Market News

Swiggy vs Eternal: Who dominated in Q4 earnings?

.png)

3 min read | Updated on May 12, 2025, 14:14 IST

SUMMARY

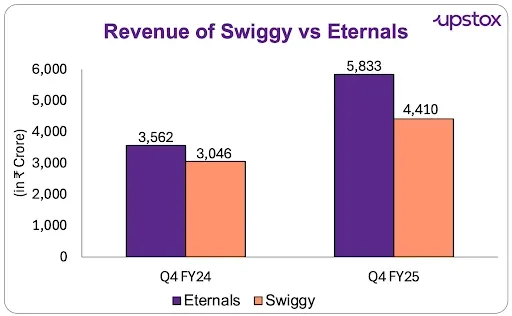

Swiggy and Eternal (Zomato) reported strong Q4FY25 revenue growth but declining profitability. Swiggy's revenue rose 44.8% YoY to ₹4,410 crore with a ₹1,081 crore loss, while Eternal posted ₹5,833 crore revenue and ₹39 crore profit. Eternal stayed marginally profitable despite Blinkit-driven expansion, while Swiggy posted deeper losses. Quick commerce expansion, margin pressure, and sluggish demand in the food delivery segment impacted the business.

Swiggy reported consolidated revenue of ₹15,227 crore in FY25, up 35% YoY, while Eternal posted a 67% YoY rise in FY25 revenue to ₹20,243 crore.

Food delivery aggregator Swiggy and Eternal (erstwhile Zomato Ltd) have released their Q4 earnings. Swiggy announced its earnings on Friday, May 9, while Zomato Q4 numbers were declared on May 1. Both companies reported a substantial rise in revenue, but a significant drop in profitability.

Revenue rises, but profitability takes a hit

Swiggy posted ₹4,410 crore in revenue, up 44.8% YoY, with losses widening to ₹1,081 crore. Eternal outpaced on revenue at ₹5,833 crore (up 63.8% YoY), though net profit dropped to ₹39 crore from ₹175 crore in Q4 FY24. Sluggish demand in the food delivery business and rapid investment in expanding the quick commerce store network impacted the profitability for both companies. Meanwhile, Eternal continues to maintain some profitability with cautious cost scaling, while Swiggy continues to prioritise expansion, even at the cost of short-term losses.

For the entire fiscal year, Swiggy reported consolidated revenue of ₹15,227 crore, up 35% compared to ₹11,247 crore in FY24. Meanwhile, its rival Eternal posted a 67% YoY rise in FY25 revenue to ₹20,243 crore. For the full year, Zomato’s profit rose 50% YoY to ₹527 crore, while Swiggy’s loss for FY25 rose by 33% YoY to ₹3,117 crore.

Food Delivery: Efficiency begins to show

Swiggy’s Gross Order Value (GOV) in food delivery reached ₹7,347 crore with adjusted EBITDA margins improving to 2.9%, a significant uplift from 0.5% last year. Eternal reported ₹9,778 crore GOV and a 5.2% EBITDA margin on Net Order Value (NOV), continuing to benefit from scale and maturity. According to Jefferies, Swiggy’s gains were aided by improved route density and take rates, though its breakeven timeline has now shifted by 3-5 quarters later than previously anticipated.

Quick Commerce: Growth vs Margin pressure

Swiggy’s Instamart GOV doubled YoY to ₹4,670 crore, with Average Order Value (AOV) up 13.3% to ₹527. Eternal’s Blinkit GOV rose to ₹9,421 crore, but AOV fell to ₹665 from ₹707 in Q3 FY25. The platforms’ contrasting strategies are playing out—Swiggy emphasising assortment and value, Eternal driving scale and penetration. Blinkit’s margins declined despite volume gains, reflecting the challenges of customer acquisition and accelerated dark store expansion amid intensifying competition from both existing and new players.

Swiggy added 316 dark stores (total 1,021), while Eternal added 294 (total 1,301), which is an indicator of sustained infrastructure build-outs despite margin stress.

Q4 FY25 snapshot

| Metric | Swiggy | Eternal (Zomato) |

|---|---|---|

| Revenue | ₹4,410 crore | ₹5,833 crore |

| Net Profit / Loss | ₹(1,081) crore | ₹39 crore |

| Food Delivery GOV | ₹7,347 crore | ₹9,778 crore |

| Quick Commerce GOV | ₹4,670 crore | ₹9,421 crore |

| Quick Commerce AOV | ₹527 | ₹665 |

| Total Dark Stores | 1,021 | 1,301 |

| Monthly Transacting Users (Food) | 15.1 million | 20.9 million |

| Monthly Transacting Users (Q/C) | 9.8 million | 13.7 million |

Sharpening focus

Both players exited experimental verticals during the quarter: Swiggy from alcohol delivery; and Eternal from Zomato Everyday, signalling a refined focus on high-potential categories. These decisions reflect an industry-wide pivot toward core strengths and capital discipline.

Eternal and Swiggy's share price trend

So far in 2025, Eternal shares are down 14.4%, while Swiggy shares are down over 41%. Shares of Eternal are currently trading around 22% lower than their all-time high level of ₹304.50 touched on December 5, 2024. Swiggy shares are down 48% from its recent high of 617.30 set on 23 December, 2024.

About The Author

Next Story