Market News

Trade setup for April 25: NIFTY50 in consolidation mode, 24500 remains key resistance; check details

.png)

3 min read | Updated on April 25, 2025, 08:01 IST

SUMMARY

NIFTY50 and SENSEX snapped the six-day rally on Thursday after benchmark indices closed 0.3% down. The gains were capped at previous swing high levels of 24,500 on NIFTY50 and 80,252 on SENSEX. Options data reveal a range-bound trade for the near term.

The technical setup for benchmark indices indicates rangebound trade on Friday. Image soruce: Shutterstock.

Asian Markets at 7 AM

Nikkei:35,535 (+1.4%)

Hang Seng: 22,081 (+0.81%)

US markets

Dow Jones: 40,093 (+1.23%)

NASDAQ: 17,166 (+2.7%)

S&P500: 5,484 (+2.03%)

The US markets closed with heavy gains on Thursday amid reports of trade talks with China surfaced again. In addition, the Cleveland Federal Reserve President hinted at a rate cut in June if the data supports the scenario. The gains were largely driven by megacaps as shares of Nvidia, Apple, Meta, and Amazon surged up to 3.5%.

NIFTY50

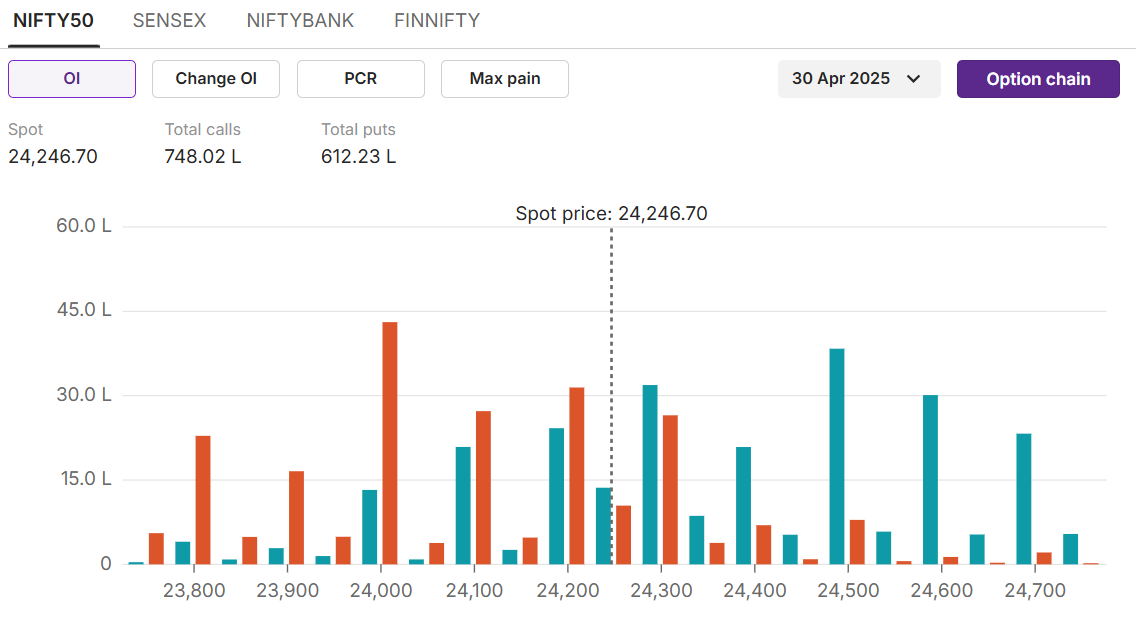

Max call OI:24,500 Max put OI:24,000 (Ten strikes to ATM, 30 April Expiry)

The index is seen in a consolidating mode with a positive bias on technical charts. Experts believe buying at lower levels will continue to hold the index above the 24,000 level. However, the upside also remained capped at the 24,500 level.

The index is seen in a consolidating mode with a positive bias on technical charts. Experts believe buying at lower levels will continue to hold the index above the 24,000 level. However, the upside also remained capped at the 24,500 level.

