – average domestic trip spend

- ₹1,29,000 – average international trip spend

For investors, this signals one thing: travel is becoming aspirational. Whether it’s airlines, hospitality, luxury experiences, or airport services—India’s travel ecosystem is heating up.

| Airline | Existing Fleet (2024) | New aircraft orders | Market share in domestic air travel (%) |

|---|---|---|---|

| Indigo | 422 | 530 | 63.7% |

| Air India Group | 334 | 570 | 27.3% |

| SpiceJet | 51 | 0 | 4.7% |

| Akasa Air | 27 | 226 | 3.2% |

| Others | 16 | 0 | 1.1% |

| Total | 848 | 1326 | 100% |

Source: Knowindia.net, Annual Reports Note:Air India Group includes Air India, Air India Express and Alliance Star

Challenges

But for all the optimism, turbulence remains part of the journey. Akasa Air, the promising new entrant, made headlines with its rapid network expansion but recently faced operational hurdles SpiceJet, meanwhile, has been navigating financial and legal pressures, working to stabilise its operations amid ongoing restructuring efforts.

These developments underscore a broader reality: while India’s aviation market offers immense potential, it has also seen several carriers struggle to sustain momentum over time. With the exception of IndiGo, few airlines have managed to thrive consistently beyond a decade.

Below is a list of non-exhausive defunct airlines in India over the years

| Airline | Why it failed? |

|---|---|

| Air Deccan → Kingfisher (+Kingfisher Red) | Acquired by industrialist Vijay Mallya and renamed as Simplifly Deccan, eventually converted to Kingfisher Red. Massive financial losses and eventual cash crunch |

| Sahara / Air Sahara | Sahara was rebranded as Air Sahara. Further renamed to Sahara Airlines in 2001; acquired by Jet and again rebranded as JetLite in 2007, before merging it with JetKonnect in 2012. Fell with Jet’s decline |

| Indus | Cash crunch; inability to obtain safety-critical Bombardier aircraft parts from General Electric’s Commercial Aviation Service |

| Jet | Cash crunch; lack of trust by lenders |

| Zoom Air | License suspension by DGCA over safety concerns in 2018; attempts to revive fell through in 2019 |

Source: Media articles

The runway ahead is promising—but will require steady navigation. Buckle up.

What’s in it for Investors?

This isn’t just a feel-good travel story—it’s an investment narrative taking shape. Here’s how investors can read between the flight paths and spot opportunities:

- Airline stocks: Look for dominant players with high load factors and large fleet expansions. IndiGo and Air India (via Tata Group) currently lead the pack.

- Airport developers: Watch firms involved in building and managing airports—think GMR, Adani, and even EPC players like L&T.

- Aviation services: Ground handling, maintenance, and catering providers are set to grow alongside passenger volumes.

| Company | Market cap (₹ Cr) | P/E | ROE % | 3Yr stock return % | 3Yr profit growth % |

|---|---|---|---|---|---|

| Interglobe Aviation | 1,99,170 | 32.8 | NA | 39.0 | 46.5 |

| GMR Airports | 90,881 | NA | NA | 29.6 | 20.8 |

| SpiceJet | 5,675 | NA | NA | -9.0 | 16.8 |

| Accelya Solutions India | 1,888 | 16 | 42.2 | 9.5 | 40.4 |

Source: screener.in; data as on 11-04-25

In summary

Domestic air travel in India is soaring, driven by budget-friendly fares, better connectivity, and a booming middle class eager to fly. With new airports, expanding airlines, and increasing demand, this trend isn’t slowing down anytime soon. So, whether it’s for business, leisure, or just the thrill of skipping a long train ride—more Indians are taking to the skies, and for those with a keen eye, the investment runway looks just as promising.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story