Upstox Originals

Budget 2026 and India’s big tech to-do list

6 min read | Updated on January 20, 2026, 17:12 IST

SUMMARY

India’s tech story has moved from slides to sites. AI is scaling. Data centres are rising. Chip fabs are finally getting built. But speed alone isn’t the win. The real test is coordination. With Budget 2026 around the corner, can policy, capital, and execution actually move in sync?

Ahead of the Budget, the government has held extensive pre-budget consultations with states, economists and the public.

Budget 2026 is almost here. And expectations? Pretty high.

Over the last year, India’s tech story has changed. AI has moved out of demos and into daily business. Data centres are scaling faster than expected. And semiconductors, once India’s biggest tech gap are finally taking shape on the ground.

And here’s the thing. All of this is deeply connected.

AI needs computing power. Computing power needs data centres. Data centres need chips. And chips need patient capital and steady policy support. Break one link, and the whole chain slows down.

That’s why, as Budget 2026 approaches, we break down the three big themes everyone’s watching:

- AI - can ambition finally turn into execution?

- Data centres - can India scale fast enough?

- Semiconductors - can policy continuity keep projects moving?

Let’s start with AI.

AI

Indian enterprises are moving fast from “AI pilots” to “AI everywhere”. India’s AI market clocked $22.85 billion in revenue in 2025. Forecasts peg growth at 38%+ CAGR till 2033.

The prize? Huge.

Deloitte estimates AI could add $17–26 trillion to the global economy over the next decade. If things go right, India could realistically capture 10-15% of that value. And.. that’s why Budget 2026 matters. It decides how big India’s AI ambition really gets.

Budget 2026 & AI

Capital isn’t the problem anymore. Execution is.

India’s data centre and AI story has moved past the “will money come?” stage. According to Ankit Saraiya, Director & CEO, Techno Digital, the bottleneck today is far more basic; power availability, faster approvals, and long-term policy certainty. And that’s exactly where Budget 2026 can make a difference.

At the centre of it all sits the IndiaAI Mission.

Reports suggest Budget 2026 could boost funding for IndiaAI, including plans for AI systems with 18,000–30,000 GPUs. That could ease the compute crunch for Indian startups.

There’s also chatter around new national AI centres, focused on education and healthcare, where AI can scale quickly.

The human bottleneck.

India may be strong on AI skills. But running AI-ready data centres is a different game, and the talent pool there is still thin.

According to Deloitte, that’s where Budget 2026 could step in, by backing hands-on AI learning, data-centre apprenticeships, and public-private training, starting early and scaling up through universities.

There’s also a fiscal lever on the table.

EY has floated an idea; extending the PLI scheme to AI, space, and robotics. The logic is pretty straightforward. If PLI worked for electronics, it might just help pull private money into deep tech too.

Data Centres

India’s data centre market is gearing up for a big leap. The Economic Survey 2024–25 estimates it could grow from $4.5 billion in 2023 to $11.6 billion by 2032. The numbers look impressive. But, what matters now is how quickly this capacity actually comes online.

Source: TOI

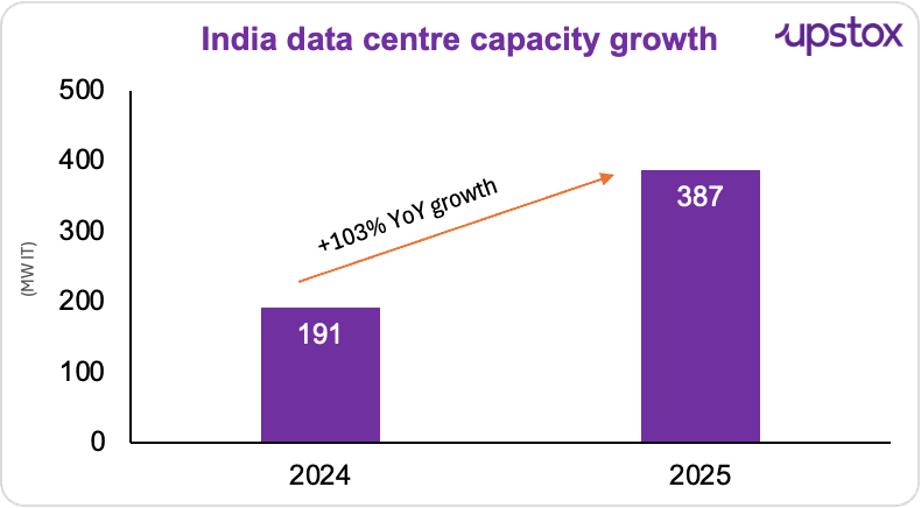

The chart shows India’s data centre capacity doubling in a year; 100%+ YoY growth. Industry estimates say capacity could jump 9× to ~9 GW by 2030.

Why?

Because the big names are already here.

