Personal Finance News

How your investments in foreign shares, mutual funds and ETFs will be taxed in FY 2025-26: A complete guide

7 min read | Updated on May 14, 2025, 15:00 IST

SUMMARY

Foreign shares, mutual funds, or ETFs are taxed as capital assets (similar to unlisted securities), not under Section 112A for Indian-listed equity. Foreign exchange swings are not taxed separately.

Non-disclosure of foreign holdings can attract penalties up to ₹10 lakh. | Image source: Shutterstock

Foreign stocks and Exchange Traded Funds (ETFs) are capital assets under the Income Tax Act, 1961 (IT Act), just like equity shares or mutual fund units. There is no separate category for foreign securities; they generally fall outside the ambit of Section 112A, which covers domestic listed shares and mutual funds holding ≥65% equity shares of Indian listed companies.

Section 112A applies to those shares where Securities Transaction Tax (STT) is paid; in the case of foreign shares, STT does not need to be paid.

Foreign shares, mutual funds, and ETFs are not eligible for the ₹1.25 lakh exemption of Section 112A. Instead, the long-term gains are taxed at the flat rate (without indexation) under Section 112 at 12.5%, and short-term gains are taxed as per the investor’s normal slab rate (like other capital assets).

Starting from April 1, 2023, to March 31, 2025, foreign mutual funds and ETFs fell under the ambit of Section 50AA, which applied to “Specified Mutual Funds” having not more than 35% investment in Indian listed equity shares. This meant such funds were taxed as short-term capital gains at slab rates, regardless of the holding period.

However, the Finance Act, 2024, with effect from 1st April 2025, amended the definition of “Specified Mutual Fund” to exclude funds investing in units located outside India, effectively rolling back the applicability of Section 50AA to foreign funds. As a result, gains on such funds continue to be taxed under standard capital gains.

For this article, we’ll consider the taxation of foreign shares, mutual funds, and ETFs sold on or after April 1, 2025.

Holding period and tax rates

From April 1, 2025, the tax rate on gains depends on how long you held the foreign asset:

Foreign Exchange (INR–USD) treatment

When you buy or sell foreign shares, the exchange rate matters. India taxes the rupee value of gains. Any INR–USD fluctuation between purchase and sale is automatically part of the gain (or loss) and is not taxed separately as a foreign exchange gain. Practically, you should:

-

Convert the purchase price and sale consideration into INR (using a consistent method, such as the RBI reference rate on the respective dates).

-

Compute the capital gain in INR: (Sale INR – Cost INR).

How to calculate taxes on the sale of foreign shares/MFs/ETFs

Suppose you bought 10 equity shares of a foreign company three years back for $200 per share and sold them for $300 per share. You also paid 10% withholding taxes (WHT) in Country X of $100. Assume the USD–INR rate was ₹70 at purchase and ₹80 at sale. The calculation will be as follows:

| S.No. | Particulars | Value (USD) | Exchange Rate (₹/USD) | Value (₹) |

|---|---|---|---|---|

| A | Purchase (10 × $200) | $2,000 | ₹70 | ₹1,40,000 |

| B | Sale (10 × $300) | $3,000 | ₹80 | ₹2,40,000 |

| C=B-A | Capital gain | — | — | ₹1,00,000 |

| D | Tax rate (LTCG) | — | — | 12.5% (no indexation) |

| E=D*C | Tax payable on gain in India | — | — | ₹12,500 |

| F | Tax credit u/s 90 (WHT paid in Country X) | 100 | 80 | (₹8,000) |

| G=E-F | Final tax payable | — | — | ₹4,500 |

Offsetting gains and losses

Capital gains and losses on foreign shares are pooled with your other capital gains/losses (subject to capital gains set-off rules). This means:

-

Short-term losses on any asset (including foreign stocks) can be set off against any capital gains (short-term or long-term).

-

Long-term losses (from foreign or domestic assets) can only be set off against long-term capital gains.

Transfer of funds and TCS compliance

Investing in foreign stocks as an Indian resident is facilitated through the Liberalised Remittance Scheme (LRS), regulated by the Reserve Bank of India (RBI). Under this scheme, resident individuals, including minors, are permitted to remit up to USD 250,000 per financial year for permissible capital and current account transactions, such as investments in foreign equities.

For remittances under the LRS exceeding ₹10 lakh in a financial year (excluding for education or medical purposes), authorised Dealers (ADs) are required to collect tax at source (TCS) at 20% on the amount exceeding ₹10 lakh at the time of remittance.

