Market News

Trade setup for April 28: Will NIFTY50 defend 24,000 levels? Here's all you need to knw

.png)

3 min read | Updated on April 28, 2025, 08:00 IST

SUMMARY

The overall trade setup for Monday remains bullish, with positive global cues and continued buying strength at lower levels. GIFT NIFTY indicates a 100+ points gap-up opening for Indian markets on Monday. However, rising border tensions remain a key trigger to watch out for in today’s trading session.

GIFT NIFTY futures indicate positive opening for Indian markets on Monday. |Image source: Shutterstock.

Asian markets

GIFT NIFTY:24,270 (+0.7%)

Nikkei: 35,970 (+0.7%)

Hang Sensg: 21,851 (-0.2%)

US Markets

Dow Jones: 40,113 (+0.05)

NASDAQ: 17,382 (+1.2%)

S&P500: 5,525 (+0.74)

The US markets closed the previous week with more than 6% gains on the NASDAQ, 4% on the S&P 500 and 2.7% on the Dow Jones. The gains were largely driven by an optimistic outlook on the trade war as the Trump administration hinted at de-escalation between the US-China trade war. In addition, positive commentory from the Federal Reserve officials on potential rate cuts, boosted the investor sentiments.

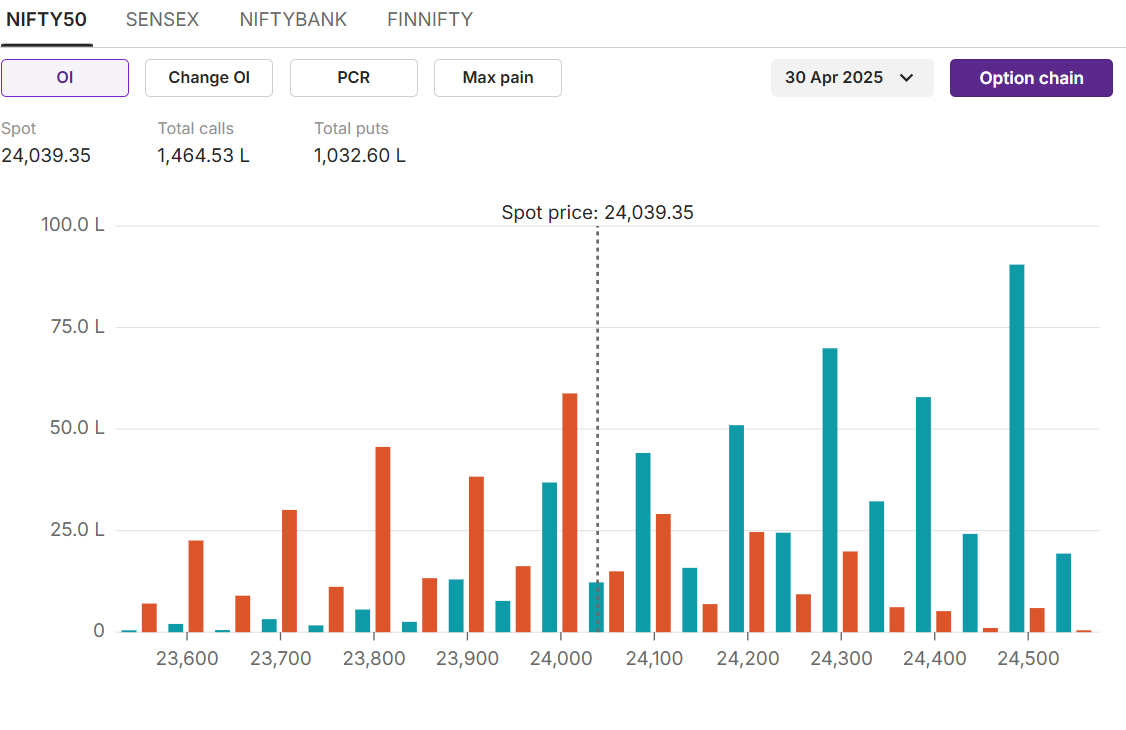

NIFTY50

Max call OI:24,500

Max put OI:24,000 (Ten strikes to ATM, 30 April expiry)

NIFTY50 closed the previous week with 0.3% gains despite volatility. After a sharp rally from lower levels, the index witnessed selling pressure at higher levels. Experts believe, 24,345 levels may remain the key resistance for next week amid heightened volatility.

