Stock Market Highlights: SENSEX ends 412 pts lower on Indo-Pak conflict, NIFTY settles at 24,274; NIFTY MIDCAP 100 crashes 2%

.png)

5 min read | Updated on May 08, 2025, 16:18 IST

SUMMARY

The Indian equity benchmarks, BSE SENSEX and the NSE NIFTY50, ended with notable losses after trading in a range for most of the session, as the rising border tensions between India and Pakistan unnerved investors. At close, the BSE SENSEX stood at 80,334.81, down 411.97 points, or 0.51%, while the NSE's NIFTY50 index settled at 24,273.80, down 140.60 points, or 0.58%.

The market breadth was in favour of declines. | Image: Shutterstock

Stock Market Highlights

- The NIFTY MIDCAP 100 index closed 1058.45 points, or 1.95%, lower at 53,229.30 levels.

- The NIFTY SMALLCAP 100 index settled at the 16,183.75 level, down 1.42%.

- NIFTY IT (+0.23%) and NIFTY Media (+0.20%) were the only sectoral indices to end in the positive territory.

- Among sectoral indices, NIFTY REALTY (-2.47%), NIFTY METAL (2.09%) and NIFTY HEALTHCARE (-1.95%) were the top laggards.

- Foreign institutional investors bought shares worth ₹2,585.86 crore on Wednesday, data from the National Stock Exchange showed.

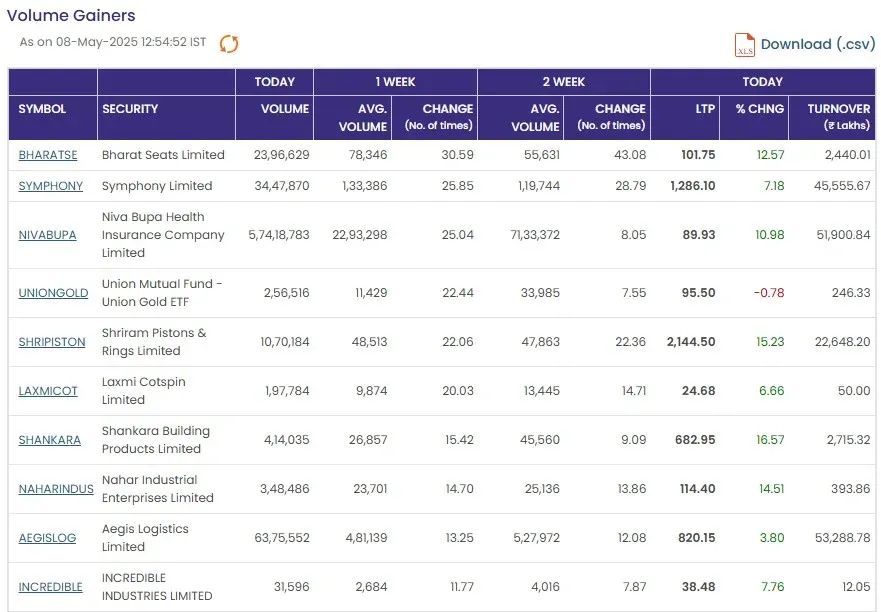

- Bharat Seats, Symphony Limited, Niva Bupa Health Insurance Company and Shriram Pistons & Rings Limited were among the high-volume stocks today.

- Rupee depreciated sharply by 84 paise to close at 85.61 (provisional) against the US dollar on Thursday, weighed down by heightened geopolitical tensions between India and Pakistan.

May 08, 2025, 16:18 PM

NIFTY 50 top gainers and losers

Axis Bank, HCL Technology, Kotak Mahindra Bank, Titan and Tata Motors were among the top gainers on the NIFTY50 today.

However, Shriram Finance, Eternal Ltd, Mahindra & Mahindra, Adani Enterprises and Hindalco Industries dragged the index down.

May 08, 2025, 15:51 PM

CLOSING BELL

At close, the BSE SENSEX stood at 80,334.81, down 411.97 points, or 0.51%, while the NSE's NIFTY50 index settled at 24,273.80, down 140.60 points, or 0.58%.

