Market News

Trade setup for May 14: NIFTY50 faces resistance at 25,000; Here's all you need to know

.png)

3 min read | Updated on May 14, 2025, 08:05 IST

SUMMARY

GIFT NIFTY indicates a positive opening for Indian markets on Wednesday, taking cues from strong gains in the US markets. The US indices closed in green on stronger inflation print , led by rally in the tech stocks. Similarly, Asian markets traded largely in green, except for Japan's Nikkei.

NIFTY50 posted the highest single day gain in four years. Image source: Shutterstock.

GIFT NIFTY indicates a gap up opening for Indian markets on Wednesday after steep correction on Tuesday. The global and domestic cues remain positive, with softer than expected inflation data boosting the investor sentiments across US and Indian markets.

Asian markets

Asian benchmark indices traded mixed on Wednesday morning, with Japanese indices paring gains of last week’s rally. The Hong Kong indices rallied nearly 200 points higher, and Chinese indices traded in flat-to-negative territory.

US markets

The benchmark US indices closed higher on Tuesday after the inflation print came in softer than the estimates. The tech shares led the rally with over 1.6% gains, followed by the S&P 500, up by 0.72%. However, Dow Jones closed in the red due to profit booking in the closing hours.

Crude oil prices

The crude oil prices pared some previous day gains on Wednesday morning after a report indicated sharp surge the US stock piles. The WTI crude oil prices traded 0.5% lower at $63.19 per barrel after gaining 2.6% on Tuesday. Similarly, the Brent crude oil prices also traded 0.6% lower at $66 per barrel.

Gold prices

Gold prices eased furher on Tuesday after easing US-China trade tensions eased the uncertainity concerns. Further, a softer than expected inflation print also added hopes for more and early rate cuts, indicating shift in flows from safe haven like gold to riskier assets like equity.

NIFTY50

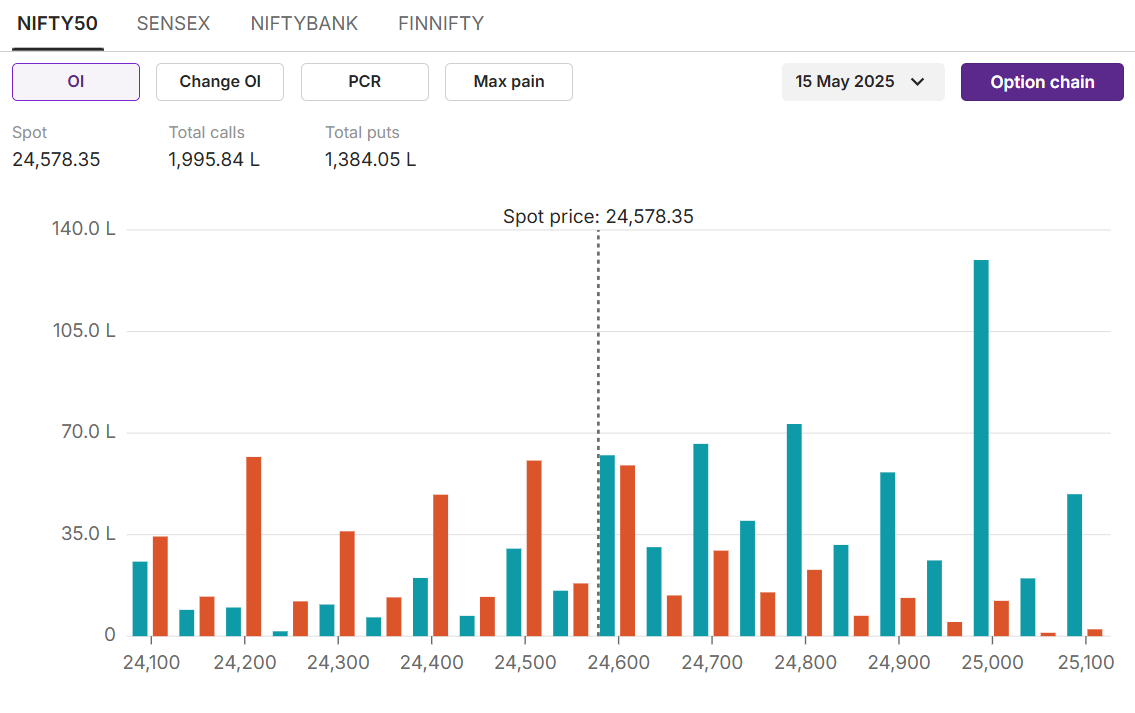

Max call OI: 25,000

Max put OI: 24,200

(Ten strikes to ATM, 15 May expiry)

NIFTY50 witnessed profit booking at higher levels on Tuesday and slipped into the deep red in the closing session. The breakout above the previous swing high level was false as the Index failed to close above Monday's closing of 24,924. 25,000 holds key resistance levels for the coming days, while on the downside, 24500 could act as a crucial support for the NIFTY50.

On the options data front, the 25,000 calls hold the highest open interest, indicating strong resistance for the current weekly expiry. Similarly, 24,200 puts hold the highest open interest, indicating crucial support.

On the options data front, the 25,000 calls hold the highest open interest, indicating strong resistance for the current weekly expiry. Similarly, 24,200 puts hold the highest open interest, indicating crucial support.

Stock scanner

Long buildup: BEL, Hero MotoCorp

Short buildup: Eternal, Infosys, PowerGrid

Top traded futures contracts: HDFC Bank, ICICI Bank, Reliance

Top traded options contracts: SBIN 820 CE, Reliance 1460 CE, HDFC Bank 2000 CE

Under F&O ban:CDSL,Manappuram

Out of F&O ban: RBL Bank

About The Author

Next Story