On the options front, 24,500 calls hold the highest open interest for the current expiry, indicating a strong resistance at these levels. On the flipside, the 24,000 puts hold the highest open interest, indicating strong support at these levels.

On the options front, 24,500 calls hold the highest open interest for the current expiry, indicating a strong resistance at these levels. On the flipside, the 24,000 puts hold the highest open interest, indicating strong support at these levels.

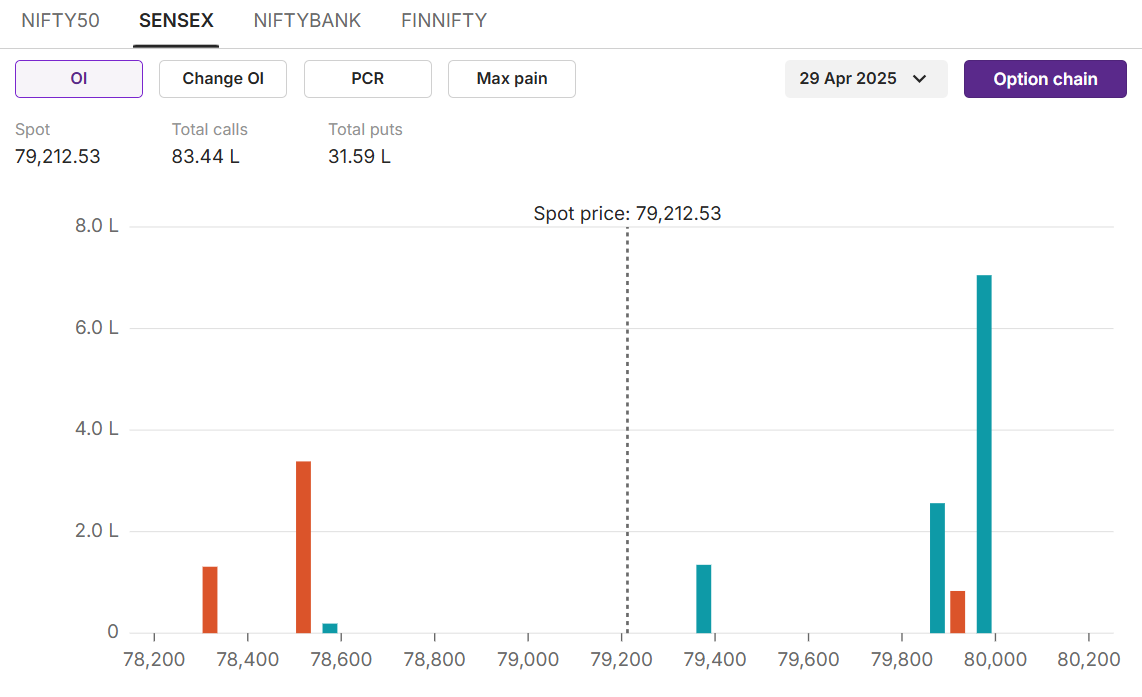

SENSEX

Max call OI:80,000

Max put OI:78,500 (Ten strikes to ATM, 29 April expiry)

SENSEX closed the previous week with 0.3% gains, maintaining the two-week winning streak. The index witnessed heavy selling pressure above the 80,000 levels, as investors preferred to be on sidelines amid rising tensions of war between India and Pakistan.

Stock scanner

Long build-up: SBILife

Short build-up: Shriram Finance, Adani Ports, Trent

Top traded futures contracts: Maruti, Reliance, Axis Bank

Top traded options contracts: Infy 1600 CE, HDFC Bank 2040 CE

Under F&O ban:, Mannapuram, RBL Bank. Out of F&O ban: Birlasoft, Hindustan Copper, National Aluminium, IREDA.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story