May 08, 2025, 15:43 PM

Polycab vs RR Kabel vs KEI Industries: Who performed better in Q4 FY25 results? Here is the analysis

The three key players in India’s cables and wires segment reported a more than 25% YoY jump in quarterly revenue for the March quarter. Polycab India’s total revenue grew by 25% YoY to ₹6,948 crore, KEI Industries saw a growth of 25.1% to ₹2,915 crore, and RR Kabel posted a 26% YoY jump in revenue at ₹2,217 crore. READ MOREMay 08, 2025, 15:31 PM

Stock Market LIVE update | NIFTY MIDCAP 100 index tanks 885 points

The NIFTY MIDCAP 100 index was trading 885 points, or 1.63%, lower at 53,401.90 levels.

May 08, 2025, 15:17 PM

Stock Market LIVE update | India VIX spikes nearly 9% on cross-border tensions

India VIX, the volatility index, jumped nearly 9% amid India-Pakistan tensions. Volatility Index is a measure of the market’s expectation of volatility over the near term. Volatility is often described as the “rate and magnitude of changes in prices," and in finance often referred to as risk.

May 08, 2025, 15:17 PM

Stock Market LIVE update | Defence stocks deliver return up to 35% in 2025 amid India-Pakistan conflict

Indian defence stocks have become a standout sector for investors in 2025, consistently delivering impressive double-digit returns despite broader market volatility. This surge has been driven by a combination of geopolitical developments, strong government support and robust order inflows, making defence companies attractive bets for long-term growth. READ MOREMay 08, 2025, 15:18 PM

Stock Market LIVE update | Asian Paints Q4 profit drops 45% YoY; volume growth comes in at 1.8%

The numbers were below Street estimates. The stock was trading at ₹2,326.70 on the NSE, down 0.32%, after the March quarter results.

May 08, 2025, 15:18 PM

Stock Market LIVE update | Bharat Forge shares trade 2% lower after Q4 results, dividend announcement

Bharat Forge said its board has recommended a final dividend of ₹6.00 per equity share of the face value of ₹2 each of the company (at the rate of 300%) for the financial year ended March 31, 2025, subject to approval of the members of the company at the ensuing annual general meeting (AGM) of the company.

The final dividend, if approved by the members, will be paid on or after Tuesday, August 12, 2025.

May 08, 2025, 15:18 PM

Stock market LIVE update | HCL Technologies share price surges 1.2%

HCL Technologies stock trades 1.19% higher at ₹1,581.9 apiece on NSE.

The company informed stock exchanges that it has been selected as an end-to-end IT services partner by Taylor Wimpey, one of the UK's largest residential developers.

As part of the multi-year collaboration, HCL Tech will deploy a comprehensive suite of IT services to modernise Taylor Wimpey's IT landscape. These will include data services, AI capabilities, application and infrastructure management, network services, cybersecurity and workplace solutions.

The stock is one of the top contributors on the Nifty IT index.

May 08, 2025, 14:26 PM

Stock market LIVE update | Canara Bank Q4 earnings impact: Shares jump 3%

Shares of Canara Bank were trading at ₹96.33 apiece on the NSE, surging 2.8% after the lender released its Q4 earnings.

The public sector bank reported a 33.14% surge in its standalone net profit to ₹5,002.66 crore in the fourth quarter of the financial year 2024-25. It had reported a net profit of ₹3,757 crore in the corresponding period of the previous fiscal year.

The bank's board also recommended a dividend of ₹4 per equity share with a face value of ₹2 each for FY25, subject to shareholders' approval at the ensuing annual general meeting (AGM).

May 08, 2025, 13:49 PM

Stock market LIVE update | High volume stocks today

Among the high-volume buzzers, counters of Bharat Seats, Symphony Limited, Niva Bupa Health Insurance Company and Shriram Pistons & Rings Limited topped the charts.

May 08, 2025, 13:35 PM

Stock market LIVE update | Mastek shares jump nearly 5% on this update

Mastek Limited shares zoomed 5% as the company partnered with Zulekha Healthcare Group to drive digital transformation with Oracle Fusion Cloud.

Zulekha Healthcare Group, a UAE-based leading healthcare provider, aims to enhance financial oversight, streamline inventory and procurement processes, reduce manual interventions, strengthen compliance, and enable data-driven decision-making.

