Market News

Week ahead: RBI policy, TCS Q4 earnings, US trade tariff among key market triggers to watch out

.png)

7 min read | Updated on April 06, 2025, 12:33 IST

SUMMARY

This week, market trends will be driven by RBI's monetary policy decision, Q4 earnings and concerns over a potential tariff war led by Donald Trump Meanwhile, the technical structure and options build-up of the NIFTY50 suggests that the index may face stiff resistance around 23,800 zone for the April expiry.

Stock list

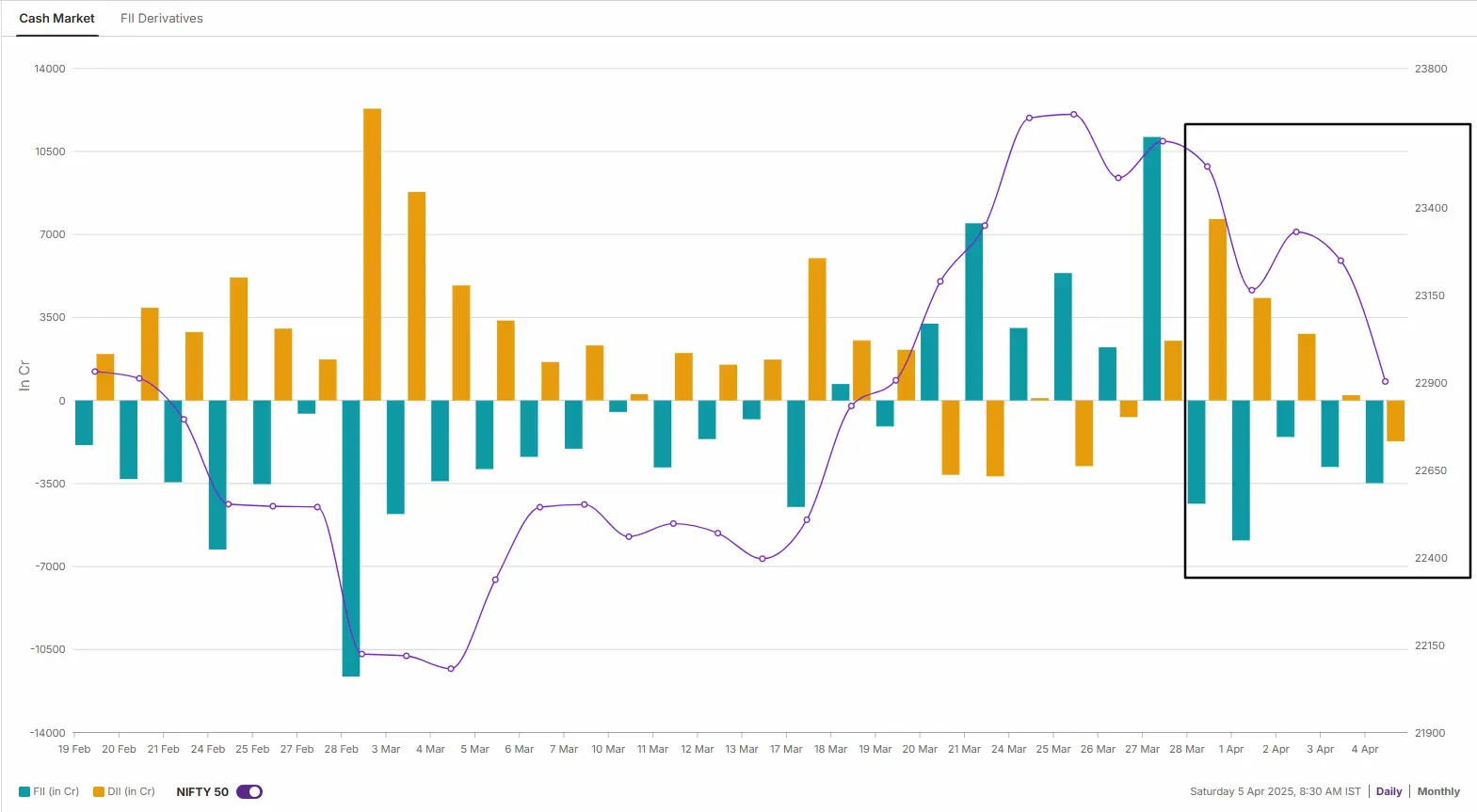

Foreign Institutional Investors (FIIs) turned net sellers in the cash market last week, offloading equities worth ₹13,730 crore. | Image: Shutterstock

Markets snapped their two-week winning streak, dragged down by fears of a global trade war. A broad sell-off followed U.S. President Donald Trump's announcement of reciprocal tariffs, reigniting fears of recession and a potential economic slowdown. The NIFTY50 index slipped below the crucial support zone of 23,000 and ended the week at 22,904, down 2.6% for the week.

Selling pressure was broad-based. The NIFTY Midcap 100 index fell 2%, while the Smallcap index dropped nearly 3%. Most sectoral indices ended the week in red, with IT (-9.1%) and Metals (-7.4%) taking the biggest hit. FMCG managed modest gains (+0.4%) and PSU Banks ended flat, offering limited support.

The impact of Trump’s tariff announcement extended beyond Indian markets, triggering a global sell-off. U.S. benchmarks saw sharp declines, with the Dow Jones plunging over 2,000 points on Friday. The S&P 500 lost $5 trillion in market value, and the Nasdaq slipped into bear market territory. European and Asian markets also reeled under the pressure.

Looking ahead, inflation concerns and recession fears are expected to drive further volatility in both domestic and global markets. In India, trading activity may remain subdued next week due to a holiday on Thursday for Shri Mahavir Jayanti.

