Market News

Trade setup for April 8: NIFTY50 defends 21,800 on closing basis, what lies ahead? Here’s all you need to know

.png)

4 min read | Updated on April 08, 2025, 08:03 IST

SUMMARY

Indian markets are set for a positive start on Tuesday after a sharp meltdown on Monday. The Asian markets traded in green, with Japanese indices gaining more than 6.4% on Tuesday. The NIFTY50 and SENSEX have defended previous swing lows on a closing basis, indicating a near-term support at these levels.

GIFT NIFTY futures indicate positive start for Indian markets on Tuesday. Image source: Freepick.

Asian markets at 7:00 am

GIFT NIFTY: 22,651 (+1.48%)

Nikkei: 33,134 (+6.4%)

Hangseng: 20,231 (+2.4%)

US markets

US markets witnessed one of the wildest movements in their stock market history, as the key benchmark indices gained and lost more than $2 trillion in a span of 30 minutes. Rumours that Trump planned to pause tariff hikes for 90 days led to a 1,300-point jump in the Dow Jones. After the White House clarified that it was fake news, the indices gave up all the gains to trade in red. In addition, Trump threatened China with 50% retaliatory tariffs above the existing 34% tariffs if China doesn't withdraw the retaliatory tariffs announced yesterday.

Amid such a heavy flow of developments, the US stock market closed in mixed with no major losses, snapping the meltdown correction within three days. The NASDAQ closed in green with little gains, and the Dow Jones & S&P 500 closed in red with losses of up to 0.9%.

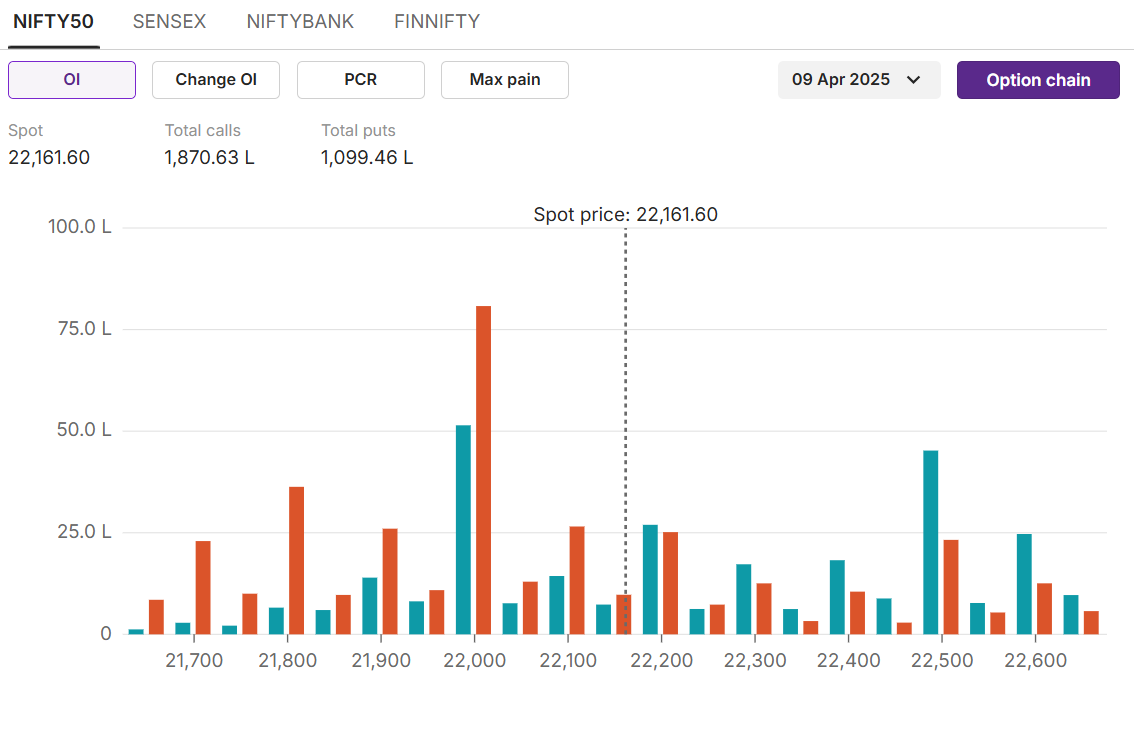

NIFTY50

Max call OI:22,500

Max put OI: 22,000 (Ten strikes to ATM, 09 April expiry)

NIFTY50 fell more than 1000 points on Monday morning below the recent swing low of 21,800 in the aftermath of a global trade war. The index witnessed wild swings of more than 500 points up and down in the intial trading hours but managed to defend the previous swing low level on closing basis.

