Personal Finance News

Step-by-step guide to filing ITR online on Income Tax e-filing portal for AY 2025-26 (FY 2024-25)

8 min read | Updated on June 15, 2025, 11:48 IST

SUMMARY

The last date to file your income tax return (ITR) for Assessment Year 2025-26 (Financial Year 2024-25) is September 15, 2025. If you are preparing to file your ITR, here’s a complete step-by-step guide to help you understand the ITR e-filing process and the forms you need to use to file your return. The article also highlights the scenarios in which you can file the return yourself and when it’s better to consult a tax expert.

This step-by-step guide can help you file ITR online by yourself on the Income Tax portal. | Image source: Shutterstock

Filing your Income Tax Return (ITR) online by yourself might seem frightening, especially if you are doing it for the first time, but it doesn’t have to be. Whether you are a salaried or self-employed person, understanding how to file ITR online can relieve you from the last-minute stress.

So, while you have to wait for the Income Tax Department to update e-filing utilities on their portal, it’s better to use this time to enhance your tax filing knowledge.

Let’s dive into the steps for e-filing ITR on the income tax portal.

How to file ITR online?

The procedure for filing an ITR has been simplified, streamlined, and digitised. You can now easily and quickly e-file your ITR from the comfort of your home or office. Here’s how to do it.

