Market News

Week ahead: Q4 earnings, India-Pak tensions, retail inflation and US-China trade talks in focus

.png)

5 min read | Updated on May 11, 2025, 16:04 IST

SUMMARY

Fourth-quarter earnings, India-Pakistan tensions, retail inflation data, foreign fund flows, and global cues will shape market trends in the week starting May 12. From a technical perspective, the crucial support for the NIFTY50 index is around 23,800. A close below this level will signal weakness.

Stock list

India's Consumer price Index (CPI) data for April will be released on May 12. | Image: Shutterstock

Indian markets snapped its three-week winning streak amid tensions between India and Pakistan. The NIFTY50 index lost over 1% despite positive global cues like the U.S.-U.K. trade deal and a free-trade agreement between the U.S and India.

The broader markets also declined and ended the week in the red. The NIFTY Midcap 100 index slipped 0.9%, while the Smallcap 100 index slumped 2.1%.

Most sectors bore the brunt of the decline, with Realty (-6.5%), PSU Banks (-4.3%) and Pharma (-2.5%) losing the most. In contrast, the Automobiles (+1.5%) and Media (+1.3%) sectors bucked the trend, showing resilience.

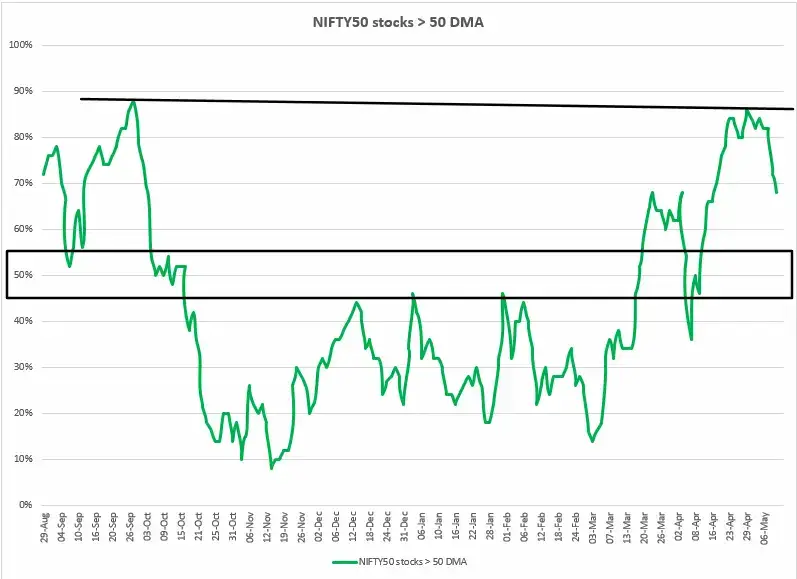

Index breadth

The NIFTY50 index witnessed profit-booking as 90% of its stocks traded above their 50-day moving average. The index hit a similar threshold in September 2024 and witnessed a sharp decline. However, it is important to know that the broader breadth of the index still remains above the 50% threshold. Unless the breadth remains comfortably above 50%, the index may consolidate and remain range-bound. A break below the 50% reading would signal weakness.

