Market News

Week ahead: Q4 results, Tesla & Google earnings, Trump tariffs and F&O monthly expiry in focus

.png)

6 min read | Updated on April 21, 2025, 08:08 IST

SUMMARY

Q4 earnings, US-China trade tensions, Tesla and Google earnings along with the monthly expiry of futures and options contracts, are expected to guide the market direction this week. Meanwhile, the technical structure of the NIFTY50 index remains bullish with immediate support around the 23,200 zone.

Stock list

Market breadth on the NIFTY50 remained strong throughout the week, with over 67% of stocks trading above their 50-day moving average (DMA). | Image: Shutterstock

Indian markets extended the rebound for the second consecutive week, rising over 4.5% during the holiday-shortened period. The rally was led by a mix of global and domestic factors, including easing trade tensions and expectations of tariff deferrals.

Benchmark indices opened the week with a sharp gap-up and extended their gains through the following sessions. Supporting the uptrend, the rupee also posted gains, backed by steady foreign institutional investor (FII) inflows and a softer U.S. dollar.

The rally was broad-based, with strong participation from all sectors. Real estate (+6.9%), Private (+6.9%) and PSU (+5.6%) banks led the way. Other segments also posted healthy gains. Meanwhile, the broader indices mirrored the benchmark's performance, each Midcap 100 and Smallcap 100 rising more than 4%, highlighting the strength of the overall uptrend.

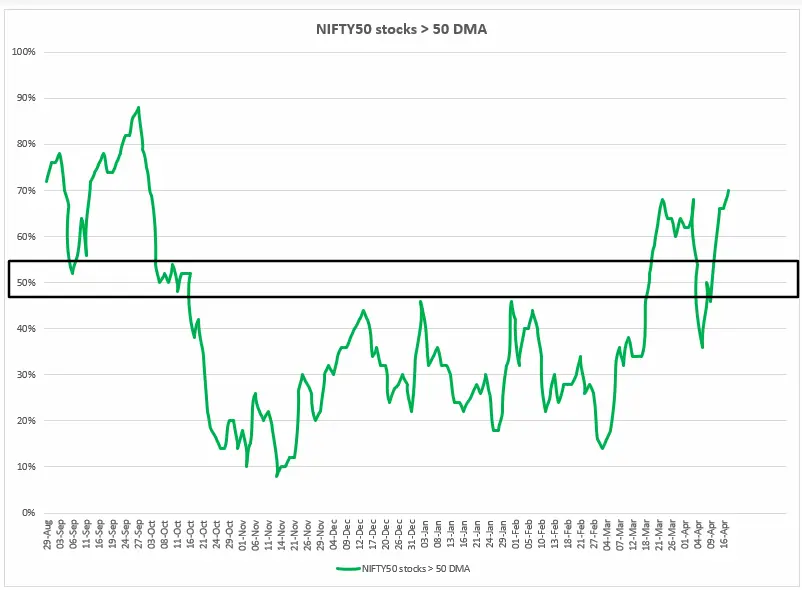

Index breadth

Market breadth on the NIFTY50 remained strong throughout the week, with over 67% of stocks trading above their 50-day moving average (DMA). This suggests that the rally was broad-based and well supported across the index.