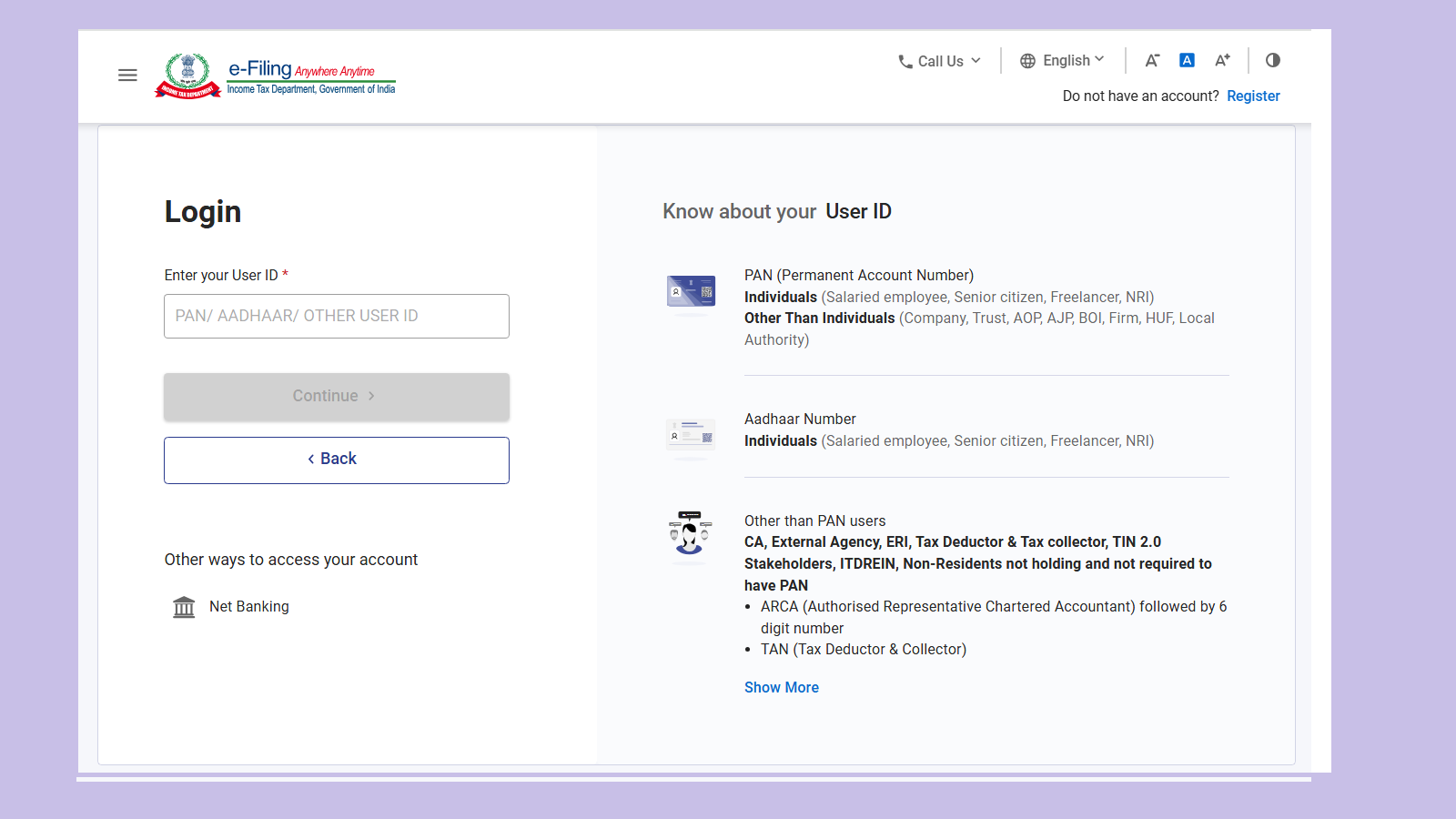

If you are a registered user, log in using your user ID or PAN, password, and captcha code.

If you are a new user, register yourself by clicking on the ‘Register’ tab on the top right and follow the instructions.

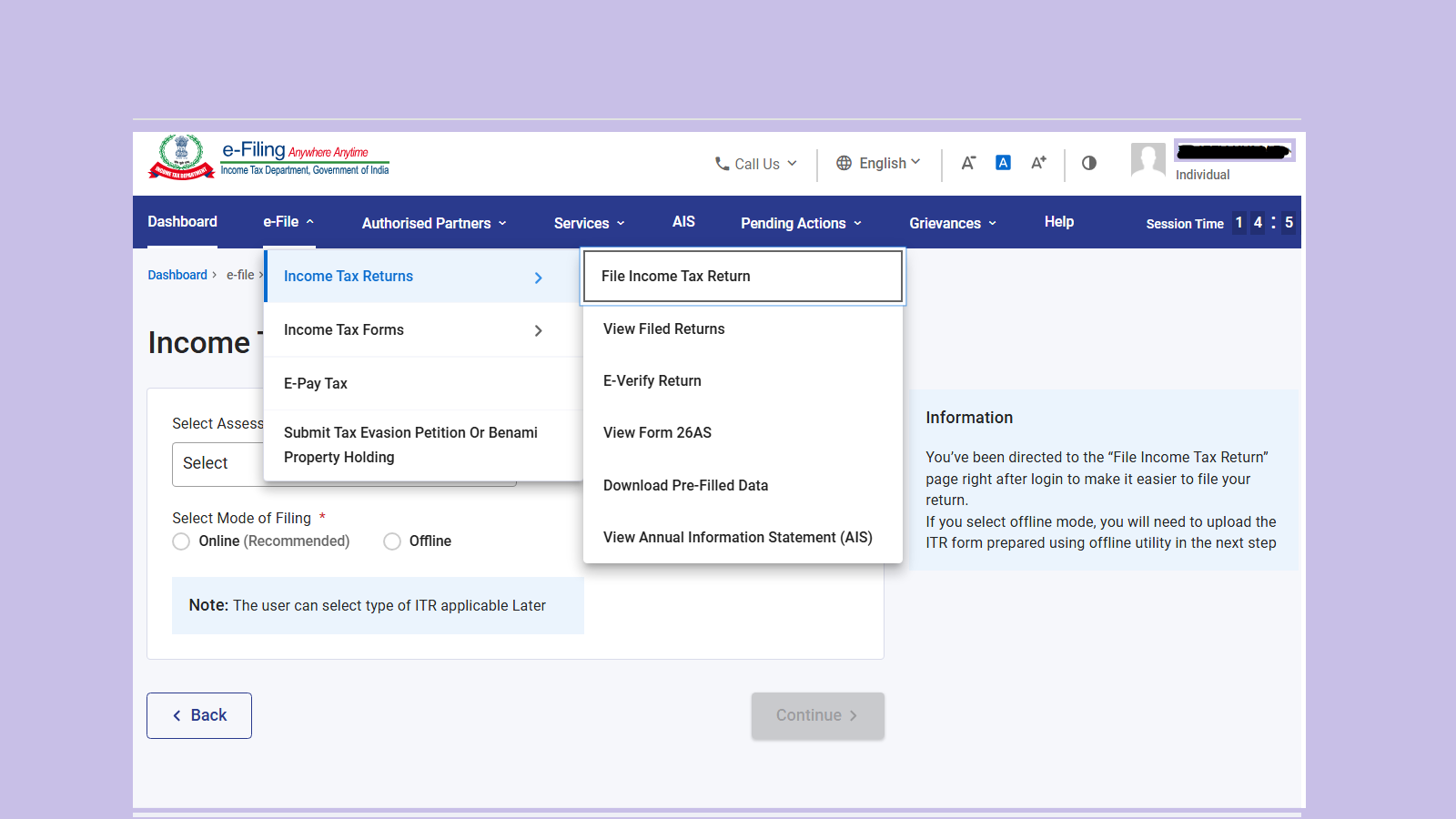

On your dashboard, click on the 'e-File' menu.

