Market News

Trade setup on May 05: NIFTY50 indicates a reversal from 24,500 levels; Here's all you need to know

.png)

3 min read | Updated on May 05, 2025, 07:53 IST

SUMMARY

NIFTY50 and SENSEX continued to trade above their short, medium and long-term averages for a third consecutive week, indicating a sustained buying momentum in the markets. However, a cautiousness persists among traders after a nearly 13% rally from lower levels in April. The NIFTY50 holds 24,500 as crucial resistance levels in today's trade.

GIFT NIFTY indicates a positive opening for Indian markets on Monday.| Image: Shutterstock

Asian markets at 7:00 am

Nikkei: 36,830 (+1.0%)

Hang Seng: 22,504 (+1.74)

US markets

Dow Jones: 41,317 (+1.3%)

S&P500: 5,686 (1.4%)

NASDAQ: 17,977 (1.5%)

The US markets continud to rally for second week in a row as US indices recoup 60% of the losses from the recent correction. The gains were largely led by tech stocks as strong employment data over the weekend brought renewed optimism around the US economy. The Dow Jones, NASDAQ and S&P500 closed up to 1.7% higher on Friday.

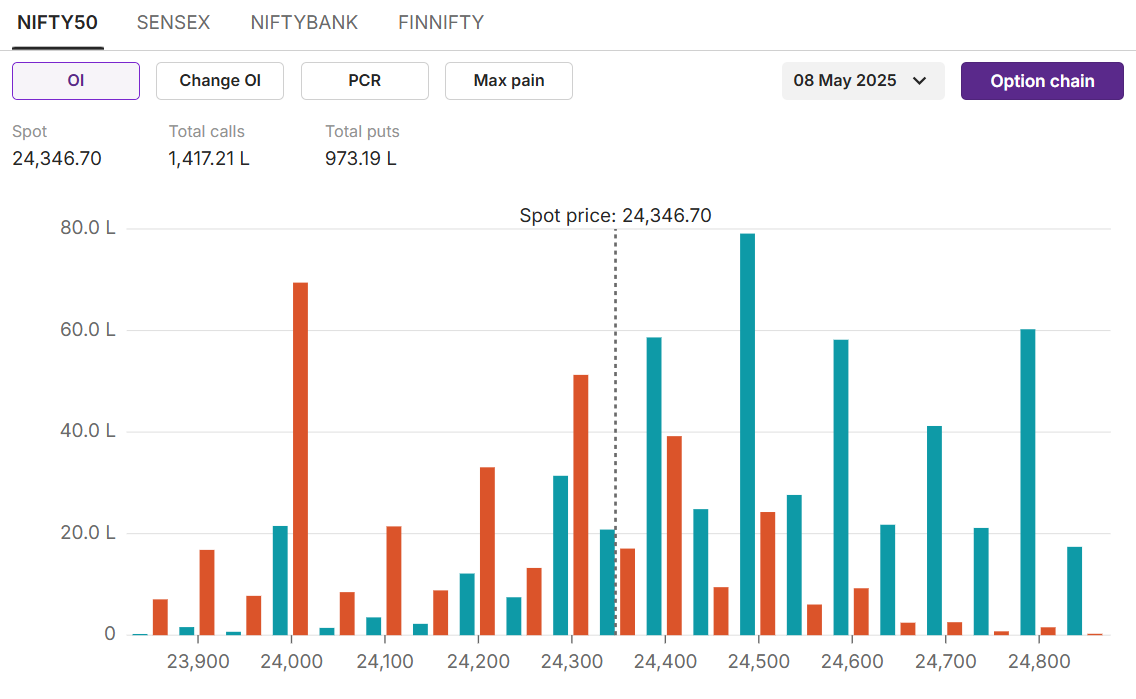

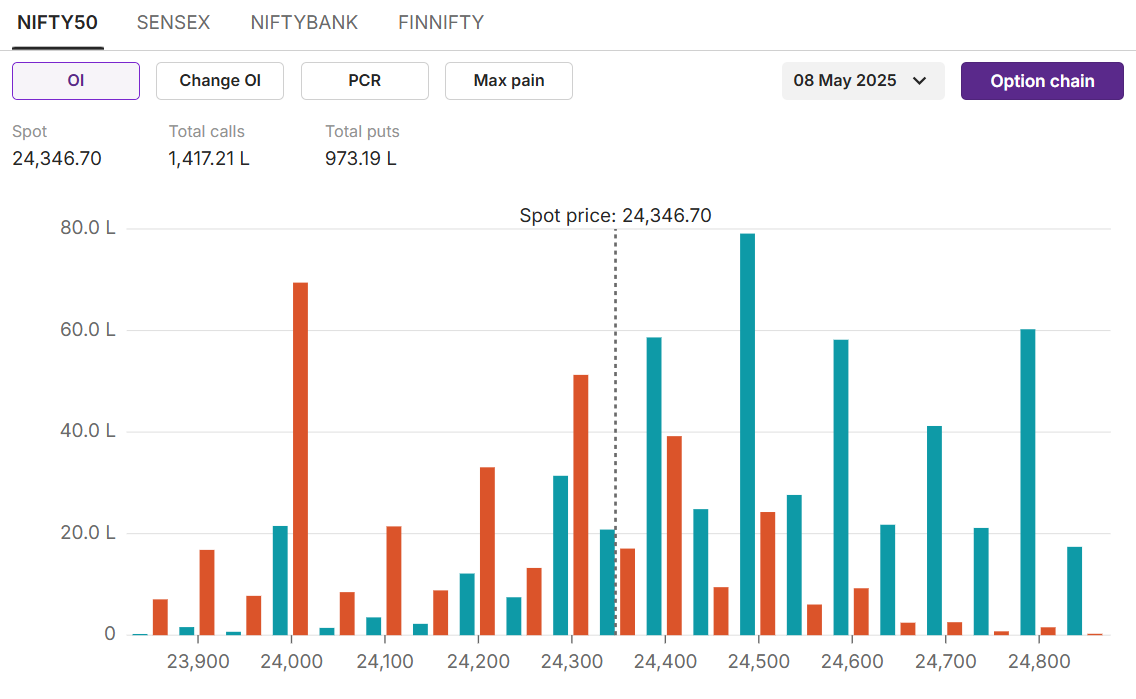

NIFTY50

Max call OI:24,500 Max put OI:24,000

