Market News

Expiry trade setup: Will NIFTY50 continue bullish momentum on Thursday? Here’s all you need to know

.png)

3 min read | Updated on April 24, 2025, 08:10 IST

SUMMARY

NIFTY50 continued its bullish momentum on Wednesday by gaining more than 160 points. The overall trade setup continues to remain bullish with some bias towards profit booking at higher levels. Experts believe the immediate resistance for the index could come at 24,500 levels.

GIFT NIFTY indicates positive opening on Thursday. Image source: Shutterstock.

NIFTY50

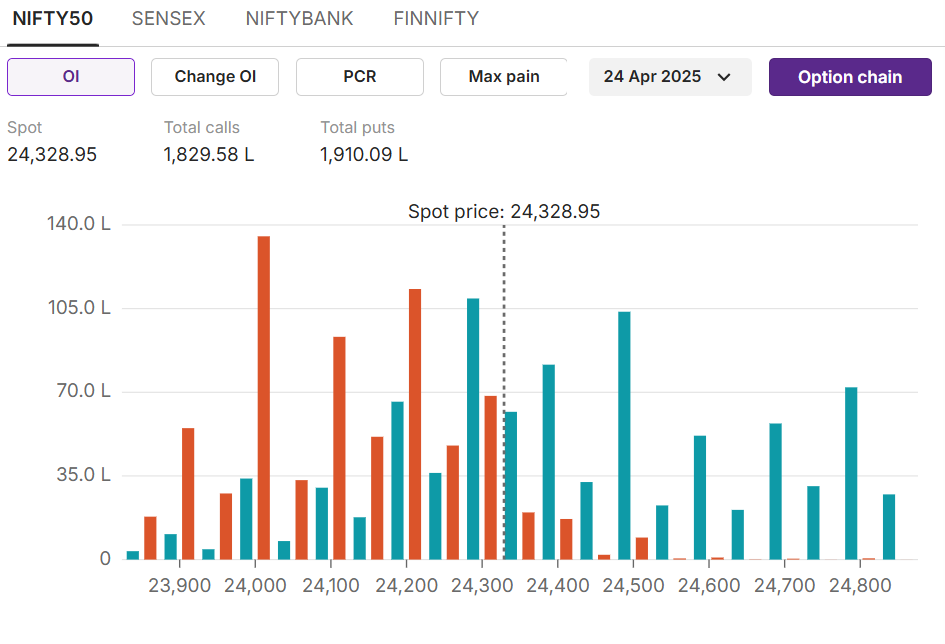

Max call OI:24,500 Max put OI:24,500

NIFTY50 index closed with gains on Wednesday for the sixth consecutive session. The rally was surprisingly led by IT stocks, which rallied higher in optimism around Q4 results and gains in the US tech stocks after reports of de-escalation between China and the US trade war. For today, the overall trade setup continues to remain bullish with positive global and domestic cues. However, experts believe Wednesday’s swing high could remain a key resistance level on Thursday.

On the daily chart, the NIFTY50 formed a hanging man candlestick pattern, which is considered to be a bearish signal after a strong rally. NIFTY50 has continued bullish momentum for the sixth consecutive session and gained more than 12% from the recent lows. The consistent rally from lower levels increases the odds for some profit-booking at higher levels.

On the daily chart, the NIFTY50 formed a hanging man candlestick pattern, which is considered to be a bearish signal after a strong rally. NIFTY50 has continued bullish momentum for the sixth consecutive session and gained more than 12% from the recent lows. The consistent rally from lower levels increases the odds for some profit-booking at higher levels.

Options buildup

Traders looking to trade with bearish sentiment can continue with a bear-put strategy by buying 24,300 puts and selling 24,000 puts. The strategy would help in having a bearish stance amid profit booking with a moderate bullish outlook.

Traders looking to trade with bearish sentiment can continue with a bear-put strategy by buying 24,300 puts and selling 24,000 puts. The strategy would help in having a bearish stance amid profit booking with a moderate bullish outlook.Traders with bullish sentiment can execute a long call strategy by buying 24,300 calls. The strategy would turn profitable after the index moves above 23,363.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story