From the dropdown menu, select 'Income Tax Returns'.

Then click on ‘File Income Tax Return’ to start the filing process.

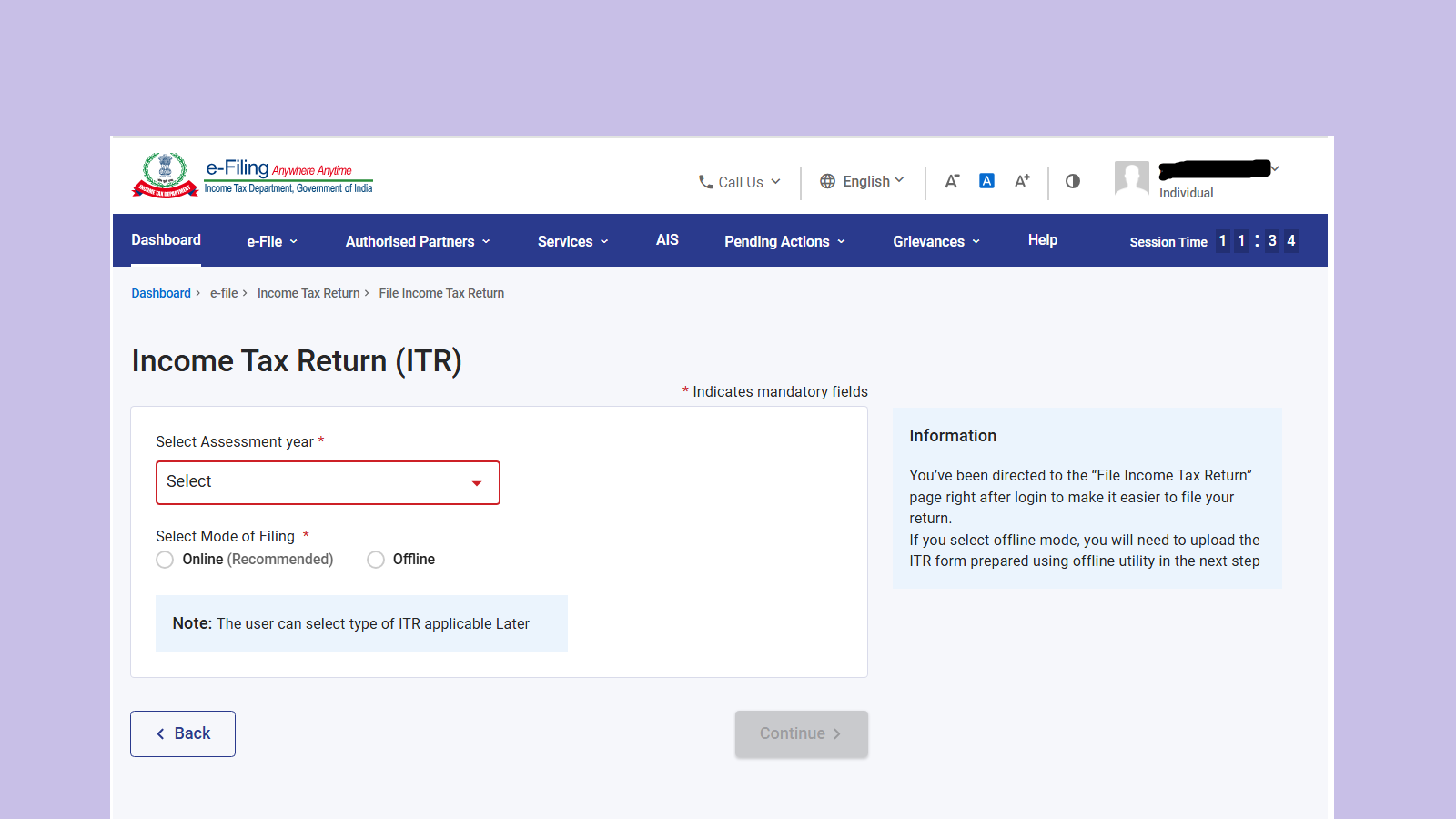

You will be redirected to the Income Tax Return Page.

On this page, fill in the relevant details for your return.

