Market News

Trade setup for May 12: Will NIFTY50 and SENSEX breakout of consolidation on Monday? Check details

.png)

3 min read | Updated on May 12, 2025, 08:00 IST

SUMMARY

NIFTY50 and SENSEX are expected to open higher on Monday, primarily due to positive domestic and global cues. As the tensions ease between India and Pakistan, investors are looking forward to normalcy on the geopolitical front. Secondly, the trade deal between the US with the UK and a breakthrough in talks with China is expected to ease global tensions.

GIFT NIFTY indicates a big gapup for Indian markets on Monday. Image source: Shutterstock.

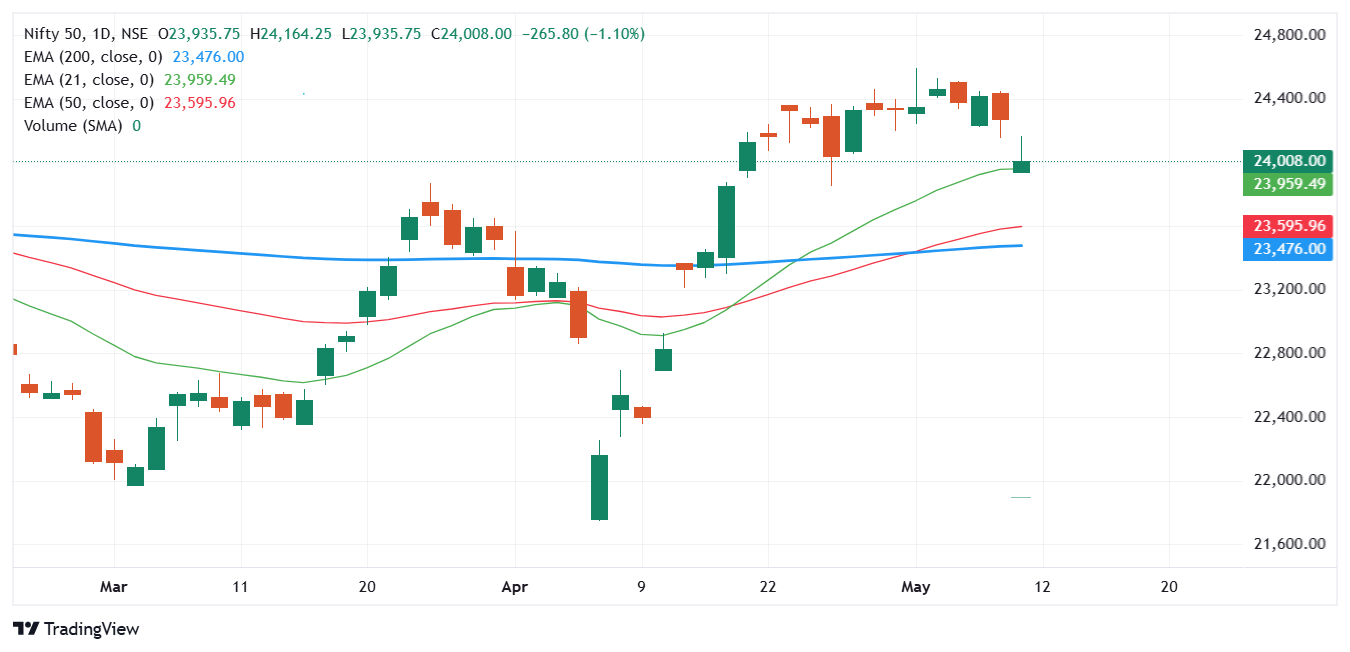

NIFTY50

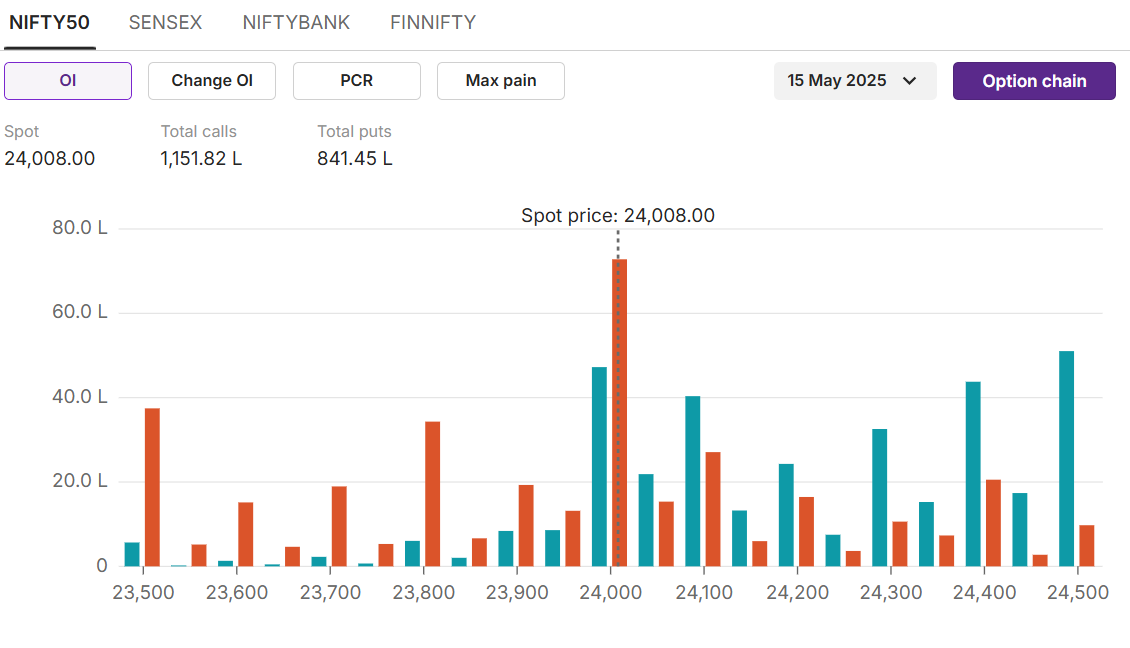

Max call OI: 24,000

Max put OI:24,500

(Ten strikes to the ATM,15 May expiry)

NIFTY50 closed above the 24,000 levels, thereby defending the crucial support. The India-Pakistan tensions heightened on Friday after both nations engaged in a fierce air battle. However, soon in the evening, a ceasefire understanding was reached, and both nations agreed to it. The index is expected to open with a big gap up as the ceasefire between India and Pakistan has softened the uncertainties. In addition, on the trade war front, the US signed a trade deal with the UK and a breakthrough in a deal with China.

