Market News

Trade setup for May 2: Will NIFTY50 breakout from consolidation? Here’s all you need to know

.png)

3 min read | Updated on May 02, 2025, 08:16 IST

SUMMARY

NIFTY and SENSEX rallied nearly 12% in April from the monthly lows. Experts believe the index could continue to consolidate with a positive bias for the next monthly series. For the weekly expiry, 24,800 and 80,500 are key resistance levels to watch out for on NIFTY50 and SENSEX.

The GIFT NIFTY futures level at 07:47 AM suggests that the NIFTY50 index will open flat. | Image: Shutterstock

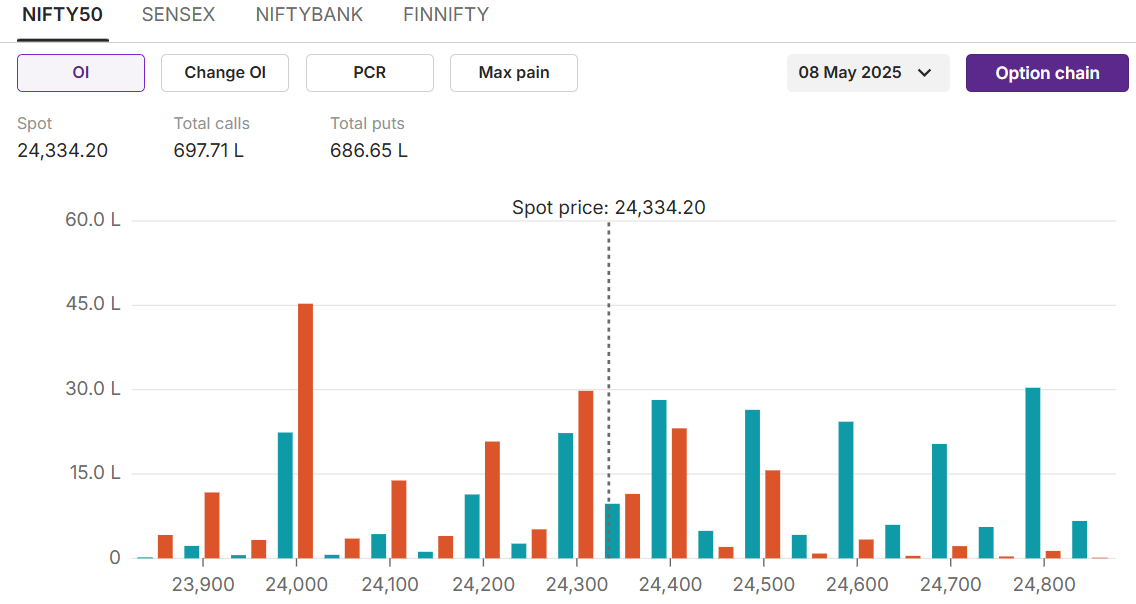

NIFTY50

Max call OI:24,800 Max put OI:24,000 (Ten strikes to ATM, 08 May Expiry)

NIFTY50 closed April on a positive note by gaining nearly 12% from the recent swing low of 21,745. The rally was largely driven by multiple factors, such as strong domestic tailwinds including optimistic earnings season, rate cut, ease in reciprocal tariffs and strong FII buying.

On daily charts, after a rally of nearly 12% from the low’s index now eyes for breakout above 24,500 levels. A successful breakout above these levels could lead us to next resistance levels of 24,800.

On daily charts, after a rally of nearly 12% from the low’s index now eyes for breakout above 24,500 levels. A successful breakout above these levels could lead us to next resistance levels of 24,800.

Options buildup

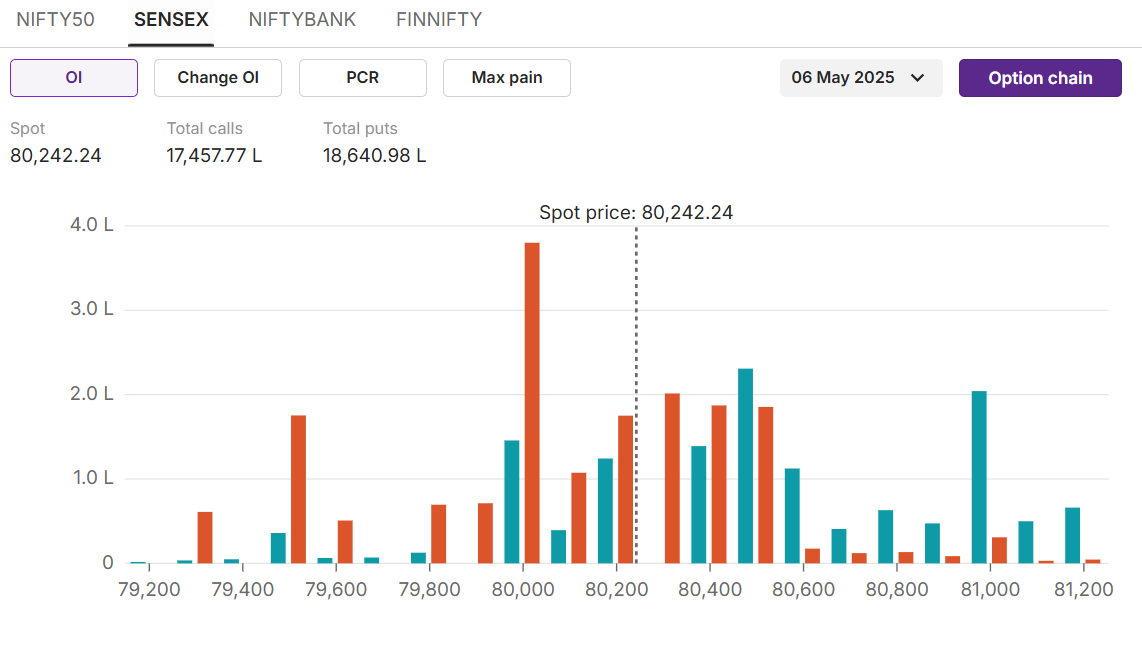

SENSEX

Max call OI:80,500 Max put OI:80,000 (Ten strikes to ATM, 06 May expiry)

SENSEX has jumped nearly 3.65% in April and nearly 12% from the monthly lows. The strong bounceback from current levels was led by banking stocks, which rallied in optimism on strong quarterly earnings, coupled with other domestic tailwinds.

On daily charts, the index looks out to break out above the consolidation levels. Experts believe a breakout above recent swing high levels of 80,300 levels could take the index to 82,000 levels.

On daily charts, the index looks out to break out above the consolidation levels. Experts believe a breakout above recent swing high levels of 80,300 levels could take the index to 82,000 levels.

Option buildup

Stock scanner

Long build-up: SBILife, HDFC Life, Maruti

Short build-up: Bajaj Finserv, Bajaj Finance, Trent

Top traded futures contracts: Bajaj Finance, Reliance, SBI

Top traded options contracts: Infy 1600 CE, HDFC Bank 2040 CE

Under F&O ban: RBL Bank.

Out of F&O ban:

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story