Market News

Trade setup: Will NIFTY50 defend 24,000 levels on Friday? Here's all you need to know

.png)

3 min read | Updated on May 09, 2025, 08:04 IST

SUMMARY

NIFTY50 and SENSEX closed in red on Thursday after India-Pakistan tensions escalated further. The global market cues remain positive as Trump announced the signing of the first trade deal with the UK, softening the stance on the trade war front.

NIFTY50 is expected consolidate further amid weak domestic cues and positive global cues. Image source: Shutterstock.

Asian markets at 7 am

Nikkei: 37,466 (+1.4%)

Hang Seng: 22,792 (+0.20%)

US markets

Dow Jones: 41,368 (+0.62%)

S&P500: 5,633 (+0.52)

NASDAQ: 17,928 (+1.0%)

The US markets closed in green after President Trump signed first major trade deal with the UK after imposing reciprocal tariffs on April 2. However, a 10% tariff remains in place. Further, Trump administration will meet Chinese counterparts in Switzerland for first trade talks between two economic powers after tariff war. Following the softening of situation in the trade war, the US markets closed in green with tech stocks leading the rally.

NIFTY50

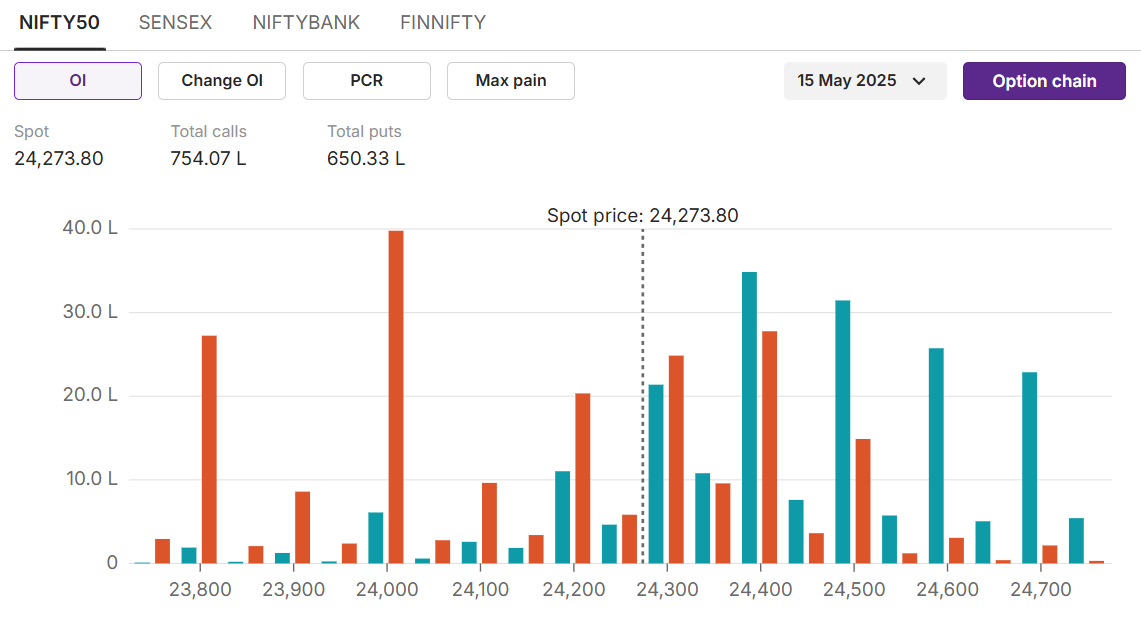

Max call OI: 24,400 Max put OI: 24,000 (Ten strikes to ATM, 15 May expiry)

NIFTY50 ended in red on Thursday, losing 140 points after tensions between India and Pakistan escalated. The index faced resistance at the 24,500 levels and continues to consolidate in the range of 24,000-24,500. Experts believe a breakdown below the 24,000 levels could take the index to the next level of 24,730.

On technical charts, the index could form an inside bar candlestick formation on weekly charts. It indicates more consolidation before a breakout on either side of the range.

On technical charts, the index could form an inside bar candlestick formation on weekly charts. It indicates more consolidation before a breakout on either side of the range. On the options front, the 15th May expiry open interest data shows 24,000 puts held the highest open interest, indicating support at these levels. While 24,400 calls hold the highest open interest on the upside, indicating resistance for the expiry.

On the options front, the 15th May expiry open interest data shows 24,000 puts held the highest open interest, indicating support at these levels. While 24,400 calls hold the highest open interest on the upside, indicating resistance for the expiry.

Stock scanner

Short buildup: Shriram Finance, Eternal, Adani Enterprises

Top traded futures contracts: HDFC Bank, ICICI Bank, Reliance

Top traded options contracts: SBIN 800 CE, Reliance 1,460 CE

Under F&O ban:CDSL,Manappuram, RBL Bank

Out of F&O ban:

About The Author

Next Story