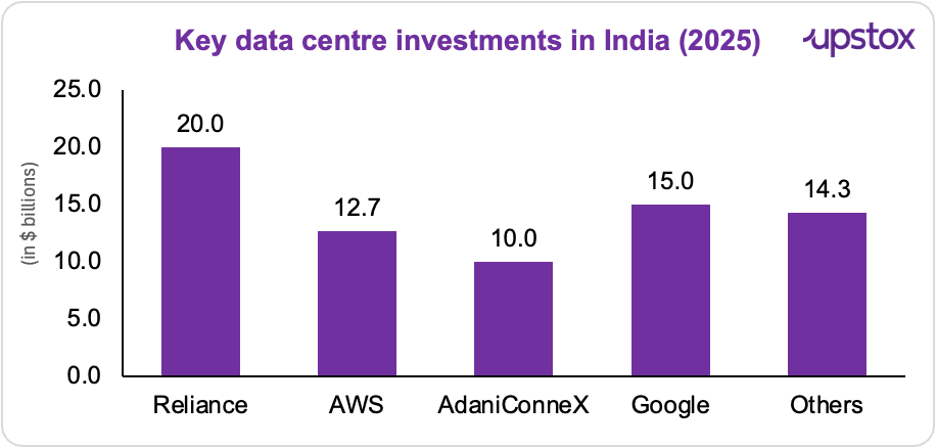

Google is lining up a $15 bn AI hub. Amazon Web Services has locked in $12.7 bn through 2030. At home, Reliance Industries is starting Jamnagar with 1 GW, while TCS plans 1–1.2 GW more.

Source: CNBC

Budget 2026 & data centres

Infrastructure status and tax breaks.

Data centres need huge upfront spending; land, power, cooling, electrical systems, servers. With the DPDP Act pushing companies to store data inside India, Deloitte says tax holidays and infra status are needed to make long-term projects viable.

Clear tax rules on who pays what.

Today, if a foreign company is seen as having a permanent establishment (PE) in India, its profits are taxed at 35%. The problem is ambiguity. Budget 2026 may see Central Board of Direct Taxes (CBDT) issue FAQs clarifying when revenue earned via Indian data centres becomes taxable.

Rules may tighten, not ease.

Officials have hinted that these clarifications won’t mean tax breaks. The focus is on certainty, not concessions. A presumptive tax model proposed by NITI Aayog is still being discussed, but nothing’s final yet.

Cheaper compute for Indian startups.

A proposed compute-credit scheme would allow startups and research labs to access discounted GPU or TPU hours on domestic data centres, reducing dependence on foreign cloud providers and lowering AI training costs.

Semiconductors

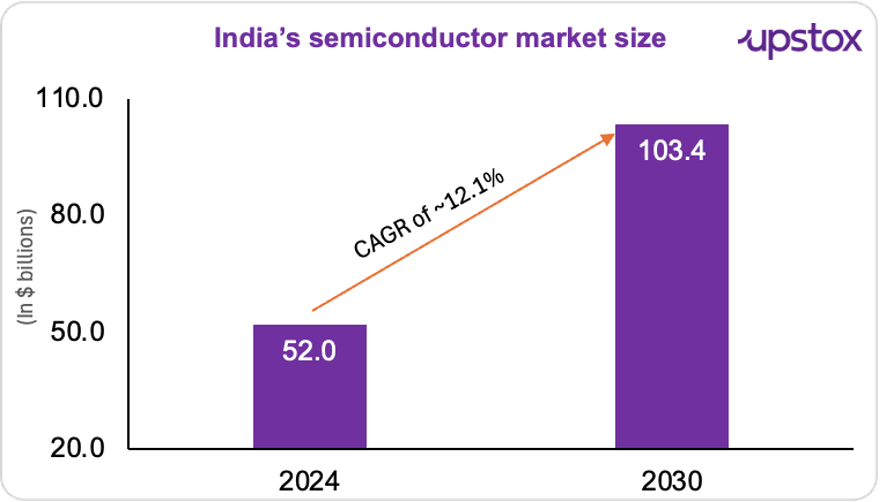

India’s semiconductor market touched $52.0 billion in 2024 and is projected to surge to $103.4 billion by 2033, growing at ~12% CAGR.

On the ground, manufacturing is catching up. 5 chip units are approved, and 4 major plants, including Tata’s Assam fab and Micron’s facility, are set to begin production in 2026.

Source: ET

Now, let’s take a closer look at the Budget 2026 expectations:

First, continuity matters.

According to the India Electronics and Semiconductor Association (IESA), the government should extend the India Semiconductor Mission 2.0 and the Design Linked Incentive scheme. Many projects are still in the scaling phase, and any break in policy support could slow things down. One theme that keeps surfacing is continuity. When funding or PLI payouts slow, project timelines stretch.

Second, more fiscal firepower.

The initial ₹76,000 crore outlay under Semicon 1.0 has been almost fully utilised. And with projects finally taking shape, there’s buzz around fresh funding, and maybe 2–3 smaller new projects, to keep investments flowing.

Third, tax relief to stay competitive.

According to ICEA (India Cellular and Electronics Association), the industry is pushing for the return and expansion of the 15% concessional corporate tax rate for manufacturing. This would cover semiconductor fabs, electronics components and advanced manufacturing units, with the eligibility window extended by another 5 years.

In a nutshell

Budget 2026 won’t decide whether India wants to lead in AI, data centres, and semiconductors, that decision is already made. What it will decide is how fast India can execute on that ambition. Get the policy continuity, infrastructure support, and talent pipeline right, and the ecosystem scales. Miss the execution details, and momentum risks stalling just as it’s picking up.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story