Market News

Trade setup for May 6: 24,500 remains crucial resistance for NIFTY50. Here's all you need to know

.png)

3 min read | Updated on May 06, 2025, 08:12 IST

SUMMARY

NIFTY50 and SENSEX advanced on Monday with 0.3% gains. However, the benchmark indices continued to remain in the consolidation mode. Experts believe SENSEX could break out of the consolidation range on expiry day.

The GIFT NIFTY futures indicate that the NIFTY50 index will open 14 points higher. | Image: Shutterstock

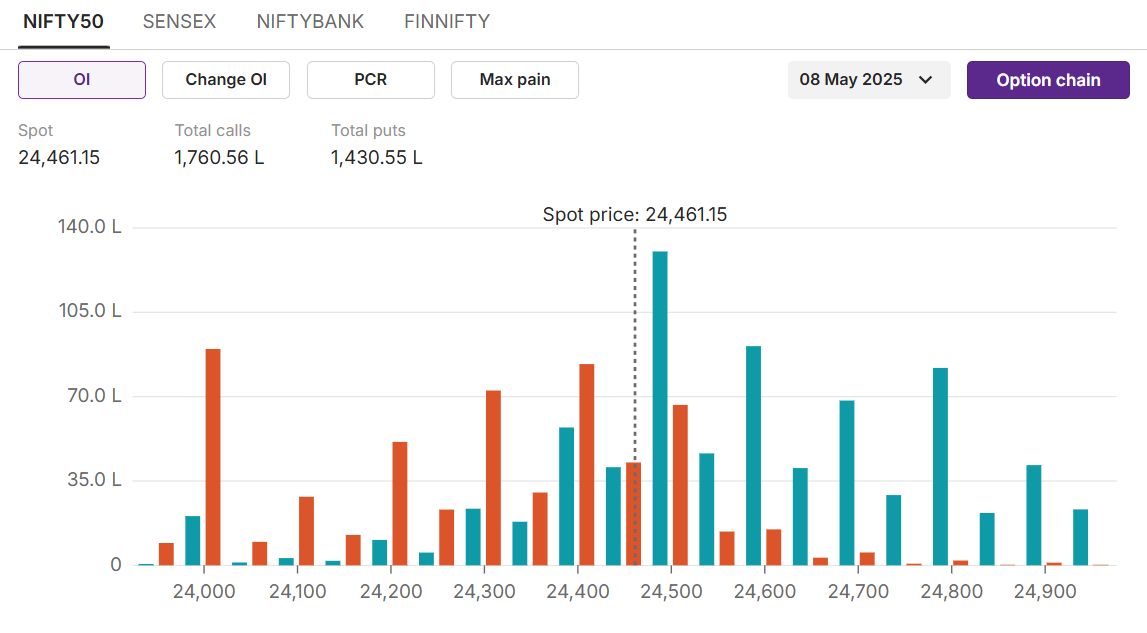

NIFTY50

Max call OI:24,500 Max put OI:24,000 (Ten strikes to ATM, 08 May expiry)

NIFTY50 advanced with minor gains on Monday as optimism around Q4 earnings pulled the indices higher. The FII’s buying spree continued in the equity segment, with the rising long position in the derivative segment. NIFTY50 continued to face the resistance of 24,500 as profit booking emerged at these levels on Monday.

On the technical front, the NIFTY50 negated the inverted hammer pattern by closing above the previous day’s closing levels. The index continues to remain in consolidation mode with little positive bias and small advances. Experts believe a breakout from the range of 24,000-24,500 could decide the next direction for the NIFTY.

On the technical front, the NIFTY50 negated the inverted hammer pattern by closing above the previous day’s closing levels. The index continues to remain in consolidation mode with little positive bias and small advances. Experts believe a breakout from the range of 24,000-24,500 could decide the next direction for the NIFTY. On the options front, the 24,500 calls hold the highest open interest, and on the flipside, 24,000 puts hold the highest open interest, indicating resistance and support levels for the 08 May weekly expiry.

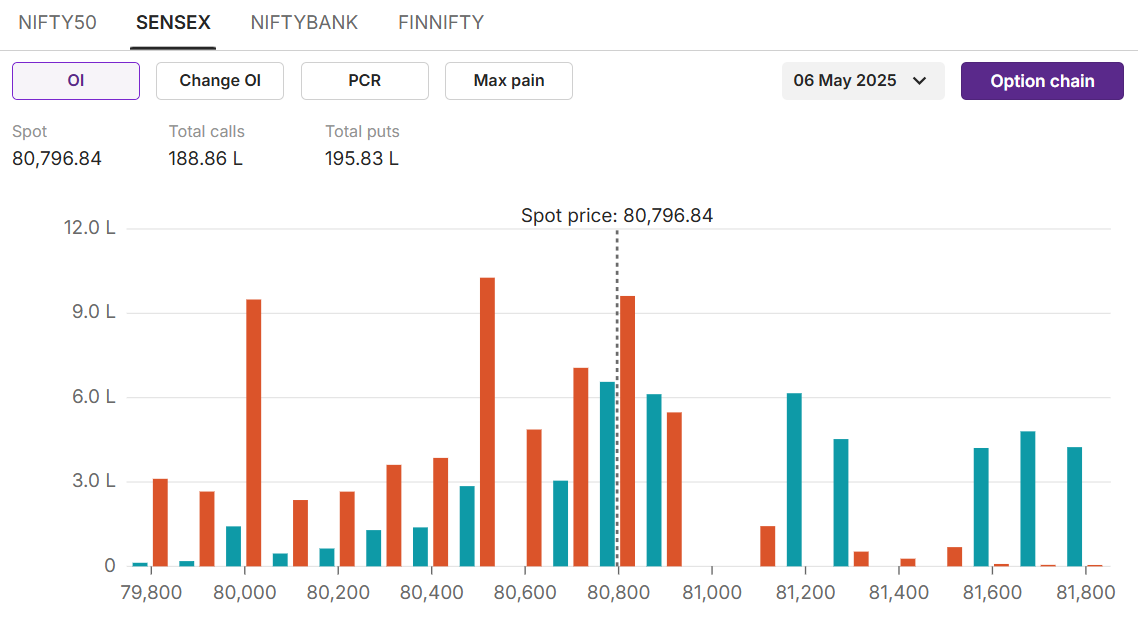

On the options front, the 24,500 calls hold the highest open interest, and on the flipside, 24,000 puts hold the highest open interest, indicating resistance and support levels for the 08 May weekly expiry.SENSEX

Max call OI: Max put OI: (Ten strikes to ATM, 06 May expiry)

The benchmark SENSEX gained 0.37% on Monday amid strong gains in Auto stocks. The index continued its consolidation phase for the 9th consecutive day. Experts believe the index to break out from the consolidation range of 80,800 to 81,000 on the expiry day.

Stock scanner

Long build-up: Adani Ports, Shriram Finance, M&M

Short build-up: Kotak Mahindra Bank, SBIN, JSW Steel

Top traded futures contracts: Kotak Mahindra Bank, M&M, SBI

Top traded options contracts: SBIN 820 CE, SBIN 850 CE, SBIN 830 CE

Under F&O ban:

Out of F&O ban:

About The Author

Next Story