On the options front, the initial buildup for 30 April expiry suggests a similar range for the NIFTY50 to trade. 24,500 calls hold the highest open interest, and 24,000 strike puts hold the highest open interest, indicating resistance and support at respective levels.

On the options front, the initial buildup for 30 April expiry suggests a similar range for the NIFTY50 to trade. 24,500 calls hold the highest open interest, and 24,000 strike puts hold the highest open interest, indicating resistance and support at respective levels.SENSEX

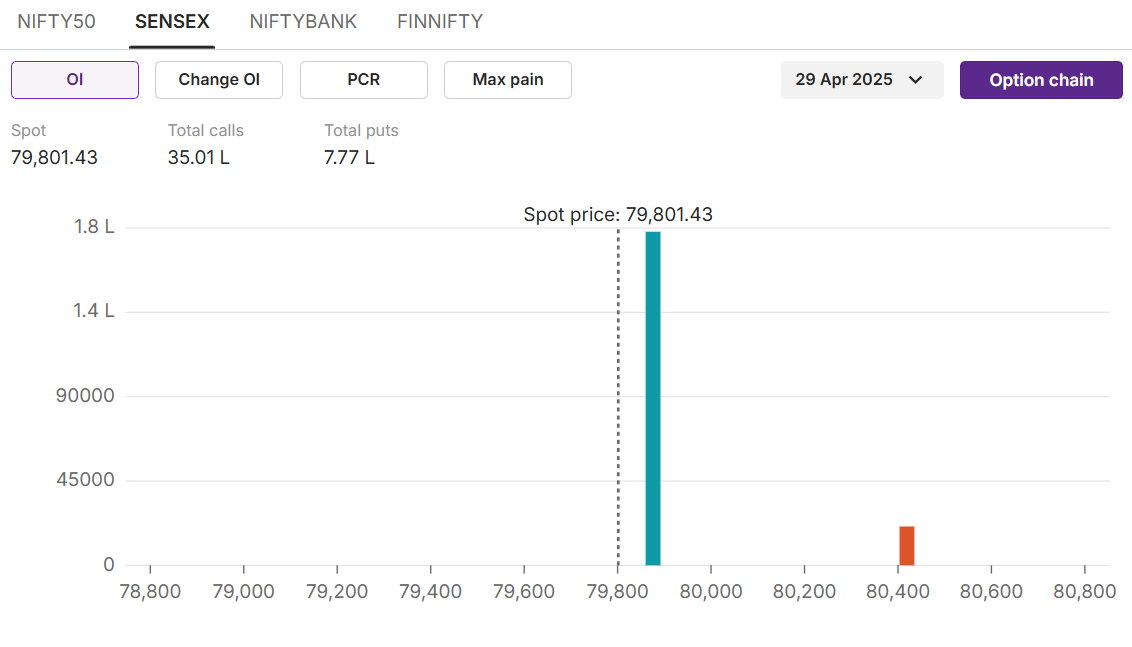

Max call OI:80,000 Max put OI:80,000 (Ten strikes to ATM, 29 April Expiry)

On the technical charts, the recent swing high of 80,254 could remain a key resistance level for the near term. Experts believe the index could rally further after breaking the recent swing high level on a closing basis.

On the technical charts, the recent swing high of 80,254 could remain a key resistance level for the near term. Experts believe the index could rally further after breaking the recent swing high level on a closing basis.

On the options front, the initial buildup for 29 April expiry indicates the 80,000 level as crucial for traders as it holds highest open interest on both side.

On the options front, the initial buildup for 29 April expiry indicates the 80,000 level as crucial for traders as it holds highest open interest on both side.Stock scanner

Long build-up: IndusInd Bank, Grasim

Short build-up: Hindustan Unilever, Eicher Motors

Top traded futures contracts: HDFC Bank, Bajaj Finance

Top traded options contracts: Infy 1600 CE

Under F&O ban:, Mannapuram, RBL Bank Out of F&O ban: Birlasoft, Hindustan Copper, National Aluminium, IREDA.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story