Select the Assessment Year for which you are filing the return. For FY 2024-25, select Assessment Year as ‘AY 2025-26’.

Select the mode of filing the return as ‘Online’.

Click on 'Continue'.

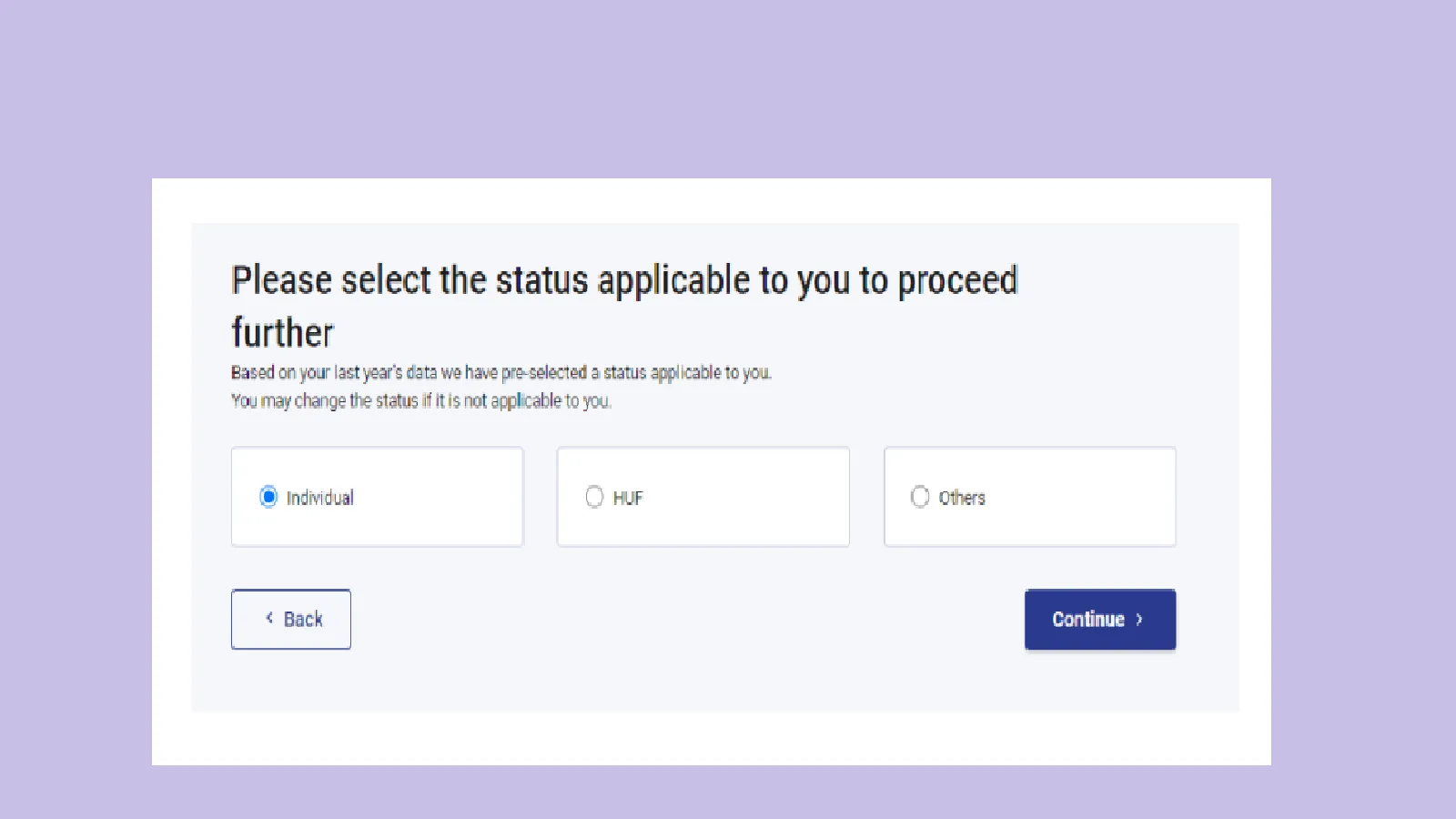

Select the applicable filing status between Individual, Hindu Undivided Family (HUF) and others. This helps the system display the relevant set of forms.

Click on ‘Continue’.

Step 5- Select the appropriate ITR form

Step 5- Select the appropriate ITR formSelect the ITR form that corresponds to your filing status and income type.

In all, seven ITR forms are available, of which ITR 1 to 4 are applicable for Individuals and HUFs.