On the options data front, 24,000 puts hold the highest open interest for the 15 May expiry, indicating strong support at these levels. On the upside, 24,500 calls hold the highest open interest, indicating a strong resistance at these levels.

On the options data front, 24,000 puts hold the highest open interest for the 15 May expiry, indicating strong support at these levels. On the upside, 24,500 calls hold the highest open interest, indicating a strong resistance at these levels.

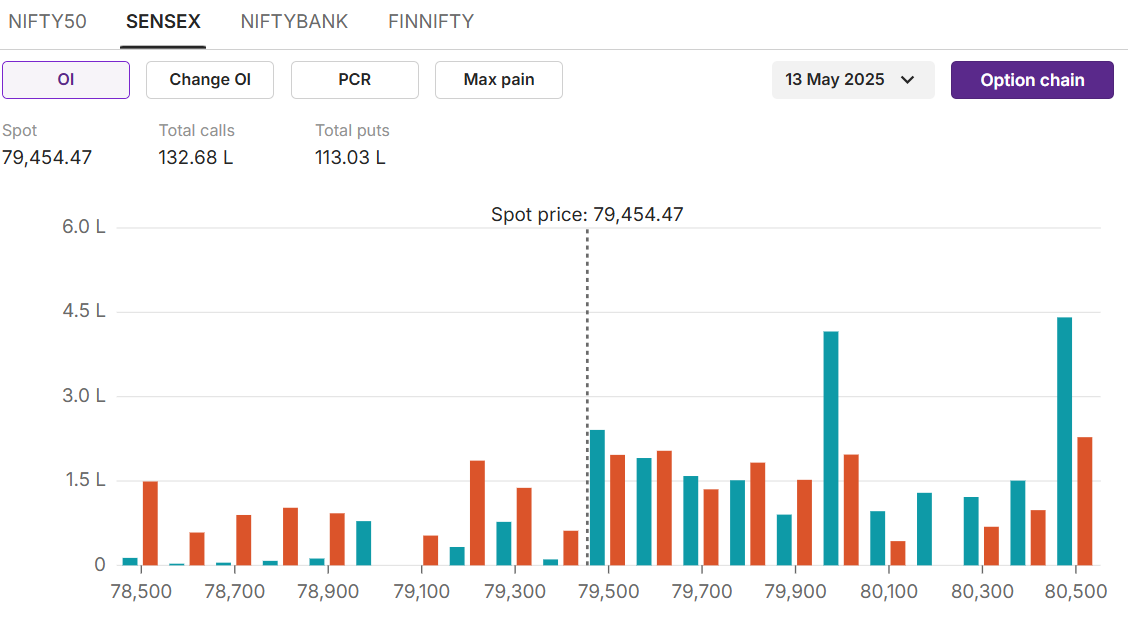

SENSEX

Max call OI:80,500

Max put OI:80,500

(Ten strikes to ATM, 13 May expiry)

SENSEX snapped the three-week winning streak by closing 1.3% lower for the week. The correction from higher levels was led by weak domestic cues and mixed global cues. The experts believe, with positive global and domestic cues, the index too break out of the consolidation range of 79,300-81,200.

On the options data front, the 80,500 holds the crucial level for the index with the highest open interest on calls and puts at the respective levels.

On the options data front, the 80,500 holds the crucial level for the index with the highest open interest on calls and puts at the respective levels.

Stock scanner

Long buildup: Titan, L&T

Short buildup: Power Grid, Grasim

Top traded futures contracts: HDFC Bank, ICICI Bank, SBI

Top traded options contracts: HDFC Bank 2000 CE, Reliance 1440 CE

Under F&O ban:CDSL,Manappuram, RBL Bank

Out of F&O ban:

About The Author

Next Story