Personal Finance News

ITR filing AY 2025-26 for NRIs: Slabs, rates, forms, who is required to file a return, who is not

.png)

5 min read | Updated on May 07, 2025, 15:45 IST

SUMMARY

Filing ITR is mandatory for Non-Resident Indians (NRIs) if their total income in India, before considering capital gain exemption and various tax deductions, is above the basic exemption limit.

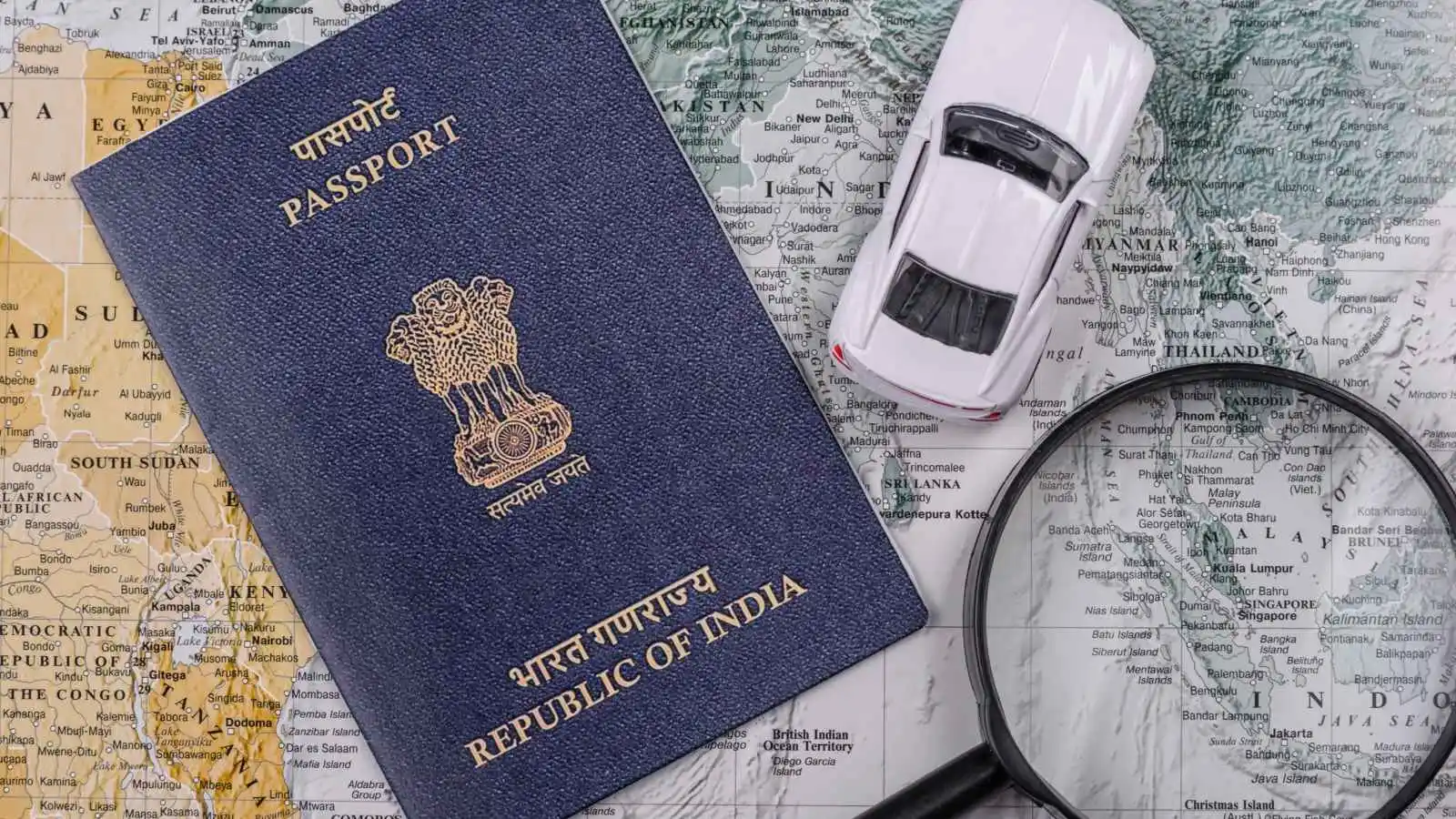

NRIs are exempted from taxation in certain situations. | Image source: Shutterstock

Income Tax Return (ITR) filing in India is mandatory for Non-Resident Indians (NRIs) in certain situations. However, there are some situations in which they don't need to file ITRs.

As the income-tax return (ITR) filing season for AY 2025-26 has started, this article takes a quick look at the key ITR filing rules for NRIs.

But before diving into details, let's understand who is an NRI as per Income Tax.

Who is an NRI?

Under income-tax laws, a person is considered a non-resident Indian if s/he does not satisfy any of the following two conditions:

-

Lived in India for 182 days or more in FY 2024-25, or,

-

Lived in India for 60 days or more in FY 2024-25 and lived for 365 days or more in the last four years before FY 2024-25.