“Leveraging Mastek’s close working relationship with Oracle and deep healthcare domain expertise, we empower organisations like Zulekha Healthcare Group to achieve smarter, faster, and more patient-centric operations. We are committed to supporting their transformation journey and are excited to drive innovation and deliver measurable outcomes together,” said Surya Nunna, Executive Vice President, AMEA, Mastek.

This transformation aligns with Zulekha’s vision of delivering “Patient First” healthcare while enhancing clinical workflows, operational efficiency, and fiscal agility.

Following this, shares of Mastek Limited were trading 4.7% higher at ₹2,192.9 apiece on NSE.

May 08, 2025, 13:12 PM

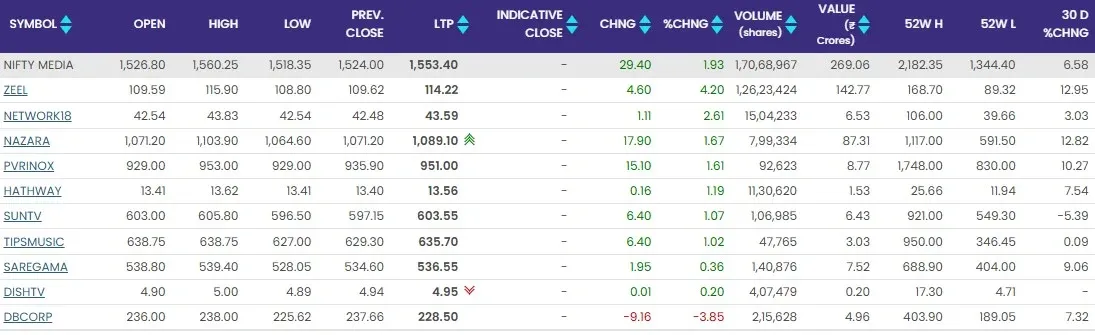

Stock market LIVE update | Sector update: Nifty Media up 1.93%

Except for DB Corp India, all the stocks on the Nifty Media index are trading higher.

Zee Entertainment shares took the leading position, soaring 4.2%, followed by Network18 Media & Investments (2.61%), Nazara Technologies (1.67%), PVR Inox (1.61%) and Hathway Cable & Datacom (1.19%).

Nifty Media index trading 1.93% higher.

Meanwhile, shares of DB Corp slipped 3.85% post March quarter earnings.

May 08, 2025, 12:55 PM

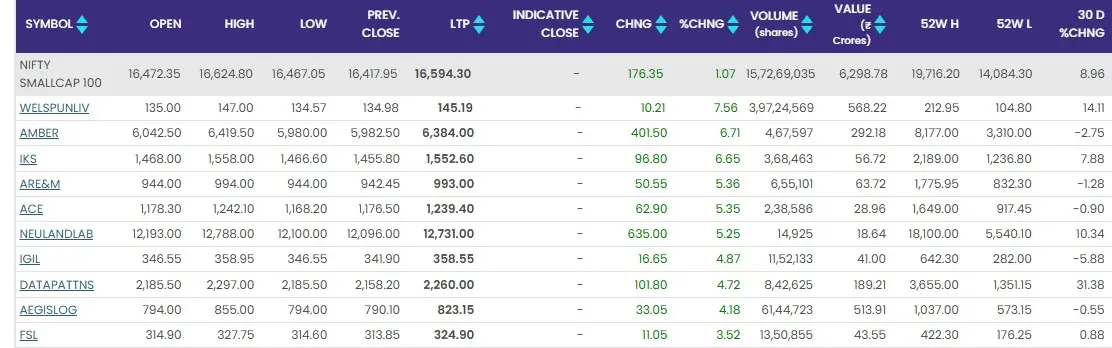

Stock market LIVE update | Broader market check: Nifty Smallcap index surges 1.07%

Welspun Living, Amber Enterprises India, Inventurus Knowledge Solutions, Amara Raja Energy & Mobility and Action Construction Equipment lead the rally in the Nifty Smallcap 100 index.

