Market News

Polycab India Q4 results today: Will it report solid numbers like RR Kabel?

.png)

4 min read | Updated on May 06, 2025, 09:51 IST

SUMMARY

Polycab India Q4: The results will be on investors' radar as Polycab India's peer RR Kabel posted strong numbers for the March quarter. Further, the earnings hold significance this time also because two business conglomerates – Adani Group and Aditya Birla Group – have entered into the cables and wires segment.

Shares of Polycab India have slipped 21% so far in 2025 and nearly 16% in the past six months. | Image: Shutterstock

In the early trade, the stock was trading 0.7% higher at ₹5,839.40 on the BSE.

The results will be on investors' radar as Polycab India's peer RR Kabel posted a strong set of numbers for the quarter gone by. Further, the earnings hold significance this time also because two business conglomerates – Adani Group and Aditya Birla Group – have entered into the cables and wires segment.

RR Kabel reported a 26.4% YoY jump in its revenue from operations during the period at ₹2,217.8 crore, while operating EBITDA rose 69.4% YoY to ₹195.8 crore. Its EBITDA margin came in at 8.8%, up 224 bps YoY, while profit after tax (PAT) surged 64.0% to ₹129.1 crore.

The company said that its revenue from the W&C segment saw nearly 28% growth in Q4 FY25 compared to Q4 FY24, driven by improved demand. The segment profit improved by nearly 47% in Q4 FY25 compared to Q4 FY24 due to better realisation and operational efficiency.

Commenting on the results, Shreegopal Kabra, MD, said, “RR Kabel has delivered a strong performance in Q4 FY25, led by robust volume growth in our wires and cables segment—driven by improved demand, favourable copper prices, and strategic capacity expansion. We remain focused on scaling up cable volumes while sustaining strong growth in wire sales."

The MD said, "Our FMEG business also demonstrated solid momentum, with healthy revenue growth. We are well-positioned to capture a significant share of the segment’s growth, thanks to our omnichannel presence, extensive distribution network, and a diversified product portfolio catering to multiple price points. Our ability to identify and address product gaps further enhances our competitive edge. As always, our commitment to quality, safety, and operational excellence remains central to our growth strategy."

Polycab Q3 FY25 Results

Polycab India reported an 11.5% rise in consolidated net profit at ₹464.35 crore in the December quarter, charged up by higher sales.

The company had posted a consolidated net profit of ₹416.51 crore in the same period last fiscal, Polycab India said in a regulatory filing.

Consolidated revenue from operation in the quarter under review stood at ₹5,226.06 crore against ₹4,340.47 crore in the October-December period a year ago, it added.

Total expenses in the third quarter were at ₹4,634.5 crore as compared to ₹3,865.06 crore in the year-ago period.

During the quarter, the wires and cables segment clocked revenue of ₹4,384.63 crore, up from ₹3,904.1 crore in the same period last fiscal, the company said.

FMEG (fast-moving electric goods) had a revenue of ₹423.18 crore over ₹296.18 crore in the year-ago period, it added.

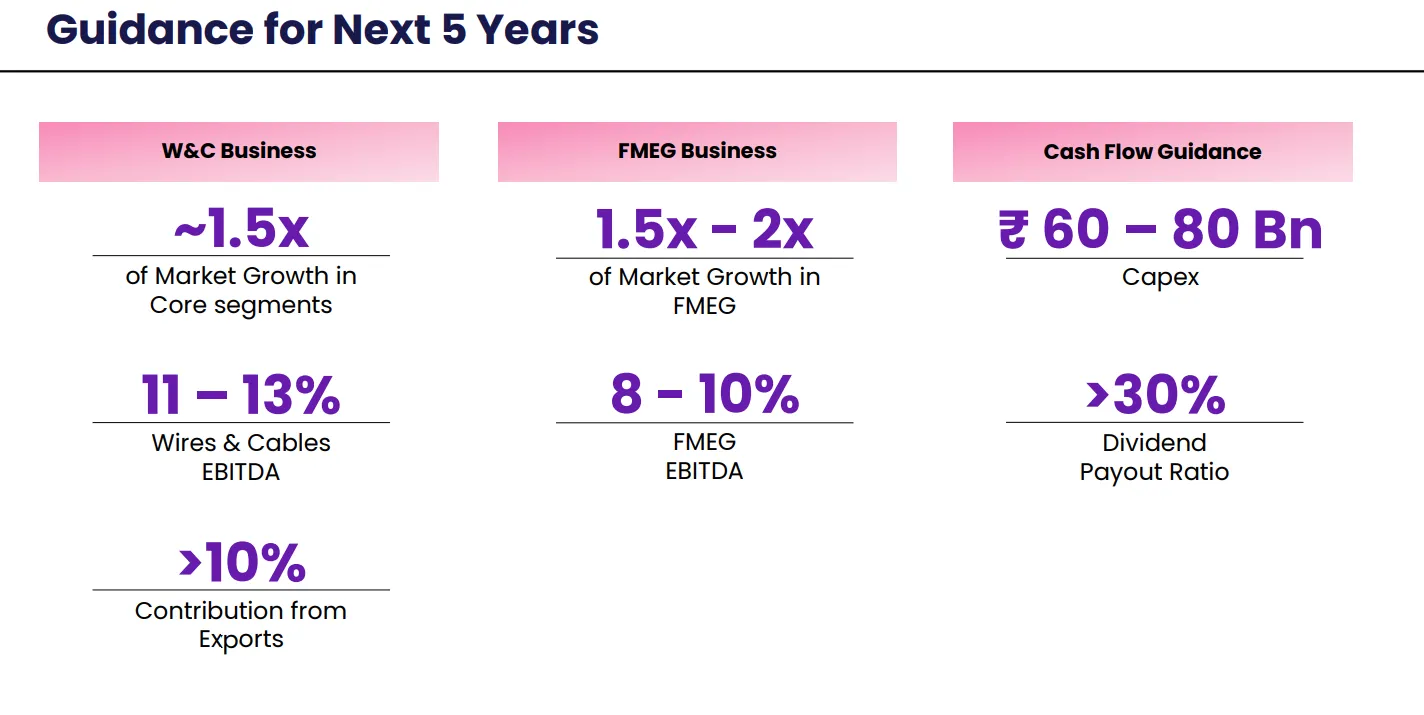

In its investor presentation for the December 2024 quarter, the company gave its five-year guidance, wherein it said that it projects Wires & Cables business to see nearly 1.5 times market growth in core segments. EBITDA for the segment is seen growing between 11% and 13% during the period.

Polycab India share price trend

Shares of Polycab India have slipped 21% so far in 2025 and nearly 16% in the past six months. However, in the past month, the share price has surged over 17.5%.

Polycab India Limited (PIL) is one of India's leading manufacturers of wires and cables and one of the fastest-growing FMEG companies. The company operates in various product categories such as fans, switches, water heaters, switchgears, luminaires tailored for residential, commercial, and industrial applications, solar panels, conduits and accessories, and cutting-edge home automation solutions.

Related News

About The Author

Next Story