Market News

Trade setup for April 23: Will NIFTY50 breakout above 24,500 today? here's all you need to know

.png)

3 min read | Updated on April 23, 2025, 07:18 IST

SUMMARY

NIFTY50 and SENSEX are set for a gap-up opening on Wednesday morning amid positive global cues. The benchmark indices continue to rally for a fifth consecutive session on Tuesday. Experts believe NIFTY50 could face some resistance at the 24,500 levels.

NIFTY50 and SENSEX gain for fifth consecutive session on Tuesday. Image source: Shutterstock.

Asian markets at 7:00 am

GIFT NIFTY: 24,391 (+0.9%)

Nikkei: 34,857 (+1.9%)

Hang Seng: 22,076 (+2.43%)

US markets

Dow Jones: 39,186 (2.6%)

Nasdaq:16,300 (2.7%)

S&P 500:5,287 (2.5%)

The US benchmark indices witnessed strong gains on Tuesday across the board as the Trump administration signalled de-escalation in the current trade-war scenario. The Treasury Secretary, Scott Besett, suggested that the current tariff situation was “unsustainable” and hinted towards potential de-escalation between the US and China. Following the comments, the NASDAQ, Dow Jones and S&P 500 gained to close more than 2.5% higher on Tuesday.

NIFTY50

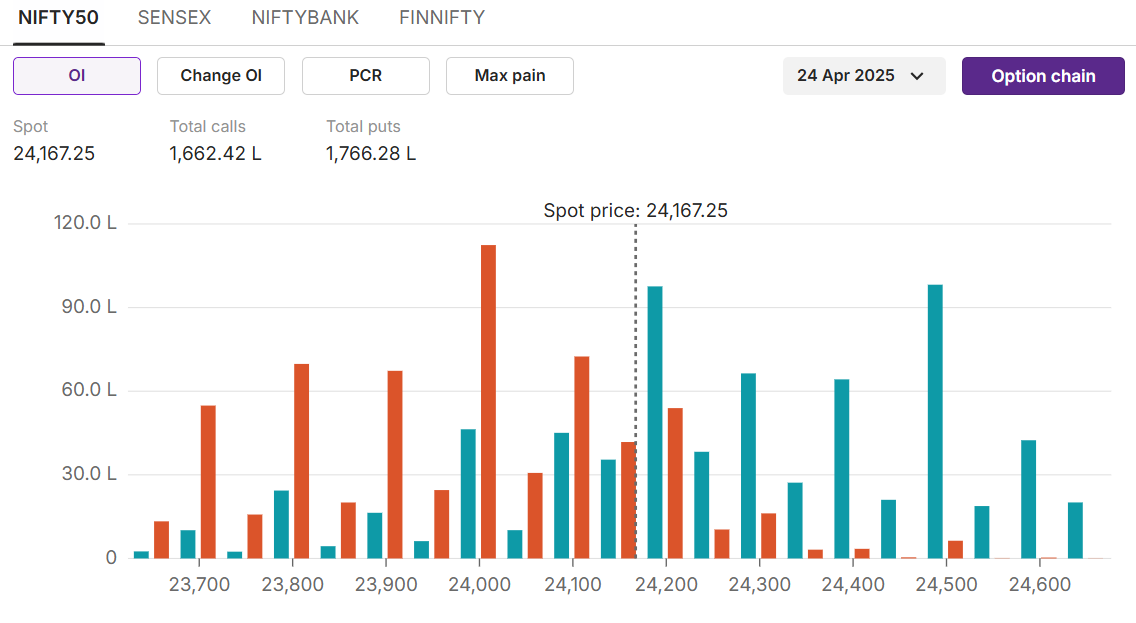

Max call OI:24,500 Max put OI:24,000 (Ten strikes to the ATM, 24 April expiry)

NIFTY50 closed modestly higher on Tuesday despite concerns over US President Donald Trump’s tariff trade war and his criticism of the Federal Reserve. Index started the session in green, followed by positive cues from Asian markets. Soon, the index turned volatile as market participants took note of the Ministry of Commerce & Industry’s report that the output of eight key infrastructure sectors slowed down to 3.8% in March 2025, as against 6.3% growth registered a year ago.

However, index manage to gain some traction as traders took support of Finance Minister Nirmala Sitharaman’s statement that India is ‘actively engaging’ with the new US administration and hopes to conclude the first tranche of the bilateral trade agreement ‘positively’ by fall (September-October) this year. Sentiments remained positive throughout the day amid foreign fund inflows and Nifty closed above 24,150 mark.

Most of the sectoral indices ended in green except IT and Oil & Gas stocks. The top gainers from the F&O segment were IIFL Finance, Dixon Technologies (India) and Max Healthcare Institute. On the other hand, the top losers were Cholamandalam Investment and Finance Company, IndusInd Bank and Cyient.

Stock scanner

Long build-up: ITC, M&M

Short build-up: IndusInd Bank

Top traded futures contracts: HDFC Bank, Reliance,

Top traded options contracts: HDFC Bank 1980 CE, SBIN 830 CE

Under F&O ban:, Mannapuram, RBL Bank Out of F&O ban: Birlasoft, Hindustan Copper, National Aluminium, IREDA.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story