Market News

Week ahead: Q4 earnings, US GDP data, FIIs activity, Ather Energy IPO among key market triggers to watch out

.png)

6 min read | Updated on April 27, 2025, 12:42 IST

SUMMARY

In the upcoming holiday-shortened week, the NIFTY50 has crucial support near the 23,800 zone. A break and close below this level could trigger further weakness. On the upside, immediate resistance is seen around 24,500.

Stock list

Electric scooter maker Ather Energy is set to launch its initial public offering (IPO) this week.

Markets extended their bullish momentum for the second week in a row, holding gains until Thursday. However, sentiment turned sour on Friday, erasing most of the week's gains. This reversal followed India's announcement of major diplomatic action against Pakistan following the terrorist attack in Pahalgam, Jammu and Kashmir. For the week, the NIFTY50 index gained 0.7% to close at 24,039.

The broader markets also posted gains at the beginning of the week but came under selling pressure on Friday. The NIFTY Midcap 100 gained 1.7% and the Smallcap 100 gained 0.8%. Despite these gains, both indices formed bearish candlestick patterns on the weekly charts, signalling potential weakness ahead.

The rally was broad-based across sectors. Only Consumer Durables (-0.8%) and FMCG (-0.2%) ended in the red. Information Technology (+6.5%) and Automobiles (+2.9%) led the gains.

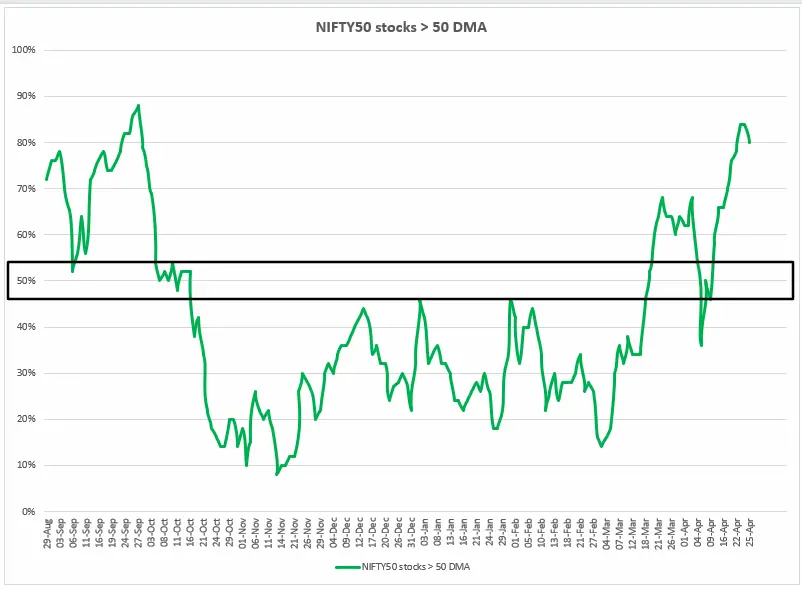

Index breadth

Breadth of the NIFTY50 index remained strong throughout the week, with most stocks holding above their 50-day moving averages (DMA). Asseen in the chart below, the index experienced profit-booking after breadth crossed 84%, signalling a slowdown in momentum. However, breadth remains comfortably above the key 70% and 50% levels. As long as it remains within and above this range, some consolidation is likely. Deeper weakness would only be confirmed if breadth falls and holds below 50%.

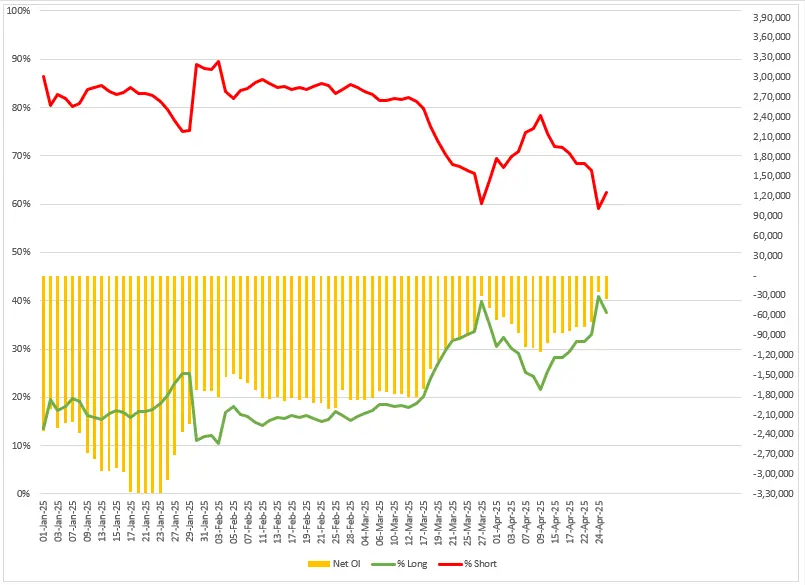

FIIs positioning in the index

The Foreign Institutional Investors (FIIs) started the May series with the long-to-short ratio of 38:62 on index futures and significantly reduced their net open interest (OI). The FIIs have started the May expiry with the net OI -35k on index futures. This indicates that the FIIs have started the series on a negative note but the ratio and net open interest still remains moderate.

The short-covering in the derivatives market was in line with the cash market activity of the FIIs. They reduced their selling spree for the second month in a row and sold shares worth ₹2,175 crore till 25 April. Conversely, the Domestic Institutional Investors remained net buyers and purchased shares worth ₹22,249 crore.

NIFTY50 outlook

The NIFTY50 extended its rally for the second week in a row, closing above the previous week's high. However, it was hit by profit-booking on Friday and formed a negative candlestick pattern resembling a shooting star, although not a classical one.

This has led to the mixed signals on the charts, suggesting that the index may be moving sideways after rallying more than 11% from the April low of 21,743. In the coming week, traders can monitor the 24,500-23,800 range. A break or breach of this range, confirmed on a daily closing basis, will provide clearer directional clues. Until then, the index is likely to remain range-bound with increased volatility.

.webp)

SENSEX outlook

The SENSEX also closed above the previous week's high, forming a bearish candlestick pattern similar to the NIFTY50. However, the confirmation of this pattern will depend on whether the next candle closes below the low of the bearish formation.

For the coming week, traders can monitor the 80,250-78,700 range. A decisive break or breach of this range, confirmed by a daily close, will provide clearer directional clues.

.webp)

Meanwhile, the Bank of Japan (BoJ) will announce its interest rate decision on the 1st of May. Experts believe that the BoJ may keep rates on hold until June, with a slight majority forecasting a 25 basis points hike in the next quarter. The central bank held rates at around 0.5% at its March meeting.

Meanwhile, globally four of the "Magnificent Seven" — Meta Platforms, Microsoft, Amazon, and Apple will announce earnings along with Coca-Cola and Domino's Pizza.

In the days ahead, traders should watch the 24,500–23,800 range. A decisive move beyond this range, confirmed by a daily close, will offer clearer directional cues. Until then, the index is likely to stay range-bound with elevated volatility.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story