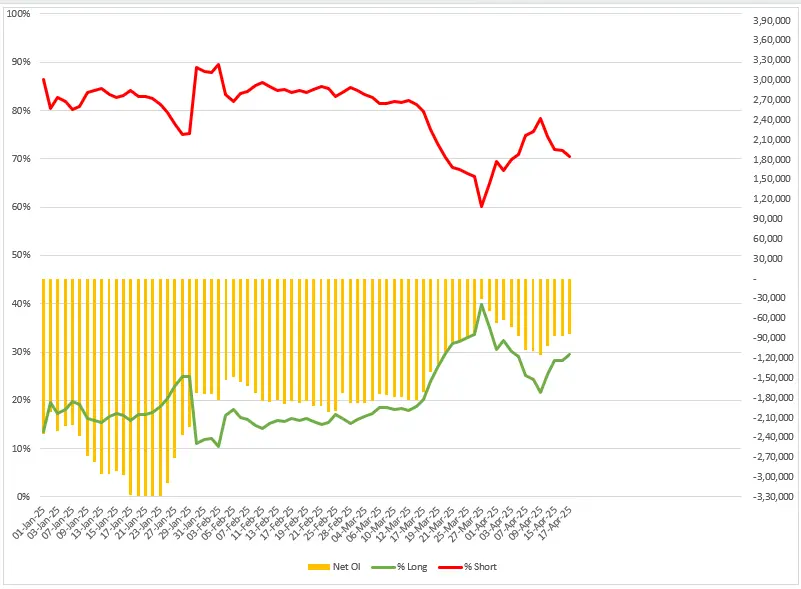

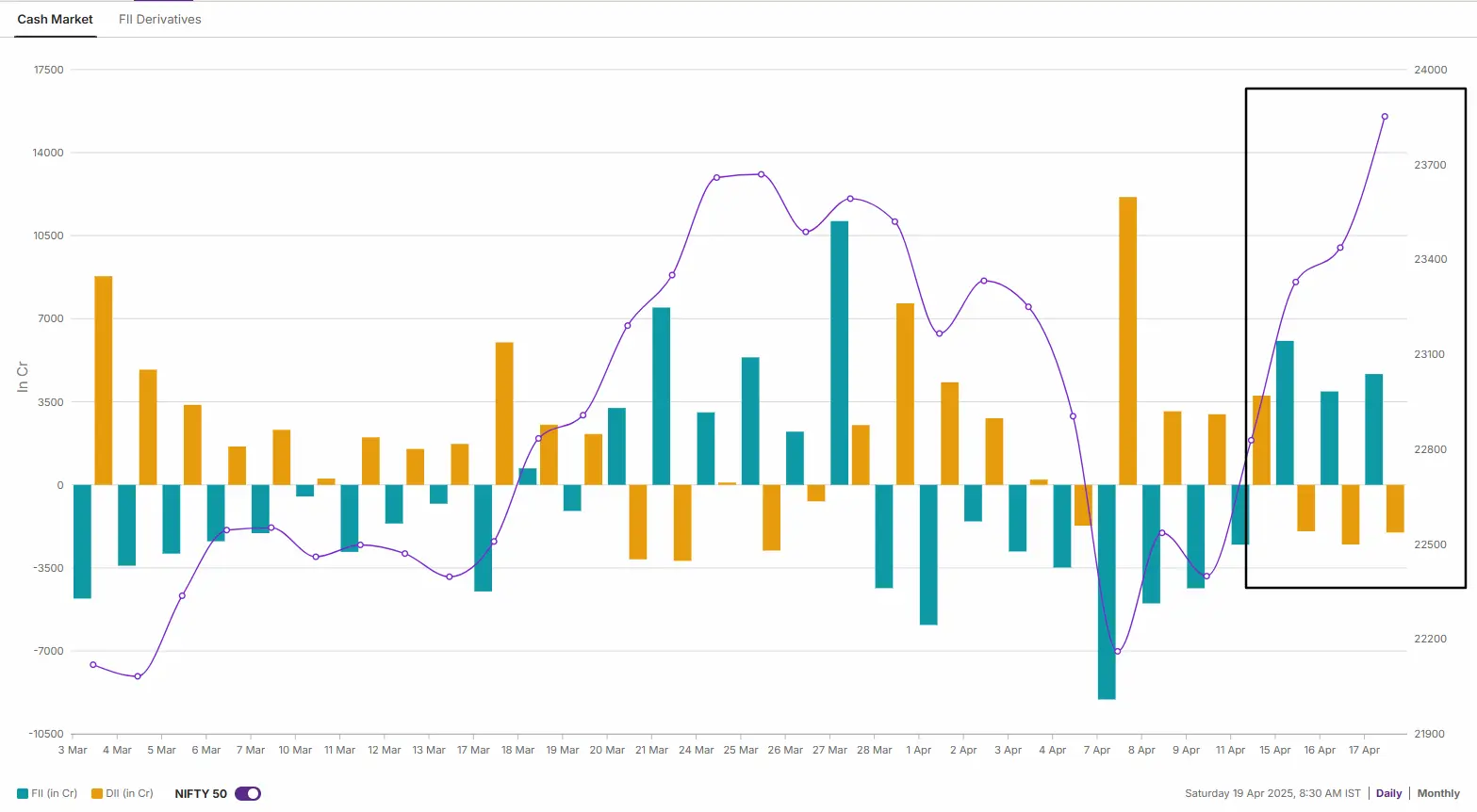

FIIs positioning in the index

Meanwhile, the cash market activity of the FIIs remained in line with their derivatives positioning. The FIIs turned net buyers during the holiday-shortened week and purchased shares worth ₹14,670 crore. On the flip side, the Domestic Institutional Investors (DIIs) took some profit and sold shares worth ₹6,470 crore.

NIFTY50 outlook

The NIFTY50 index formed a bullish candle on the weekly chart and reclaimed its weekly 21 and 50 exponential moving averages. It reclaimed its crucial swing high of February (23,807) on a closing basis, registering its highest close since December 2024.

For the upcoming sessions, the index may maintain positive momentum and advance towards the 24,000 and 24,200 zone. A close above this zone on a daily chart will signal strength and can push the prices higher up to 24,500 zone. Conversely, the support for the index is around 23,200 zones. Unless the index closes below this level, the trend may remain sideways to bullish.

SENSEX outlook

The SENSEX also formed a bullish candle on the weekly chart and reclaimed its weekly 21 and 50 EMAs on a closing basis. However, it has approached the crucial resistance zone of 78,600 and 79,500 as it failed to capture the February swing high on a closing basis.

With the broader structure remaining bullish in the short-term, traders can monitor the price action of the index around the crucial resistance zone. A close above these zones on the daily chart will signal further upside momentum. Meanwhile, the immediate support for the index is around 76,700 zone.

🗓️Key events in focus: From the economic point of view, the crucial data points which will steer the markets next week are new and existing home sales figures and jobless claims in the United States. U.S. new home sales rose 1.8% in February 2025 to 6,76,000 units, rebounding from a revised January. Meanwhile, the street expects March sales to remain steady or rise modestly amid cautious buyer demand.

