Market News

Week ahead: US Fed policy meet, Q4 earnings, Ather Energy listing among key market triggers to watch out

.png)

6 min read | Updated on May 04, 2025, 15:09 IST

SUMMARY

In the upcoming week, policy decisions of the U.S. central bank, fourth-quarter earnings and tensions between India and Pakistan will shape the market trends this week. The technical structure of the index could sustain its bullish momentum if it reclaims 24,500 on a closing basis.

Foreign Institutional Investors (FIIs) continued to pare their bearish bets on index futures, bringing the long-to-short ratio down to 47:53. | Image: Shutterstock

Indian equity markets ended the week with modest gains even as global markets witnessed a strong rally. Market breadth showed signs of improvement, helped by renewed foreign investor interest, a strong fourth quarter earnings from Reliance Industries and a subdued dollar index.

This resilience came despite multiple headwinds - including escalating trade tensions, renewed geopolitical tensions between India and Pakistan, and a sharp rise in the volatility index.

The NIFTY Midcap 100 and Smallcap 100 indices reflected the underlying caution. The Midcap index posted a marginal gain of 0.4%, while the Smallcap index fell 0.5% as investors weighed earnings uncertainty against broader macro risks.

Sectorally, Oil & Gas (+4.3%) and Real-Estate (+2.5%) advanced the most, while Consumer Durables (-0.9%) and Metals (-0.6%) declined the most among major sectoral indices.

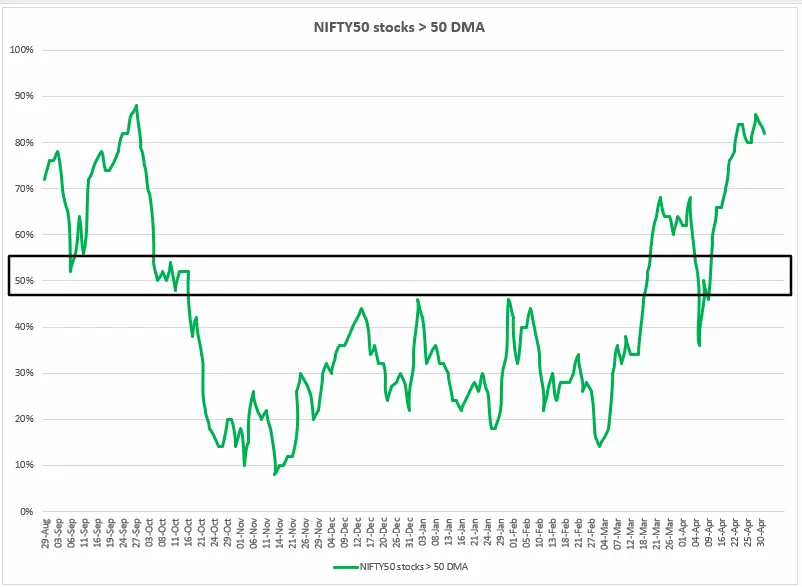

Index breadth

The breadth of the NIFTY50 index remained positive throughout the truncated week, with over 80% of stocks trading above their 50-day moving averages (DMAs). Although, there was a slight pullback from near 90%. This strong breadth indicates broad market participation and underlying strength.

As long as breadth remains comfortably above the key 70% and 50% levels, the market is likely to consolidate rather than weaken significantly. A sustained break below 50% would signal deeper weakness and a potential trend reversal, making it an important threshold to watch in the coming sessions.

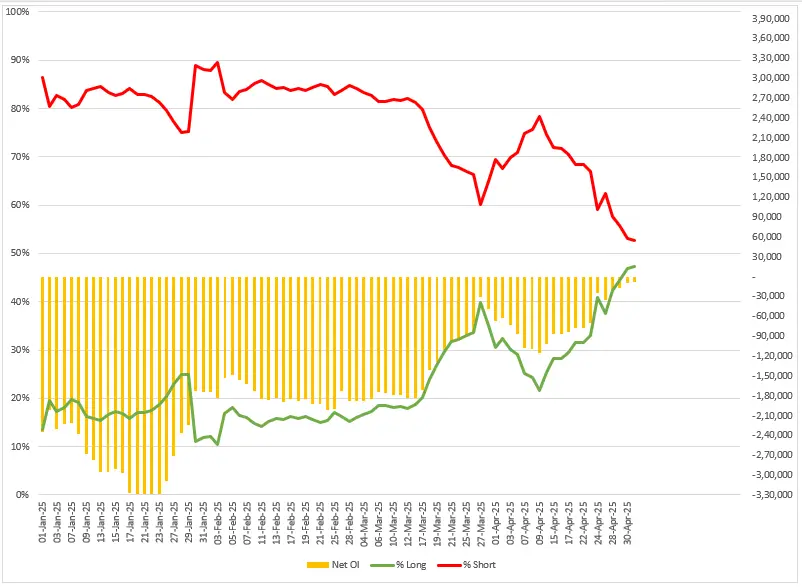

FIIs positioning in the index

Foreign Institutional Investors (FIIs) continued to pare their bearish bets on index futures, bringing the long-to-short ratio down to 47:53 from the previous week's 41:59. In addition, they reduced their net open interest in index futures to just -8,488 contracts. A similar contraction in both the long-to-short ratio and net open interest — nearing flat positioning — was last observed in December and August 2024.

