Market News

Trade setup for April 29: Will NIFTY50 breakout above 24,500 on Tuesday? here's all you need to know

.png)

3 min read | Updated on April 29, 2025, 08:10 IST

SUMMARY

NIFTY50 and SENSEX continued it bullish momentum on Monday after pausing on Friday on jitters of Indo-Pak tensions. The rally was largely led by index heavyweights like Reliance Industries. Tuesday’s trade setup continues to remain on the bullish side with strong buying momentum at lower levels.

GIFT NIFTY indicates flat-to-positive opening of Indian markets on Tuesday. Image source: Shutterstock.

Asian markets at 7:30 am

GIFT NIFTY: 24,497 (+0.10)

Nikkei: 35,839 (+0.38%)

Hang Seng: 22,169 (+0.07%)

US markets

Dow Jones: 40,227 (+0.28%)

S&P 500: 5,528 (+0.06%)

NASDAQ: 17,366 (-0.10%)

The US benchmark indices closed lower after giving up early gains as weakness in the megacaps pulled the indices lower. The Dow Jones and S&P 500 managed to close in green, while NASDAQ closed in red on Monday. Nvidia shares slipped 3% amid reports that Huawei is preparing its own AI chips, thereby intensifying competition in the AI infrastructure space.

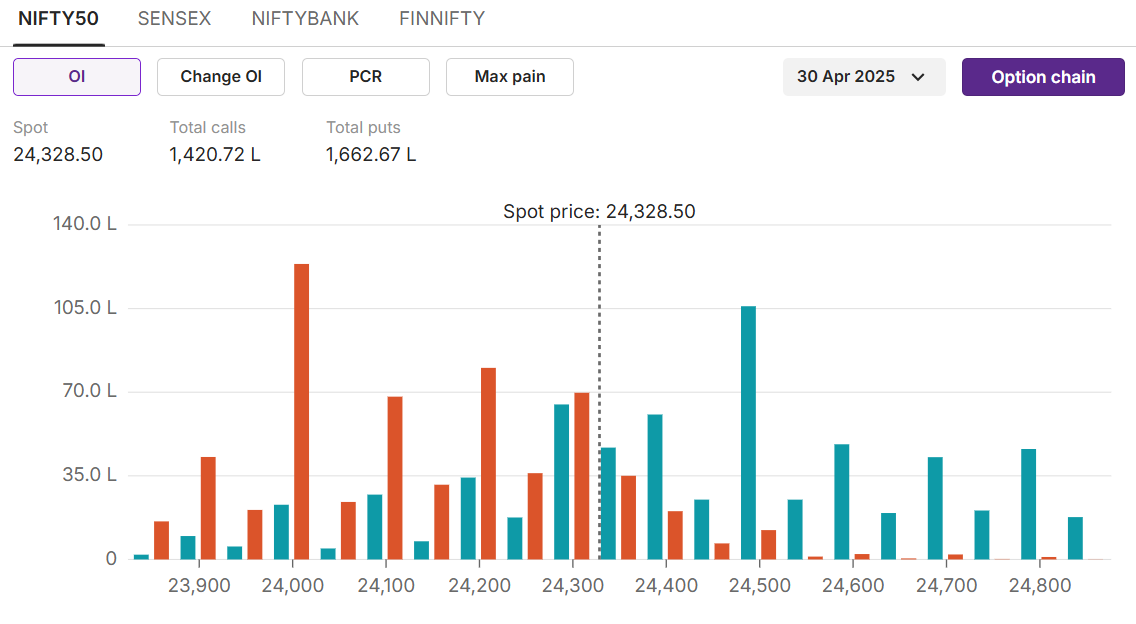

NIFTY50 Max call OI: 24,500 Max put OI: 24,000 (Ten strikes to ATM,30 April Expiry)

The index recouped all its losses on Friday and closed 1.2% higher on Monday. Markets rejoiced at the strong earnings growth of index heavyweight companies like Reliance Industries, the top index mover with 5% gains. Experts believe the overall bullish stance to continue amid strong buying strength by FIIs and DIIs.

On the technical front, the index formed a bullish engulfing pattern and negated the previous week’s fall. Index defended 24,000 levels and continued its bullish momentum. Experts believe the index could take resistance at the 24,500 levels for the current expiry.

On the technical front, the index formed a bullish engulfing pattern and negated the previous week’s fall. Index defended 24,000 levels and continued its bullish momentum. Experts believe the index could take resistance at the 24,500 levels for the current expiry.

On the options front, 24,000 puts witnessed heavy open interest addition, indicating a strong support for the index for 30 April expiry and 24,500 calls hold the highest open interest, which may act as a resistance.

On the options front, 24,000 puts witnessed heavy open interest addition, indicating a strong support for the index for 30 April expiry and 24,500 calls hold the highest open interest, which may act as a resistance.Stock scanner

Long build-up: Reliance, Sun Pharma, JSW Steel

Short build-up:

Top traded futures contracts: Reliance, HDFC Bank, RBL Bank

Top traded options contracts: Infy 1600 CE, HDFC Bank 2040 CE

Under F&O ban: RBL Bank

Out of F&O ban: Birlasoft, Hindustan Copper, National Aluminium, IREDA.

About The Author

Next Story