May 08, 2025, 12:31 PM

Stock market LIVE update | Tata Motors shares extend gains

Shares of Tata Motors, which owns Jaguar Land Rover (JLR), rose on Thursday, May 8, on a probable trade agreement between the United Kingdom and the United States. Jaguar Land Rover, which manufactures a significant share of luxury cars in the UK, has a strong presence in the US market.

According to a New York Times report, citing sources, President Donald Trump is expected to announce a trade deal with Britain on Thursday. The POTUS also teased a trade deal on Truth Social without naming any country.

"Big News Conference tomorrow morning at 10:00 A.M., The Oval Office, concerning a MAJOR TRADE DEAL WITH REPRESENTATIVES OF A BIG, AND HIGHLY RESPECTED, COUNTRY. THE FIRST OF MANY!!!," he said.

Tata Motors shares rose as much as 3.55% to ₹704.5 apiece on the National Stock Exchange (NSE). At 11:43 am, it was up 2.32% to ₹696.10 per unit.

May 08, 2025, 11:59 AM

Stock market LIVE update | Dabur India shares trim losses, down over 2%

Shares of Dabur India slipped as much as 4.27% to ₹461.95 apiece on the BSE in the early trade on Thursday, May 8, a day after the company reported its financial results for the quarter ended March 31, 2025 (Q4 FY25). However, the stock trimmed losses later and was trading over 2% lower in the morning deals.

On Wednesday, the homegrown FMCG reported an 8.35% decline in its consolidated net profit to ₹312.73 crore for the fourth quarter ended March 31, 2025, owing to higher expenses in a challenging demand environment.

The company had posted a profit of ₹341.22 crore in the year-ago period, Dabur India said in a regulatory filing.

Revenue from operations in the quarter under review stood at ₹2,830.14 crore, up 0.55% as against ₹2,814.64 crore logged in the year-ago period, it added. Read moreMay 08, 2025, 12:25 PM

Stock market LIVE update | Punjab National Bank shares flat post Q4 earnings

Shares of Punjab National Bank (PNB) trading flat post March quarter earnings. At11:20 AM, shares of the lender was at ₹93.88 apiece on NSE, slipping 0.39%.

The country's leading public sector lender on Wednesday reported a net profit of ₹4,567 crore in the January-March quarter, marking an upside of 52% from ₹3,010 crore in the same period last year.

The jump in profit came on the back of sharply lower provisions for non-performing assets (NPA). The Delhi-based lender's provisioning for bad loans fell to ₹588 crore as against provisions of ₹1,958 crore in the year-ago period.

PNB's net interest income, or the difference between interest earned on loans and expended on deposits, rose 4% annually to ₹10,757 crore from 10,363 crore.

The bank's asset quality showed an improvement in the fourth quarter of the financial year 2025, as its gross NPA, as a percentage of total advances, came in at 3.95% at the end of Q4 compared with 5.73% in the corresponding period last financial year.

In absolute terms, gross NPA came in at ₹44,081.60 crore as against ₹56,343.05 crore in the year-ago period.