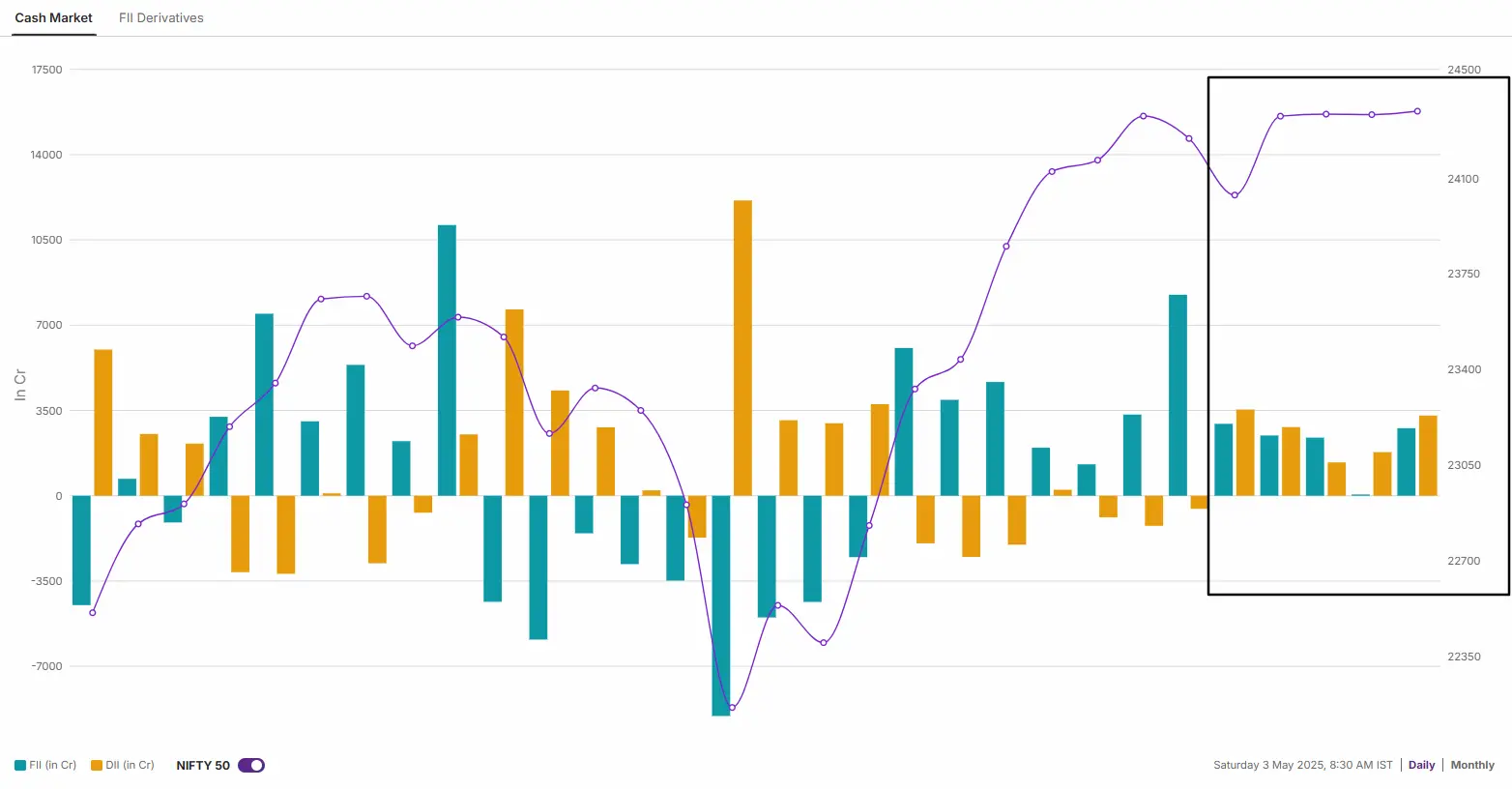

The cash market activity of the FIIs remained in line with the derivatives positioning for the third week in a row. The FIIs remained net buyers and purchased shares worth ₹7,680 crore. The Domestic Institutional Investors (DIIs) sustained their buying momentum and purchased shares worth ₹9,269 crore last week.

NIFTY50 outlook

The NIFTY50 index sustained the positive momentum for the third consecutive week and is currently trading above its short-term and long-term daily exponential moving averages (EMAs). The index invalidated last week’s shooting star pattern and closed near the high of the bearish reversal pattern.

The technical structure of the index moved into consolidation last week after a sharp rally of over 11% from the April 2025 low. It is currently consolidating between 24,500 and 23,800 zones and a break above or below this zone on a closing basis will provide further directional insights.

SENSEX outlook

The SENSEX also extended its bullish momentum for the third week in a row and closed above the previous week’s high. The index also invalidated last week’s shooting star candlestick pattern, signalling strength of the current trend.

For the upcoming week, traders can monitor the crucial support zone of 78,600. Unless its breaks this level on a closing basis, the trend may remain bullish. On the flip side, if the index slips below the immediate support of 80,250, it may remain range-bound.

This comes after the Fed Chair faces pressure from the White House to cut interest rates. In addition, the street will also be watching the release of the Services PMI on Monday and the New York Fed's consumer expectations survey on Thursday. These events will shape market sentiment and provide insight into the Fed's future policy direction. In domestic market, spotlight will also be Ather Energy IPO listing on Tuesday, May 6.

Buffett addressed the ongoing tariff tensions, stressing that trade should not be used as a weapon. On artificial intelligence, Buffett acknowledged its growing influence but remained cautious about its long-term impact on investing. Berkshire's cash reserves reached a record $347.7 billion and Buffett said he is always looking for attractive opportunities but expects the high cash balance to continue for the time being.

With the broader trend of the index sustaining its bullish momentum, the index remains range-bound between 24,500 and 23,800 zones. Within this range, the index may consolidate its gains and a break above or below these levels on a daily closing basis will provide further directional clues.

About The Author

Next Story