📈📉Earnings blitz: In the coming week, all eyes will be on the earnings season. On the domestic front, markets will react to the fourth quarter earnings of HDFC Bank and ICICI Bank, which were declared over the weekend. Additionally, the street will also focus on the earnings of key companies like HCL Technologies, Nestle India, Hindustan Unilever, Tech Mahindra, Axis Bank, ACC, Maruti Suzuki and Reliance Industries.

Meanwhile on Wall Street, over 100 S&P 500 companies - around 22% of the index - are due to report results. Key highlights include Tesla and Alphabet (Google). Tesla, down more than 40% this year amid falling vehicle sales, will report earnings after the close on Tuesday. Alphabet reports after the bell on Thursday. Other key earnings include Lockheed Martin, IBM, Chipotle, Boeing, Procter & Gamble and Intel.

🛢️Oil: Oil prices jumped more than 4% last week as fresh US sanctions on Iranian oil exports raised concerns about tightening global supplies. The sanctions target Chinese importers, including a China-based refinery. Meanwhile, the International Energy Agency (IEA) expects global oil demand growth in 2024 to be the weakest since the COVID. However, experts believe that ongoing trade tensions between the U.S. and China could limit the downside in economic growth and help stabilize overall oil demand.

📊Stocks in focus: Based on price and open interest (OI), the stocks which witnessed long build-up are Sun Pharma, Aurobindo Pharma, Bharti Airtel, Bajaj Finserv and Avenue Supermart (Dmart). Similarly, to track the OI and price losers, log in to Upstox ➡️F&O➡️Futures smart list ➡️OI losers.

📓✏️Takeaway: The NIFTY50 index has staged a strong rally of over 2,100 points over the past two weeks, reclaiming both its 21- and 50-week exponential moving averages on a closing basis. Short-term momentum remains bullish, with immediate support at the 23,200 level.

However, the index is now approaching a key resistance zone between 23,800 and 24,200 - an area that coincides with the swing highs of February and March 2025. A decisive weekly close above this area would indicate a potential shift in trend and momentum, while a rejection of this area, especially if followed by a bearish candlestick pattern, could signal a pause in the current rally.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story