Market News

Trade setup for April 21: NIFTY50 signals positive crossover on daily charts; here's all you need to know

.png)

4 min read | Updated on April 21, 2025, 07:35 IST

SUMMARY

Indian benchmark indices were the top performers amongst the key global markets with 4.4% gains for the week. The strong rally was led by all-around buying in the diversified sectors like banks, media, consumer durable, defence and more. The technical structure for Indian markets continues to remain bullish with NIFTY50 and SENSEX closing above 50 WMA levels.

Technical structure for Indian markets continues to remain bullish. Image source: Shutterstock.

Asian markets at 7:00 am

GIFT NIFTY: 23,804 (+0.02%)

Nikkei: 34,367 (-1%)

Hang Seng: 21,395 (+1.6%)

US markets

The US markets were closed the week of red after gaining more than 5% in the previous week. US markets continue to face the brunt of an ongoing trade war with China. Initial numbers for April suggest a substantial drop in trade between the two nations. The US president continues to intensify as he imposed 245% tariffs on China. Following the huge volatility, Dow Jones, Nasdaq and S&P 500 closed 2.6%, 2.3% and 1.6% lower for the week.

NIFTY50

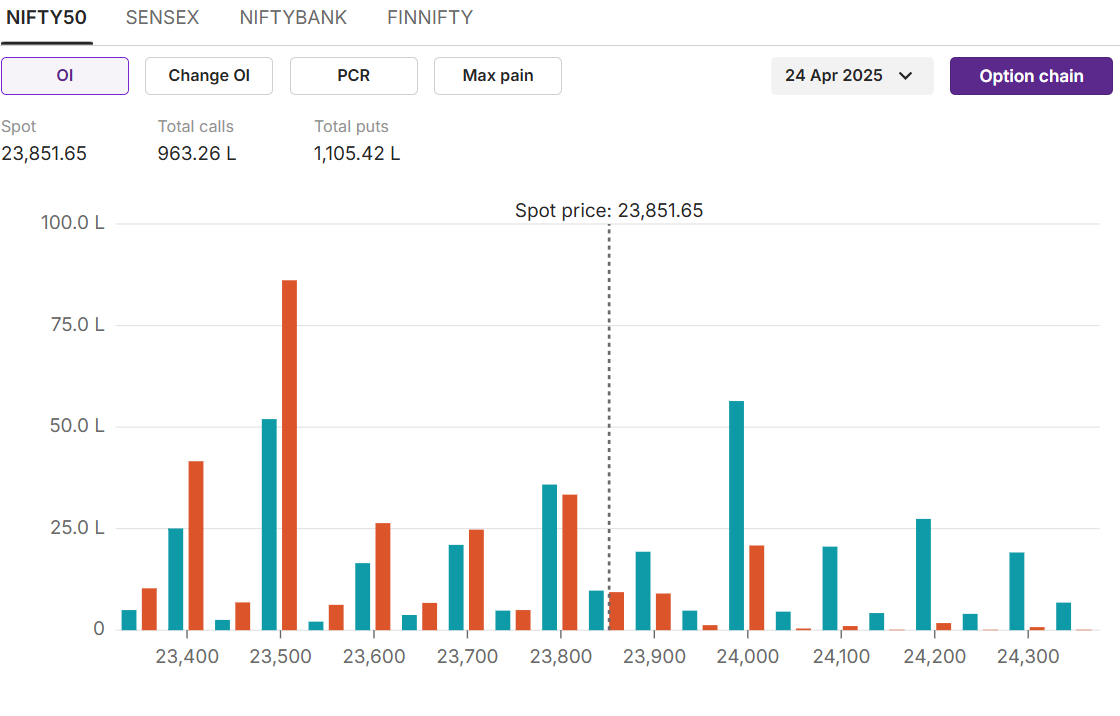

Max call OI:24,000 Max put OI:23,500 (Ten strikes to ATM, 24 April Expiry)

NIFTY50 and SENSEX closed the holiday-shortened week on a strong note by gaining more than 4.4%. Inflation data, strong buying by FII and all-around optimism in banking and finance institutions largely drove the rally in the Indian markets. External factors also cooled off as the Trump administration exempted smartphones, semiconductors and other key equipment from the reciprocal tariff list. This was followed by delaying the tariff imposition by 90 days for key trading nations, except China.

On the technical side, NIFTY50 closed above the previous swing high closing levels of 23,669. On the weekly charts, NIFTY50 closed above its 50 WMA levels at 23,742, indicating a positive breakout on the charts. In addition, the index also broke the downward sloping channel pattern from the record high levels of 26,270, which further boosted the investor confidence in the Indian markets.

On the technical side, NIFTY50 closed above the previous swing high closing levels of 23,669. On the weekly charts, NIFTY50 closed above its 50 WMA levels at 23,742, indicating a positive breakout on the charts. In addition, the index also broke the downward sloping channel pattern from the record high levels of 26,270, which further boosted the investor confidence in the Indian markets. On the daily charts, NIFTY50 now comfortably traded above 20, 50 and 200 EMA. Moreover, the index is also expected to witness a positive crossover of 20 EMA crossing 50 EMA from below. This indicates continuity of bullish stance in the index.