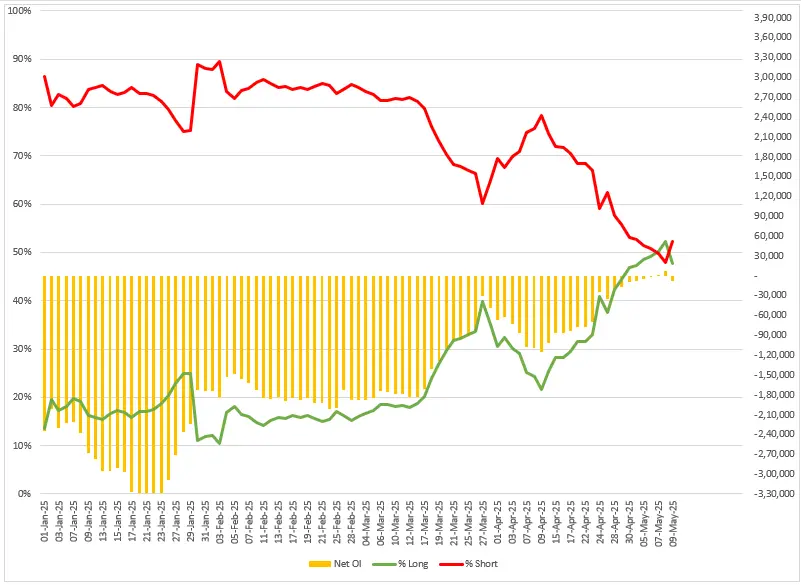

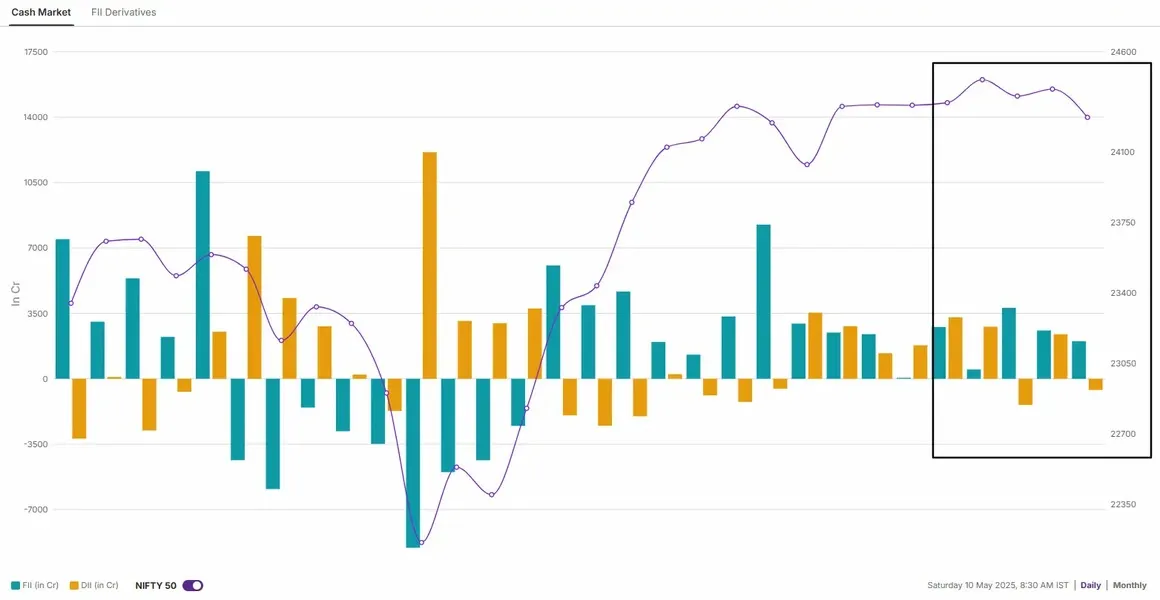

FIIs positioning in the index

In the cash market, the FIIs remained net buyers last week and bought shares worth ₹5,086 crore. The Domestic Institutional Investors (DIIs) also remained net buyers and purchased shares worth ₹10,450 crore.

NIFTY50 outlook

The NIFTY50 index ended the week below previous week’s low and formed a bearish engulfing pattern on the weekly chart. It failed to cross the crucial resistance around the 24,800 level and faced rejection around the 24,500 on a closing basis. Meanwhile, the index has immediate support around the 23,800 zone. Unless the index breaks this range on a closing basis, the trend may remain range-bound. A break of this range on a closing basis will provide further directional clues.

SENSEX outlook

The SENSEX also formed a bearish candle on the weekly chart and ended the week on a negative note. However, it protected the crucial support zone of ₹78,600 on a closing basis and is currently consolidating at higher levels. The index has crucial resistance around the 82,300 zone and support is around 77,600 zone. Within this range, the index can remain sideways.

Meanwhile, on the domestic front, India's Consumer price Index (CPI) data for April will be released on May 12. The April reading is expected to ease further to 3.27% YoY from 3.34% YoY in the previous month. Additionally, the Wholesale Price Index (WPI) for April 2025 will be released on 14 May, highlighting inflation at the producer level.

From a technical perspective, unless the index breaks the crucial support zone of 23,800 on a closing basis, it may consolidate its gains. A break below this zone could signal further downside. On the upside, resistance is around 24,600 zone.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

Related News

About The Author

Next Story