Here’s a complete list of ITR forms:

-

ITR-1 (Sahaj): For individuals with income up to ₹50 lakh, coming from salary, one house property, and other sources like interest income.

-

ITR-2: For individuals and HUFs with income exceeding ₹50 lakh, coming from capital gains and not from business or profession.

-

ITR-3: For individuals, HUFs or a partner in a firm having income exceeding ₹50 lakh from business or profession.

-

ITR-4 (Sugam): For individuals, HUFs and firms (other than LLPs) with income up to ₹50 lakh, coming from presumptive business or profession (under sections 44AD, 44ADA, or 44AE), salary, one house property, and other sources.

-

ITR-5: For firms, LLPs, AOPs, BOIs (not for individuals or HUFs).

-

ITR-6: For companies other than those claiming exemption under section 11 (charitable or religious trusts).

-

ITR-7: For persons, including companies like trusts, political parties, institutions, colleges, and so on, required to furnish returns under sections like 139(4A), 139(4B), 139(4C), or 139(4D).

Select the suitable form and click ‘Continue’.

If you are still confused about which ITR form to file for AY 2025-26 (FY 2024-25), here’s a quick comparative table to help you understand better.

| ITR Form | Applicable to | Salary | House Property | Business Income | Capital Gains | Other Sources | Exempt Income | Lottery Income | Foreign Assets / Foreign Income |

|---|---|---|---|---|---|---|---|---|---|

| ITR-1 (Sahaj) | Individual (Residents) | ✔ | ✔ (one house property) | ✖ | ✖ | ✔ | ✔ (Agricultural Income below ₹5,000) | ✖ | ✖ |

| ITR-2 | Individual, HUF | ✔ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ |

| ITR-3 | Individual, HUF, partner in a firm | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| ITR-4 (Sugam) | Individual, HUF, Firm (other than LLP) | ✔ | ✔ (one house property) | Presumptive business income | ✖ | ✔ | ✔ (Agricultural income below ₹5,000) | ✖ | ✖ |

| ITR-5 | Partnership Firm/LLP, AOP, BOI | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| ITR-6 | Company | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| ITR-7 | Trust | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

From the options specified, select the appropriate reason for which you are filing the return.

-

Your taxable income is more than the basic exemption limit.

-

You meet specific criteria like foreign travel expenses or bank deposits and are mandatorily required to file ITR. Others

-

Click ‘Continue’.

The system will automatically pre-fill most of your personal details, such as your PAN, Aadhaar, name, date of birth, contact information, bank details and salary information, based on data submitted by your employer or financial institutions.

Review all the details carefully and ensure the information is accurate.

If any information is missing, enter it manually.

Ensure that you disclose all relevant income, exemptions, deductions and tax paid details.

Confirm the summary of your return, validate the details and make the balance tax payment, if any.

The last and most important step in filing your ITR online is verification. You must verify your return within 30 days from the filing date. Failing to verify your return is equivalent to not filing it at all.

You can verify your ITR using one of the following options:

- Aadhaar OTP: If your Aadhaar is linked with your PAN.

- Electronic Verification Code (EVC): Sent to your registered mobile number or email.

- Net banking: If your bank offers the service for e-verification.

- Physical verification: You can also send a physical copy of the ITR-V form to CPC Bengaluru.

After selecting a verification mode, select 'Preview and Submit'.

Once you have successfully uploaded your income tax return, you will receive an acknowledgement on your email address.

You see how easy the entire process of filing ITR is!

Now, if you are wondering, is it possible to file ITR without the help of a professional? Let’s understand!

Can you file an ITR by yourself?

Yes, you can! In fact, the Income Tax Department has made the entire process simple and user-friendly, encouraging individuals with simple tax situations to file their returns online with ease.

If your income consists of salary, interest earnings, or dividend income with no complex investments, you can easily file your ITR yourself.

However, if you have complex tax situations, such as multiple income sources, foreign assets, capital gains, own a business, or have intricate tax implications, you may seek the help of a professional to ensure accuracy and compliance. An expert can help you avoid costly mistakes that can lead to tax notices, penalties, and missed tax-saving opportunities.

While filing a return yourself is easy, you must make a note of the recent changes in ITR filing for AY 2025-26.

What's new in ITR filing for AY 2025-26

ITR filing for AY 2025-26 is set to be a new experience for taxpayers. Several changes have been introduced, including ease of compliance for small taxpayers, revised capital gains tax rates, changes in ITR forms, and more.

For a detailed explanation, you can refer to our dedicated article:

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story