When is ITR filing mandatory for an NRI?

Filing ITR is mandatory for Non-Resident Indians (NRIs) if their total income in India, before considering capital gain exemption and various tax deductions, is above the basic exemption limit.

The basic exemption limit for AY 2025-26 (FY 2024-25) is ₹3 lakh under the new tax regime and ₹2.5 lakh under the old regime.

NRIs are required to file ITR to claim a TDS refund if their income in India is below the basic exemption limit, but TDS has been deducted by the payer.

They are also required to file tax returns to claim TDS if their income is not taxable in India due to DTAA, but the payer has still deducted TDS.

However, there are certain exceptions when NRIs are not required to file ITR.

When are NRIs exempted from ITR?

-

When the total income, excluding capital gains and deductions, is below the basic exemption limit.

-

NRIs are exempted from filing ITR when their total income is only from the following sources and tax has already been deducted from such income, according to the Income Tax Department's website.

-

Dividend Income

-

Interest from the Government or an Indian concern on monies borrowed or debt incurred by them in foreign currency.

-

Interest from an Infrastructure debt fund, which is notified under section 10(47)

-

Interest from an Indian Company on foreign currency loans from a source outside India

-

Interest from an Indian person on investment made in a rupee-dominated bond of an Indian Company, Government security, Municipal Debt security, as per section 194LD

-

Distribution of Interest income to unit holders by the business trust when interest income is from a Special Purpose Vehicle.

-

Interest from units of a Mutual Fund (purchased in foreign currency)

-

Interest from units of the Unit Trust of India (purchased in foreign currency).

-

Royalty income or Fees for Technical Services (FTS) income

-

Interest on bonds of an Indian company purchased in foreign currency.

-

Interest on bonds of a public sector company sold by the government and purchased by him in foreign currency.

-

Dividends on Global Depository Receipts as per section 115AC(1)(b).

-

If the total income of NRI is derived from specified foreign exchange assets, provided the conditions are met and TDS at the applicable rates has been duly deducted from such income.

-

A non-resident who doesn't have any income in India other than income from investment made in Category III AIF (Alternative Investment Fund) is exempted from filing ITR, subject to fulfilment of certain conditions

Income tax slabs and rates for NRIs for AY 2025-26

| Income Tax Slab | Income Tax Rate | *Surcharge |

|---|---|---|

| Up to ₹2,50,000 | Nil | Nil |

| ₹2,50,001 - ₹5,00,000 | 5% above ₹2,50,000 | Nil |

| ₹5,00,001 - ₹10,00,000 | ₹12,500 + 20% above ₹5,00,000 | Nil |

| ₹10,00,001 - ₹50,00,000 | ₹1,12,500 + 30% above ₹10,00,000 | Nil |

| ₹50,00,001 - ₹100,00,000 | ₹1,12,500 + 30% above ₹10,00,000 | 10% |

| ₹100,00,001 - ₹200,00,000 | ₹1,12,500 + 30% above ₹10,00,000 | 15% |

| ₹200,00,001 - ₹500,00,000 | ₹1,12,500 + 30% above ₹10,00,000 | 25% |

| Above ₹500,00,000 | ₹1,12,500 + 30% above ₹10,00,000 | 37% |

| Income Tax Slab | Income Tax Rate | *Surcharge |

|---|---|---|

| Up to ₹3,00,000 | Nil | Nil |

| ₹3,00,001 - ₹7,00,000 | 5% above ₹3,00,000 | Nil |

| ₹7,00,001 - ₹10,00,000 | ₹20,000 + 10% above ₹7,00,000 | Nil |

| ₹10,00,001 - ₹12,00,000 | ₹50,000 + 15% above ₹10,00,000 | Nil |

| ₹12,00,001 - ₹15,00,000 | ₹80,000 + 20% above ₹12,00,000 | Nil |

| ₹15,00,001 - ₹50,00,000 | ₹1,40,000 + 30% above ₹15,00,000 | Nil |

| ₹50,00,001 - ₹100,00,000 | ₹1,40,000 + 30% above ₹15,00,000 | 10% |

| ₹100,00,001 - ₹200,00,000 | ₹1,40,000 + 30% above ₹15,00,000 | 15% |

| Above ₹200,00,001 | ₹1,40,000 + 30% above ₹15,00,000 | 25% |

*Note: The enhanced surcharge of 25% & 37% is not levied, from income chargeable to tax under sections 111A, 112, 112A and Dividend Income. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%, except when the income is taxable under section 115A, 115AB, 115AC, 115ACA, and 115E.

***Note: Health & Education cess @ 4% to be paid on the amount of income tax plus Surcharge (if any) in both the regimes.

ITR forms for NRIs

ITR-2: This return is suitable for an NRI

-

who doesn't have income under the head "Profits and Gains of Business or Profession".

-

who is not eligible for ITR-1

ITR-3: This return is applicable for an NRI who

- has income under the head "Profits and Gains of Business or Profession)

- is not eligible for ITR-1, 2 or 4

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story