May 08, 2025, 11:22 AM

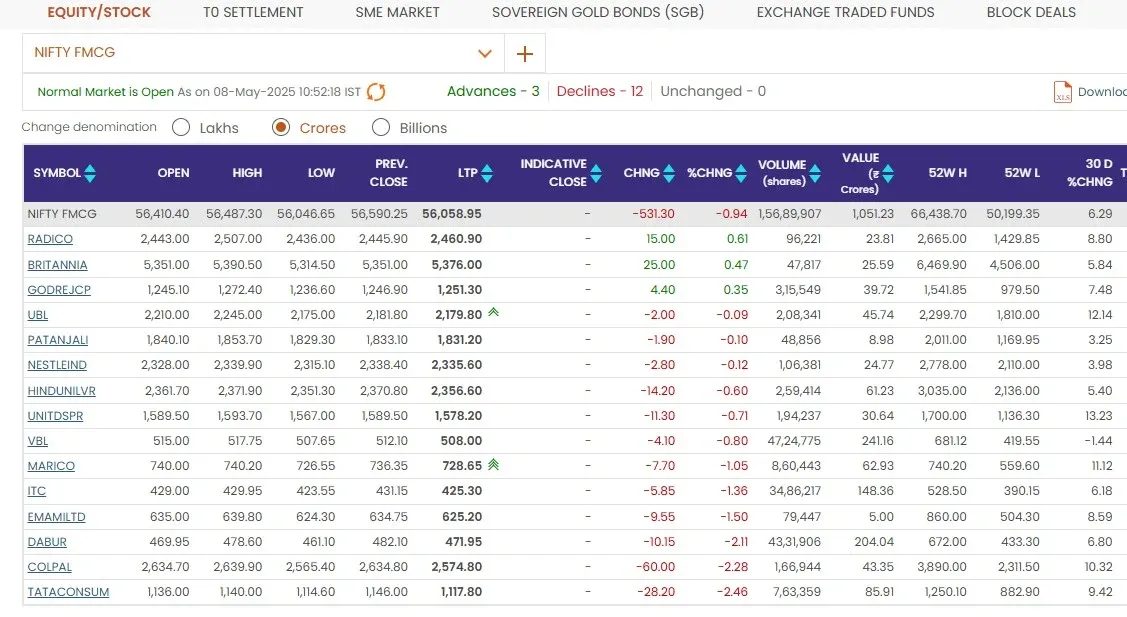

Stock market LIVE update | Sectoral watch: FMCG stocks under pressure

Tata Consumers, Colgate Palmolive, Dabur India, Emami and ITC among top loser on Nifty FMCG sector.

May 08, 2025, 11:39 AM

Stock market LIVE update | Tata Chemicals Q4 earnings impact: Stock surge over 2%

Shares of Tata Chemicals on Thursday were trading over 2% after the firm reported consolidated net loss for the quarter ending March 31 narrowed to ₹56 crore for the financial year 2024-25. Its net loss for the same quarter last fiscal year was at ₹850 crore.

Due to continued pricing pressure in all geographies, the company’s revenue marginally grew by 1% year-on-year (YoY) to ₹3,509 crore in the quarter under review, compared to ₹3,475 crore in Q4 FY24.

For the quarter under review, its earnings before interest, tax, depreciation, and amortisation (EBITDA) stood at ₹327 crore, slipping 26% YoY from ₹443 crore in the year-ago period. Its margin shrank to 9.3% from 13.8%.

Tata Chemical’s board has recommended a dividend of ₹11 per share, i.e., 110% for the financial year 2024-25. The dividend, if approved by the members at the ensuing 86th Annual General Meeting (AGM) of the company, will be paid (subject to deduction of tax at source) within five days of the AGM, it said.

AT 10:36 AM, shares of Tata Chemicals were up 2.01% at ₹842.80 apiece on NSE.

May 08, 2025, 10:38 AM

Stock market LIVE update | Rupee rises 23 paise to 84.54 against US dollar

The rupee gained 23 paise to 84.54 against the US dollar in early trade on Thursday, as the US Federal Reserve kept the federal fund rate steady.

Forex traders said sustained foreign fund inflows and overall dollar weakness supported the local unit but geopolitical tensions continue to dent investor sentiments.

At the interbank foreign exchange, the domestic unit opened at 84.61 and fell to an early low of 84.65 and a high of 84.54 against the greenback, registering a gain of 23 paise over its previous close.

May 08, 2025, 10:21 AM

Stock market LIVE update | Voltas shares rise over 3.5% after Q4 earnings; check key highlights

Shares of the country's leading air conditioner maker, Voltas, rose as much as 3.54% to hit an intraday high of ₹1,288 after it reported March quarter earnings post market hours on Wednesday.

Voltas Q4 net profit came in at ₹241 crore in Q4FY25, jumping 107.76% year-on-year (YoY) from ₹116 crore in Q4FY24.The company's revenue increased by 13.42% YoY to ₹4,767 crore in the quarter under review, as against ₹4,203 crore in Q4FY24.

Its EBITDA was at ₹332.8 crore, up 74.6% YoY from ₹191 crore in the year-ago period. Its margin expanded to 7% compared to 4.5% last year.

Voltas' board recommended a final dividend of ₹7 per equity share.

