Market News

Expiry Trade setup: Options data shows narrow range of 24,300 to 24,500 for NIFTY50; here's all you need to know

.png)

3 min read | Updated on May 08, 2025, 08:02 IST

SUMMARY

NIFTY50 managed to close in green on Wednesday after opening lower due to geopolitical tensions. Experts belive the consolidation to continue in the Indian markets due to mixed cues. The GIFT NIFTY indicates a flat opening for NIFTY50 on expiry day.

GIFT NIFTY indicates a flat opening for Indian markets on Thursday. Image source: Shutterstock.

NIFTY50

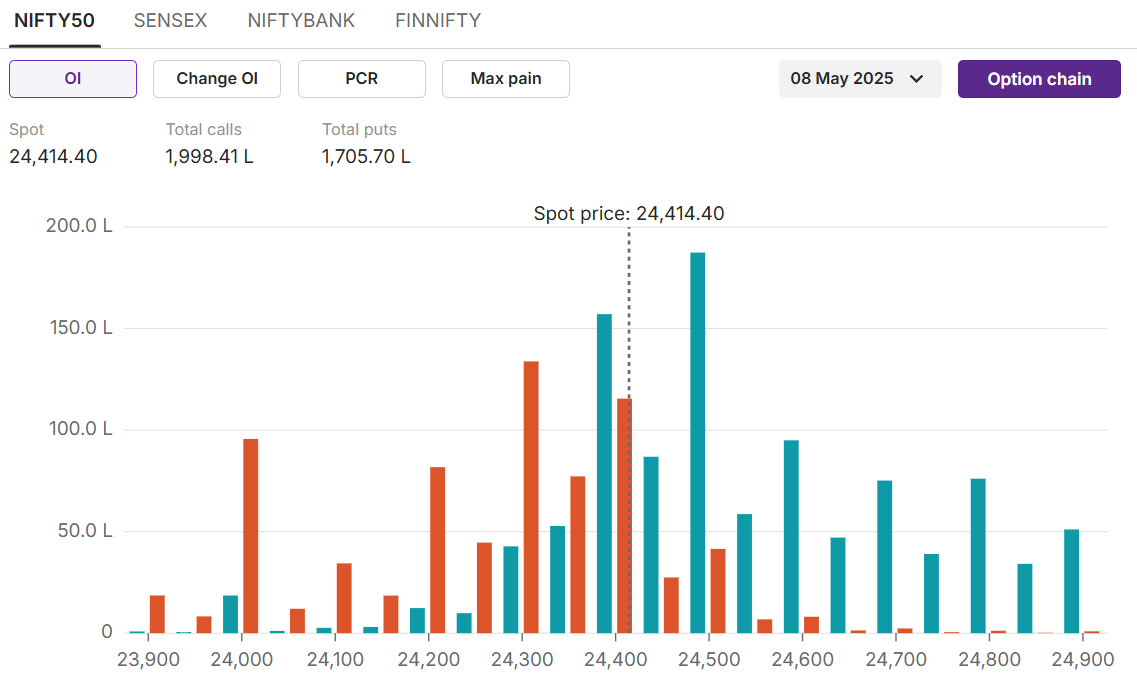

Max call OI: 24,500

Max put OI: 24,300

(Ten strikes to ATM, 08 May expiry)

NIFTY50 opened lower on Wednesday as India and Pakistan tensions rose after India attacked Pakistan. However, the index managed to close in green by recouping all the losses. The recovery was largely led by index heavyweights like HDFC Bank and M&M, which pulled the index higher by 60 points.

On daily charts, the index continues to trade in a range of 24,000 to 24,500, keeping traders on the edge for a breakout. Experts believe the index is expected to consolidate further before it gives a breakout on either side of the range.

On daily charts, the index continues to trade in a range of 24,000 to 24,500, keeping traders on the edge for a breakout. Experts believe the index is expected to consolidate further before it gives a breakout on either side of the range.

Bullish outlook

Traders with bullish sentiment can execute a long call strategy by buying 24,400 calls. The strategy would turn profitable after the index moves above 23,441.

Bearish outlook

Traders with a bearish outlook can execute a long put strategy by buying a put strike of 24,450. The strategy would turn profitable after the index moves below the 24,354 level.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommended. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story