NIFTY50 closed the previous week with 1.2% gains for the third consecutive time. The rally was largely driven by strong optimism around Q4 earnings performance and sustained FII buying. The index now faces crucial resistance at 24,800. A closing above these levels would lead to a further rally.

On the options front, 24,500 calls hold the highest open interest, indicating a strong resistance. On the other hand, 24,000 puts hold the highest open interest on the downside.

On the options front, 24,500 calls hold the highest open interest, indicating a strong resistance. On the other hand, 24,000 puts hold the highest open interest on the downside.

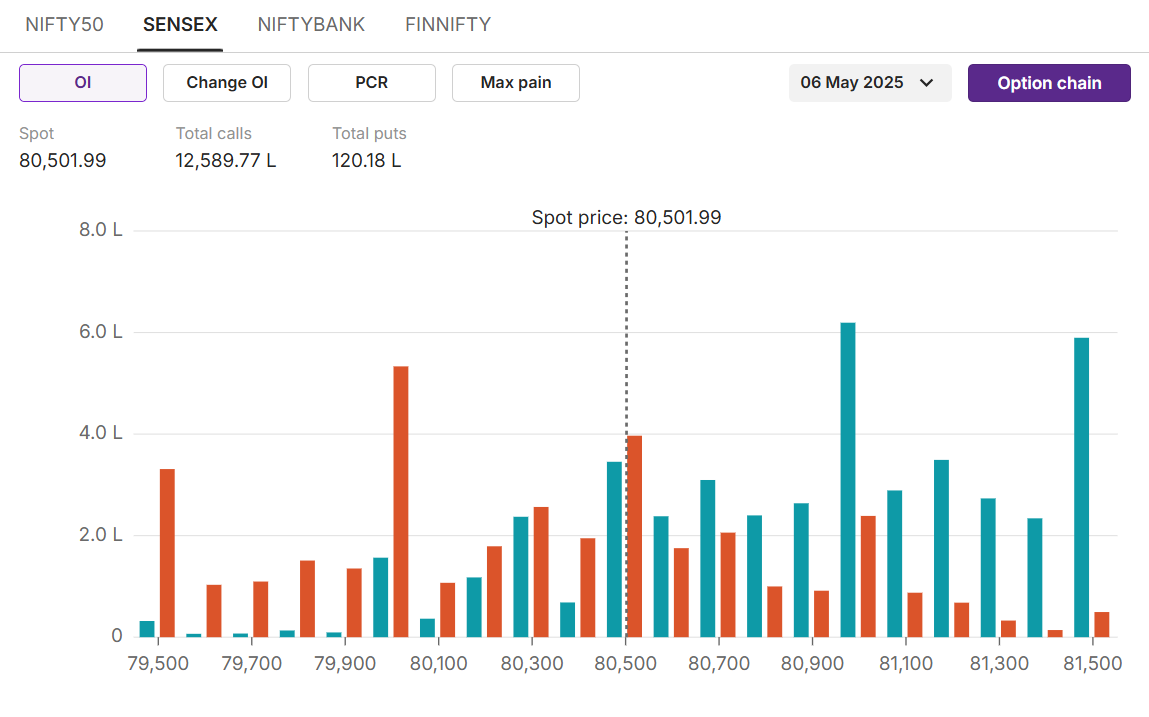

SENSEX

Max call OI:81,000 Max put OI:80.000 (Ten strikes to ATM, 06 May expiry)

SENSEX closed the previous week with 1.6% gains. The gains were driven by a strong rally in the index heavyweights like Reliance Industries, TCS, Infosys and more, which gained up to 10% for the week. The index now faces crucial resistance at the 82,000 level, above which the index could lead the rally to previous record high levels.

Stock scanner

Long build-up: SBILife, HDFC Life, Maruti

Short build-up: Bajaj Finserv, Bajaj Finance, Trent

Top traded futures contracts: Bajaj Finance, Reliance, SBI

Top traded options contracts: Infy 1600 CE, HDFC Bank 2040 CE, SBI 860 CE

Under F&O ban: RBL Bank.

Out of F&O ban:

About The Author

Next Story