On the options front, the 22,000 puts hold the highest open interest for the current expiry, indicating strong support at these levels. On the other hand, the 22,500 calls hold the highest OI on the call side, indicating resistance at these levels. However, India VIX continues to remain elevated with gains of 65%, indicating wild swings on either side of the market and may test the support and resistance levels in a volatile session.

On the options front, the 22,000 puts hold the highest open interest for the current expiry, indicating strong support at these levels. On the other hand, the 22,500 calls hold the highest OI on the call side, indicating resistance at these levels. However, India VIX continues to remain elevated with gains of 65%, indicating wild swings on either side of the market and may test the support and resistance levels in a volatile session.

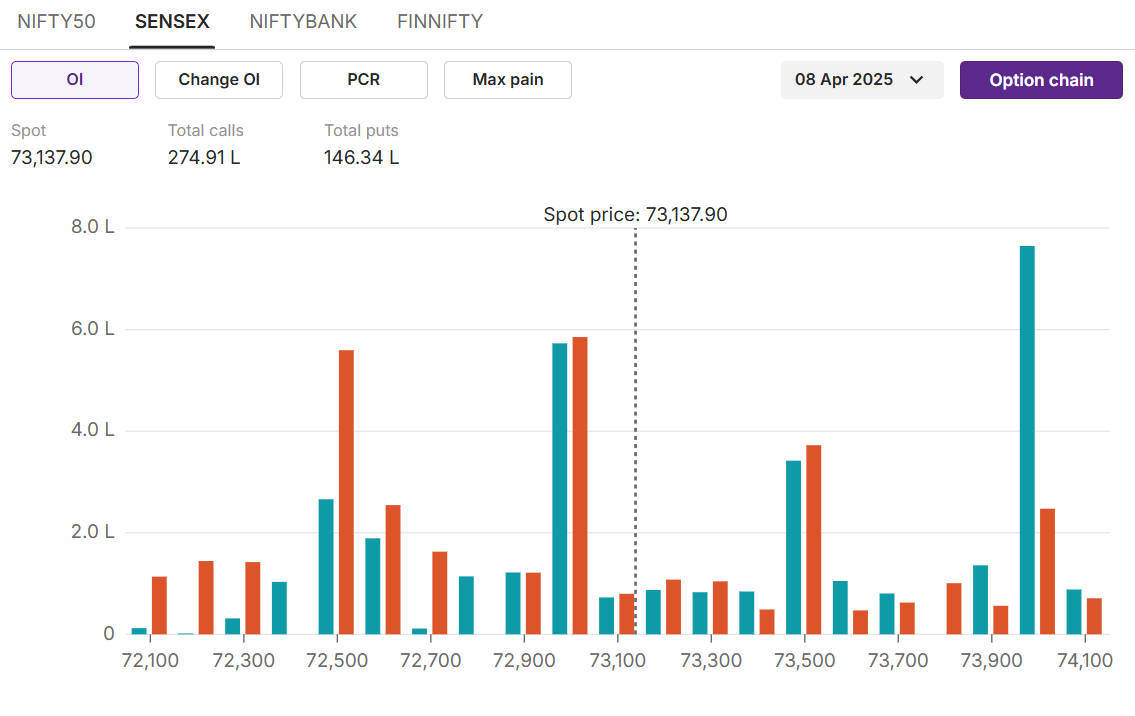

SENSEX

Max call OI:74,000 Max put OI:72,500 (Ten strikes to ATM, 08 April 2025)

After opening 5% lower on Monday, the index managed to close with losses of nearly 3%, indicating strong buying at lower levels. Similar to the NIFTY50, the SENSEX also managed to close above the swing low of 72,633 levels, indicating a near-term support at these levels may remain intact.

On the options front, the 74,000 strike price holds the highest open interest, indicating resistance at these levels. On the downside, the 72,500 puts hold the highest open interest indicating support for today’s expiry. As indicated earlier, the rising India VIX suggest high volatility on both sides, and the market may test both levels. Experts advise trading with caution.

On the options front, the 74,000 strike price holds the highest open interest, indicating resistance at these levels. On the downside, the 72,500 puts hold the highest open interest indicating support for today’s expiry. As indicated earlier, the rising India VIX suggest high volatility on both sides, and the market may test both levels. Experts advise trading with caution.

Foreign Institutional Investors (FIIs) sold Indian equities worth ₹9,040 crore. On the flip side, Domestic Institutional Investors (DIIs) bought equities worth ₹12,122 crore on Tuesday.

Foreign Institutional Investors (FIIs) sold Indian equities worth ₹9,040 crore. On the flip side, Domestic Institutional Investors (DIIs) bought equities worth ₹12,122 crore on Tuesday.Stock scanner

Long build-up:

Short build-up: Trent, JSW Steel, Tata Steel

Top traded futures contracts: HDFC Bank, Reliance, ICICI Bank

Top traded options contracts: HDFC Bank 1860 CE, HDFC Bank 1880 CE, SBIN 800CE

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story