May 08, 2025, 10:18 AM

Symphony shares jump 12% after March quarter profit surges 63%

Shares of air cooler maker Symphony rose as much as 12.33% to hit an intraday high of ₹1,347.90 on the National Stock Exchange after it reported strong earnings fourth quarter of financial year 2024-25.Symphony said that its consolidated revenue from operations came in at ₹488 crore, up 47% YoY, while its operating profit or EBITDA (earnings before interest, taxes, depreciation, and amortisation) jumped 77% YoY to ₹103 crore against ₹59 crore logged in the year-ago period.

EBITDA margin jumped 358 basis points (bps) to 21.22% against 17.64% in the March 2024 quarter.

Net profit, or PAT (profit after tax), saw an increase of 63% YoY to ₹79 crore.

May 08, 2025, 09:57 AM

NIFTY50 top gainers and losers: Tata Motors surges for second straight session

Tata Motors was top gainer in the NIFTY50 basket of shares, the stock rose 2.43% to ₹697. Coal India (2.14%), Kotak Mahindra Bank (1.53%), Power Grid (1.32%) and Axis Bank (1.19%) were also among the gainers.

On the flipside, Tata Consumer Products, ITC, Eternal, Dr Reddy's Labs, Apollo Hospitals and Maruti Suzuki were among the losers.

May 08, 2025, 09:49 AM

Coal India shares gain after March quarter profit rises 12%

Shares of the country's largest coal mining company, Coal India, rose as much as 3.03% to hit an intraday high of ₹395 on the National Stock Exchange after it announced its March quarter earnings post market hours on Wednesday.

State-owned Coal India Ltd on Wednesday reported a 12 per cent rise in consolidated net profit to ₹9,604.02 crore in the quarter ended March 2025 on the back of higher income.

The company had posted a consolidated net profit of ₹8,572.14 crore in the year-ago period, Coal India Ltd (CIL) said in a filing to BSE.

Total income during the January-March period rose to ₹41,761.76 crore from ₹40,457.59 crore a year ago, the filing said.

The company said that the Ib Valley coal washery of Mahanadi Coalfields Ltd (MCL) with a capacity of 10 million tonnes per annum (MTPA), which began its operations in April last year, became the largest non-coking coal washery in the country.

(With PTI inputs)May 08, 2025, 09:43 AM

Sectoral picture: Banking stocks outperform, pharma, FMCG shares subdued

Most of the sector gauges compiled by the National Stock Exchange were trading higher led by the NIFTY Private Bank index's 0.63% gain. NIFTY Bank, PSU Bank, IT, Financial Services and Auto indices were also trading higher.

On the other hand, FMCG and Pharma indices were trading with a negative bias.

Broader markets were outperforming their larger peers as NIFTY Midcap 100 index rose 0.30% and NIFTY Smallcap 100 index advanced 0.83%.

India VIX, the fear barometer, was down 3% at 18.47.

May 08, 2025, 09:38 AM

SENSEX, NIFTY50 rangebound; banking stocks outperform

The Indian equity benchmarks were little changed in opening deals on Thursday, May 8, ahead of weekly expiry of NIFTY50 futures an option contracts. The 30-share SENSEX was trading in a range of 170 points and NIFTY50 index touched an intraday high of 24,447.25 and a low of 24,393.60.

The sluggish movement in the benchmarks came as gains in Kotak Mahindra Bank, Axis Bank, Tata Motors, Power Grid and Tata Consultancy Services were offset with losses in HDFC Bank, Reliance Industries, ITC, Eternal, Maruti Suzuki and Hindustan Unilever.

As of 9:23 am, the SENSEX was down 19 points at 80,728 and NIFTY50 index slipped 23 points to 24,390.

May 08, 2025, 09:24 AM

Q4 earnings reaction to watch: Voltas, Sonata Software, Blue Star, Dabur India

Voltas

Voltas Q4 net profit stood at ₹241 crore in Q4FY25, jumping 107.76% year-on-year (YoY) from ₹116 crore in Q4FY24.

The company's revenue increased by 13.42% YoY to ₹4,767 crore in the quarter under review, as against ₹4,203 crore in Q4FY24.

Its EBITDA was at ₹332.8 crore, up 74.6% YoY from ₹191 crore in the year-ago period. Its margin expanded to 7% compared to 4.5% last year.

