Market News

Expiry trade setup: Will NIFTY50 defend 24,300 on Thursday? Here's all you need to know

.png)

3 min read | Updated on April 30, 2025, 07:57 IST

SUMMARY

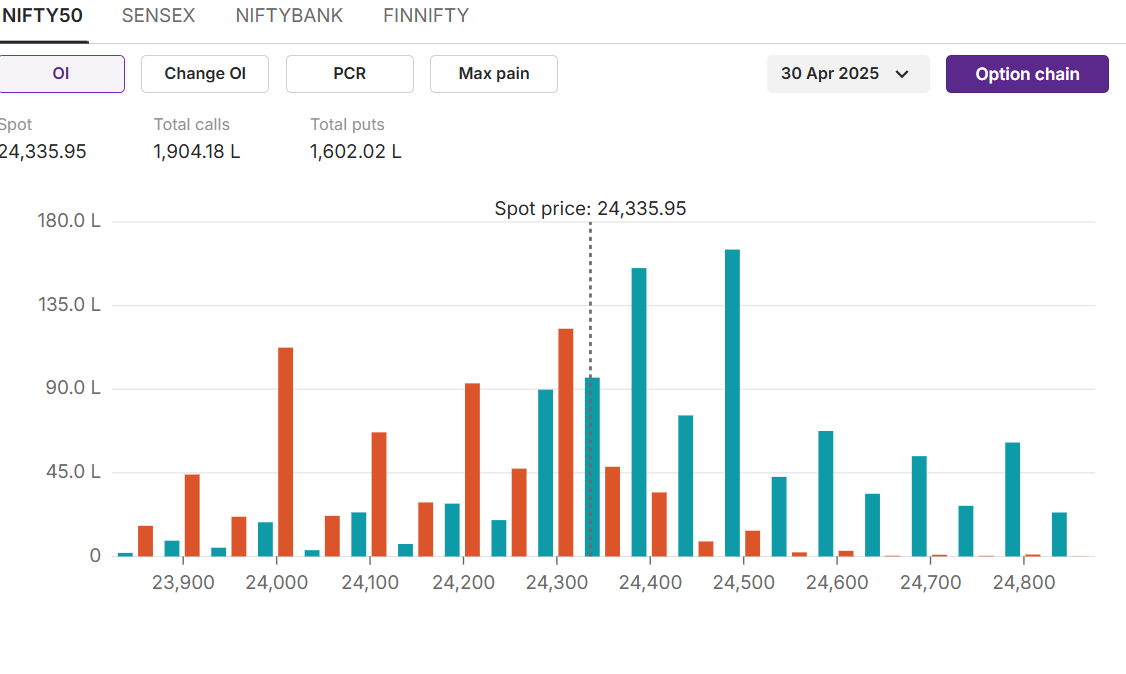

NIFTY50 is on the verge of forming an evening star pattern, indicating a reversal from the current levels. The expiry day trade setup remains neutral with the expectation of range-bound movement. The option chain indicates 24,300 to 24,500 as a probable range of expiry for the index.

At 07:08 AM on Wednesday, the GIFT NIFTY futures level suggested that the NIFTY50 index will open 53 points lower. | Image: Shutterstock

NIFTY50

Max call OI: 24,500 Max put OI: 24,300 (Ten strikes to ATM, 30 April expiry)

On technical charts, the index is on the verge of forming an evening star pattern, which indicates a probable reversal in the investment stance from slightly bullish to bearish. Experts believe the recent swing high of 24,457 could remain as a near-term resistance for the index.

On technical charts, the index is on the verge of forming an evening star pattern, which indicates a probable reversal in the investment stance from slightly bullish to bearish. Experts believe the recent swing high of 24,457 could remain as a near-term resistance for the index. On the 15-minute chart, the index continued to defend the 21 EMA levels. However, a breakdown below the 50 EMA level of 24,300 could lead the index to the 24,000 level.

On the 15-minute chart, the index continued to defend the 21 EMA levels. However, a breakdown below the 50 EMA level of 24,300 could lead the index to the 24,000 level.Options Buildup

Bullish outlook

Traders with bullish sentiment can execute a long call strategy by buying 24,300 calls. The strategy would turn profitable after the index moves above 23,363.

Bearish outlook

Traders with a bearish outlook can execute a long put strategy by buying a put strike of 24,350. The strategy would turn profitable after the index moves below the 24,280 level.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story