On the daily charts, NIFTY50 now comfortably traded above 20, 50 and 200 EMA. Moreover, the index is also expected to witness a positive crossover of 20 EMA crossing 50 EMA from below. This indicates continuity of bullish stance in the index. On the options front, the Initial buildup on the current week expiry suggests 24,000 as a strong resistance level, with the highest open interest at the respective call strike price. Similarly, on the flipside 23,500 strike price puts hold the highest open interest, indicating strong support on the downside.

On the options front, the Initial buildup on the current week expiry suggests 24,000 as a strong resistance level, with the highest open interest at the respective call strike price. Similarly, on the flipside 23,500 strike price puts hold the highest open interest, indicating strong support on the downside.SENSEX

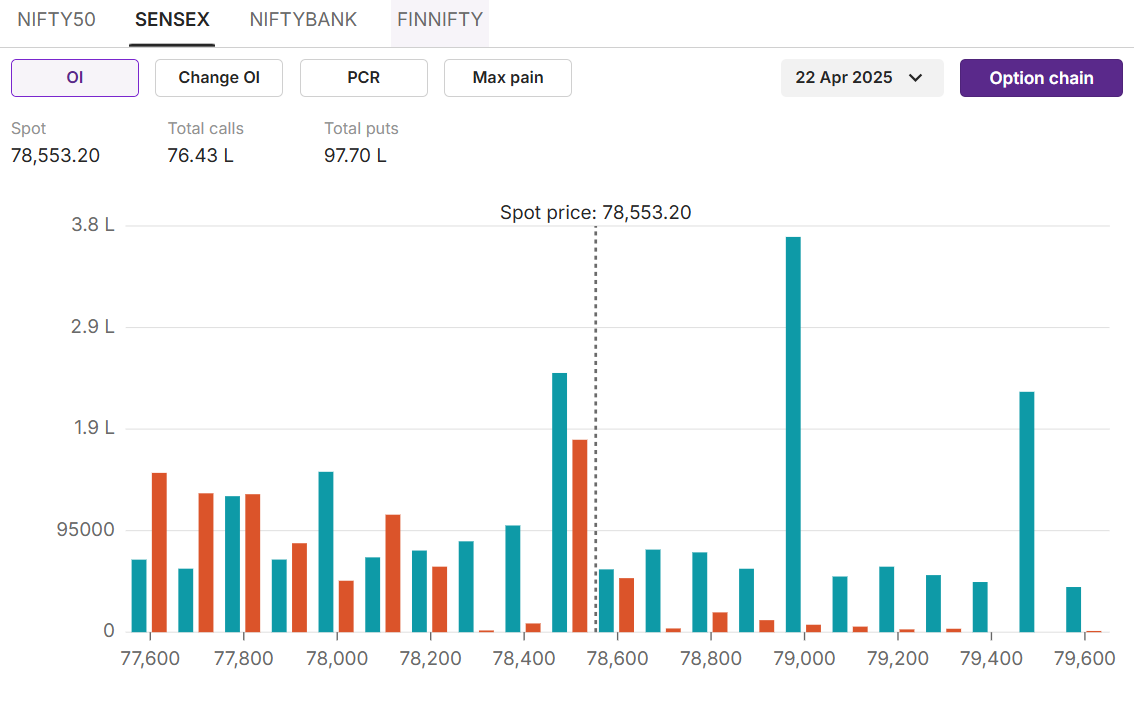

Max call OI:79,000 Max put OI:78,500 (Ten strikes to the ATM, 22 April expiry)

SENSEX surged 3395.94 points or 4.52% to 78,553.20 during the week ended April 17, 2025. The rally was largely driven by strong FII buying in all sectors and optimism around Q4FY25 results. India’s top two private sector lenders, HDFC Bank and ICICI Bank, announced their Q4FY25 results over the weekend. The two stocks gained more than 5% for the week, respectively, thereby aiding the overall index performance.

On the daily charts, SENSEX is also expected to witness a positive crossover of 20 EMA crossing 50 EMA from below. Experts believe the next key resistance level for the index lies at the 82,204 level.

On the daily charts, SENSEX is also expected to witness a positive crossover of 20 EMA crossing 50 EMA from below. Experts believe the next key resistance level for the index lies at the 82,204 level.

On the options front, 79,000 calls hold the highest open interest, indicating resistance for the current expiry. On the flipside, 78,500 put holds the highest open interest, indicating support at these levels for the expiry.

On the options front, 79,000 calls hold the highest open interest, indicating resistance for the current expiry. On the flipside, 78,500 put holds the highest open interest, indicating support at these levels for the expiry.

Stock scanner

Long build-up: Sun Pharmaceuticals, ICICI bank,Bharti Airtel

Short build-up: Wipro

Top traded futures contracts: HDFC Bank, Reliance, ICICI Bank

Top traded options contracts: SBIN 800 CE, Reliance 1300 CE

Under F&O ban: Birlasoft, Hindustan Copper, Mannapuram, National Aluminium, IREDA.

Out of F&O ban: Nil.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story