Sonata Software

Sonata Software on Wednesday reported a 2.4% quarter-on-quarter rise in its net profit to ₹108 crore in Q4FY25, as against ₹105 crore in Q3FY25.

Its revenue fell by 7.9% QoQ to ₹2,617.2 crore in March FY25, as against ₹2,842.8 crore in December FY25.

Blue Star

Home appliances maker Blue Star reported a consolidated net profit of ₹193.64 crore in the latest March quarter, up 20.6% from ₹160.54 crore a year back.

The company's board also recommended a final dividend of ₹9 for FY25. The record date is July 18.

Dabur India

FMCG major Dabur India posted an 8.41% fall in its consolidated net profit to ₹320.13 crore in the latest March quarter, compared to ₹349.53 crore a year back.

Revenue from operations increased 0.55% to ₹2,830.14 crore in Q4 FY25 as against ₹2,814.64 crore in the year-ago quarter.

TamilNadu Petroproducts

Petrochemical manufacturing company TamilNadu Petroproducts Ltd has recorded a standalone PAT of ₹24.91 crore for the January-March 2025 quarter, the company said on Wednesday.

The Chennai-based company registered a post-tax profit of ₹10.96 crore during the corresponding quarter of previous financial year.

May 08, 2025, 09:00 AM

Foreign investors buy shares worth ₹2,586 crore on Wednesday

Foreign institutional investors bought shares worth ₹2,585.86 crore on Wednesday, data from the National Stock Exchange showed.

They have so far this month bought stocks worth ₹9,647.98 crore in cash segment.

May 08, 2025, 08:34 AM

US Fed keeps interest rates steady; here's what Jerome Powell said about tariffs

The US Federal Reserve on Wednesday, May 7, held the key interest rate between 4.25% and 4.5%, noting that the economic activity is expanding at a solid pace but inflation remains somewhat elevated.

The Federal Open Market Committee (FOMC) led by Federal Reserve Chair Jerome Powell said that "uncertainty" in relation to the "economic outlook has increased further".

In a press conference, Powell stated that tariffs announced by the Trump administration have been significantly larger than anticipated.

"All of these policies are still evolving, however, and their effects on the economy remain highly uncertain," he said.

The Fed chair added that if large increases in tariffs are sustained, then it will likely generate a rise in inflation, a slowdown in economic growth and an increase in unemployment.

May 08, 2025, 08:22 AM

Expiry Trade setup: Options data shows narrow range of 24,300 to 24,500 for NIFTY50

NIFTY50 opened lower on Wednesday as India and Pakistan tensions rose after India attacked Pakistan. However, the index managed to close in green by recouping all the losses. The recovery was largely led by index heavyweights like HDFC Bank and M&M, which pulled the index higher by 60 points.On the technical charts, the index took intraday support of 24,220 and closed slightly above 24,400. On 15-minute chart, the index traded above the 20 and 50 EMA levels, indicating strength in the recovery from lower levels. Experts believe that, previous day’s low of 24,220 could act as a strong support for today’s trading session.

On daily charts, the index continues to trade in a range of 24,000 to 24,500, keeping traders on the edge for a breakout. Experts believe the index is expected to consolidate further before it gives a breakout on either side of the range.

May 08, 2025, 08:07 AM

Q4 earnings to watch: Asian Paints, L&T, Titan among others

An array of companies are expected to announce their earnings for the March FY25 quarter on Thursday, May 8. This includes engineering, procurement and construction (EPC) major Larsen & Toubro, watchmaker Titan Company, paint and coating manufacturer Asian Paints, adhesive maker Pidilite Industries, food products company Britannia Industries, state-run power projects financer REC, public lender Union Bank of India, forging giant Bharat Forge, and jewellery chain Kalyan Jewellers India.Public sector bank Canara Bank, stainless steel manufacturer Jindal Stainless, biopharmaceutical firm Biocon, agricultural tractors producer Escorts Kubota, commodity exchange Multi Commodity Exchange of India, agrochemical firm Chambal Fertilisers and Chemicals, speciality chemicals firm Aarti Industries, non-banking financial company IIFL Finance, media conglomerate Zee Entertainment Enterprises, and construction and infrastructure development company Dilip Buildcon, among others, will also declare their results on May 8.