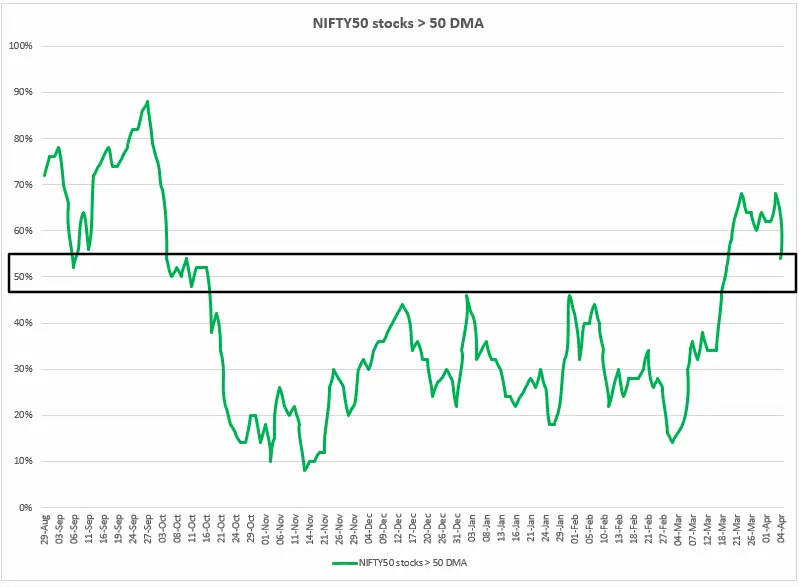

Index breadth

In a holiday-shortened week, the NIFTY50’s breadth lost steam, with just 54% of its stocks now trading above their 50-day moving averages (DMA). The index began April with a stronger reading of 62% but failed to sustain momentum.

As shown in the chart below, the NIFTY50 crossed the 50% threshold in March for the first time in six months. A drop back below that level in the coming sessions would signal weakening breadth and a potential shift to a bearish undertone.

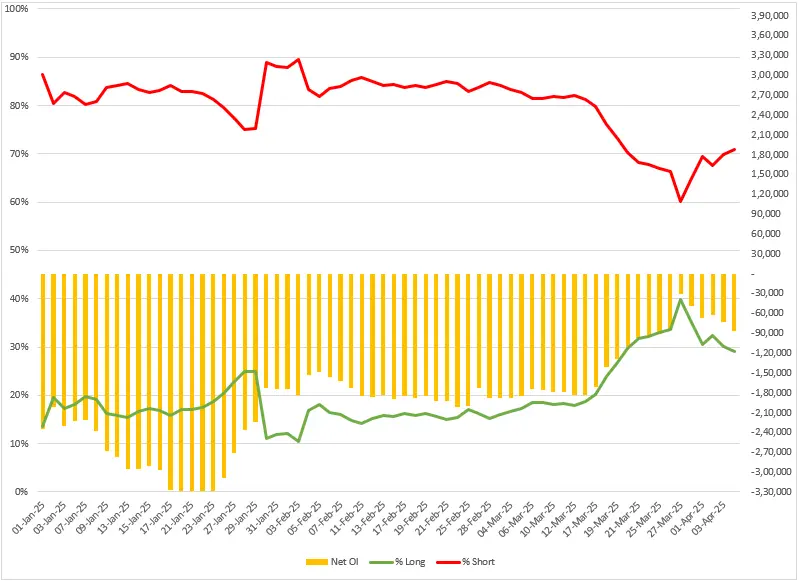

FIIs positioning in the index

After reducing their bearish bets around the rollover of the March series in index futures, Foreign Institutional Investors (FIIs) increased their bearish bets. They started the April series with a long-to-short ratio of 35:65 in index futures and increased it to 29:71. This translated into a 77% jump in FIIs net short open interest in the index futures by over 86,000 contracts.

Meanwhile, Foreign Institutional Investors (FIIs) turned net sellers in the cash market last week, offloading equities worth ₹13,730 crore. In contrast, Domestic Institutional Investors (DIIs) stepped in as net buyers, absorbing some of the pressure with purchases totaling ₹5,632 crore.

NIFTY50 outlook

The NIFTY50 index fell over 2% last week, confirming the gravestone doji pattern on the weekly chart that formed in the week ending 28th March. The index closed below the low of the bearish reversal pattern on the weekly chart as well as its 21- and 50-week exponential moving averages, reflecting weakness.

According to the technical structure and options data, the structure of the index remains weak with immediate resistance around the 23,800-mark. Meanwhile, key support for the index is around 21,900 zone. A close below this zone will further weaken sentiment and may push the index towards the next key support zone of 21,200.

.webp)

SENSEX outlook

SENSEX also confirmed the gravestone doji on the weekly chart and closed below the immediate support zone of 75,900, reflecting weakness. It also surrendered its 21 and 50 weekly EMAs and closed the week below the low of bearish reversal pattern.

This indicates that the technical structure of the SENSEX remains weak with immediate support around the 73,000 zone. Meanwhile, the crucial February swing high (78,735) will remain as the resistance zone for the index.

.webp)

On the macro front, inflation data will be key with the release of the Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) on Friday. In addition, the University of Michigan's consumer sentiment index, which recently hit a two-year low, will be released on Friday. Investors will also be looking to the minutes of the U.S. Fed’s March meeting on Wednesday for clues on the direction of monetary policy amid rising recession fears.

In India, the Reserve Bank of India will announce its interest rate decision after its monetary policy meeting on 9 April. Experts expect a 25 basis point cut, which could boost interest rate sensitive sectors. In February, the RBI cut rates by 25 basis points to 6.25%, the first cut in five years.

On the downside, a close below the immediate support at 22,700 could open the door for further weakness towards the 22,100 zone.

About The Author

Next Story