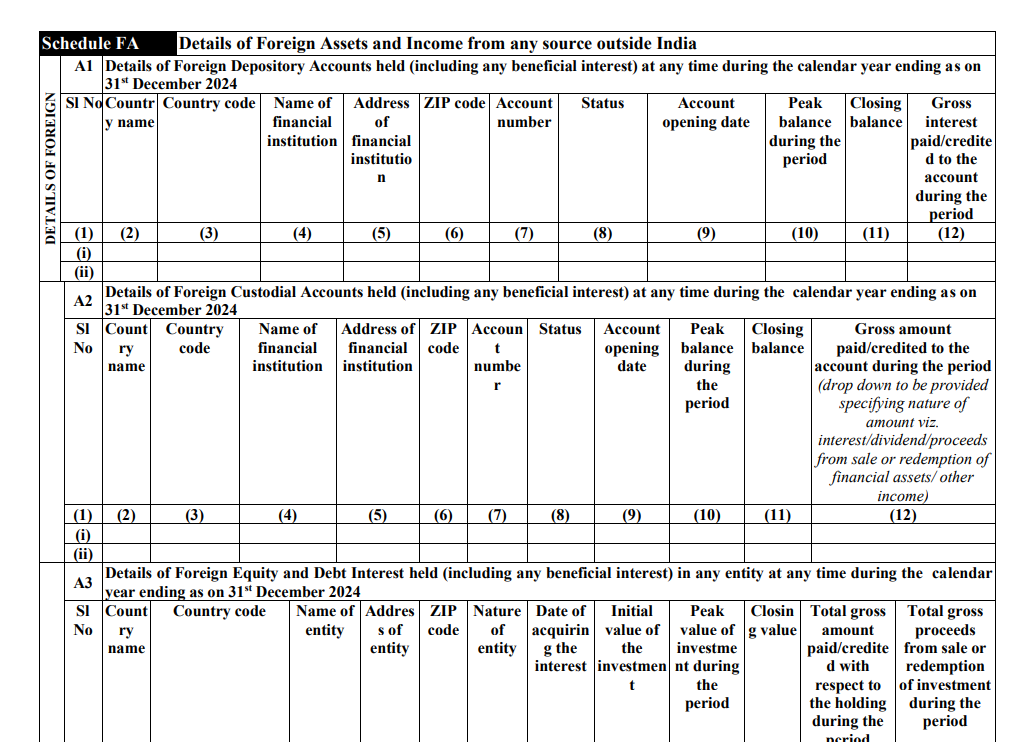

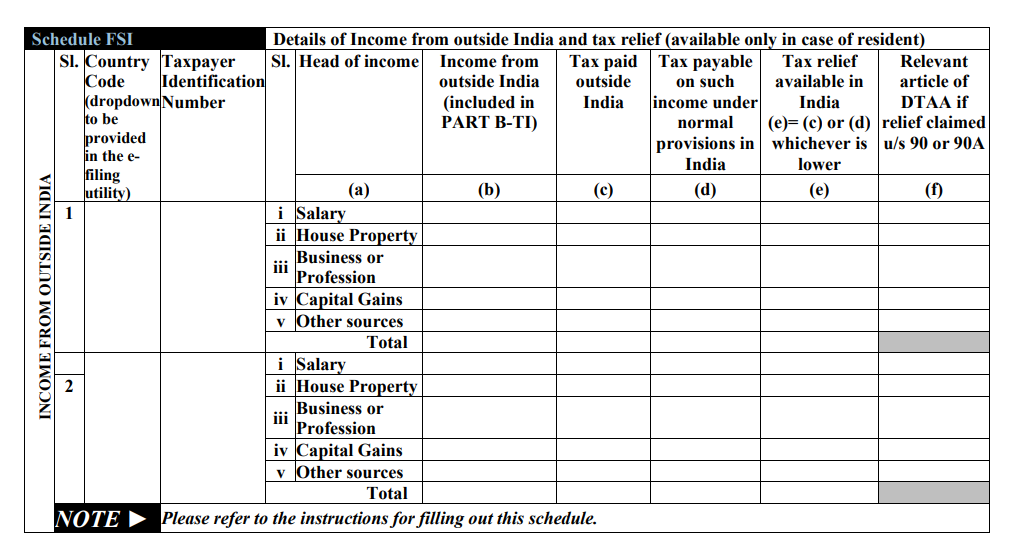

Reporting in the ITR – Schedules FA and FSI

- Schedule FA (Foreign Assets): List all foreign assets held at any time during the year. This includes foreign bank or broking accounts, depository accounts, foreign equity shareholdings, ETFs, mutual funds, real estate, etc. For example, “Foreign custodial account” or “Foreign equity investment” rows. According to the Income Tax Department’s guidance, the details of all foreign assets where you are an owner or beneficial owner must be furnished mandatorily.

- Schedule FSI (Foreign Source Income): Report any income arising from outside India. This includes salary, interest, dividends, and capital gains from foreign assets. You should enter the gross foreign income (in INR) and specify the type of income. (The same income should also be shown under the appropriate head in the main computation.) Schedule FSI is required for resident taxpayers and captures details country-wise.

Failure to correctly report foreign assets/income can be very costly. Under the Black Money Act, if undisclosed foreign assets exceed ₹20 lakh, a penalty of ₹10 lakh can be levied. Even for amounts below ₹20 lakh, misreporting violates the Income Tax Act and can trigger penalties (under section 271AAC) and interest.

Imprisonment provisions may also be triggered for non-disclosure of foreign assets/income in the ITR that may extend up to seven years.

Conclusion

Investing in foreign shares and ETFs can offer diversification and global exposure, but it comes with specific tax obligations under Indian law and respective DTAA. If you’re remitting funds abroad to invest in foreign equities, ensure you do so under the LRS; a 20% TCS will apply on the amount in excess of ₹10 lakhs.

Most importantly, always disclose your foreign investments and income in your Income Tax Return through Schedule FA (foreign assets) and Schedule FSI (foreign income).

Non-disclosure—even of small holdings—can attract strict penalties under both the Income Tax Act and the Black Money Act, including fines up to ₹10 lakh for undisclosed assets exceeding ₹20 lakh.

As a prudent investor, maintaining proper documentation, adhering to reporting norms and staying informed of regulatory changes can help you invest globally with confidence and compliance.

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story