May 08, 2025, 08:05 AM

Stocks to watch: Coal India, Lupin, EKI Energy Services, GCPL

Coal India: State-owned Coal India Ltd on Wednesday reported a 12% rise in consolidated net profit to ₹9,604.02 crore in the quarter ended March 2025 on the back of higher income.The company had posted a consolidated net profit of ₹8,572.14 crore in the year-ago period, Coal India Ltd (CIL) said in a filing to BSE.

The filing said that total income during the January-March period rose to ₹41,761.76 crore from ₹40,457.59 crore a year ago.

The company said that Mahanadi Coalfields' (MCL) Ib Valley coal washery, with a capacity of 10 million tonnes per annum (MTPA), began operating in April last year and became the largest non-coking coal washery in the country.

Lupin: The pharma major on Wednesday said it has launched in the US its generic version of Eslicarbazepine Acetate tablets used in the treatment of partial-onset seizures.The company has launched the drug in strengths of 200 mg, 400 mg, 600 mg, and 800 mg, following the approval of its abbreviated new drug application (ANDA) from the US USFDA, Lupin said in a regulatory filing.

The company is one of the first ANDA applicants and is eligible for 180 days of shared generic exclusivity, it added.

Eslicarbazepine Acetate tablets, 200 mg, 400 mg, 600 mg, and 800 mg, are bioequivalent to Aptiom tablets in the same strengths of Sumitomo Pharma America, Inc.

EKI Energy Services: Carbon credit developer and supplier EKI Energy Services on Wednesday reported a narrowing of consolidated losses to ₹6.63 crore in the March quarter, mainly on account of lower expenses.It had posted a net loss of ₹29.10 crore in the January-March period of the preceding 2023-24 fiscal year, the company said in an exchange filing.

The company's total income fell to ₹22.24 crore from ₹85.64 crore in the year-ago period.

EKI's expenses declined to ₹29.33 crore during the quarter under review from ₹114.73 crore a year ago.

Godrej Consumer Products (GCPL): FMCG major Godrej Consumer Products Ltd (GCPL) expects a revival in demand in the next 12-18 months, helped by tailwinds such as lower food inflation, a normal monsoon, and pay commission, said its Managing Director and CEO, Sudhir Sitapati, on Wednesday.Besides, the Godrej Industries Group also expects its profit to go up again once the palm oil prices, a key raw material for its soap business, come down, said Sitapati in a post-earnings media briefing.

GCPL termed the persistent inflation a "short-term blip", where it has passed on only 15–16 % of the palm oil price increase to customers.

Tata Chemicals: Tata Chemicals’ consolidated net loss for the quarter ending March 31 narrowed to ₹56 crore for the financial year 2024-25. Its net loss for the same quarter last fiscal year was at ₹850 crore.Due to continued pricing pressure in all geographies, the company’s revenue marginally grew by 1% year-on-year (YoY) to ₹3,509 crore in the quarter under review, compared to ₹3,475 crore in Q4 FY24.

May 08, 2025, 08:04 AM

US markets end higher after Fed keeps rates unchanged

The United States (US) Federal Reserve the interest rates unchanged and the markets reacted positively as it came on expected lines.

S&P500 index rose 0.43%, Dow Jones advanced 0.70% and Nasdaq gained 0.27%.

The Federal Reserve kept its key interest rate unchanged Wednesday, brushing off President Donald Trump’s demands to lower borrowing costs, and said that the risks of both higher unemployment and higher inflation have risen, an unusual combination that puts the central bank in a difficult spot.

According to an AP report, the Fed kept its rate at 4.3% for the third straight meeting, after cutting it three times in a row at the end of last year. Many economists and Wall Street investors still expect the Fed will reduce rates this year, but the sweeping tariffs imposed by Trump have injected a tremendous amount of uncertainty into the U.S. economy and the central bank’s policies.

May 08, 2025, 07:55 AM

Asian markets trade higher

Most of the Asian markets were trading higher as Japan's Nikkei rose 0.46%, Hong Kong's Hang Seng advanced 0.35%, China's Shanghai Composite rose 0.13% and South Korea's KOSPI gained 0.10%.

May 08, 2025, 07:49 AM